Political Risk and Political Risk Assessment

advertisement

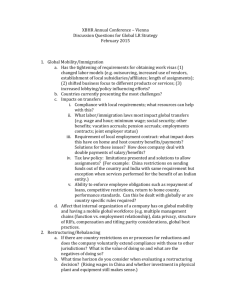

Political Risk and Political Risk Assessment 1 Political Risk Analysis Definitions Empirical relationships Forecasting techniques Using risk analysis Managing political risks 2 3 Definition of Political Risk Possibility of an unexpected politically- motivated event affecting the outcome of an investment Instability vs. risk Classified based on - actor responsible - nature of effect - breadth (micro vs. macro) 4 Types of Political Risks Cause Result Government Others Property Loss Confiscation Destruction Income Loss Discrimination Disruption de la Torre & Neckar (1988), p. 223 5 Main Types of Political Risks a) Expropriation “Forced divestment of equity ownership of a foreign direct investor” (Minor 1994) Peaked in the mid-70s; almost nil now Mostly Africa till 1980, then Latin America Declined since: - Key sectors already nationalized - Economic need = > privatization - Regulate rather than expropriate Many hosts have joined MIGA (Multilateral Investment Guarantee Agency) Some controversy over future: - is free enterprise here to stay, or will there be a backlash when privatization, etc. fails to provide widespread benefits? 6 Main Types of Political Risks (Continued) b) Terrorism Terrorist acts infrequent, but spectacular - L. America #1 esp. kidnappings - U.S. – owned corps. Esp. targets, U.S. public institutions - China, India, Turley, Israel etc. -sept 11, Iraq Little research-seems to be primarily groups denied a voice in legitimate channels Symbolism particularly important (MacDonalds, etc.) c) Selective Intervention Most risks are less dramatic changes in the rules of the game. Some areas of government policy affect foreign-owned companies more than most domestic ones 7 Main Types of Political Risks (Continued) Restrictions on Cross-Border Transfer of Resources Tariffs, NTBs inhibit sourcing, exporting FX controls limit repatriation Capital controls Labour regs Taxation Concerns Restrictions on transfer pricing Unitary taxation policies Withholding taxes Availability of tax holidays and other incentives 8 Main Types of Political Risks (Continued) Investment Restrictions Sectoral restrictions Requirements for JVs, local ownership Transparency of licensing procedures Requirements for disclosure of technology Requirements for forced divestiture Operating Restrictions limits on expansion, ownership of land, etc. Discriminatory access to labour, inputs Restrictions on local market access Performance requirements (e.g. employment & export levels, etc.) 9 Unequal access to government procurement Main Types of Political Risks (Continued) Non-Neutrality of the Legal Environment Judges or other arbiters insulated from political pressure International and regional conventions International conventions re compensation Guarantees of national treatment Regulations with Differential Effects on Foreigners Some may be much harder for foreign companies to comply with 10 Main Types of Political Risks (Continued) d) “Crossfire” Problems Activities may lead to international or home country sanctions or consumer boycotts against the country or firms that deal there - human rights abuses (e.g. imprisonment, torture or murder of political opponents; use of prison labor; persecution of minority groups; not abiding by election results) - conflicts with neighboring countries - lack of concern for the environment, endangered species, etc. - disregard for international agreements (e.g. re nuclear nonproliferation) - the misuse of social issues as means of protectionism What kind of cross-fire problems associated with Iraq winemakers in the Bordeaux region faced? 11 Political Risk Empirical Relationship Most studies examine correlates of expropriation Minor (1993): no link with stability Positive correlations (more risk) - extractive, service and key sectors - JVs with the host government - host countries with pervasive governments (“hands-on”) - medium-technology - need for scapegoats - “obsolescing bargains” 12 Empirical Relationship (Continued) Negative correlations (less risk) - integrated subsidiaries that depend on rest of network - low/high tech - lobbying Makhija (1993): information indicating convergence of MNC actions and government economic objectives 13 Forecasting Techniques “old hands” = ask experts for gut instinct, personal evaluations - taps expertise, but may be dated, subjective or irrelevant “grand tour” = send executives for personal visits - access to top decision makers, first-hand exposure, but superficial - may hear self-interested pleading quantitative - Delphi: obtain expert views, aggregate and give to same experts for chance to revise their views given what others think; repeat until consensus - tends towards “conventional” predictions - econometric: use historical data, macro-orientation, but 14 low-cost, may be helpful for initial screening 15 The Economist Method Political Risk Service (PRS) -- 100 points 33 points economic factors: falling GDP/per capita high inflation capital flight decline in productivity raw materials as percentage of exports 50 points politics: bad neighbours authoritarianism staleness illegitimacy generals in power war/armed insurrection 16 The Economist Method Political Risk Service (PRS) -- 100 points 17 points society: urbanization race Islamic fundamentalism corruption ethnic tension 17 Political Analysis Expert qualitative studies - rational actor-type - what is the logical action given goals - best if unitary actor and major decision - organizational type - organizations do what they have always done - best for small decisions by bureaucracies Political bargaining type - who has power and influence where - best for fractionated power environments Results are best when model fits the characteristics of 18 the decision and the decision-maker Example of Rational Actor Analysis: A Focus on Government Foreign Business Relationships Examination of FDI costs and benefits - Benefits: Capital inflow, job creation, better jobs (?), tax revenue, improved balance of payment, technology transfer, training, market access - Costs: Branch-plant Syndrome, sovereignty and National Security 19 Government Actions When Interests Are in Conflict (Source: Head) Issue: division of spoils (assets and future profits) Actions: limit profit repatriation, taxation, expropriation, force companies’ to sell off all or part of a subsidiary below market value. Issue: technology transfer/control/ Actions: maximum foreign ownership rules, jointventure requirements, investment 20 Government Actions When interests are in Conflicts (Source: Head) – cont’d Issue: sourcing of inputs Actions: tariffs and quota in key imported inputs, domestic control rules Issue: contribution to balance of payments Action: export requirements 21 Managing Political Risk (counter moves) Insurance from EDC, etc. JVs with local or foreign partners Local stakeholders Structural dependency Lobbying Planned divestiture with s/t profits Integrate with strategy Security for expatriates General rule: make the costs to the government of an undesirable move to the firm very costly. Provide “incentives” for appropriate government regulations 22 and policies.