BM496-03 The Company Write-up Example

advertisement

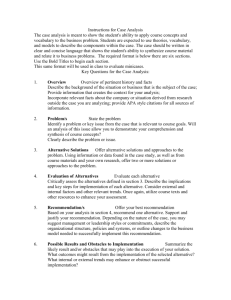

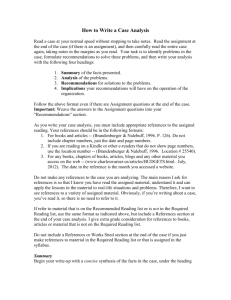

Investment Banking Internship Class The Company Write-up Or Getting your best ideas on paper Or You have to know it--to do it! Objectives A. Know the importance of the company write-up process B. Understand the process on how to write a good company report C. Understand the format that I require for this internship A. The Importance of the Company Report What is the company report write-up? • It is the final document that will be read by your readers • It may be your only chance to convince your reader of the validity of your recommendation. Do it well! Will it differ depending on your audience? • Yes. Write accordingly! The Company Report (continued) How much will most portfolio managers actually read of a normal report? • Generally only the first paragraph or page, and the rest only if you can pique their interest. Keep it clear and succinct! How important is a good summary? • Very important. Your summary must stand out to get read! Questions Any questions as to the importance of the company write-up process? B. Know How to Write up a Good Company Report? Follow the process Understand the global and country economic framework in which the company operates Understand the global and country industrial framework in which the company operates Understand the type of company and the key factors which drive value or profitability Use the Global Analysis Framework Global Economic and Political Analysis (You know what is the world doing!) Country Economic and Political Analysis (You know what’s happening in your main markets!) Global Industry Analysis (You know what the global industry is doing!) Country Industry Analysis (You know what’s happening in your main industry!) Company Analysis (Here’s where you should be now!) Find your key information Economic information • Multilateral institutions, global publications, general financial and economic magazines (I will provide this!) Industry information • Key data providers (Bloomberg, Reuters, etc.) • Company and competitor reports Company information • Discussions with management, suppliers, etc. This is the really valuable work comes in! • Financial press and industry and related sources • Financial reports (10-K, 10-Q, and other reports) Categorize your company • Each of these general types of firms possess different characteristics, so investors need to focus on different firm attributes to determine if the firm is attractive or not. We will use Peter Lynch’s same six categories that we used with the industry reports (review the Industry PowerPoint's for details): Slow Growers Stalwarts Fast Growers Cyclicals Turnarounds Asset Plays Gather Your Information Do your homework Know the company like you owned it. You may. Document major positive and negative factors Keep these in a specific place as you read and study the company. That way you will not forget anything Prioritize your positive and negative factors Emphasize those that support your recommendation Write up the Report Finalize your analysis and make a recommendation Come to a conclusion as soon as possible. Support it! Update, review, and finalize your report Update your financials, review your recommendations after any market moves, and finalize your report the day before you turn it in. Update your Report Finally, just before you present to company management, update your report a final time: • Update your: • Stock Price • Market Index Price • Industry Index Price • Company Earnings Estimates and date • Reprint your relative return graphs, and • Review your major recommendations and intrinsic value Note: When you present to company management, they are not just concerned about your financials, but everything that has happened with your company. You must know: • Any recent announcements that would impact your company, i.e.: • Changes in the company: purchases, management changes, earnings reports, profitability • Changes in the industry: technology, consolidation/acquisitions, leadership changes Prepare accordingly Questions Any questions on how to write up a good company report? C. How to Write your Company Report in “My” Report Format Remember: • Note that every analyst, portfolio manager, or director of research will have their own preferred way of writing up a company • Learn to do it their way, but don’t hesitate to add the key areas you think are important after you have put it in “their” format! Why this Framework? • Efficient • There is lots of information in one place • Effective (but more difficult) • It is harder to write a one-page report than a 20 page report, but it is easier to get others to read it • Consistent • We will be sending out your research to asset management/buy-side companies as examples of BYU students analysis • Up-to-date • We are seeing more of this type of research in industry Key Areas of the Framework Key areas of information 1. Company and Market related information 2. Summary 3. Background 4. Positive Factors 5. Negative Factors 6. Things to Watch 7. Earnings Estimates Investments Write-up Format 7. Earnings Estimates 6. Things to Watch 1. Key Stock/ Market Information 2. Summary The Company Report 4-5. Positive/Negative Factors 3. Background 1. Key Stock and Market Information Key general pieces of information • Company, country, industry Key specifics (and source of the data) for the forecast year • Current Price (from Exhibit 4 section 5, i.e.,E4-5) • Current Market value (from E4-2) • Prospective Price earnings (from E4-2) • Prospective Market PE (from E4-17) • Company type (discussed earlier) • Relative fair value (from Intrinsic Value section 8) • Intrinsic value (from IV-7) • Recommendation (your view, but consistent with your Intrinsic Value-8) 2. Summary What is the summary? This is the key piece of information for the analysis If you have no recommendation, you are just learning about the company The purpose of financial analysis is to make a decision about the company that can make the reader money Write it well. It may be the only part read by your audience It should be a summary of your most important key points supporting your decision 3. Background Why is the background important? • This gives the historical framework on which your analysis is built • It includes specific information that is important to the analysis, including when founded, listed, key divisions, sales/profits by division, sales/profits by region, major shareholders/groups, percentage float, etc. • Help the reader to understand which divisions are most important and profitable • Include those areas which you think most relevant to the investment decision 4. Positive Factors What are positive factors? • These are factors which will enhance the profitability of the company to the investor. These could relate to: • Valuation • Earnings growth • Financial condition • Economic positioning • Market/industry competitiveness • Management • Cost structures • Asset utilization (PP&E) • Accounting aspects 5. Negative Factors • What are negative factors? • These are factors which detract from the attractiveness of the company to the investor. These could include the same factors discussed before • Key caution: • Regardless of your recommendation, your positive and negative factors should overall support that recommendation, i.e. don’t have all positives and a sell recommendation • You want to show you have analyzed the key areas for analysis, yet your key goal is to support our recommendation 6. Things to Watch Why a Things to Watch area? • Portfolio managers/analysts cannot spend all their time watching a single stock when they have 20-80 stocks in their portfolios • Here you are stating the most important areas for the Portfolio Manager to watch. • Pick 2-3 critical items to watch • That way, if these events or items happen, it’s a flag for the portfolio manager to go back and re-evaluate what is going on 7. • Earnings Per Share Estimates Why Earnings per Share estimates? • 1. It shows you the forecasts and directions that the other analysts are going • 2. It gives a mean and standard deviation to tell you how close or how far away you are from the mean forecast of the other analysts • 3. It lets you know if, perhaps, others are seeing things you aren’t, or perhaps, you are seeing things others aren’t • Note: You will rarely make money on forecasts where your forecasts are in line with what everyone else is saying. You make money when your forecasts are different from others-and when you are right! Suggestion • As you finalize your report, I would recommend that you go to the HBL Library and read a couple of Wall Street reports on your company to get a sense of the things other analysts are writing. • Read what they are saying • Read what items they find most critical • See if you have included all pertinent data Review of Objectives A. Do you recognize the the importance of the company write-up? B. Do you understand the process on how to write up a good company report? C. Do you understand the format that I require for this class for the company write-up?