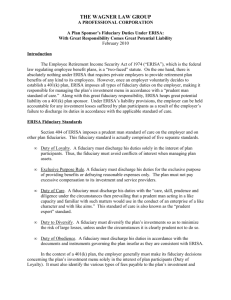

ERISA Essentials and What to Advise Clients to Avoid Audits and be

advertisement

ERISA Essentials and What to Advise Clients to Avoid Audits and be ACA Compliant ERISA • Federal Law Enacted in 1974 • Applies to plans sponsored by all size employers, but does not apply to church or government plans • DOL & IRS increased scrutiny after ACA Plans Subject to ERISA Employee Welfare Benefit Plan • Plan, fund or program • Established or maintained by an employer • For the purpose of providing medical and/or other specified benefits Plans Subject to ERISA ERISA generally applies to the following • benefit Plans and fringe benefits, whether they are fully insured or self-insured: • • Medical, Surgical, Hospital, or HMO • Group Insurance Plans • • Health Reimbursement Accounts • (HRAs) • • Health FSAs (Flexible Spending • Accounts) • • Group Dental Insurance Plans • • Group Vision Insurance Plans • Prescription Drug Plans • • Group Sickness, Accident, and Disability Insurance Plans • Group Life and AD&D Insurance Plans • Group Long Term Care Insurance Plans • Group Employee Assistance Plans (EAPs) (if providing counseling, not just referrals) • Severance Pay Plans Group Business Travel Accident Insurance Plans Prepaid Legal Services Unemployment Benefit Plans Vacation Plans Apprenticeship or other Training Plans Scholarship Plans Holiday Plans Housing Assistance Plans Wellness plans that provide or reimburse for health care 419A(f)(6) and 419(e) Welfare Benefit Plans Plans not Subject to ERISA • HSAs • Premium only plans • Certain self-insured plans, such as sick pay, short term disability, paid time off, overtime, jury duty, and vacation pay, may be exempt if benefits are paid: – as a "normal payroll practice," – to currently employed individuals (i.e., not retirees, COBRA Participants, or dependents), – without prefunding or using insurance, – entirely from the employer's general assets, AND – without employee contributions. Plans not Subject to ERISA • Most voluntary plans (whether group or individual), if: –Employee pays the entire premium –Employer has limited involvement – employer cannot endorse the plan –Can be exempt, even if premiums paid through cafeteria plan Plan Sponsored by An Employer • Be careful that plan does not cover the employees of more than one employer • Certain related employers (under common control) are considered a single employer – Subsidiary – Brother/sister • But if not a single employer, plan is considered a MEWA – multiple employer welfare arrangement - and is subject to additional laws Requirements for Welfare Plans under ERISA • Plan Document – Must be written – Describe benefits, funding and procedures for payment • Summary Plan Descriptions – Provided to employees within 90 days – Updated every 5 years if changes and every 10 years if no changes • Summary of Material Modifications – Amendments – Provided to participants within 60 days after a material reduction in coverage Requirements for Welfare Plans under ERISA • Notices – WHCRA, NMHPA • 5500 filings • Fiduciary obligations – Includes duty to follow plan documents • Prohibited transactions • ACA Compliance – SBC’s – Benefits and coverage mandates – Grandfathered plans DOL Audits • In 2013, EBSA received $1.69 billion from its audit program – Enforcement – Voluntary fiduciary corrections – Informal complaint resolutions • This includes retirement plans DOL Audits • May be initiated by: – Random – Complaint – Tips from other agencies (IRS, HHS) – 5500 Information DOL Audits • Process – – EBSA sends letter to plan sponsor – Requests an entire list of documents that must be sent to DOL (list is 13 pages) with two pages focused on ACA – Auditor/Investigator completes checklist – May include onsite visit or subpoena – EBSA issues voluntary compliance letter (often 9 -12 months later) – will seek voluntary resolution to issues found – If issues not correct, EBSA may seek to impose penalties – Closing letter sent if no violations found List of Documents that May be Requested • • • • • • • Plan Document(s) Form 5500 filings (past 3 years) SPD’s for all benefits offered SAR for last year (if applicable) Service Provider Contracts Payroll/contribution records ACA Notices List of Documents that May be Requested • COBRA Notices • HIPAA Documents • All documents sent to plan participants If plan is funded, also: • Trust Agreement • Fidelity Bond • Fiduciary Insurance Policy • Trustee (bank) statements Potential Consequences for NonCompliance • Voluntary correction – no penalties if action that is needed is agreed upon • Civil monetary penalties • Re-adjudication of incorrectly paid claims How to Make sure your Client is Prepared • Look at client’s compliance before the audit letter comes. • Make sure documents that are needed are in place and are updated • Make clients aware that compliance obligations are more important than they used to be