Financial Aid Night - Powerpoint

advertisement

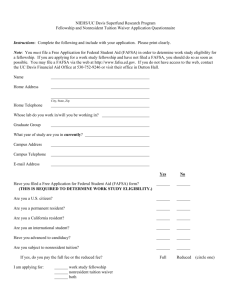

Financial Aid Night 2016-17 1 2 Nick and Nola 3 Financial Aid Philosophy Students and their families have the primary responsibility to pay for postsecondary education expenses Note: even if the student has left the household 4 Types of Applications Types of Applications • FAFSA/FOTW (Free Application for Federal Student Aid) / FAFSA on the Web) www.fafsa.gov • Standard Priority Deadline: Between Jan 1 and March 2 of senior year o Some schools may have an earlier deadline o Available January 1 of senior year (at 12:01 AM) • CSS/Financial Aid Profile o Due as early as October 1 of the senior year o Not required by all schools 5 6 Types of Applications (con’t) • Dream Act Application www.caldreamact.org • GPA Verification Form- complete release form for Counselor’s office • Apply early January for fall 2016, but no later than the March 2 deadline! 7 FAFSA Application Cycle and PPY Starting 2017-2018 • FAFSA available October 1st (2016) • FAFSA will use “prior-prior-year” (PPY) income data • 2017-2018 FAFSA will use 2015 tax year information © 2015 CASFAA 8 FAFSA on the Web (FOTW) • Collects family income, assets, number in college • Built-in edits prevent costly errors and delays • Smart logic allows student and/or parent to avoid unnecessary questions • Transfer data using the Internal Revenue Service (IRS) data retrieval tool 9 FAFSA on the Web (FOTW) Additional benefits: • Available anytime/anywhere • Easier corrections & updates • Comprehensive instructions and “help” for common questions • Simplified renewal application • For Federal & State Aid Determination CSS Profile • Individual colleges ask for information including home equity, income and assets from non-custodial parents, etc. • Not used for awarding federal financial aid- only aid from the colleges/universities • Not all schools require • Cost - $25 for app & one college, $16 for additional colleges • Online Registration only- https://profileonline.collegeboard.org 1 0 11 Initial Student Eligibility • High school diploma, GED, or Proficiency test • U.S. citizen or eligible non-citizen • Valid Social Security number • Enroll in an eligible degree or certificate program • Register with Selective Service (males only) • Sign a statement of educational purpose 12 Maintaining Student Eligibility • Not be in default or owe an overpayment on a grant • Maintain Satisfactory Academic Progress (SAP) • No drug convictions based on Department of Education standards 13 Who is the California Dream Act Application for? • Students who meet the requirements of AB540: • Attend a California high school for at least three years • Graduate from a California high school or the equivalent (GED or CHSPE) • Attend a qualifying California college or university, and • If applicable, complete an affidavit to legalize immigration status as soon as student is eligible 14 www.caldreamact.org 15 Calculating Financial Aid Eligibility 16 What is Financial Aid? Funds provided to students to help pay for postsecondary education expenses. Financial aid includes • Grants • Scholarship • Work study • Loans Cost of Attendance (COA) Standard Costs Optional Costs Tuition and fees Student loan fees Room and board Study-abroad Books and Supplies Disability-related services Transportation Employment expenses for co-op study Miscellaneous personal expenses Child or dependent care Note: Costs vary from institution to institution (and year to year). 17 18 Expected Family Contribution (EFC) • EFC is the measure of a family’s financial strength • EFC is used to determine the student and parent ability to contribute towards the student’s cost of education • Need analysis is the consistent formula used in determining a family’s EFC 19 EFC Calculators www.finaid.org Click on Calculators Click on Expected Family Contribution and Financial Aid Calculator www.FAFSA4caster.ed.gov www.Collegeboard.com Under “For Students” Click on Pay for College Click on Financial Aid Easy Planner 20 Calculating Need Based Eligibility Cost of Attendance (COA) Expected Family Contribution (EFC) Eligibility for Need-Based Aid 21 Need and Eligibility Depend on Cost Private 4-year COA $49,000 - EFC $5,000 = Need $44,000 Public 4-year COA $26,000 - EFC $ 5,000 = Need $21,000 Public 2-year COA $17,000 - EFC $5,000 = Need $12,000 22 Types of Financial Aid Calculating Eligibility Need-Based Aid—2015-2016 Federal Programs Program Award Amount Notes Pell Grant Up to $5775* Lifetime Eligibility 600% (max) FSEOG (grant) $100 to $4,000 Priority to Pell eligible students TEACH Grant Up to $3728* Requires service contract otherwise converts to unsubsidized loan Iraq & Afghanistan Service Grant Up to $5382* equal to Pell Grant – not to exceed the COA Work Study Varies by school On and off-campus employment Subsidized Direct Loan $3500- $5500 (undergrad level) Interest subsidy during periods of enrollment of at least ½ time (150% max eligibility) 23 Calculating Eligibility