Timeline - Florida Government Finance Officers Association

advertisement

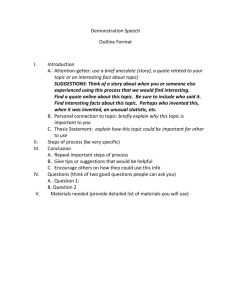

Technology and Treasury Trends Central Florida Government Financial Officers Association Chapter Meeting February 8, 2013 | 1:00 p.m. to 3:00 p.m. Agenda Introduction Did you know? ’60s ’70s ’80s ’90s 2000 and beyond Think Tank (game) Q&A 2 Introductions Biography Glenna Thompson Bank of America Vice President Treasury Solutions Officer Glenna is a Vice President and Treasury Solutions Officer within the Public Sector Treasury Solutions Division of Bank of America. She has been with Bank of America for 28 years and a member of the Treasury Management team for 16 years. She is a proven treasury management leader with a strategic focus on complex state and municipal clients. She’s responsible for assisting municipal clients in the development of an efficient and cost effective end-to-end treasury workstation, while leveraging technology and integrating with existing infrastructure. She delivers the scope and strength of Bank of America’s enterprise to help meet her client’s specific objectives and achieve their goals. With Glenna’s vast experience in the government sector she covers the central Florida market, Tennessee and Kentucky. With her expanded knowledge and industry expertise, she understands the unique challenges government entities face in these unprecedented and challenging times and is able to share industry best practices with clients across the southeast region. Her main office is located in Tampa, Florida. Glenna has been a featured speaker and panelist on innovative comprehensive government and treasury management topics including Developing a Successful Request for Proposal, Comprehensive Payables, Check Conversion to Electronic Payments, and Payments Transformation at various industry venues including The Florida Government Finance Officers Association, The Florida School Financial Officers Association and The Florida Tax Collectors Conference. Glenna attended the University of Miami. 4 Biography Evan Tullos Bank of America Senior Vice President Senior Card Account Manager Evan Tullos is responsible for the State of Florida public sector market. This includes managing the State of Florida purchasing card contract and all local governments utilizing Bank of America Merrill Lynch card solutions in Florida. Evan leads the strategic card account management responsibilities for this region focused on program growth and servicing requirements for our local government and state agency clients. The Florida card market for Bank of America Merrill Lynch is considered the largest in the US with spend volume in excess of a billion dollars. The scope of offerings Evan is responsible for include Commercial Visa and MasterCard branded solutions; Corporate Purchasing Card, Corporate Travel Card, Commercial Pre-Paid, B2B Payments, and Comprehensive Payables. This also includes consulting on various industry leading applications such as the Works, Visa and MasterCard web-based solutions, Concur Travel Technologies, Payment Center and multiple commercial ERP system integration requirements. Evan is a representative for the Global Card Payments Solution joint venture that includes Visa Commercial Card issuers around the world. Evan has been with Bank of America since 1991 and resides in Fort Myers, Florida. 5 Biography Kathryn Sikes Bank of America Senior Vice President Senior Client Manager Kathryn has over 25 years banking experience, with 18 years dedicated to the government and institutions market. Her background includes tax exempt debt structuring, corporate and investment banking, relationship management, as well as treasury management. Her current responsibilities include client management of the government market segment in the central and north Florida region. She has extensive experience serving as a relationship manager for numerous governmental clients in Florida. She is a Certified Cash Manager, (CCM). 6 Did You Know? 7 1960s Timeline Cuban Missile Crisis 1962 1961 Berlin Wall Built Beatles become popular in the U.S. 1964 1963 Marin Luther King makes his “I have a dream” speech Mass draft protests in U.S. 1966 1965 Japan’s Bullet Train Opens Martin Luther King assassinated 1968 1967 First heart transplant First super bowl 1969 Neil Armstrong becomes the first man on the moon Rock-and-Roll concert at Woodstock 9 1960s: Beginning of the computer age The computers enabled bank employees to process checks in a faction of a second as well as access customer information saved in databases. This modern machinery included magnetic reel to reel tape and an automatic typewriter, among other space-age tools, and processed 30,000 transactions in three-to-four hours of computing time. This film provides an illuminating view of the early days of electronic banking. Since then, banking has experience a number of revolutions. Check clearing has evolved into an increasingly electronic format with the introduction of check clearing for the 21st Century Act. Most checks are now presented to financial institutions as electronic images, changing the way that the majority of checks are processed. 