Students to Start-ups - The Paul Merage School of Business

The Art of Valuation

Alex Moen

Vice President, CB Capital Partners

CB Capital Partners

860 Newport Center Drive

Newport Beach, CA 92660

(949) 219-7462 alex.moen@cbcapital.com

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

Executive Summary

• Valuation Methodology

• Comparable Company Analysis

• Precedent Transaction Analysis

• Discounted Cash Flow

• Putting It All Together – Determining a Valuation

Range

• Appendix

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

Valuation Methodology

A potential institutional investor would typically utilize a combination of the following methods and techniques to value the Company including:

Comparable Company Analysis

–

Value based on trading multiples of similar publicly traded companies

Similar Transactions Analysis

–

Value based on completed and pending transaction multiples in related industries

Discounted Cash Flow (DCF) Analysis

–

Value based on discounting the Company’s projected cash flows back to today’s value

Book Value

–

Minimum/liquidation value of the Company

–

Ignores the future earning power of the Company

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

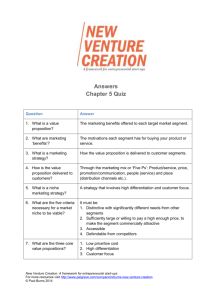

Comparable Company Analysis

Determines how the market would currently value the Company

• Advantages

– Reflects the market’s opinion of future growth, trends and risks

– Includes premiums for size and maturity

• Disadvantages:

– Often imprecise due to non-comparable data, non-financial issues and low sample size

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

Medical Device Example

Comparable Company Analysis

Midcap Medical Applications and Technology Companies

Company

Midcap Companies

Beckman Coulter Inc.

Gen-Probe Inc.

Kinetic Concepts Inc.

Mettler-Toledo International Inc.

Ticker

Symbol

BEC

GPRO

KCI

MTD

Price @

3/2/09

$ 40.60

$ 37.95

$ 20.43

$ 49.18

52 Week Mkt Cap

% Change ($mm)

EV

($mm)

-25.75%

-22.44%

-60.14%

-50.49%

$

$

$

$

2,570.0

2,010.0

1,440.0

1,650.0

$

$

$

$

3,640.0

1,640.0

2,960.0

2,170.0

LTM

Sales

($mm)

$ 3,100.0

$ 472.7

$ 1,880.0

$ 1,970.0

LTM

EBITDA

($mm)

$ 549.9

$ 180.1

$ 545.5

$ 339.9

EV/

LTM

Sales

EV/

LTM

EBITDA

1.2x

3.5x

1.6x

1.1x

6.6x

9.1x

5.4x

6.4x

Average

Median

High

Low

Dow

S&P 500 Index

DJI

SPX

$ 6,763

$ 700.82

-44.83%

-47.36%

1.8x

1.4x

3.5x

1.1x

6.9x

6.5x

9.1x

5.4x

Source: Capital IQ; Yahoo! Finance; Thomson Financial

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

Precedent Transaction Analysis

Determines amounts paid for recent acquisitions of companies similar to the

Company

Advantages :

Includes control, synergy and auction premiums

Provides precedent for transaction value range

Reflects supply and demand for similar companies

Disadvantages :

Often imprecise due to lack of data, non-financial issues and low sample size

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

Precedent Transaction Analysis

Announced/Initial

Filing Date

(Including Bids and Letters of

Intent)

02/03/2009

Target/Issuer

PharmaNet Development Group, Inc.

(NasdaqGS:PDGI)

01/30/2009 Tepnel Life Sciences plc (AIM:TED)

01/11/2009 Advanced Medical Optics Inc. (NYSE:EYE)

12/01/2008

08/13/2008

06/01/2008

04/07/2008

03/26/2008

Mentor Corp.

