Tax Seminar Presentation

advertisement

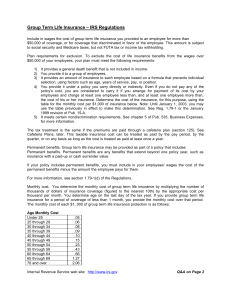

TAX SEMINAR The hardest thing in the world to understand is income tax. – Albert Einstein Why Should I File? All individuals who have income subject to withholding must file a tax return, regardless of whether or not they owe money to the IRS If you have taxes withheld from your income, you maybe eligible for a refund Failure to file may be regarded as non-compliance with U.S. law and can affect your visa status Failure to file may also negatively impact residency and citizenship application processes in the future What is my Residency Status? Aliens (non-U.S. citizens) can be resident, dual-status or nonresident Why is this important -Resident and dual-status aliens are taxed like U.S. citizens, nonresidents are taxed differently. -The status affects amount of reportable income, availability of deductions and treaty benefits. How do I determine my residency status? -You are a resident alien for tax purposes if: Green card test – you receive permanent resident status from the INS (a.k.a. BCIS) Substantial presence test – you have spent more than 183 days in the U.S (excluding days as exempt individual) Am I an Exempt Individual? Exempt individuals can exclude days of presence in the U.S. for the Substantial Presence Test. Common exempt categories: - Student on F, J, M or Q visa - Teacher/trainee on J or Q visa - Immediate family members (spouse & children) of above categories - Closer connection to foreign country (needs to file Form 8840 see IRS Pub. 519 for criteria) The Substantial Presence Test Nonresident vs. Resident Nonresident: a) pays tax only on U.S. source income, b) subject to special rates, and c) might qualify for treaty exemptions. Resident: Taxed under the same rules and file the same forms as a U.S. citizen. What Should I File? (nonresident) 1) 1040NR: U.S. Nonresident Alien Income Tax Return OR 1040NR-EZ: U.S. Income Tax Return for Certain Nonresident Aliens With No Dependents 2) 8843: Statement for Exempt Individuals and Individuals With a Medical Condition (all nonresident aliens MUST file the 8843) 3) 6251: Alternative Minimum Tax – Individuals (typically required for Kellogg students) Some Other Common Form: 843: Claim for Refund and Request for Abatement (erroneous withholding of Social Security and Medicare taxes) 4868: Application for Automatic Extension of Time to File U.S. Income Tax Return (4 month auto extension) 8233: Exemption from Withholding for Independent Personal Services for a Nonresident Alien 8822: Change of Address 8840: Closer Connection Exception Statement for Aliens Useful Tax Publications 519: U.S. Tax Guide for Aliens 901: U.S. Tax Treaties 520: Scholarships and Fellowships 508: Tax Benefits for Work-Related Education 514: Foreign Tax Credit for Individuals 529: Miscellaneous Deductions 970: Tax Benefits for Education 17: Your Federal Income Tax – Individuals Some Familiar Forms Form W-2: A form issued by the University/Employer stating all payments made to you as compensation for services (RA, TA, Summer internships) and all amounts withheld. You should have received your W-2 by the end of January. You need to file: Copy B with Federal Tax return Copy 1 with State Tax return Copy 2 with City Tax return Copy C with your records Some Familiar Forms Form 1042-S: Same as the W-2, but for scholarships and fellowships which are not compensation for services. 1042-S forms are mailed by the University around March 15th. Form 1098-T: A form issued by the University to inform you of the amount of tuition paid by you. It is useful to help you calculate your deductions. It need not be sent along with your Tax returns. How do I get Forms & Publications Online: http://www.irs.gov/formspubs By phone: 1-800-TAX-FORM (1-800-829-3676) 24 hours a day, 7 days a week In the mail: using the order blank in the tax package you receive in the mail Form 1040NR or 1040NR-EZ You can file the 1040NR-EZ only if you meet ALL of these conditions: 1) No dependents are claimed on your tax return 2) You are not claimed as a dependent on another U.S. tax return 3) The only sources of income were wages, salaries, tips, taxable refunds of state and local income taxes and scholarship/fellowship grants 4) Taxable income is under $50,000 Continued… Form 1040NR or 1040NR-EZ 5) The only adjustment to income is student loan interest deduction or scholarship exclusion 6) No tax credits are claimed 7) No exemption is claimed for spouse 8) The only itemized deduction is state and local income tax 9) The only taxes