10 1970s Timeline Mark Spitz wins seven gold medals U.S. President Nixon resigns 1972 1971 United Kingdom changed to decimal system for currency Nadia Comaneci given seven perfect tens 1974 1973 Sears tower built First test tube baby born 1976 1975 Microsoft founded 1978 1977 Elvis found dead 1979 Margaret Thatcher first women Prime Minister of Great Britain Sony introduces the walkman 12 1970’s Inflation The 1970’s saw inflation skyrocket and consumer price rose, oil prices soared and the federal deficit more than doubled. By the end of the decade drastic action was needed to break inflation's stranglehold on the U.S. economy. 13 1980s Timeline The Apple Lisa invented. Soft bifocal contact lens invented. The first 3-D video game invented. First Cabbage Patch Kids sold. Programmer Jaron Lanier first coins the term "virtual reality". 1983 1981 Windows program invented by Microsoft. 1985 1984 MS-DOS invented. The CD-ROM invented. The first IBM-PC invented. The Apple Macintosh invented. Disposable contact lenses invented. High-definition television invented. 1987 1986 Fuji introduced the disposable camera. 1989 1988 Digital cellular phones invented. Doppler radar invented by Christian Andreas Doppler. 15 1980’s Setting the stage for financial modernization Marks the beginning of a period of modern banking industry reforms. Banks began offering interest-paying accounts and instruments to attract customers from brokerage firms. 16 1990s Timeline The World Wide Web and Internet protocol (HTTP) and WWW language (HTML) created by Tim Berners-Lee. The Pentium processor invented. Web TV invented. 1993 1990 1991 The digital answering machine invented. 1996 1995 The Java computer language invented. DVD (Digital Versatile Disc or Digital Video Disc) invented. 1997 The gas-powered fuel cell invented. 18 1990’s The Longest Economic Expansion Interstate Banking and Branching Efficiency Act allowed banks to engage in interstate branching outside of its home state. 19 2000 & Beyond The New Millennium Timeline US Dept of Homeland Security Do Not Call List 9/11 2001 2000 New millennium Hurricane Katrina 2003 2002 The Euro introduced 2005 2004 Mars Exploration Rovers Water is discovered on the Moon Global economic downturn 2007 2006 Pluto is demoted to "dwarf planet" status 2009 2008 Artificial DNA Privately funded human spaceflight 21 Technology in the 2000s Portable (and ultra-portable) PCs iPhone Wikipedia Apple iPod MySpace 2001 2000 dot-com bubble bursts 2003 2002 Apple iMac G4 YouTube Kindle USB flash drives Google Street View 2005 2004 Web 2.0 Facebook Mind control headsets for gamers 2007 2006 Twitter 2009 2008 Scientists extract images directly from the brain Artificial DNA 22 2010s Timeline 2010 Haiti earthquake 2011 2012 Japan earthquake and tsunami The Diamond Jubilee of Queen Elizabeth II Death of Osama bin Laden Facebook IPO BP Oil rig explosion As The World Turns Final Episode Greece debt crisis Wikileaks Mayan calendar approaches the end Toyota recall Pakistan flood 23 2010s Timeline 2010 2011 iPad iphone4 2012 Windows 8 is released Scientists create synthetic life Multi-touch surface computing Quad-core smartphones and tablets Scientists trap antimatter The first open petaflop supercomputer comes online Nintendo launches the Wii U Speech-to-speech translation in mobile phones 22 nanometre chips enter mass production Consumer-level robotics are booming 24 Government thinking: the Future is Now Integrated application design Digital Identity Wet signature technology vs. digital signatures Crowd Sourcing http://www.govtech.com/technology/Tech-Trends-Public-Agencies-Should-Watch-2012.html 25 Rethinking Banking Banks are exploring how emerging technologies and insights into human behavior can transform the customers’ experience and elevate the role of the bank in their financial lives. Banks seek to invent new ways to anticipate the needs and desires of customers down to the level of the individual to put every customer in total control of his or her own financial future, to rethink the experience of customer-bank interaction as visual and physical reality become increasingly intertwined, and finally to leverage the unique position of a bank to make people’s lives simpler and more fulfilling. 