TIF

advertisement

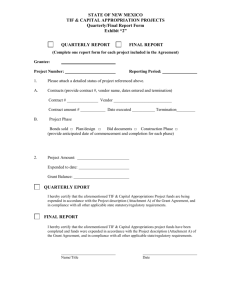

Tax Increment Financing (TIF): “The only game in town” - Chicago Mayor, Richard M. Daley Andrea Clinkscales Brian Henry Function of TIF A specific geographic area for TIF district is defined. Tax assessment values for properties this area are “frozen”. Taxing jurisdictions may only collect taxes from these properties at the frozen or base value for a specific period (usually measured in decades). As real assessment values rise, property owners continue to pay higher taxes. The difference between the taxes collected at the base value and the real value is diverted to a special TIF fund. This fund is used to finance investments within the TIF district. Assessed Value TIF Conceptual Scenario Increasing assessed value with redevelopment Tax increment Frozen tax base TIF base year Time History: 1950s – 1990s Introduced in 1950s as last resort to finance slum or blighted areas Federal development money in grants, tax breaks, and bonds decreased in 1970s Used sparingly until 1980s when many states passed TIF-enabling laws or amended old laws to expand TIF Redefined blight more broadly Added economic development as essential public purpose Included industrial areas with labor surplus or decommissioned military bases More amendments to TIF-authorizing laws Allowing construction of low to moderate-income housing or workforce development TIF Theory & Central Conflict • TIF spurs economic development that otherwise would not occur • An area is blighted or stagnant, it needs help •Without help there will be no change • Investments are made which make the area more attractive • New investment in the area starts a positive cycle for further private improvements * BUT: There are conflicting academic studies which disagree on this central point. Other Pros & Cons Not a new or direct tax Self-financing Less effected by debt limits and other checks Flexible and specific to problems Takes money from other jurisdictions (like schools) Can be seen as developer subsidy Can cause an increase in tax rates (just a backdoor tax increase) Administrative costs, higher interest rates Industry Opinion “As I see it, TIF is another tool in the community toolbox; works best in portions of community where new development is anticipated; and should be focused at a rather limited set of specific improvements. It does not take the place of regular capital improvements; is really only a bookkeeping concept, but wow . . . it has accomplished so much.” Peter Ryner Director of Community Development Peterborough, NH TIF Today Legal in 49 states and Washington D.C. Prohibited in Arizona APA’s Planning magazine (March 2007): “development credit card for the city: Buy a project now and pay it off in the future” Often first “municipal government revenue development tool” considered by local governments Once used to restore blighted areas – now used to restore “blighted municipal budgets” Funding all kinds major building projects Does it really work? Most cities report increases in property values as a result of TIF Few cities report declines Success depends on location, markets, local wealth Best results in metropolitan communities and rapidly growing suburbs Two examples to illustrate Successful TIF Heavily criticized TIFs Success: Portland Development Commission (PDC) Citizens of Portland, Oregon voted to create PDC in 1958 to improve neighborhood livability PDC is the agency in Portland that administers TIF Characteristics Controlled by a 5-member board of commissioners Quasi-governmental in nature Local citizens appointed by the Mayor and approved by City Council Because executive reports to the board of commissioners rather than directly to the Mayor or other City Commissioners Unique organization: high degree of coordination in urban renewal, housing, economic development, and redevelopment The River District PDC controls 11 urban renewal areas One of the most successful is the River District River District plan calls for a high density urban residential neighborhood The Pearl District The Pearl District neighborhood is located within a sub-area of the River District Many achievements here can be credited to Hoyt Street Properties, a major Pearl District landowner and developer In 1994 Hoyt Street purchased the old Burlington Northern rail yard 34-acre Brownfield site River District Map 1980s 1980s initiated strong potential for improvement Availability of low cost warehouse-to-loft conversions attracted a