Chap007

advertisement

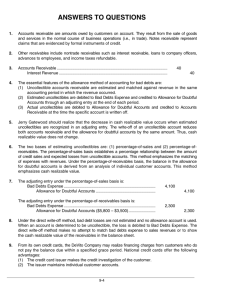

Cash and Receivables Chapter 7 Learning Objectives 1. Define internal control and describe some key elements of an internal control system for cash receipts and disbursements. SELF-STUDY 2. Explain the possible restrictions on cash and their implications for classification on the balance sheet. 3. Distinguish between the gross and net method of accounting for cash discounts. 4. Describe the accounting treatment for merchandise returns. 5. Describe the accounting treatment of anticipated uncollectible accounts receivable. 6. Describe the two approaches to estimating bad debts. 7. Describe the accounting treatment of short-term notes receivable. 8. Differentiate between the use of receivables in financing arrangements accounted for as a secured borrowing and those as a sale. 9. Describe the variables that influence a company’s investment in receivables and calculate the key ratios. 10. Discuss the primary differences between U.S. GAAP and IFRS with respect to cash and receivables. Cash and Cash Equivalents Cash Currency and coins Balances in checking accounts Items for deposit such as checks and money orders from customers Cash equivalents are short-term, highly liquid investments that can be readily converted to cash. Money market funds Treasury bills Commercial paper Cash and Cash Equivalents Cash Currency, coins and amounts on deposit in bank accounts: checking accounts, and many savings accounts. Also includes items such as customer checks, cashier checks, certified checks, and money orders. Cash Equivalents Short-term, highly liquid investments that are: 1. Readily convertible to a known cash amount. 2. That have an original maturity date of three months or less from the date of purchase 3. US Treasury Bills & Notes: 3-month maturity. 4. 3-month CDs and Money Market Funds 6-4 Cash & Cash Equivalents On Dec. 31, 2010, ABC Co's total CASH COUNT= $1,000,000 The following items are included in the CASH COUNT: Petty cash funds=$12,000, Customers Checks =$3,000, Coins =$1,000 and Stamps =$100. The following items are not included in cash count: -Three-month CD: $10,000 -Two-month Treasury Note (Bill): $7,000 Required: Prepare the Current Assets Section of the Balance Sheet Restricted Cash and Compensating Balances Restricted Cash Management’s intent to use a certain amount of cash for a specific purpose – future plant expansion, future payment of debt. Compensating Balance Minimum balance that must be maintained in a company’s bank account as support for funds borrowed from the bank. Cash & Cash Equivalents, Restricted Cash and Compensating Balances Exercise 7–1 Cash & Cash Equivalents, Restricted Cash and Compensating Balances Exercise 7–1: Requirement 1 a. b. c. f. Balance in checking account Balance in savings account Un-deposited customer checks Currency and coins on hand U.S. treasury bills with 2-month maturity Total $13,500 22,100 5,200 580 15,000 $56,380 Requirement 2 d. The $400,000 savings account will be used for future plant expansion and therefore should be classified as a noncurrent asset, either in investments & Funds. e. The $20,000 in the checking account is a compensating balance for a long-term loan and should be classified as a noncurrent asset, either in investments & Funds. f. The $20,000 in 7-month treasury bills should be classified as a current asset along with other temporary investments. Cash & Cash Equivalents, Restricted Cash and Compensating Balances RED WING CORPORATION Partial Balance Sheet As of December 31, 2013 Current Assets: Cash and cash equivalents Marketable Securities $56,380 20,000 Investments and Funds: Plant Expansion Fund Loan Compensating Fund 400,000 20,000 U.S. GAAP vs. IFRS In general, cash and cash equivalents are treated similarly under IFRS and U.S. GAAP. One difference is highlighted below. Bank overdrafts are treated as liabilities. Bank overdrafts may be offset against other cash accounts. Exercise 4 Internal Control (SELF-STUDY) Encourages adherence to company policies and procedures Promotes operational efficiency Minimizes errors and theft Enhances the reliability and accuracy of accounting data Internal Control Procedures (SELF-STUDY) Cash Receipts Separate responsibilities for receiving cash, recording cash transactions, and reconciling cash balances. Match the amount of cash received with the amount of cash deposited. Close supervision of cash-handling and cash-recording activities. Cash Disbursements All disbursements, except petty cash, made by check. Separate responsibilities for cash disbursement documents, check authorization, check signing, and record keeping. Checks should be signed only by