Andor Technology plc (AIM:AND)

WuXi PharmaTech (Cayman) Inc. (NYSE:WX)

Alcon Inc. (NYSE:ACL)

Athenahealth, Inc. (NasdaqGS:ATHN)

Industry Classifications

Exchange:Ticker [Target/Issuer]

NasdaqGS:PDGI Life Sciences Tools and

Services

AIM:TED

NYSE:EYE

Life Sciences Tools and

Services

Healthcare Equipment and

Supplies

-

AIM:AND

Healthcare Equipment and

Supplies

Healthcare Equipment and

Supplies

NYSE:WX Life Sciences Tools and

Services

NYSE:ACL Healthcare Equipment and

Supplies

NasdaqGS:ATHN Health Care Technology

Buyers/Investors

JLL Partners

Gen-Probe Inc.

(NasdaqGS:GPRO)

Abbott Laboratories

(NYSE:ABT)

Transaction

Status

Announced

Announced

Closed

Johnson & Johnson

(NYSE:JNJ)

Closed

ICC Venture Capital; Delta

Partners Limited; Crescent

Capital

Warburg Pincus LLC

Cancelled

Closed

Novartis AG (VIRTX:NOVN)

-

Closed

Closed

Total Transaction

Value ($mm)

41.46

TEV/Forward

EBITDA - Capital IQ

[NTM]

[Target/Issuer]

95.92 90.4

TEV/Forward Total

Revenue - Capital IQ

[NTM] [Target/Issuer]

255.45 7.46 0.534

-

2,902.29 10.2 2.45

1,210.57 14.0 3.16

5.6 0.607

63.0 3.9 0.886

10,605.43 10.7 3.94

21.0 31.3 6.25

Source: CapitalIQ

Note: Numbers in bold are outliers and were excluded in the analysis.

Average

Median

Max

Min

12.9 2.9

10.5 2.8

90.4 6.3

3.9 0.5

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

Discounted Cash Flow

Determines the Company’s value by summing the net present value of free cash flows the ensuing projected five years and the terminal value at the end of the fifth year using a terminal value multiple

Advantages:

According to modern financial theory, this is the most "correct" form of valuation

The method is least influenced by stock market conditions or the M&A environment

Principal valuation techniques used by foreign, large corporate, and LBO buyers

Disadvantages:

Sensitive to assumptions of revenue growth, operating margins, fixed capital investment, working capital investment and weighted average cost of capital

Does not account for a "control" premium

Does not account for the value of synergies

Does not account for potential auction premium

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

Discounted Cash Flow

Revenue

Gross Profit

Gross Margin

Income from Operations

EBIT Margin

EBITDA

EBITDA Margin

Income from Operations (Adjusted) (1)

Less:

Plus:

Taxes on EBIT

Depreciation

Plus:

Less:

Inc. (Dec.) in Working Capital

Capital Expenditures

Free Cash Flow

2007

$ 1,000

$ 1,000

100%

(6,320)

-632.0%

$ (6,267)

-626.7%

(6,320)

53

-

(836)

250

$ (7,353)

2008

$ 11,141

$ 9,139

82%

(10,905)

-97.9%

$ (10,710)

-96.1%

(10,905)

-

195

357

925

$ (11,278)

Projected for Years Ending June 30,

2009 2010 2011

$ 51,001 $ 100,783 $ 190,330

$ 40,422

79%

14,861

29.1%

$ 15,093

29.6%

$ 80,274

80%

44,778

44.4%

$ 44,957

44.6%

$ 154,110

81%

111,425

58.5%

$ 111,709

58.7%

14,861

-

232

(3,131)

1,100

$ 10,862

44,778

13,487

179

(3,341)

850

$ 27,279

111,425

33,513

284

(7,271)

1,350

$ 69,575

2012

$ 301,752

$ 252,835

84%

204,469

67.8%

$ 204,753

67.9%

204,469

61,426

284

(8,718)

1,350

$ 133,259

Notes:

(1) Assumptions and Projections provided by management.

(2) EBITDA Margin reflects management projections.

(3) Working Capital assumptions reflects management projections.