26 Foresight and Insights Customer Driven Innovation What kind of innovation can we expect as banks cultivate and deepen customer relationships – Mobile banking (expected to be as routine as ATMs) – Internet banking – Cashless Society (emerging markets-Asia and Europe) – Security – Convenience Transparency and Innovation Understand when the customer desires a technology solution versus a personal touch – New branch concepts, interacting with technology – Trusted Advisor on certain topics (i.e. Investments, retirement, etc.) Innovation for Growth Like business everywhere, global banks are adjusting to the new normal following the global financial crisis – Re-regulation – IT Investment (i.e. who owns, who operates, etc.) 27 Monitoring Global Trends What’s most important to you? 50+% Risk Management And Mitigation of CFOs experienced increased responsibility in risk management Risk Management Trends Identifying and evaluating risk factors Drive for profitability and shareholder value... diversification and growth efficiency and standards regulatory reform MARKET RISK OPERATING RISK REGULATORY RISK Cost control Centralization Basel III Concentration risk Interoperability Risk management Access to credit and liquidity Real-time information Sarbanes Oxley, IFRS Sovereign and counterparty risk Standardization Single Euro Payments Area Source: CFO Magazine, “Keeping Cool in the Hot Seat” (March 1, 2012) 29 Working Capital Optimization U.S. Liquidity Trends Safety, increased visibility and access to funds Key challenges Regulatory Rapidly changing regulatory environment Low-rate environment Global macroeconomic challenges and sluggish growth leading to depressed yields on cash Visibility Requirement to see real-time information for cash positions across multiple entities and regions Leading practices Simplification Safety Liquidity Management Effective deployment of cash management to respond to changing regulatory environment Global Liquidity Structure Tailoring liquidity globally to capitalize on yield-producing opportunities Visibility Automation Online tools Leverage advanced technology to view cash position and investments in real time 30 Payments and Receipts Trends Automating Through Technology 80% challenge for treasurers in reaching a desired operating model: business unit relationships Improving Processing Through Automation Standardize Simplify Standardized system integration Standardized file types Universal messaging standards Standardized security Source: PayStream’s Invoice Automation Adoption Survey 2011 32 Invoice Automation Payment Trends Invoice automation Solutions companies are implementing Converting paper to electronic Technology = competitive advantage Current challenges of adopting invoice automation1 1. Supplier not willing to adopt electronic payments (54%) 2. Shortage of IT resources (40%) 3. System integration (27%) Source: Electronic Supplier Payments PayStream Advisors Q2 2012 33 Checks On The Decline In The U.S. Payment Trends Checks Current trends1 Solutions companies are implementing 68% of corporations in 2011 were writing fewer checks ACH Purchasing Card programs Wire 78 % increased use of ACH Half of respondents reported an increase in Purchasing Card transactions Third of respondents reported an increase in Wire transfers Source: Electronic Supplier Payments PayStream Advisors Q2 2012 34 Fraud Prevention Payment Trends Fraud Prevention Current Issues Solutions Companies Are Implementing Altered checks Positive Pay solutions Stolen cards ACH Positive Pay solutions Organized crime Payroll Card solutions Malicious insiders Hacked systems Stale Date and Maximum Dollar Control Check Outsourcing Fraud prevention solutions for paper payments are in demand Source: AFP Payments Fraud and Control Survey 2011 35 52% Centralization of corporates indicated they plan to move to a centralized payment structure Payment Trends Centralization Current Environment Decentralized payment structure Solutions Companies Are Implementing Centralized payment structure Information Reporting Single file payment types: ISO 20022 XML, SAP IDoc, ASC X12 EDI, EDIFACT Card and ACH Payments Ghost card Outsource payments Source: Fifth Annual Cash Management Survey in association with SEB (2010) GT news 36 Fed Extended Remittance Wire Format Change 95% of companies indicated including business remittance information with a wire would be “valuable” Payment and Receipt Trends Wire format change Recognizing the value of remittance information to business, the Federal Reserve Banks and the Clearing House expanded remittance information formats for wire on November 21, 2011. The industry support the Fedwire Extended Remittance information format Information Reporting Receipts: Lockbox Remote Deposit Service Online 9,000 characters of remittance information Automated Clearing House Wire Transfer Electronic Data Interchange Enable businesses to more accurately identify incoming payments and post