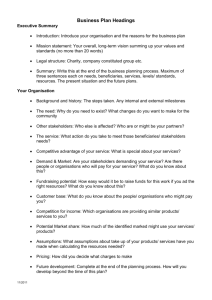

People and Finance - Kinross High School

advertisement