Value capture - Minnesota Department of Transportation

advertisement

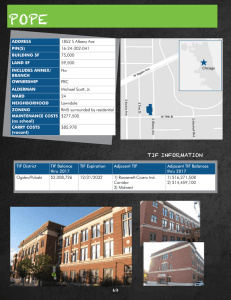

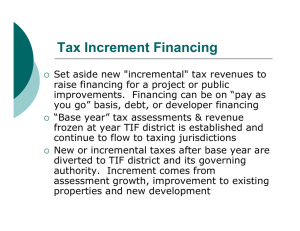

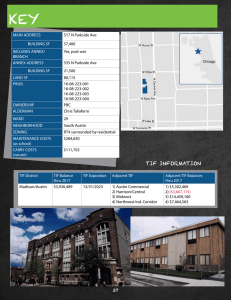

Transportation Finance Advisory Committee, June 2012 Value Capture Strategies for Transportation Finance fafa Zhirong (Jerry) Zhao Associate Professor zrzhao@umn.edu Land Value (EMV/Acre) 1 The General Framework of Transportation Finance 2 3 Value capture strategies: Type-I -- on property owners Land value tax Tax increment financing Special assessment Transportation utility fees 4 Land Value Tax The conventional property tax Tax on buildings Tax on land Henry Georgia in 1865 A land value tax or split-rate tax Captures more value from transportation More efficient in land use 5 Tax Increment Financing (TIF) Public improvements tend to cause a rise in property values in adjoining areas, causing an increase in property taxes. TIF uses these future increments in property taxes generated by new development to finance the initial costs of the development itself. Tax Increment Financing (TIF) Source: How TIFs work, Chicago, Illinois, 2004 7 8 Special Assessments District 1. 2. 3. A compulsory levy used to finance a particular public improvement program Its only levied against those parcels receiving a special benefit from the improvement Assessment amount is directly related to the value of the benefits the property receives (Source: League of Minnesota Cities) 9 The Peachtree Street Streetcar Line Midtown Neighborhood SAD Atlanta, GA 10 Transportation Utility Fees Transportation network functions as a utility Facility use does not correlate with property value Depends on property type More direct connection between costs and benefits 11 TUF Simulation: Annual fee by land use - Minneapolis 12 Value capture strategies: Type-II -- on estate developers Negotiated exactions Development impact fees Joint development Air rights 13 Negotiated Exactions Non formulaic or preset contributions for the local transportation improvements decided through negotiation. 14 Development Impact Fees One-time predetermined assessments levied on new development Offset the impact of the development on the capital cost of providing regional transportation infrastructure Development Impact Fees With new highway exist 15 Development Impact Fees 16 Defining Joint Development Joint development private-sector sharing of capital costs private-sector payments to the public entity Incentives Public: additional $ for capital improvements Private: enhanced development potential 17 Mechanisms of Joint development 18 Air Rights Development “The legal capacity to make use of a threedimensional area for development or improvement.” -The Use and Abuse of the Term “Air Rights,” Sam Galowitz, 1996 19 Air Rights Development: The Minnesota Context Characteristics of Minnesota’s freeway system provide unique opportunities for air rights development 20 Air Rights Development: Oases in Illinois State Tollway 21 Features of Value Capture Strategies 22 Exaction Value Capture Strategies Air Rights JD TIF DIF Land value tax SAD Transportation Utility Fee 23 24 TH610: Value capture study 25 Summary Value capture The rationale to link benefits to costs A useful toolset with various features Policy considerations State authorization Local discretion Policy research and design Public engagement 26