them to the correct accounts without manual intervention Source: AFP survey, May 2009 Remote Payments Online Collection of Consumer Online Banking Payments 37 35% Receivables Management projected global spend growth for receivables management technology Receipt Trends Centralization and standardization of receivables Benefits Companies Are Seeing Current Environment Receivables Processing Receivables Management Receivables Cost savings Greater efficiencies Collections/reconciliation automation (STR) Enhanced customer service Enhanced relationships Improved payer behavior Enhanced DSO Cash forecasting Stronger commercial and operational risk management Receivables Receivables Receivables Challenges: jurisdiction regulatory/tax issues, invoice detail sharing, customer contact, and varied clearing standards/payment methods Source: CEB TowerGroup Edge (February 2012) Drivers: regulatory reform (SEPA), invoice matching tools, virtual account management, global liquidity overlays and single FX rates 38 36% Go Green And Process Efficiencies of corporates want to reduce receivables processing time and cost1 Receipt Trends Finding efficiencies in receivables processing Going Green Potential Solutions Reduce paper processing: Convert paper document to electronic Evaluate whether processes are environmentally friendly Educate consumers about electronic bills, statements and payments over paper alternatives Image Lockbox Remote Deposit Internet Gateway Solutions Cash Processing Efficient processing and early credit with the bank for cash: Faster posting and positioning for deposited cash Avoid risk of employees transporting cash Just-in-time change and currency Combine transportation management requirements Source: Aberdeen Group (Jul 2011),"The Order to Cash Cycle: Enhancing performance with process Automation" Cash Vault Smart Safes Deposit ATM Cards 39 Efficiencies Through Consolidations 36% of corporates want to reduce receivables processing time and cost1 Receipt Trends Operation site consolidations The US Postal Service As Well As FIs Are Streamlining Operations USPS: USPS site consolidations still under review Next day delivery of first class mail coverage minimized Potential Solutions Image Lockbox Image Cash Letter Remote Deposit Paper processing sites are consolidating due to accelerated image exchange: Banking centers are enabling image capture Item processing, vaults and returned item paper volumes continue to decline Source: USPS press release, May 2012 40 Integration Trends Data Transmission Services 3% Transmission accounts increased three percent year-over-year Integration Trends Data transmission services Protocol Trends New Setups 2011 Connect Direct 7% SSL/FTP 7% FTP/SSH 11% HTTPS 44% Source: Bank of America Merrill Lynch FTP/PGP 29% AS2 2% Traditional data transmission services (authentication and encryption are required) Traditional HTTPS FTP with PGP sFTP (FTP with SSH) FTP with SSL AS2 VPN Emerging SWIFT FileAct (requires SWIFT Corporate Access membership) 42 Mobile Banking Integration Trends $245 billion Mobile payment services expected to reach $245 billion in value by 20141 Mobile banking Mobile offers another channel to meet your electronic mobile banking needs. Source: IDC Financial Insights press release, 2010/0712 43 Securing Files Using Digital Identity 53% corporates expect they will eventually require digital signatures as a means of securing the files they send and receive Integration Trends Digital identity Enterprise level authentication process, able to bridge multiple channels with interoperability between multiple banks and accounts. ONE LOG-IN ACCESS In lieu of ink signatures consider: IdenTrust digital identity token device SWIFT 3SKey digital identify token device Source: Bank of America Merrill Lynch 44 Cloud Technology Not Just For Media Integration Trends Cloud technology for treasury services Cloud computing is next transformational technology wave since the Internet: Cloud-based solutions: Has built in controls to ensure Information Reporting capability, security and value of delivering using cloud technology Reduces the need to manage and monitor disparate applications Acts as enabler for consumer’s treasury management services Source: Sand Hill’s 2011 “Leaders in the Cloud” DATA Cloud based vendor ERP solutions (e.g., SAP Business ByDesign; Oracle Fusion Applications; Lawson Enterprise Management Systems; NetSuite SuiteFlow) SWIFT “cloud-based” connectivity 45 What’s Most Important To Global Companies? Issues Very important Important Not important Not important at all 120 100 80 60 40 20 0 Source: GT News survey. Commissioned by Bank of America Merrill Lynch 46 What’s Most Important To You? Discussion Create Ideas Customize Solutions Brainstorm Dialogue Specifics Discuss Issues Improve 47