Need-Based Aid-2015-2016 California Programs California Programs Award Amount Cal Grant A and B (new student tuition/fees) Up to $12,240 (Public); $9084 (Independents); $4,000 (For Profit) Cal Grant B Access Award $1,656 (at all schools) ; Cal Grant C Up to $2,462 (non CCC) $547 (at CCC) Chafee Grant Up to $5000 UC Student Aid $100 or more State University Grant Covers full system-wide fees Child Development Grant $1,000 (CCC) or $2000 (4 yr) Law Enforcement & Personnel Dependents Grant Up to $13,665 (for up to four years) CCC Board of Governors Fee Waiver Covers all Enrollment Fees 24 25 Basic Cal Grant Eligibility Federal Requirements Additional Cal Grant Requirements *U.S. citizen or eligible non-citizen *California Resident Meet Selective Service requirements Attend an eligible California school *Have a Social Security number Be enrolled at least half-time Maintain Satisfactory Academic Progress High School GPA required (Entitlement) Not owe a grant repayment or be in default on a student loan Not be incarcerated Not have earned a BA/BS degree * These requirements are supplanted by other eligibility criteria for AB 540 students 26 Middle Class Scholarship New program beginning in the 2014-15 academic year. http://www.csac.ca.gov/pubs/forms/grnt_frm/middle_class_scholarship_faqs.pdf • Must be a CA resident attending a UC or CSU; US Citizen, permanent resident or have AB540 status. • If family earns up to $100,000 per year, may be eligible for a scholarship of up to 40% of the system tuition & fees. • If family earns between $100,001 & $150,000 per year, may be eligible for a reduced scholarship of no less than 10% of system tuition & fees. • Not set amounts & may vary by student & institution. The award it determined after Pell, Cal Grant & institutional need-based grants 27 Non-need based aid • Unsubsidized Direct Loan o Borrower amount based on grade level o Fixed interest rate based on 10 yr T-Bill- currently 4.29% o Interest accrues while student is enrolled- can be paid while in school or added at repayment o Principal payment deferred until 6 mos after graduating • Private Loans- credit based, interest varies 28 Non-need based aid Federal Parent PLUS Loan • Parent borrows for the dependent undergraduate • Approval subject to credit check- no adverse credit history • Loan limits: COA less other aid • Interest rate is fixed-currently 6.84%; fees up to 4% • Repayment may begin while the student is in school or can be deferred until after graduation. Student must maintain half time enrollment to remain eligible for the deferment. 29 Scholarships • Apply (investigate) early • Create a portfolio • No time to be modest • Personal statements . . . you’re only one person • Letters of recommendation- 2 to 3 *make sure they like you 30 Outside Scholarships • Don’t pay money to get money in searching for scholarships or applying for financial aid! • Use Your College Center or other free sources for info. • Four-year planning - are the scholarships renewable? • Ask the colleges how they use them - Does the scholarship go “on top” of the package, or replace the college’s own scholarships? • Students should start withwww.scholarshipexperts.com and www.finaid.org 31 Awarding 32 Net-Cost 33 Awarding & Packaging • Award letters may vary in composition o Listing of awards and amounts o COA, EFC, need and unmet need o Period of enrollment covered • Response may or may not be required • Expect them between March and April • Compare offers CHECK EMAIL…OFTEN!! 34 Sample Award Offer Total Cost of Attendance $36,000 - Expected Family Contribution Financial Need $0 $36,000 Federal Pell Grant Cal Grant A Outside Scholarship Federal Work- Study Federal Subsidized Stafford Loan Federal Unsubsidized Stafford Loan Unmet Need $5,775 $13,896 $1,000 $3,000 $3,500 $2,000 $29,171 $6,829 *Federal Parent Plus Loan $6,829 35 Sample Award Offer Total Cost of Attendance $36,000 - Expected Family Contribution Financial Need $6,000 $30,000 Federal Pell Grant Cal Grant A Outside Scholarship Federal Work- Study Federal Subsidized Stafford Loan Federal Unsubsidized Stafford Loan Unmet Need $0 $0 $5,000 $3,000 $3,500 $2,000 $13,500 $22,500 *Federal Parent Plus Loan $22,500 36 College Scorecard & Net Price Calculator © 2014 CASFAA collegecost.ed.gov 37 Shopping Sheet • Standardized, clear, and concise format for personalized financial aid offers • Better understanding of the costs of college before making a final decision on where to enroll • Identifies the types and amounts of aid qualified for and allows for easy comparison of aid packages • Consumer comparison tool • Transparently and consistently providing information to students 38 Packaging at Most Private Institutions • Subtract EFC (from FAFSA or Profile) from COA • Use all state/federal funds possible to meet need • “Leverage” gift aid/self-help institutional funds based on desired characteristics • MAY “gap” or apply Parent PLUS Loan to meet need • MAY offer merit scholarships for academics, leadership, athletics, talent, etc. 