Instructor Lesson Plan Scenario 2

advertisement

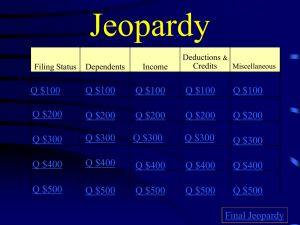

Scenario #2 SCENARIO #2 TAX LAW TOPICS COVERED 1. 2. 3. 4. 5. Filing Status – Head of Household Income: W-2, 1099-INT, 1099 MISC, and Unemployment Income Exemptions: Dependency Adjustment: Student Loan Interest Credits- Refundable and nonrefundable EITC, CTC, CDCC, Education Credit AOTC 6. Determining Itemization: Charitable Donations & Medical Expenses 7. Affordable Care Act 8. Form 8888- Split refund 50% in Savings & 50% in Checking OBJECTIVES Students will be able to: Identify the taxpayer’s filing status (HOH) Determine dependency exemption: qualifying child and qualifying relative Input income from a W-2, 1099-MISC, 1099-G and 1099-INT Enter Student Loan Interest Adjustment from 1098-E Input Post-Secondary Student Tuition Payments: 1098-T Determine if a taxpayer is eligible for EITC, CTC, AOTC and CDCC Explain the difference between standard v. itemized deductions Learn how to do a split refund using the Form 8888 Determine applicable healthcare exemptions Finish a basic tax return MATERIALS Online Savings training videos, volunteer cheat sheet, and savings integration manual – can be found on the training page on the EKS website: www.earnitkeepitsaveit.org/coordinators/savings/ Print Volunteer packet for Scenario 2 1040 Formula Worksheet Tax Forms 1. 13614-C Intake and Interview sheet for Cheryl Webster 2. Tax forms: W-2, Wage and Tax Statement 1098-E, Student Loan Interest 1099-MISC, Miscellaneous Income 1099-G, Unemployment Income 1099-INT, Interest Income 1098-T, Tuition Statement 1098-E, Student Loan Interest Statement Form 1095-C for Health Insurance Coverage 1|P a g e 2016 Scenario #2 SCENARIO OVERVIEW FOR INSTRUCTOR Cheryl is married but has not lived with her husband since 2009. She has two children, Jeremy and Joshua, who lived with her the entire year. She paid all household expenses and provided support to both of her children. Jeremy is a college student and paid tuition. Cheryl also paid for a summer program for her son Joshua. Cheryl worked for most of the year, but she lost her job in October and collected unemployment for 2 months. She also received a 1099-MISC. for babysitting she provided. For this scenario, the volunteers will have to know about exemption for gap in health coverage for the year. If due a refund, Cheryl will elect to split her refund 50/50 between her checking and savings accounts. OPENING THE LESSON Handout Scenario 2 Packet to volunteers Review the objectives of the scenario with the volunteers and tell them what exactly they will be learning. Go over the documents included 1. 13614-C Intake and interview form 2. Supporting documents 3. Scenario Interview Notes Intake & Interview BUILDING ON WHAT YOU’VE ALREADY LEARNED: 1. Review intake form; did Cheryl answer all of the questions correctly? As a volunteer you must review form and verify if their answers correspond with documents presented 2. Verify if form is filled out correctly and corrections are made when clarifying questions are asked 3. Determine if the client is eligible for VITA services- see Scope of Service chart in Publication 4012, Pages 8-10 Ask volunteers: Did Cheryl complete the following? Met the program requirements (household income, photo identification, and social security cards)? YES 2. Completed the intake and interview sheet and has supporting documentation? YES 3. Have a filing requirement? YES 1. 2|P a g e 2016 Scenario #2 CONDUCTING THE LESSON Starting tax return - Publication 4012, Tab N Now that volunteers have determined that Cheryl is eligible for VITA, it’s time to create a new return. Have all students refer to instructions covered in lesson 1. Remind volunteers that their TaxWise screen should be green during training. TAXWISE 1. Create a new return and locate the forms tree on the left side of the screen 2. Input information from Part I of Intake Sheet into Main Information sheet. Refer to Pub. 4012, Tab K 6-11 3. Taxpayers must choose a five digit PIN number (recommend using zip code) and today’s date-. This is the client’s e-file approval signature. Dependency Exemptions - Publication 4012, Tab C THREE THINGS YOU NEED TO KNOW ABOUT DEPENDENCY EXEMPTIONS: 1. You are allowed one exemption for each person you can claim as a dependent. You can claim an exemption for a dependent even if your dependent files his/her own return to receive their refund from income tax withheld from their pay. 2. A “dependent” is defined by a qualifying child or qualifying relative and meet the dependency tests. See Pub 4012 Tab C-3 3. You cannot claim a person as a dependent unless that person is a U.S. citizen, U.S. resident alien, U.S. national, or a resident of Canada or Mexico WITH CLASS – 1. Review Part II, number 2 of Intake and Interview Sheet 2. Determine the number and type of dependency exemptions Cheryl can claim. Instruct volunteers to use chart in Pub 4012, Tab C-3. 