owed are income tax If you do not meet one or more of these conditions, you must file the 1040NR What is my File Status? Single Married - Filing separately - Filing jointly (usually not available to nonresident aliens see IRS Pub. 519 for more information) What is my Taxable Income? The IRS only taxes U.S. source income: Scholarship/fellowship grants from a U.S. source that are not exempt by a tax treaty Salaries, wages and other compensation for personal services, including RA/TA/internships Dividends from stock investments Lottery/casino winnings Income from sale of personal property, real estate, rent etc. located in the U.S. Royalties from patents, copyrights registered in the U.S. What Income is NOT Taxable? All non-U.S. source income (personal funds, family funds, foreign scholarships etc.) Interest paid by U.S. banks on checking and savings accounts Scholarships/fellowships/wages exempt by a tax treaty Tax Treaty Information Tax benefits available to persons from certain countries Some treaty benefits have time and dollar limits If limits are exceeded, benefits may be lost retroactively Most treaties require residency in home country prior to entry into the U.S. Treaty information listed in IRS Pub. 901 Deductions vs. Credits Deductions and exemptions are the amounts you can subtract from your income before calculating your tax liability Credits are amounts that you can subtract from your tax liability Income $10,000 Deductions $ 2,000 Taxable Income $ 8,000 Tax Liability @ 20% $ 1,600 Tax Credit $ 500 Net Tax Payable $ 1,100 What Deductions Can I Take? Students without prior work experience: Charitable contributions State and local income taxes paid during the year Losses from casualty or theft if property was located in the U.S. Qualified student loan interest (see IRS Pub. 519 for qualification criteria) Students/scholars from India can take a standard deduction of $4,750 instead of itemizing deductions Job expenses (only if they are over 2% of your Adjusted Gross Income) Generally one personal exemption of $3,050 for 2003 Exemption for spouse or other dependents (See Pub. 519 for qualification criteria) What Deductions Can I Take? Additionally, for students with prior work experience: Tuition expenses, books, supplies are deductible if it is a qualifying education (see IRS Pub. 508 for details) Student loan interest payments are deductible if your Adjusted Gross Income is less than $65,000 What is a qualifying education? What is Qualifying Education? What Credits are Available? Usually nonresident aliens are not eligible for any tax credits Under some special circumstances, some nonresident aliens may be eligible for Child and Dependent Care Credit, and Child Tax Credit. (see IRS Pub. 519 for details) What Should I Send to IRS? Completed Form 1040NR/NR-EZ Copy B of W-2 from University and Summer Employer (if you did an internship) 1042-S from University Form 8843 If you owe the IRS money, attach a check, money order or cashier’s check made out to “U.S. Treasury” (put Social Security No. and which tax year the money is meant for in ‘memo’ section), or pay by credit card Do not send cash! Where do I Send the Forms? Send your tax return with all enclosures to: Internal Revenue Service Philadelphia, PA 19255 TAX RETURNS MUST BE POSTMARKED APRIL 15TH OR EARLIER! Where Can I Get Help? Online: IRS website at www.irs.gov (Forms, FAQs etc.) By phone: (800) 829-1040 (live general tax assistance) Other: Professional tax preparer, e.g. H&R Block OTHER USEFUL LINKS: Refund status: https://sa.www4.irs.gov/irfof/lang/en/irfofgetstatus.jsp Tax treaties (complete texts): http://www.irs.gov/businesses/corporations/article/0,,id=96739,00. html STATE TAX Who Should File? All full-year or part-year residents of the state of California Residency implies domicile, and not citizenship or green card status If your U.S. address is in California, you are a resident of the state of California for state tax purposes Start state tax paperwork after you have completed the federal tax return Who Should File? All individuals: Form CA 540NR In addition: - Part-year residents: Schedule NR - Residents claiming credit for taxes paid in another state: Schedule CR (see form for criteria) Where Can I Get the Forms? Online: www.ftb.ca.gov By phone: (800)338-0505 In Person: libraries and post offices How Can I Pay? Personal check Money order Credit card Do not send cash! Where Do I Send the Forms? Refund: Franchise Tax Board PO BOX 942840 Sacramento CA 94240-0002 OWE: Franchise Tax Board PO BOX 942867 Sacramento Ca 94267-0001