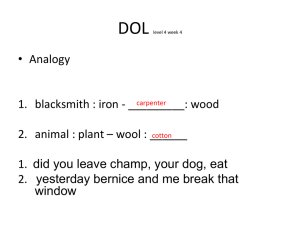

What Does DOL Look For?

advertisement

WHAT TO DO WHEN DOL AUDITS James V. Cole II Groom Law Group, Chartered (202) 861-0175 JCole@groom.com NECA Labor Relations Conference October 14, 2009 1 Overview Overview Investigation Process Common Enforcement Issues – What does DOL look for? Correction Programs DOL in Court 2 Overview Structure of the EBSA The Employee Benefits Security Administration (“EBSA”) is the agency within DOL that administers and enforces ERISA Title I. - Phyllis Borzi is the Assistant Secretary of EBSA - Office of Enforcement is headed by Virginia Smith Office of Enforcement has four divisions: - Enforcement Support, Field Operations, Field Offices, and Criminal Coordinator Most enforcement activities take place through regional offices. EBSA has more than 300 investigators. 3 Overview Civil Authority, ERISA § 504 Secretary of Labor (acting through the EBSA Office of Enforcement) may investigate whether any person has violated or is about to violate any provision of Title I, and may — - Require submission or inspection of reports, books and records; - Question persons as the Secretary may deem necessary; - Administer oaths, compel attendance of witnesses, and access and copy documentary evidence. Solicitor of Labor has litigation responsibility. 4 Overview Civil Penalties ERISA § 502(i) - Authorizes Secretary to assess penalty (5% of “amount involved”) against a party in interest who engaged in prohibited transaction (if plan is not subject to Code § 4975). ERISA § 502(l) - Requires Secretary to assess civil penalty against a fiduciary who breaches fiduciary responsibility, or against any person who knowingly participates in such breach. - Penalty is 20% of “applicable recovery amount” recovered from the fiduciary under a settlement agreement with the Secretary or ordered by court in proceeding instituted by Secretary. ERISA § 502(c)(2) - Authorizes Secretary to assess civil penalty against plan administrator who fails to file annual reports (Form 5500). 5 Overview Criminal Authority, ERISA § 506(b) ERISA § 506(b) - Authorizes Secretary of Labor to investigate and refer criminal violations involving employee benefit plans. - 18 U.S.C. § 664 - embezzlement from plan - 18 U.S.C. § 1027 - false statements in documents required by ERISA, such as Form 5500 filing - 18 U.S.C. § 1954 -solicitation to influence operations of a plan - ERISA § 411 - prohibits certain persons from holding plan positions - ERISA § 501 - willful violation of Title I - ERISA § 511 - coercive interference with participants’ rights Prosecuted by DOL/U.S. Attorney’s office. 6 Overview Why DOL Investigates Participant complaints/inquiries Referrals from other regulators Other information,e.g., news reports National and field office projects Form 5500 desk and edit checks 7 •Overview Why DOL Investigates National Enforcement Projects – Health Disclosure and Claims – Participant and Beneficiary Complaints – Non-Filer Enforcement Program – Late Filer Enforcement Program – On-Site Reviews of Audit Work Papers – Desk Reviews of Form 5500s – Multiple Employer Welfare Arrangements – Consultant/Adviser Project – Employee Contributions – Sponsors in Bankruptcy (REACT) – ESOPs •See www.dol.gov/ebsa/erisa_enforcement 8 Investigation Process Initial document request or subpoena On-site document review – DOL may take copies of documents Key person interviews Closing 9 Sample Document Request (Plan Sponsor) Plan documents in effect Summary plan description Trustee or fiduciary committee minutes Form 5500/Summary Annual Report All correspondence with plan service providers, or relating to any plan matter Sponsor annual reports, contracts with plans Detailed documentation of plan administrative expenses 10 Sample Document Request (Plan Sponsor) Cont’d Fidelity bond and fiduciary liability policies List of sponsor’s officers, board of directors Trust participation agreements Plan merger documents Participant contribution records Investment policy Plan receipt and disbursement journals 11 •Investigation Process: What Does DOL Look For? FINANCIAL INSTITUTIONS Areas Examined __ Scope of Fid. Respon. __ Proxy Voting __ Cash Management __ Equity Investments __ Fixed Income Investments __ Pool Investments __ Real Estate __ Insurance __ Commercial Side Transactions Records Reviewed A. Financial Institution Agreements __ ERISA Client List __ Organizational Chart __ Officers/Directors List __ Internal Audits __ Investment Performance __ Marketing Materials __ Trust/Inv. Committee Minutes __ Asset Valuations B. Plan/Client Records __ Financial Institution Agreements __ Correspondence Files __ Financial __ Insurance __ Annuities __ Fees/Commissions __ Rebates __ Bonding __ Rptg. & Disclosure __ Regulatory Filings __ Fee Schedules __ Financial __ Client Complaints/Litigation __ Written Procedures & Guidelines __ Approved Securities List __ Master Securities List __ Investment Contracts __ Billing Invoices __ Participant Records __ Plan/Trust Documents __ Asset Holding __ Investment Contracts 12 Investigation Process: What