2 – Joshua and Jeremy are qualifying children. 3. Remind volunteers that exemptions reduce the income that is subject to tax and that an exemption for a particular person cannot be claimed on more than one tax return. 3|P a g e 2016 Scenario #2 TAXWISE – 1. Back to Main Info on TaxWise – Pub 4012, Tab K-6 2. Input dependent information into Main Info sheet 3. Ensure that the EIC box is checked for each dependent Filing Status - Publication 4012, Tab B THREE THINGS YOU NEED TO KNOW ABOUT DETERMINING CHERYL’S FILING STATUS: 1. Does Cheryl have dependents? Yes, See Pub 4012, Tab C-3 2. Did Cheryl provide more than half the cost of keeping up her home for the entire year? YES 3. If the client has more than one filing status that can apply to them, choose the one that is most beneficial. Head of Household WITH CLASS – Determine Cheryl’s Filing Status. Review all 5 filings statuses and explanations for each. Use Decision Tree in Publication 4012, B-1 to identify her filing status. 2. Ask volunteers, what is the filing status and what makes her eligible for this filing status? Head of Household; she is considered unmarried, she has two qualifying dependents and paid more than half the cost of keeping up the home for the entire year. 1. TAXWISE – 1. Back to Main Info on Taxwise 2. Input Cheryl’s filing status as Head of Household Income - Publication 4012, Tab D WITH CLASS – 1. Cheryl has a 1099 Misc. Teach business income and how it is reported: cash income and 1099 Misc. 2. Review Schedule C-EZ and C, Publication 4012, Tab D 13-14 3. Refer to Lesson 1 for details on how to input income documents, refer to Tab D-3 for TaxWise entry information TAXWISE – 1. Have volunteers enter all income documents for Cheryl: W-2 1099-MISC 1099-INT 1099-G 4|P a g e 2016 Scenario #2 Adjustments to Income - Publication 4012, Tab E4 THREE THINGS YOU NEED TO KNOW ABOUT STUDENT LOAN INTEREST: 1. Can reduce the amount of your income subject to tax up to $2,500 in 2015 2. Taxpayer must be legally liable for the loan 3. Expenses were made to pay for education expenses like tuition and books. TAXWISE – 1. Input student loan interest reported on Form 1098-E. Pub 4012 Tab E-5. 2. Link to 1040 worksheet 2 from line 33. Deductions - Publication 4012, Tab F THREE THINGS YOU NEED TO KNOW ABOUT DEDUCTIONS: 1. Taxpayers can take either the Itemized or Standard Deduction, whichever is greater. a. Standard Deduction is a fixed dollar amount that reduces the income you’re taxed on. Your standard deduction varies according to your filing status. Your standard deduction increases if you're blind or age 65 or older. b. Itemized deductions also reduce your taxable income, but are typically used when you have qualifying expenses (like mortgage interest or large unreimbursed medical/dental expenses) that add up to more than the standard deduction. 2. Schedule A must be prepared if the client is itemizing their deductions. 3. Clients must have a written record of these expenses in case they get audited. Medical Expenses – (Refer to Publication 17 for full list of eligible medical/dental expenses you can use to itemize) THINGS YOU NEED TO KNOW ABOUT MEDICAL EXPENSES: 5|P a g e 2016 Scenario #2 In order to claim these medical expenses there are some things you need to note: 1. Medical expenses are the costs of diagnosis, cure, mitigation, treatment, or prevention of disease, and the costs for treatments affecting any part or function of the body. These expenses include payments for legal medical services rendered by physicians, surgeons, dentists, and other medical practitioners. 