number of artists to the area Adventurous investors began to buy property Met all conditions for TIF success: Blighted Potential for redevelopment Central location near downtown Strong private-public partnership Hoyt Street Properties Initially, site was hampered by the Lovejoy Street offramp from the Broadway Bridge Divided the property in half PDC removed the ramp; Hoyt Street promised to build a world-class, mixeduse, urban community Pre-TIF The Pearl District is now one of Portland’s most distinctive, thriving, upscale neighborhoods Post-TIF Critiques Few exist to-date Pioneering tenants priced out of the market Average five-year appreciation rate of 50% made property taxes and rent unaffordable Not strong critique because very few people actually lived there pre-TIF Likely the City won’t let the profitable 20year River District TIF expire Threatens public schools – already in danger Rebuttals / Added Protections The Pearl was blighted to begin with and wasn’t generating significant property tax With TIF, the PDC has been able to fund numerous affordable housing projects Private developers wouldn’t initiate without TIF incentives If Hoyt Street defaults on development agreement, the City can recover damages in court If tax increment revenues surpass what is needed to meet PDC debt obligations, additional money goes to the general fund Heavily Criticized: The Midwest Over-use and abuse Leads the nation in the number of TIF districts per state Top 3 in the U.S. 1. Minnesota: 1,782 TIF districts 2. Wisconsin: 871 TIF districts 3. Illinois: 458 TIF districts Chicago TIF is the dominant economic development tool used by Mayor Daley’s administration 140 TIF districts that cover nearly 30% of the land area, generating nearly $400 million in TIF funds Establishing a TIF in Chicago 1. 2. 3. 4. 5. 6. 7. 8. 9. Politician, developer, and/or CDC enters discussions with the City planning dept Eligibility study is conducted and a redevelopment plan is created Special public hearing is held if existing housing will be impacted General public hearing is ordered Joint Review board reviews Public hearing is held; City does not have to respond to or act on public input Community Development Commission meets and almost always approves the TIF Plan Commission holds another public hearing; again – it isn’t required to respond to or act on public input Proposal goes to City Council for designation “The only game in town…” Chicago Theatre District 67% of Chicago TIFs were created after 1996 Indicating recent momentum 25% of taxable real estate is subject to TIF diversion Indicating breadth A study of 36 TIF districts showed Chicago Public Schools will lose a hundreds of millions in property tax revenue TIF were administered in areas where property value was growing at a healthy rate – i.e. not blighted Lack of Checks and Balances Unlike Portland Chicago TIF revenues aren't itemized on property tax bills No annual TIF budget or independent oversight Can You Spot the Blight? Central Loop TIF (Dearborn at Randolph) Other issues Causes gentrification Long-time stakeholders are forced into less desirable neighborhoods Uses eminent domain 2007 property taxes in the hot condo markets are projected to increase by 100% Due to TIF, property taxes are increasing faster than people’s incomes Reform in Chicago TIF excesses lead to push for accountability and transparency This summer, Cook County Commissioner, Mike Quigley, introduced three TIF-reform proposals Increasing negative publicity is affecting perception of TIF and raising awareness TIF in Washington First passed in 1982 as Community Development Refinancing Act Ruled unconstitutional by WA Supreme Court in 1995 Resurrected by 2001 TIF Act TIF in Washington • 2001 TIF Act: incredibly weak statute • School districts exempt • Fire districts can veto • Only 75% of increment captured • Expires in 2010 • Not tested in court Questions? Wal-Mart 90% of Wal-Mart stores are subsidized Equals more than $1 billion in tax payer monies Most Texas (30 deals worth $108 million) Then Illinois (29 deals worth $102 million) In 2002, Wal-Mart sought an $18 million subsidy for a project to be located on the Near South Side of Chicago. Often from TIF Project was abandoned due to controversy In Niles, adjacent to Chicago’s south-side, a TIF was granted to a Wal-Mart developer for redeveloping an old manufacturing Wisconsin designated a cornfield and apple orchard as blighted so Wal-Mart could qualify for TIF to build a superstore