authorized individuals. Internal Control Procedures PETTY CASH ACCOUNTING BANK RECONCILIATION Appendix 7-A: Cash Controls Petty cash is used for minor expenditures. Petty cash fund Has one custodian. Replenished periodically. P2 Petty Cash System of Control Small payments required in most companies for items such as postage, courier fees, repairs and supplies. Internal Control requires that companies pay for these small amounts from Petty Cash Fund. 6-15 P2 Operating a Petty Cash Fund Petty Cash Company Cashier Petty Cashier May 1 Petty cash Cash 400 400 Accountant 6-16 P2 Operating a Petty Cash Fund Petty Cashier Petty Cash 6-17 P2 Operating a Petty Cash Fund A petty cash fund is used only for business expenses. Petty Cashier 39¢ Stamps $45 Courier $80 6-18 P2 Operating a Petty Cash Fund Petty cash receipts with either no signature or a forged signature usually indicate misuse of petty cash. Receipts Petty Cashier 39¢ Stamps $45 Courier $80 6-19 P2 Operating a Petty Cash Fund Receipts $125 Company Cashier To reimburse petty cash fund May 31 Use a Cash Over and Short account if needed. Petty Cashier Postage expense Delivery expense Cash 45 80 125 Accountant 6-20 Operating a Petty Cash Fund Sometimes, the petty cash receipts plus the cash remaining will not total to the fund balance. i. A shortage is recorded as an expense in the reimbursing entry with a debit to the Cash Over and Short account. ii. An overage is recorded with a credit to the Cash Over and Short account in the reimbursing entry. P2 Petty Cash Example Tension Co. maintains a petty cash fund of $400. The following summary information was taken from petty cash vouchers for July: Travel Expenses Customer Business Lunches Express Mail Postage Miscellaneous Office Supplies $79.30 93.42 55.00 32.48 $260.20 Let’s look at replenishing the fund if the Cash Balance on July 31 was $137.80. 6-22 Petty Cash Example P2 What amount of cash will be required to replenish the petty cash fund? a. b. c. d. $260.20 $262.20 $139.80 $137.80 6-23 Petty Cash Example P2 What amount of cash will be required to replenish the petty cash fund? a. b. c. d. $260.20 $262.20 $139.80 $137.80 Desired Balance Actual Balance Amount Needed $ 400.00 137.80 $ 262.20 Let’s prepare the journal entry to replenish the petty cash fund. 6-24 P2 Petty Cash Example Journal entry to replenish petty cash fund Dr. July 31 Travel Expense 79.30 Entertainment Expense 93.42 Postage Expense 55.00 Office Supplies Expense 32.48 Cash Over and Short Cash Cr. 2.00 262.20 6-25 EXERCISE 26, 27 Appendix 7-A: Cash Controls A bank reconciliation explains the difference between cash reported on bank statement and cash balance on a company’s books. Provides information for reconciling journal entries. Bank Balance Book Balance + Deposits in Transit + Bank Collections - Outstanding Checks - Service Charges - NSF Checks ± Bank Errors = Corrected Balance ± Book Errors = Corrected Balance Bank Statement Once a month, the bank sends each depositor a bank statement showing activities of a bank account. A bank statement includes, at least, the following: 1. 2. 3. 4. Beginning cash balance per bank; Check & other debits decreasing the balance; Deposits & other credits increasing the balance; Ending cash balance per bank. Bank Statement First National Bank Nashville, TN 37459 May 31, 2009 Clothes Mart Nashville, TN Acct No 278609 Previous Balance Total Checks Total Deposits 1488.79 5/1 5/2 5/4 5/7 1,367.09 107 2,604.22 55.00 108 109 279.50 44.75 5/9 5/12 5/15 5/18 110 111 21.81 37.55 112 175.98 5/21 5/27 5/30 5/31 113 114 288.31 12.54 Current Balance 2,725.92 1,251.88 825.04 527.30 115 451.65 Bank Reconciliation P3 A bank reconciliation is prepared periodically to explain the difference between cash reported on the bank statement and the cash balance on company’s books. Bank Statement First National Bank Nashville, TN 37459 May 31, 2009 * Clothes Mart Nashville, TN Why are the balances different? Acct No 278609 Previous Balance Total Checks Total Deposits 1488.79 5/1 5/2 5/4 5/7 1,367.09 107 2,604.22 55.00 108 109 279.50 44.75 5/9 5/12 5/15 5/18 110 111 21.81 37.55 112 175.98 5/21 5/27 5/30 5/31 113 114 288.31 12.54 115 451.65 Current Balance 2,725.92 Account: Cash GENERAL LEDGER Acct. No. 1,251.88 Date Item May 31 Balance PR Debit Credit 102 Balance DR (CR) 2,481.18 825.04 527.30 6-30 Reconciling Items Bank Statement Balance Add: Deposits in transit. Deduct: Outstanding Checks Add or Deduct: Bank errors. Adjusted Bank Balance Book Balance • Add: Collections made by the bank. • Add: Interest earned on checking account. =>CM • Deduct: Nonsufficient funds check (NSF). • Deduct: Bank service charge =>DM • Add or Deduct: Book errors Adjusted Book Balance. 