2. Medical and dental expenses were paid this year (2015), regardless of when the services were provided 3. Medical and dental expenses were more than 10% of the taxpayer’s AGI (7.5% if 65 or older) 4. Medical and dental bills paid for by the taxpayer or spouse for: dependents, spouse and taxpayer. WITH CLASS – Example: You are unmarried and under age 65 and your AGI is $40,000, 10% of which is $4,000. You paid medical expenses of $2,500. You cannot deduct any of your medical expenses because they are not more than 10% of your AGI. TAXWISE – 1. Input Cheryl’s medical expenses. Pub 4012 Tab F-5. 2. Link to Schedule A, from 1040 line 40, then link to itemized detail sheet from Schedule A, Line 1 for breakout of medical expenses. 3. Enter information on the worksheet Pub 4012 F-7. Charitable Contributions (Publication 17 for full list of eligible charitable contributions you can use to itemize. ) THREE THINGS YOU NEED TO KNOW ABOUT CHARITABLE DONATIONS: 1. A charitable contribution is a donation or gift to, or for the use of, a qualified organization. It is voluntary and is made without getting, or expecting to get, anything of equal value. 2. To deduct a charitable contribution, you must file Form 1040 and itemize deductions on Schedule A. 3. Generally, you can deduct contributions of money or property you make to, or for the use of, a qualified organization. A contribution is “for the use of” a qualified organization when it is held in a legally enforceable trust for the qualified organization or in a similar legal arrangement. The contributions must be made to a qualified organization and not set aside for use by a specific person. WITH CLASS – 1. Have volunteers review Cheryl’s notes and determine whether she will take the Standard Deduction or Itemize. 6|P a g e 2016 Scenario #2 2. Cheryl will be using the standard deduction in this scenario because her medical expenses and charity contributions did not equal more than her standard deduction. TAXWISE1. Refer to Pub 4012 F-4 Step 12 in chart. 2. Go to Itemized Deductions Detailed Worksheet, enter amount given by cash or check under “Cash Contributions” Pub 4012 F-8 3. Review amount on Schedule A, line 29, and compare amount to the standard deduction on 1040 line 40. Does the client qualify to itemize? Tax Credits - Publication 4012, Tab G THINGS YOU NEED TO KNOW ABOUT TAX CREDITS 1. There are two types of credits: refundable and nonrefundable 2. Nonrefundable Tax Credit: allows taxpayers to lower their tax liability to zero, but not below zero. The child tax credit is a nonrefundable tax credit. 3. Refundable Tax Credit: allows taxpayers to lower their tax liability to below zero. When this occurs, the government owes the taxpayer a refund. The additional child tax credit is a refundable tax credit. Child & Dependent Care Credit- Publication 4012, Tab G 3-5 THREE THINGS YOU NEED TO KNOW ABOUT THE CHILD AND DEPENDENT CARE CREDIT 1. The tax credit for child and dependent care expenses allows taxpayers to claim a credit for expenses paid for the care of a child under the age of 13 and/or a disabled spouse or dependent. 2. To claim the credit, there are requirements for the taxpayer, the child/dependent and the type of expense. Pub 4012, G-4 3. There is a limit to the amount of qualifying expenses. The credit is a percentage of the qualifying expenses. WITH CLASS – 1. Have volunteers determine if Cheryl can claim the child and dependent care credit. Review documents and have volunteers review chart found on Pub. 4012, Tab G-3. 7|P a g e 2016 Scenario #2 TAXWISE1. Go to 1040, Line 49 and link to Form 2441. 2. Fill out form, see Pub 4012, Tab G-5 for instructions Education Credits - Publication 4012, Tab J THINGS YOU NEED TO KNOW ABOUT EDUCATION CREDITS: 1. There are two education tax credits taxpayers may claim for themselves or their dependents, for higher education. There are differences in the credits and they have different eligibility requirements. Refer to Pub. 4012, Tab J for guidelines. a. American Opportunity Credit b. Lifetime Learning Credit 2. Taxpayers who are eligible to claim the American Opportunity Credit and the Lifetime Learning Credit for the same student in the same year, can choose to claim either credit, but not both. Taxpayers can choose the credit that will give them the lower tax. 3. Form 8863, Education Credits, is used to determine eligibility and figure each credit. 