Does DOL Look For? SERVICE PROVIDERS Areas Examined __ Scope of Fid. Respon. __ Claim/Benefits Processing __ Claim/Benefit Payments __ Unnec'y/Duplicate Svcs. __Contributions __ Commissions __ Ins. Arrngmnt. __ Fees __ COBRA Administration __ Investments __ Actuarial Services __ Rebates Records Reviewed A. General Service Provider Records __ Client List __ Marketing Materials __ Financial __ State License __ Receipts/Disbursements __ Band/Investment __ Organizational Chart __ SP Contracts B. Plan/Client Records __ Administration Agreement __ Billing/Invoices __ Contributions/Premiums __ Participant Records __ Pended Claims __ Plan/Trust Doc __ Form 5500 __ Benefits/Claims __ Correspondence 13 __ Trustee/Corp. Minutes __ Financial Statements __ Bank/Invt Statements __ Insurance Contracts __ Other Contracts Sample Document Request (Financial Institution) List of all current and former plan clients (name, sponsor name and address, identity of trustee, investment managers, and custodian) Asset list/portfolio statement for all current and former plan clients Organization chart, list of affiliates, subsidiaries, officers and directors Standard contracts and agreements for relevant period Schedule of fees charged for relevant period Documentation of “affiliated” mutual funds and collective funds invested in by plan clients Internal audit reports related to plan services 14 Sample Document Request (Financial Institution) Cont’d Third party reports on services, including audited financial statements, commentary by external auditors, internal control letters, other performance or peer review reports prepared by third parties All reports filed with regulatory agencies (FDIC, FFIEC, etc.) Fiduciary insurance policy Financial accounting records Detailed documentation related to 12b-1 fees received in connection with investments by plan clients, including name of paying entity, amount, relevant contracts and agreements Documents that identify income earned on funds held in excess of Federal Reserve Requirements 15 Sample Document Request (Financial Institution) Cont’d Documentation of handling of client funds, including — – statements of accounts holding assets pending distribution or investment and contracts for such accounts – contracts with third parties used in connection with client distributions – disclosures to clients For selected plans, – all fee schedules, notices or disclosures – all billings or invoices for services fees – investment authorization forms 16 Investigation Process Coordinating with DOL After DOL inquiries, negotiate: – Scope of issue or subject matter – Time period under review (or risk requests covering the entire statute of limitations period) – Document list and priority of production – Specific entities, lines of business, and geographic areas covered Why negotiate? – Minimize disruption and burden – Facilitate getting closure on investigation – In a large company, focus on specific divisions with awareness that other divisions may have different practices and systems 17 Investigation Process Information Release under ERISA § 504 Secretary may release information to any person actually affected by a matter that is subject to investigation. Secretary may release information to another federal agency. Release may be restricted by various statutes, such as FOIA, Privacy Act, IRC. (For example, FOIA has exceptions for personnel files, commercial and financial information, inter-agency and intraagency communications, law enforcement records, and financial regulatory information.) Investigative information for active cases generally will only be released within DOL and, in limited cases, to other government agencies. 18 Investigation Process Privilege Considerations Fiduciary exception to attorney-client privilege. – Generally, fiduciaries may not assert attorney-client privilege to withhold information about their fiduciary activities from plan participants or DOL. Exception does not apply to advice received when engaged in “settlor” functions or other activities not in scope of fiduciary duty. Fiduciary exception for work product doctrine? – Work product doctrine covers material prepared in anticipation of litigation, including analyses commissioned by corporation (e.g., memo on prospect of IRS litigation). Privilege for self-critical evaluations (e.g., internal audit) generally not recognized by federal courts. See generally Dept. of Education v. NCAA, (7th Cir. March 21, 2007). 