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

Discounted Cash Flow

Present Value of Free Cash Flow

Discount Rate

65%

66%

65%

66%

67%

PV of Free Cash Flow

$23,510

22,846

23,510

22,846

22,203

Net Debt $ -

2012 EBITDA

Terminal Value Multiple

2012 Terminal Value

Discount Rate

65.0%

66.0%

65.0%

66.0%

67.0% Inputs

EBITDA Multiple

Corp. Tax Rate*

WACC

Revenue Growth Rate

EBIT Margin

Shares Out

32,360

10.0x

0%

65.0%

1%

0% Discount Rate

65.0%

66.0%

65.0%

66.0%

67.0%

Discount Rate

65.0%

66.0%

65.0%

66.0%

67.0%

Present Value of Terminal Value Using EBITDA Multiple

$ 204,753

$

10.0x

2,047,530

$

$

204,753

10.5x

2,149,907

$

$

204,753

11.0x

2,252,283

$ 204,753

$

11.5x

2,354,660

$

10.0x

167,421

162,439

167,421

162,439

157,633

$

10.5x

175,792

170,561

175,792

170,561

165,515

Terminal Value Multiple

11.0x

$ 184,163 $

11.5x

192,534

186,805 178,683

184,163

178,683

173,397

192,534

186,805

181,278

Implied Equity Value Using EBITDA Terminal Value Multiple

$

10.0x

190,931

185,285

190,931

185,285

179,836

$

10.5x

199,303

193,407

199,303

193,407

187,718

Terminal Value Multiple

11.0x

$ 207,674 $

11.5x

216,045

209,651 201,529

207,674

201,529

195,599

216,045

209,651

203,481

$

10.0x

5.90

5.73

5.90

5.73

5.56

Implied Per Share Value

$

10.5x

6.16

5.98

6.16

5.98

5.80

Terminal Value Multiple

$

11.0x

6.42

6.23

6.42

6.23

6.04

$

11.5x

6.68

6.48

6.68

6.48

6.29

$

12.0x

2,457,036

$

12.0x

200,905

194,927

200,905

194,927

189,160

$

12.0x

224,416

217,773

224,416

217,773

211,363

12.0x

$ 6.93

6.73

6.93

6.73

6.53

Notes:

(1) Assumptions and Projections provided by management.

(2) EBITDA Margin reflects management projections.

(3) Working Capital assumptions reflects management projections.

(4) Early stage discount rate of 65% (average of 55% for a pre-IND lead product) over 1 year back to 2008s.

(5) DCF assumes an EBITDA Multiple of 10x as referenced in the precedent transaction analysis.

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

Takeaways from Discounted Cash Flow

• Clearly define the DCF assumptions.

• Emerging technology and life science companies will likely require more significant discounting given the increased uncertainty that the early company will meet its projections.

• DCF analysis has been around (at least in some form) for centuries.

• Early-stage investors will likely review a prospect’s projections and

DCF with skepticism – be able to defend your assumptions.

• Be able to reference other valuation methodologies to further support your analysis.

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

Putting It All Together – Developing a Valuation

Range

Public Company Comparables Valuation Approach - EBITDA

Comp Group #1

MedTech Company EBITDA

Budget

2009

$1,917,172

Comp Group #2

MedTech Company EBITDA

Budget

2009

$1,917,172

Comp Group #3

MedTech Company EBITDA

Budget

2008

$1,917,172

Selected EBITDA

Multiple Range

2.4x

5.2x

EBITDA

Median

5.7x

EBITDA

Average

6.0x

% of Median

41.3% 100%

Enterprise Value Conclusion

Selected EBITDA

Multiple Range

4.5x

10.3x

Selected EBITDA

Multiple Range

4.1x

6.4x

EBITDA

Median

14.7x

EBITDA

Average

13.1x

% of Median

30.2% 100%

Enterprise Value Conclusion

EBITDA

Median

7.9x

EBITDA

Average

8.2x

% of Median

52.6% 100%

Enterprise Value Conclusion

% of Average

39.1% 86.2%

Indicated

Enterprise Value

$4,509,868 -$9,942,296

$4,509,868 -$9,942,296

% of Average

34.0% 78.6%

% of Average

50.3% 77.5%

Indicated

Enterprise Value

$8,543,919 -- $19,754,802

$8,543,919 -- $19,754,802

Indicated

Enterprise Value

$7,920,392 -- $12,195,538

$7,920,392 -- $12,195,538

Blended Value Conclusion (50% Group #1, 30%

Group #2, and 20% Group #3)

$6,402,188 -- $13,336,696

Notes:

(1) EBITDA Multiples adjusted downward by 40% given market conditions and size of company.