39 WICHE- WUE • Students who are residents of WICHE states are eligible to request a reduced tuition rate of 150% of resident tuition at participating two- and four-year college programs outside of their home state. • The WUE reduced tuition rate is not automatically awarded to all eligible candidates. Many institutions limit the number of new WUE awards each academic year, so apply early! • WICHE states include: Alaska, Arizona, California, Colorado, Hawaii, Idaho, Montana, Nevada, New Mexico, North Dakota, Oregon, South Dakota, Utah, Washington, Wyoming. http://www.wiche.edu/wue 40 FAFSA/ FOTW (Free Application for Federal Student Aid) 41 FAFSA on the Web (FOTW) Start here for: • • • • • Initial FAFSA Corrections Signatures / FSA ID Continuing a saved FAFSA Renewal FAFSA www.fafsa.gov 42 FAFSA on the Web (FOTW) Contact Us • Live Help (Chat) (Mon-Fri 5am-7pm) • (800) 433-3243 (1-800 4FedAid) • FederalStudentAidCustomerService@ed.gov © 2015 CASFAA 43 FOTW help at StudentAid.gov © 2015 CASFAA 44 FSA ID replaces FSA PIN! What this means: Where to use an FSA ID: • Improved security • User-selected username & password • Eliminates need to supply SSN and date of birth for login • Each FSA ID must have a unique email address! • FAFSA on the Web • My Federal Student Aid (studentaid.gov/login) • NSLDS • StudentLoans.gov • TEACH Grant website fsaid.ed.gov © 2015 CASFAA 45 Whose info goes on a FAFSA? © 2015 CASFAA 46 Whose info goes on a FAFSA/ CA Dream Act application? THE FAFSA & CA DREAM ACT APPLICATIONS NOW USE RELATIONSHIP OF PARENT TO STUDENT, VS. LEGAL RELATIONSHIP BETWEEN PARENTS FOR BASIS OF COLLECTING INFO Relationship of Student to Parent Parents married, living together Parents not married, living together Includes both parents’ incomes on the app? YES YES Only includes one parent’s income on the app? NO NO Parent is widowed, not remarried NO YES Parents are divorced or separated, not living together NO Parent and step-parent, living together Legal guardians* YES NO YES (include the parent the student lived with most during the last 12 months. If equal time, include the income from the parent who provided most of the student’s financial support during the last 12 months) NO NO Foster Parents* NO NO Grandparents, brothers, sisters, uncles, or aunts* NO NO “Parent” means biological/adoptive parent – gender of biological or adoptive parents is not relevant. *Students living with legal guardians, foster parents, or relatives are usually considered to be independent students. © 2013 CASFAA 47 Responses on the FAFSA Never Married Unmarried and both parents living together Married or Remarried Divorced or Separated Widowed 48 Divorced or Separated Parents • Provide information for the parent(s) with whom the student lived with most during the 12 months prior to filing the FAFSA • If the student spent equal time with both parents, use the information for the parent who provided the greatest amount of financial support for the student in the prior 12 months • If both parents are still living together, use information for both parents on FAFSA © 2015 CASFAA 49 Remarried Parent Provide information about the custodial parent and stepparent regardless of: • Agreement of “nonsupport” • Prenuptial agreement • Divorce decree designating tax filing exemptions Note: A parent claiming the student on his or her tax return need not be the parent required to provide data on the FAFSA Note: Children of parent and stepparent should be included on the FAFSA (if they provided more than half of their support) © 2015 CASFAA 50 Special Circumstances 51 Special Circumstances- examples • Change in employment status o Dislocated workers/Loss of employment • Change in parent marital status • Medical expenses not covered by insurance o Elder care expenses • Unusual dependent care expenses 52 Special Circumstances • Cannot be reported on the FAFSA • Contact the financial aid office for procedures. Procedures vary • School’s decision is final and cannot be appealed to the Department of Education 53 Professional Judgment and Dependency Status The Financial Aid Office has authority to make a dependent student independent if unusual circumstances exist: • An abusive family environment • Abandonment by parents • Inability to locate parents 54 Professional Judgment and Dependency Status Not considered “unusual circumstances” • Parents refuse contribution towards education • Parents unwilling to provide information on the application or for verification • Parents not claiming the student as a dependent for income tax purposes • Student demonstrating total self-sufficiency Questions to Ask Colleges • Does the institution offer merit-based scholarships? • What forms do the institution require? • What are the filing deadlines for each form required? • What are the deadlines for applying for financial aid and/or special scholarships? • How does the college apply outside scholarships? • Does the institution package to “need”? How? 56 Questions Luanne Canestro canestrol@smccd.edu