Putting It All Together

Presented by the

UH Pacific Business Center

(PBCP)

David M. Gillespie

PBCP is a partner with the Shidler in providing economic technical assistance throughout the Pacific Region. The PBCP also operates the Honolulu Minority Business Enterprise

Center. We have extensive experience and expertise in business plan development.

1

Document/Submission Requirements

Prefer PDF format

Less than 1mb single file

Single Spaced (min.), 12 Point Font

(min.), 1” Margins all around (min.) &

8.5” X 11” paper size

Emailed as attachment to: pace@hawaii.edu

by 5pm on 4/4/08, AND

Five hardcopies to PACE office

If Mailed - postmarked by 4/4/08

If Hand Delivered – At PACE by 5pm on

4/4/08

2

Document Specification Requirements

Cover Sheet –

1 page

Executive Summary

2 pages

Business Plan

pages

–

Maximum

–

Maximum 10

Attachments or Appendices

Maximum 10 pages, open format

–

3

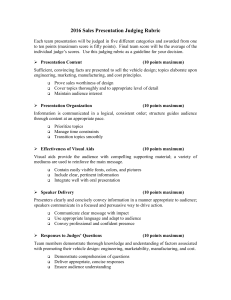

Judging Criteria

1) Overall Appeal -10%

2) Attractiveness of Market Opportunity-15%

3)

4)

5)

6)

7)

Value Created by the Product/Service-15%

Competitive Advantage of Venture-15%

Operational & Technological Viability-

15%

Management Team Capability-15%

Capital Requirements & Financial Forecast

-15%

4

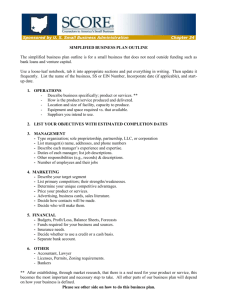

Suggested Organization

1. Cover Sheet

2. Exec. Summary -

Overall

Appeal (10%)

3. Overview of the Firm

4.

Market Analysis –

Market

Opportunity (15%)

5. Products/Services

Offered –

Value

Created (15%)

6.

Marketing Plan/Strategy

– Competitive Advantage (15%)

7. Operations Plan –

Operational & Technical

Viability (15%)

8. Management Team –

Team

Capability (15%)

9. Financial Plan –

Capital

Requirements & Projections

(15%)

10. Appendices &

Attachments

5

Data Requirements:

Team Name

Business Name

Names of All Team Members

Other:

Logo Development

Balanced Sheet with Lots of White

Use of Color

6

Judging Criteria 1 - Overall Appeal of the Plan

(10%): Compelling “vision”; enthusiasm; greater than the sum of its parts.

The business plan judge will probably obtain most of his/her ‘appeal’ in reading your Executive Summary.

Write the Final Executive Summary Last

Things will change as you write the plan

The Executive Summary you already turned in can be adjusted/changed.

7

‘Elevator Pitch’ – The reader must ‘get it’ in the

Executive Summary.

Who – Manoa Tansgenics, Inc., a start up life science company

What – Provide genetically modified mice, a novel gene insertional methodology and gene therapy research development.

How – Use a proprietary gene insertion technology invented by the two business founders

Why – Transgenic mice market at $180 million; once technology validated potential for gene therapy market projected at $5.7 billion in 2011

How Much & Return – Need $2.5 million for research; offer 15% equity in the firm. Once reach

20% market penetration, firm sold/merged/IPO.

8

Other Key Items to Address:

Mission and Objectives

Product, Process, or New Business

Model

The ‘Pain’ the Above will relieve

Target Market – Customers, Value

Added, Competitors, Competitive

Advantage

Business Model – Who pays, how much, and how often. Model margins

The Executive Summary MUST stand on its own; don’t copy sections word for word from the business plan narrative—a common mistake.

9

Include/Expand By the Level of

Importance to Your Business Plan

Technology & Intellectual Property

Management Team

Milestones/Goals

Revenue/Cash Projection

Funding Needs & Use of Proceeds

Investor Potential Return & How and

When Returned

10

Major Sections to Consider

– A way

of introducing the firm

Value, Vision & Mission

History

Distinctive Competence

Technology

Competitive Advantage

Strategy and Objectives of Firm

Major Milestones Achieved to Date

11

Judging Criteria 2 - Attractiveness of

Market Opportunity (15%)

Market size and growth potential

Your firm’s potential in this market

Expected margins and net profit long-term potential

12

Market Profile

- Show you know the market you are entering

Demographic/Geographic/Psychographic or

Business Profile

Maturity of Industry

–

Which Phase: Start-Up,

Growth, Maturity, Decline

Size of Market – Units and Dollars

Growth Potential – Tie it to research and in units and dollars over time

Market ‘Pain’

Needs – What is the ‘pain’ of this market

Set it up so that your product relieves ‘pain’

13

Market/Industry ‘Business Model’

What is the current set-up (business model) for businesses in this market.