6-31 Reconciling Items Identify and list any unrecorded Debit Memoranda (DM) from the bank for NSF Checks, service charges, and errors overstating the book balance. => Deduct them from the book balance. Identify and list any unrecorded Credit Memoranda (CM) from the bank for interest, collections, and errors understating the book balance. => Add them to the book balance. Bank Reconciliation P3 Two sections: 1. 2. Reconcile bank statement balance to the adjusted bank balance. Reconcile book balance to the adjusted book balance. The adjusted balances should be equal. 6-33 Bank Reconciliation Example P3 Let’s prepare a July 31 bank reconciliation statement for the Simmons Company. The July 31 bank statement indicated a balance of $9,610. The cash general ledger account on that date shows a balance of $7,430. Additional information necessary for the reconciliation is shown on the next screen. 6-34 Bank Reconciliation Example 1. Outstanding checks totaled $2,417. 2. A $500 check mailed to the bank for deposit had not reached the bank at the statement date. 3. The bank returned a customer’s NSF check for $225 received as payment on account receivable. 4. The bank statement showed $30 interest earned during July. 5. Check No. 781 for supplies expense cleared the bank for $268 but was erroneously recorded in our books as $240. 6. A $486 deposit by Acme Company was erroneously credited to our account by the bank. 6-35 P3 Bank Reconciliation Example Simmons Company Bank Reconciliation July 31, 2009 Bank Balance, July 31 Add: Deposit in Transit Less: Bank Error $ 486 Outstanding Checks 2,417 Adjusted Balance, July 31 Book Balance, July 31 Add: Interest Less: Recording Error NSF Check Adjusted Balance, July 31 $ (2,903) $ 7,207 $ $ 9,610 500 28 225 $ 7,430 30 (253) 7,207 6-36 P3 Recording Adjusting Entries from a Bank Reconciliation Only amounts shown on the book portion of the reconciliation require an adjusting entry. Dr. 30 July 31 Cash Interest revenue July 31 Supplies expense Accounts receivable Cash Cr. 30 28 225 253 6-37 P3 Recording Adjusting Entries from a Bank Reconciliation After posting the reconciling entries the cash account looks like this: Account: Cash GENERAL LEDGER Acct. No. Date Item July 31 Balance 31 Adjusting entry 31 Adjusting entry PR Debit Credit 30 253 101 Balance DR (CR) 7,430 7,460 7,207 Adjusted balance on July 31. 6-38 Exercises 28, 29 Accounts Receivable Result from the credit sales of goods or services to customers. Are classified as current assets. Are recorded net of trade discounts. P1 Trade Discounts Used by manufacturers and wholesalers to offer better prices for greater quantities purchased. Example Matrix, Inc. offers a 30% trade discount on orders of 1,000 units or more of their popular product Racer. Each Racer has a list price of $5.25. Quantity sold Price per unit Total Less 30% discount Invoice price 1,000 $ 5.25 5,250 (1,575) $ 3,675 4-41 Cash (Sales) Discounts increase sales Cash discounts encourage early payment increase likelihood of collections P1 Cash (Sales) Discounts A deduction from the invoice price granted to induce early payment of the amount due. Terms Discount Period Credit Period Time Due Date of Invoice Due: Invoice price minus discount Due: Full Invoice Price 4-43 Cash (Sales) Discounts 2/10,n/30 Discount percent Number of days discount is available Otherwise, net (or all) is due Credit period When Discount is Not Taken P1 If we fail to take a 2/10, n/30 discount, is it really expensive? 365 days ÷ 20 days × 2% = 36.5% annual rate Days in a year Number of additional days before payment Percent paid to keep money 4-45 Cash (Sales) Discounts Gross Method Net Method Sales are recorded at the invoice amounts. Sales discounts are recorded as reduction of revenue if payment is received within the discount period. Cash (Sales) Discounts On October 5, Hawthorne sold merchandise for $20,000 with terms 2/10, n/30. On October 14, the customer sent a check for $13,720 taking advantage of the discount to settle $14,000 of the amount. On November 4, the customer paid the remaining $6,000. Cash (Sales) Discounts Exercise 5 (1 & 2) and Exercise 6 Sales Returns Merchandise may be returned by a customer to a supplier. A special price reduction, called an allowance, may be given as an incentive to keep the merchandise. To avoid misstating the financial statements, sales revenue and accounts receivable should be reduced by the amount of returns in the period of sale if the amount of returns is anticipated to be material. P2 Accounting for Merchandise Sales Matrix, Inc. Partial Income Statement For Year Ended May 31, 2009 Sales Less: Sales discounts Sales returns and allowances Net sales Cost of goods sold Gross profit $ 2,451,000 $ 29,412 18,500 47,912 $ 2,403,088 (1,928,600) $ 474,488 Sales discounts and returns and allowances are Contra Revenue accounts. 