19 Investigation Process Is there a duty to organize or analyze information? What if requested information is personal information or sensitive for other reasons? What if requested information is covered by third party confidentiality agreements? When should counsel be involved? How long should an investigation take? 20 Enforcement Issues What Does DOL Look For? Typical plan sponsor Issues – – – – – – – failure to forward participant contributions failure to make employer contributions use of plan assets to pay non-plan expenses improper valuation of assets (e.g., real estate, LLCs) failure to keep assets in trust abandoned (“orphan”) plans no process for service provider selection 21 • Enforcement Issues What Does DOL Look For? Service Provider Focus on Fee Arrangements “When investigating plan service providers, PWBA [now EBSA] generally focuses on the abusive practices committed by the specific service providers rather than the plans. For example, where a third party administrator has systematically retained an undisclosed fee…” • Strategic Enforcement Plan, 65 Fed. Reg. at 18210 (April 6, 2000). Undisclosed commissions or other fees from mutual funds. – See DOL Adv. Ops. 97-15A and 16A (May 22, 1997). “Float” – Earnings on funds held pending investment or distribution should be disclosed and approved. FAB 2002-3 (November 5, 2002) Soft Dollars 22 Enforcement Issues What Does DOL Look For? DOL Statement on Mutual Fund Abuses – review of practices of mutual funds, collective trust funds and other pooled funds, AND their service providers and “intermediaries,” to determine whether there have been violations of ERISA • whether activities such as market timing or late trading harmed retirement plan beneficiaries • improper payments for directed investments • whether retirement accounts were used to facilitate market timing 23 Correction - VFCP The Voluntary Fiduciary Correction Program’s (VFCP) purpose is to encourage self-correction of possible ERISA Title I violations. Program updated in April 2006, 71 Fed. Reg. 2026 (April 19, 2006). In order to be eligible for the VFCP, neither the plan or the applicant can be under investigation, and the VFCP application must not contain evidence of potential criminal violations. The VFCP covers 19 transaction types. Examples — – – – – Delinquent participant contributions to a plan Improper transactions with parties in interest Benefit payments based on improper valuations of plan assets Plan payment of excess compensation 24 Correction VFCP Application An application must describe the transaction and its correction, and provide supporting documentation, including copy of plan and other retirement documents, proof of correction, restoration of losses, signed checklist, and penalty of perjury statement. – Correction procedures are specified by VFCP Program The application is filed with the EBSA regional office. PTE 2002-51 provides relief from excise taxes for some types of transactions covered by VFCP - participant contribution violations, certain transactions with parties in interest. (Notice to participants required). 25 Correction VFCP Result If the VFCP application is accepted, DOL issues a “no-action” letter stating that it will not conduct a civil investigation and that it will not assess any § 502(I) or 502(i)penalties. Other government agencies, or any individual, may still enforce their rights. If the application indicates that a violation has not been adequately corrected, applicants could be subject to DOL enforcement, including § 502(I) penalties. 26 Correction Informal Self-Correction Upon identifying an issue: advise DOL that entity will do its own investigation; take steps to remedy; advise DOL on findings; and propose correction. May result in DOL deferring its own investigation. If DOL investigates and settles, it is statutorily required to charge a penalty in some cases (e.g., ERISA § 501(I)). Considerations – May avoid DOL enforcement and penalties – DOL may still investigate; DOL may require more burdensome correction than anticipated 27 Correction Form 5500 Filing Modifications to Delinquent Filer Voluntary Compliance Program (DFVC Program) in March 2002 further reduced penalties. – $10/day, maximum $2000/year for large plans or $750/year for small plans, and no more than $4000 for large plans or $1500 for small plans, even if for multiple years. 67 Fed. Reg. 15052 (March 28, 2002). DOL/IRS announcements promise more aggressive efforts to identify delinquent filers. – After DOL issues a written notice of failure to file, the DFVC Program is not available. Penalties of $50 per day may apply. 28 DOL In Court ERISA §§ 502(a)(2) and (5) authorize Secretary to commence certain kinds of civil actions to enforce Title I of ERISA. – Where plan sponsor is in bankruptcy, DOL may file contingent and unliquidated proofs of claim on behalf of plans and their participants. ERISA § 502(h) gives Secretary authority to intervene in private ERISA litigation (other than benefit claim disputes). See Campbell v. Hall-Mark Electronics Corp., 808 F.2d 775 (11th Cir. 1987) (affirming denial of Secretary’s motion to intervene). Secretary of Labor participates as amicus curiae in significant cases or on significant issues (e.g., WorldCom, Enron). 29 DOL In Court Courts have held that DOL may sue for relief, even where DOL’s target had previously settled with class of affected plan participants. Martin v. South Carolina National Bank 140 F.3d 1413 (11th Cir. 1998); Secretary of Labor v. Fitzsimmons, 805 F.2d 682 (7th Cir. 1986) (en banc). How to address risk of ERISA “double jeopardy.” – condition private parties' settlement on defendants' obtaining adequate comfort that DOL will take no action – statute of limitations 30