Note: The analysis above is a sample. Each valuation range will have unique attributes given the company and the corresponding industry.

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

CB Capital Contact Information

Alex Moen

CB Capital Partners

860 Newport Center Drive

Newport Beach, CA 92660

(949) 219-7462 (Direct) alex.moen@cbcapital.com

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

Appendix

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

Appendix A - Medical Device Companies in Orange County

Source: Orange County Business Journal

Note: There are over 300 Medical Device companies in Orange County alone.

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

Appendix A - Medical Device Companies in Orange County (cont.)

Source: Orange County Business Journal

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

Appendix A - Medical Device Companies in Orange County (cont.)

Source: Orange County Business Journal

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

Appendix B - VCs with an Interest in Medical Device Companies

Accuitive Medical Ventures – Invested in WaveTec Vision of Aliso Viejo in

February 2009

De Novo Ventures – Invested in WaveTec Vision of Aliso Viejo in February

2009

New Leaf Venture Partners – Invested in ReShape Medical of San Clemente in February 2009

SV Life Sciences– Invested in ReShape Medical of San Clemente in February

2009

U.S. Venture Partners – Invested in ReShape Medical of San Clemente in

February 2009

Versant Ventures – Invested in WaveTec Vision of Aliso Viejo in February

2009

Note: There are hundreds of prospective Medical Device investors in the United

States and abroad.

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

Appendix C - Prominent UCI Alumni

Adam Tomasi, Ph.D., Kauffman Fellow, Alta Partners

Adam joined Alta partners in 2006 as a Kauffman Fellow and focuses on investments in the life sciences. Originally trained as an organic and medicinal chemist, Adam spent seven years in early stage drug discovery with Gilead Sciences and

Cytokinetics. In his last technical position, he founded and led the Anti-Infectives Medicinal Chemistry Program at

Cytokinetics, which was the first group to validate KIP-1 as an anti-fungal target, and played a key role in the creation of

Cytokinetics’ cardiovascular drug CK-1827452, which is currently in clinical trials.

Prior to joining Alta, Adam was a student in the Harvard-MIT Biomedical Enterprise Program; he completed internships at

MPM Capital and Lehman Brothers, where he was an Analyst covering the biotech sector, and attended the Harvard

Medical School. Adam completed his Ph.D. at the University of California, Irvine, where he was a Fellow of the American

Chemical Society and the University of California Regents, and was a post doctoral student with Peter Schultz at The

Scripps Research Institute/The Genomics Institute of the Novartis Foundation.

Adam holds a Bachelor of Science in Chemistry from the University of California, Berkeley, a Ph.D. in Chemistry from the

University of California, Irvine, and a Masters of Business Administration from the MIT Sloan School of Management.

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

Appendix C - Prominent UCI Alumni

Brian Atwood, Co-Founder & Managing Director,

Versant Ventures

Brian Atwood specializes in biotechnology investing at Versant. Brian co-founded Versant Ventures after spending four years at Brentwood Venture Capital where as a general partner he led investments in biotechnology, pharmaceuticals, and bioinformatics. He also has more than 15 years of operating experience in the biotechnology industry, with emphasis on therapeutic products, devices, diagnostics, and research instrumentation.

Prior to launching his career in venture capital, Brian was founder, president, and CEO of Glycomed, a publicly traded biotechnology company. At Glycomed, Brian concentrated on business development and strategic alliances, closing deals with Eli Lilly & Company, Millipore, Genentech, and Sankyo, before leading the sale of Glycomed to Ligand

Pharmaceuticals. Prior to this, he co-founded and served as director of Perkin Elmer/Cetus Instruments, a joint venture for robotics automation and genomics research instruments and products later acquired by Perkin Elmer. Under Brian's management, the venture developed and launched the GeneAmp® Polymerase Chain Reaction (PCR) system, the fundamental DNA amplification innovation responsible for fueling the explosive growth of genomics research. Brian served on the Board of Directors at Pharmion Corporation (sold to Celgene in 2008). Brian currently serves as a Board member at the private companies ForteBio Inc., FivePrime Therapeutics, Inc., Veracyte, Inc., Trius Therapeutics, Inc., Synosia

Therapeutics, OpGen, Inc., PhaseRx, Inc., and Immune Design Corp., as well as public companies, Cadence

Pharmaceuticals (CADX), and Helicos Biosciences (HLCS).