4. Students receive Form 1098-T, Tuition Statement, from eligible educational institutions, which identify tuition and any related expenses paid to the educational institution, and/or reimbursements or refunds. WITH CLASS – 1. Determine which credit Cheryl will claim. Refer to Interview Notes for further information. Use chart on Pub 4012, J-4. American Opportunity Credit TAXWISE1. Go to 1040 Line 50, and link to the American Opportunity Credit Form 8863 and fill out form. Pub 4012 J-7 Child Tax Credit- Publication 4012, Tab G-8 & 9 THINGS YOU NEED TO KNOW ABOUT THE CHILD TAX CREDIT: 1. The child tax credit allows taxpayers to claim a tax credit of up to $1,000 per qualifying child. 2. In order to claim the child tax credit, the taxpayer must have at least one eligible child. Don't confuse this credit with the child and dependent care tax credit! 3. Taxpayers who are not able to take the full amount of the child tax credit may be able to take the additional child tax credit. 8|P a g e 2016 Scenario #2 4. To claim the child tax credit, there are requirements for both the qualifying child and taxpayer; in addition there are limits on the amount the credit. The amount of a taxpayer's child tax credit depends on the taxpayer's: a. Tax liability b. Modified adjusted gross income and filing status c. A taxpayer's child tax credit can only be as much as their tax liability. Once the tax liability is zero, the credit is zero because there is no tax liability to reduce. WITH CLASS – 1. Determine if Cheryl qualifies to receive the Child Tax Credit and identify which dependent makes her eligible to claim the credit. Yes 2. Explain to students that this credit is non-refundable, meaning it reduces their tax liability to zero. If their tax liability was less than $1,000 the taxpayer may be eligible for the difference as the Additional Child Tax Credit. TAXWISE1. Information should automatically populate if qualifying dependent information was entered on the Main Information Sheet. 2. Review the return to see if the information populated. Line 51 on 1040 Additional Child Tax Credit- Publication 4021, Tab G-8 THREE THINGS YOU NEED TO KNOW ABOUT THE ADDITIONAL CHILD TAX CREDIT 1. When a taxpayer's child tax credit is more than their tax liability, they may be eligible to claim an additional child tax credit as well as the child tax credit. 2. The additional child credit is also a tax credit of up to $1,000 per qualifying child. To claim the additional child tax credit, there are: the same requirements for the qualifying child as for the child tax credit additional requirements for the taxpayer different limits on the amount of credit 3. The credit is whichever is lower: a. 15% of the taxpayer's taxable earned income that is over $3,000, or a. b. c. 9|P a g e 2016 Scenario #2 b. The amount of unused child tax credit (caused when tax liability is less than allowed credit) TAXWISE1. Information should automatically populate if qualifying dependent information was entered on the Main Information Sheet. 2. Review the return to see if the information populated – 1040 Pg. 2, Line 67 Affordable Care Act, Publication 4012, Tab D Refer to Lesson 1 on how to interview for ACA procedures WITH CLASS – 1. Review taxpayer answers on Part VI on 13614-C using the Job-Aid in Pub 4012 K 3-4 2. Identify applicable flowchart in ACA tab. Ask students which one they would use for Cheryl? (Determining ACA- Next Steps Insurance all year. ACA-1) 3. Go through flowchart (ACA-1) with students 4. Review Minimum Essential Coverage on ACA-4 (she qualifies) 5. Finish reviewing flowchart (ACA-1) with students 6. Have students complete 13614-C gray box in part VI TAXWISE – 1. Indicate on the tax return that taxpayer had insurance all year (Form 1040, line 61) by checking the box. 2. Link to the ACA worksheet and mark the appropriate coverage explanation. In this case, it is the first bullet: “Had minimum essential coverage and / or is applying for or was granted an exemption for the entire year” 3. Now look for Form 8965 and fill in exemption code determined by the gap in coverage. Exemption code B. CA State Return THINGS YOU NEED TO KNOW ABOUT THE CA STATE RETURN: 10 | P a g e 2016 Scenario #2 1. Get the red out! Most information will automatically populate from the federal return 2. If you have entered more than one W-2 on the 1040, you will have to manually add the