Saving Money & Simple Interest: Financial Literacy Presentation

advertisement

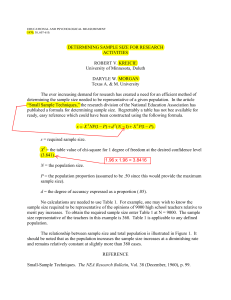

Problem of the day…. • You have to pay the first $500 of car repairs following an accident. The money you pay is called your: Planning Ahead Saving money is an important part of financial freedom and responsibility. What are the advantages of having a savings account? Brainstorm Ideas! Anticipation- where does all that money come from??? • Simple ways to save money • Using your smart phone to save money– justify that expensive phone • Can you come up with more? WHY SAVE MONEY? A little goes a long way… • Person 1 (age 18) puts away $3,000 per year in her Individual Retirement Account (IRA) earning 10% - she does this for 10 years then stops. • She accumulates $1,239,564 by the age of 65. • 3000 x .10 x 10 years • Money continues to grow 47 years Person 2 waits until he is 28. He contributes $3,000 to his IRA account earning 10% for 37 years. He accumulates $1,102,331 by the age of 65. 3000 x .10 x 37 years Time Value of Money • Time value of money -- Money to be paid out or received in the future is not equivalent to money paid out or received today. Rule of 72 8% x no. of years = 72 TIME NEEDED FOR MONEY TO DOUBLE OR 72 DIVIDED BY THE RATE $1,000 AT 8% WILL DOUBLE IN APPROXIMATELY 9 YEARS Examples: @ 2% years to double = Example: @ 4% years to double = 36 years, 18 years Which would you rather have? Million dollars or a penny that doubled it’s value everyday? A few years back I was having a conversation with some people on how whenever you decide to invest in something for the long term, you should always think ahead on what would be the best choice in the long run while having persistence to follow through with it. The scenario was that if you were given a choice to receive one million dollars in one month or a penny doubled every day for 30 days, which one would you choose? When I first heard this, I knew that the penny doubled everyday must have been the better choice to go with as it was a little obvious to me that it had to be a trick question of some sort. But how much better would it be was not something that I knew immediately. So to demonstrate this, it was actually written out with all the calculations and it turned out to something like this: • • • • • • • • • • • • • • Day 1: $.01 Day 2: $.02 Day 3: $.04 Day 4: $.08 Day 5: $.16 Day 6: $.32 Day 7: $.64 Day 8: $1.28 Day 9: $2.56 Day 10: $5.12 Day 11: $10.24 Day 12: $20.48 Day 13: $40.96 Day 14: $81.92 • • • • • • • • • • • • • • • • Day 15: $163.84 Day 16: $327.68 Day 17: $655.36 Day 18: $1,310.72 Day 19: $2,621.44 Day 20: $5,242.88 Day 21: $10,485.76 Day 22: $20,971.52 Day 23: $41,943.04 Day 24: $83,886.08 Day 25: $167,772.16 Day 26: $335,544.32 Day 27: $671,088.64 Day 28: $1,342,177.28 Day 29: $2,684,354.56 Day 30: $5,368,709.12 Time Value of Money: Money is worth more in the future, than what it is worth today. This all boils down to one concept: Patience Lesson Objective Calculate simple interest and the amount. Content Vocabulary Interest ( I ) interestinterest rate simple principal annual simple interest Interest The amount percent paid of only money theon principal the paid for the use original earning earned as principal. interest. interest of a lender’s in one money. year. Principal (P) annual interest rate (R) Time (T) The amount of time for which the principal is borrowed or invested. (How long was the money in the bank?) When you calculate time in an equation, it must be written as “part of a year” if it is less than a year. Examples: 3 months 3/12______ 7 months __7/12____ 15 days _15/365_____ 26 days __26/365____ $1,000 Invested at 10% Simple Interest Rate 1 Year 2 Years $1,100.00 $1,200.00 AMOUNT • If the interest is computed and deposited into the account, the new quantity is called the amount. Amount = Principal + Interest (A = P + I) Interest = Principal x Rate x Time (I = PRT) Example: • You open a savings account and deposit $9,000. Your bank advertises a 5.5% annual interest rate. If you don’t make any deposits or withdrawals, how much interest will you make in 3 years? Principal ($_9000__) x Rate (__5.5_%) x Time (_3 years) 1. Convert the rate to a decimal: _______% = _.055_____ 2. If the “Time” is less than a year, write it as part of a year (this example is not) 3. Multiply the Principal x Rate x Time: $__9000___ x __.055__ x 1____ = $___495____ • You will make $__495___ interest in 1 year. 4. Find the “Amount” = P + I Principal ($__9000) + Interest ($_495_) = $_9495_ Using the same example, how much interest will you earn at the end of 3 months? Interest = P ($_9000__) x R (.055) x T (__3/12___) remember it is part of a year $_9000 x .055 x 3_÷ 12_= $_123.75_ (interest for 3 months) • Amount = $_9000___ + $123.75_ = $__9123.75 Using the same example, calculate the interest earned for 3 days. Interest = P ($_9000_) x R (_5.5%) x T (3/365) $__9000 x _.055 x _3_ ÷ _365_ = $_4.07_ Interest = $__4.07___(round final answer to a dollar amount) Amount: $_9000 + $_4.07___= $_9004.07_ Closure: WHAT GIVES YOU THE BEST RETURN ON INVESTMENT? MONTHLY OR DAILY COMPOUNDING Assignment: • p. 224 (5-14) **for #8 use 15 12 Answer key for p. 224: 5a. $216 b. $936 6a. $18 b. $738 7a. .59 b. $720.59 8a. $506.36 b. $6,398.51 9a. $232.57 b. $27,201.01 10. $760 x .05 x 3/12 = $9.50 11. $2,430 x .0675 x 65/365 = $769.50 12. 618.75 = 15,000 x .055 x T/12 618.75 = 825T 12 Multiply both sides by 12: 7425 = 825T Divide each side by 825: 9 = T (9 months) 13. 10,000 = P x .0475 x 90 365 10,000 = .0117123288 P P = $853,801.1672 = $853,801.17 14. $75,760 – 73,000 = $2760 (this is the interest) $2,760 = $73,000 x .075 x T 12 $2,760 = 456.25 T 6.049314068 (6 months) March 1 plus 6 months = September 1 #15 Warm-up 9,364.85 x .04 x 5/ 365 = 5.13 8,364.85 x .04 x 12/365 = 11.00 6364.85 x .04 x 10/365 = 6.98 4364.85 x .04 x 3/365 = 1.44 Total 24.55 30 days of activity