Brian received a Bachelor's degree in Biological Sciences from the University of California, Irvine; a Master's degree from the University of California, Davis, and an MBA from Harvard Business School.

*Disclaimer: Brian Atwood is focused on biotechnology, pharmaceuticals and bioinformatics.

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

Kurt Miklinski Slideshow

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

Who is SVB Financial Group?

• Comprised of three segments:

1. Silicon Valley Bank

2. SVB Capital

3. Other Business Services

• 31% Loan Growth (2007 to 2008)

• $5.5 Billion of loans

• $10 Billion of on balance sheet assets

• Over 11,000 clients / 1100 employees

• Global Presence (27 US offices plus India, China, UK,

Israel)

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

SVB Target Market

• Technology, Life Sciences, Private Equity and Venture Capital

• Loans $1-20 Million

• Senior blanket lien on all assets

• Quad I, II, III, IV

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

SVB Med Device Clients

Orange County

• 8 public

• 30 private

• 6 private equity raises in prior 12 months

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

Most Active SoCal Investors

(with a SoCal office)

Redpoint

Firm

Rustic Canyon

Clearstone

Enterprise

Tech Coast Angels

Palomar

Deals

31

21

17

13

13

13

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

Medical Device Themes

• Aging population

• Resiliency compared to broader market

• High ticket and elective procedures suffering

• Market consolidation

• Unemployment affecting volume of doctor and dentist visits

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

Success Factors/Strong

Valuations

• Minimally invasive / Compelling ROI

• Non-elective

• New frontiers (Obesity, Diabetes)

• International

– General increase in standards of living

– Increased healthcare spending

– Nationalized healthcare

• Avoidance of DOJ investigations / IP litigation

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

Jeremy Holland Slideshow

Private Equity Trends

Jeremy Holland

Principal, Vintage Fund Management

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

Executive Summary

• US EV/EBITDA Multiples

• Average Purchase Price by Transaction Type

• Median Acquisition P/E Multiple by Transaction Size

• Equity P/E Ratio vs. Number of Deal Announcements

• 2008 Private Equity

• US Middle Market M&A Activity by Buyer Type

• Private Equity – History

• Prototypical Deal Capital Structure

• Average Equity Contribution

• Credit Markets Commentary

• Valuation Issues and Problems

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

U.S. EV/EBITDA Valuation Multiples

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

Average Purchase Price by Transaction Type

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

Median Acquisition P/E Multiple by Transaction Size

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

Equity P/E Ratio vs. Number of Deal

Announcements

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

2008 Private Equity

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

U.S. Middle Market M&A Activity by Buyer Type

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

Private Equity - History

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

Prototypical Deal Capital Structure

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

Average Equity Contribution

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

Credit Markets Commentary

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

Valuation Issues and Problems

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

Vintage Fund Management

Contact Information

Jeremy R. Holland

Principal

Vintage Fund Management, LLC

11611 San Vicente Blvd, 10 th Floor

Los Angeles, CA 90049

310-979-9090 jholland@vintagecapitalgroup.com

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

Chuck Packard Slideshow

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

PACKARD BUSINESS RULES

Success Rules for

Successful Businesses

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

• Successful businesses must be adequately capitalized:

– Human Capital

– Financial Capital

– Network Capital

– Vendor/Supplier Capital

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

• Experienced, Active Board of Directors

• Recruit a Strategic Advisory Board

• Operate at a Profit

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

• Manage Cash Daily / Collect Accounts

Receivable

• Develop business-specific Performance

Metrics

• Business Capital / Business Experience

The Les Kilpatrick

Students to Start-ups

Entrepreneurial Skills Workshop Series

• Develop the mindset of a successful business

• Must be able to Survive Death Valley –

Staying Power