additional W-2s. The first W-2 will carry over, but the rest won’t. 3. Make sure to complete the direct deposit or balance due portion of the return 4. Complete the CA Renters Credit Worksheet when applicable. See below for eligibility requirements: a. Taxpayer was a California resident for the entire year. b. Their California adjusted gross income (AGI) is: $38,259 or less if your filing status is single or married/RDP filing separately. $76,518 or less if you are married/RDP filing jointly, head of household, or qualified widow(er). c. Taxpayer paid rent for at least half the year for property in California that was your principal residence. d. The property that was rented was not exempt from California property tax. e. Taxpayer did not live with another person for more than half the year (such as a parent) who claimed them as a dependent. TAXWISE (CA RETURN) – 1. Scroll down forms tree and locate 540 forms highlighted red 2. Go to CA 540 Pg. 5 and answer question #115 – Direct Deposit of Refund or Electronic Funds Withdrawal of Balance Due. Since William has elected for Direct Deposit, choose the first option since he wants his refund deposited into the same account. 3. Ensure all red fields on Form 3514, State EITC form, are filled out. 4. For CA 540 Page 1, below line 6, there is a question about the Renters Credit. 5. Check the “Yes” box, since William rents. 6. Note that the CA Rent Worksheet turns red in the forms tree. 7. Note questions 6 and 7 are red. Answer the questions. Examples of exempt properties are: HUD and church property (section 8 property is NOT exempt). To claim the property tax exemption, you must own property. In this scenario the answers are both “NO.” 8. Fill out information on 12 and 13 9. Shortcut: Go to CA 540 line 35. If the tax amount listed is “0” then there would be no benefit to the client in claiming the non-refundable renter’s credit. You may answer “No” to renter’s credit question to avoid inputting landlord information. 11 | P a g e 2016 Scenario #2 Splitting Refunds in TaxWise - Publication 4012, Tab K-15 According to the Interview Notes and 13614-C, Cheryl elects to split her refund 50% in Savings and 50% in Checking THREE THINGS YOU NEED TO KNOW ABOUT SPLITTING REFUNDS: 1. Always use 8888, Allocation of Refund Form. You can add this form to the forms tree by clicking on the “add forms” icon. 2. Do not enter the bank account information on the Main Info Sheet, only enter their info on the 8888 form. 3. See Publication 4012, Tab K-15 for how to input into TW WITH CLASS – 1. Cheryl wants to split her refund and direct deposit. Tell volunteers to consult the questions on Direct Deposit and Split Refund page on the Intake and Interview sheet, bottom of Page 2 and notice that she provided bank account numbers. The interview notes also state that she wants to save half of her refund. 1. Show Savings videos to class – links to video can be found on the EKS website: www.earnitkeepitsaveit.org/coordinators/savings/ TAXWISE1. Use Pub. 4012, Tab K to assist volunteers in entering Cheryl’s bank account(s) information onto form 8888. Reviewing the Federal Tax Return Review the 1040, line by line pointing out the different amounts and where they came from. Tie it back to the documents and information input by the volunteers. TAXWISE – 1. Review all lines of the 1040 that have amounts in them. 2. Bank account information needed for direct deposit- refer to Part VII of the Intake Sheet and Interview Notes 3. Identity Protection PIN- if client checked the “yes” in box 12 of the Intake Sheet, refer to Pub. 4012, Tab P-4 12 | P a g e 2016 Scenario #2 Finishing the return- Publication 4012, Tab K See scenario 1 on how to further complete the tax return then… 1. Ensure that all federal and state forms are green, then… 2. Click the Run Diagnostics button at the top of the page to check for mistakes or missing information. Address any issues and click the button again until it is clear. 3. Click E-file button below the Diagnostics summary FINISHING THE LESSON After all volunteers have entered all documents into TaxWise for Scenario 2, ask them whether that have any questions about the information that was taught. Review all topics that were covered and be sure to use the questions in the PowerPoint to gauge student comprehension. 13 | P a g e 2016