What is the margin and net profit profile of this market/industry – financial research

Is there a niche unsatisfied, or a better business model— set it up so your product/service, and, or business model is the answer.

14

Competition

– Who else provides the service or product and what else do they provide their customers

Competitive Position of Leaders

Market Share Distribution - % of the market pie by leader, market share growth

Barriers to Entry – How difficult is it to enter the market you’re interested in.

15

Judging Criteria 3 Value Created by the

Product/Service (15%)

How will you relieve the ‘pain’- what is the unique value of product/service

Importance of Product/Service to

Customer

Product/Service Description or

Prototype

Features and Benefits of

Product/Service

Market Reaction to Product/Service

16

Product/Service Description – Clear, concise and complete. Detail in

Appendix

Product Benefits & Features – The things that will relieve the ‘pain’ you identified in Market Analysis.

Product/Service Customer Reaction –

Sampling, interviews, testimonials

Product SWOT – If appropriate

17

Cleary Describe Product Need

Need may not be fully recognized by the market at this time

Describe how you see the ‘need’ developing

Product Development Plan

Current level of product development

Phasing plan of product development

18

Judging Criteria 4 - Competitive Advantage of the

Venture (15%)

How Will the Product Gain Market

Share Against Competitors

Market Share and Growth Profile

Potential

How Long to Get Product/Service to

Market

What Business Model/Distribution

Method Will Position the Firm Best

19

Business Model Proposed

Be as specific as possible. Clear, concise explanation (B2B, B2C, etc.)

Product Market Development Plan

Phases of development: drawing, prototype, pilot manufacturing

Overcoming Competition – How?

Pricing, Business Model, Quality,

Market Tactics

20

Focused Target Market(s) Profile

Size and Trends of Markets

Demographic, Geographic,

Psychographic or Business Profile

Buying Sensitivity

Vulnerability to Economic Factors

Purchasing Patterns

21

Pricing Strategy –

Image Awareness, Cost

Recovery

How will you fit within the market? - Above

Market, Match Competition, Below Market ?

Promotional Strategy

Media – Web-based, Print, TV: what does the competition do?

Message – What will be your key message; Is it focused on your core business?

Promotional Budget – Sales growth requires a matching promotional budget.

22

Sales Strategy

– How will sales be developed and processed

Sales Generation in the Business

Model

Sales Force Management

Order Processing

Compensation Plan

23

Sales Projections

First Year – by quarter; then yearly

By Product/Service Line

By Units and Dollars

Other Marketing Activities

Service and Support Capability

Strategic Alliances

24

Judging Criteria 5 - Operational &

Technological Viability (15%)

Product/Service Production

Product/Service Distribution

Production obstacles and how you will overcome them

Any essential technology property and how will it be protected

Develop a plan timeframe

25

Production

Plan – Where produced or developed – materials required & sources, outsourcing

Technical requirements of producing the product/service and how met.

Patent protection or other means of protection

Distribution Strategy

– How will you get your product/service to the customer

Retail, Wholesale, Distributor, Internet,

Licensing, Franchising – tie into the business model

26

Manufacturing Requirements – by order of importance to the plan

Facilities – plan for growth

Equipment

Outsourcing

Third-Party Agreements

Contracts

Licensing

27

Milestones –

Make/Break Activities

Schedule of key activities to be accomplished – GANTT Chart

Specific/Crucial Objectives:

Timeframe

Responsibility of who?

Results expected

28

Judging Criteria 6 -Management Team Capability

(15%)

Venture management/expertise needs

Education, experience, skills of team

Acknowledge skill gaps and show how you will overcome them – hire, contract, etc.

Role of each team member in the development of the venture – dual roles

29

Names

Roles and Positions

Experience and Education

Other Related Experience

‘Gap’ Experts – Technical skills

Strategic Alliances

30

Show that Your Organization is Set to Meet the

Growth You Planned For

Principal Players – Do you have the right people in the right places? Will the firm’s expertise requirements change as the firm grows?

Consultants and Specialist – Are industry changes severe enough to bring on experts?

Organizational Structure – What is your organizational structure and will it be appropriate for your firm’s growth?

31

Judging Criteria 7 - Capital Requirements &

Financial Forecast (15%)

Capital

Needs – Capital asset purchases, start-up expenses, working capital

Sources – Venture Capitalist, lenders, FFF?

Phasing – Start-up, 1 st , 2 nd , other rounds

Entity Ownership structure

Investment Exit Strategy

Project Evaluators – ROI, NPV, IRR

Cash Flow - when turn positive

32

Financial Forecast

P & L Summary

Cash Flow Summary

Cash Flow Breakeven –

When does firm turn to positive cash flow

Investor Return – ROI,

Dividends,

Capital Returns, NPV, IRR

33

Stages of VC Funding:

Seed – Develop proto-type

Early Stage – Launch product

Growth Stage – Expand marketing

Mezzanine – Add resources, acquire other firms

Develop a structure/mix of funding

34

Income Projections – Revenues,

COGS and major expense categories. $ and %.

Cash Flow Forecasts –Too little cash

(common problem) for working capital.

Cash Flow Break-Even Analysis –

Do you need to generate more or less sales to cover operating costs than what you originally planned for?

35

Income Statement Format

Major Revenue Categories – Ascending

Order

By product/service type

Show Key % - Gross & Operating Margins

Major Expense Categories – Ascending

Order

COGS, Personnel, Rent

Level of Detail

By Quarter for the first 12 months

By Year after first 12 months

Three years minimum, five years maximum

36

Cash Flow – Direct Method

Operating Activities

Revenues, Direct Materials and Labor,

General & Admin. Expenses

Investing Activities –

Asset

Purchases

Financing Activities –

Dividends,

Return on Investment

37

Be sure you have a financial macro & micro understanding of your venture and that micro and macro are in sync.

Macro View

– The financial big picture: Review, understand and analyze the financial statements you generate.

Micro View

– The financial details:

Pricing strategy, margins, mark-up of the product or service you are offering.

38

39

Examples of what you can put in the Appendix

Detailed Financial Documents

Start-up Cost Schedule

Funding Sources Detail

Detailed Income Projections

Balance Sheet Projections

Detailed Cash Flow Projections

Cash Break-Even Analysis

40

Assumptions Critical to Your Plan

Interest Rates: Long & short-term

Sales on Credit

Inventory Turnover

Personnel Overhead

Licensing Agreement

Other

41

Product/Service

Detailed Description, Drawings,

Production Processes

Management Team

Resumes

Consultants/Experts Qualifications

Other

Market Research Data

Relevant News Articles

42

6 C’s Of A Winning Business Plan

Complete

– No missing sections, cover all the judging points.

Clear

– Concept of your product/service, its market, and business model are explained completely during the first read of the plan.

Credible

– The plan makes ‘sense’. No crazy revenue projections, outrageous market share claims, belief in a lack of any competition, etc.

43

6 C’s Of A Winning Business Plan

Compelling – Draws the reader into the business concept they way a good novel draws in a reader. The reader buys into your idea because your plan is convincing and your narrative is persuasive.

Customer Focused

– Show you understand your customer and how you will relieve their pain.

Concern for Investor/Lender

– Show how, and when, debt/equity is returned and ROI is developed.

44

‘Form’ of the Plan

Use of Charts and Graphs

Simple, Clean, Easy to Read

Font

Type and

Size

Changes

Limited Changes - subtle

Color

Make sure it prints ‘ok’ in black and white

Shading and texture for graphs/charts

Number the pages

45

Plan Development

Many contributors—one writing voice

Proofread by non-team member

Support assumptions when ever possible

Business Plan Team Skill Needs

Marketing – Research, Market Size, Sales Est.

Financial – Projections & Statement

Development

Plan Wording

Positive word choices; not “might”, “maybe”,

“probably”; but don’t overstate or exaggerate.

46

Business Plan Judges Are Hawaii

Business Professionals

Bankers, Business Owners, Gov’t and Non-Gov’t Organization

Employees

Business Service Providers –

Accountants, Lawyers, Consultants

Investors, Venture Capitalist

Entrepreneurs

47

Software & Website Assistance:

Business Plan Pro – palo-alto.com

Business Plan Builder – jianusa.com

Business Plan Writer Deluxe

Bplans.com

Businessplans.org – sample plans

Microsoft Business Planner – Office

Pro

48

Good Luck to

All!!

49