4-50 Sales Returns During the first year of operations, Hawthorne sold $2,000,000 of merchandise that had cost them $1,200,000 (60%). Industry experience indicates a10% return rate. During the year $130,000 was returned prior to customer payment. Record all necessary Journal Entries including YE adjustment. Accounts Receivable 2,000,000 Sales Cost of Goods Sold 1,200,000 Inventory Actual Returns Sales returns (I/S Account) 130,000 Accounts receivable Inventory 78,000 Cost of goods sold (60%) Adjusting Entries Sales returns (200,000 – 130,000) 70,000 Allowance for sales returns (B/S Account) Inventory estimated returns 42,000 Cost of goods sold (60%) 2,000,000 1,200,000 130,000 78,000 70,000 42,000 Sales Returns Exercise 8 Uncollectible Accounts Receivable Bad debts result from credit customers who are unable to pay the amount they owe, regardless of continuing collection efforts. In conformity with the matching principle, bad debt expense should be recorded in the same accounting period in which the sales related to the uncollectible account were recorded. Uncollectible Accounts Receivable Most businesses record an estimate of the bad debt expense by an adjusting entry at the end of the accounting period. Normally classified as a selling expense and closed at year-end. Contra asset account to accounts receivable. Bad debt expense Allowance for uncollectible accounts xxx xxx Allowance for Uncollectible Accounts Accounts Receivable Less: Allowance for Uncollectible Accounts Net Realizable Value Net realizable value is the amount of the accounts receivable that the business expects to collect. Income Statement Approach Balance Sheet Approach Composite Rate Aging of Receivables Allowance Method of estimating Bad Debts Expenses Two Methods 1. Percent of Sales Method (Income Statement) 2. Accounts Receivable Methods (Balance Sheet) Percent of Accounts Receivable Method Aging of Accounts Receivable Method 7-56 Percent of Sales Method Bad debts expense is computed as follows: Current Period Sales X Bad Debt % = Estimated Bad Debts Expense Barton has credit sales of $1,400,000 in 2009. Management estimates 0.5% of credit sales will eventually prove uncollectible. What is Barton’s Bad Debts Expense for 2009? 7-57 P2 Percent of Sales Method $ × = $ 1,400,000 0.50% 7,000 Barton’s accountant computes estimated Bad Debts Expense of $7,000. Dec. 31 Bad Debts Expense Allowance for Doubtful Accounts DR 7,000 CR 7,000 To record estimated bad debts 7-58 Percent of Sales Method Barton has $100,000 in accounts receivable and a $900 credit balance in Allowance for Doubtful Accounts on Dec.31, 2009. What is the balance in AFDA on Dec. 31, 2009? Prepare the ‘T’ accounts for A/R and AFDA showing the balances as of 12/31/09. Bal. Accounts Receivable 100,000 Allowance for Doubtful Accounts Dec. 31 900 BDE 7,000 Dec. 31 7,900 Barton, Co. Partial Balance Sheet December 31, 2009 DR Cash Accounts receivable Less: Allowance for doubtful accounts $ 100,000 7,900 CR $ 92,100 Percent of Sales Method (Income Statement Approach) Exercise 10 Percent of Accounts Receivable Method Compute the estimate of the Allowance for Doubtful Accounts: Year-end Accounts Receivable Bad × Bad Debt % Debts Expense is computed as: Estimated Adj. Bal. in Allowance for Doubtful Accounts Unadj. Year-End Bal. in Allowance for Doubtful Accounts = Estimated Bad Debts Expense 7-61 Percent of Accounts Receivable Barton has $100,000 in accounts receivable and a $900 credit balance in Allowance for Doubtful Accounts on December 31, 2009. Past experience suggests that 4% of receivables are uncollectible. What is the balance in AFDA on Dec. 31, 2009? What is Barton’s Bad Debts Expense for 2009? 7-62 Percent of Accounts Receivable Desired balance in Allowance for Doubtful Accounts. $ 100,000 × 4.00% = $ 4,000 Allowance for Doubtful Accounts 900 Dec. 31 Bad Debts Expense Allowance for Doubtful Accounts 3,100 4,000 DR 3,100 CR 3,100 To record estimated bad debts 7-63 Percent of Accounts Receivable Bal. Accounts Receivable 100,000 Allowance for Doubtful Accounts Dec. 31 900 BDE 3,100 Dec. 31 4,000 Barton, Co. Partial Balance Sheet December 31, 2009 DR Cash Accounts receivable Less: Allowance for doubtful accounts $ 100,000 4,000 CR $ 96,000 Percent of Accounts Receivable Exercise 11, 12, 13 Aging of Accounts Receivable Method Each receivable is grouped by how long it is past its due date. Each age group is multiplied by its estimated bad debts percentage. Estimated bad debts for each group are totaled. 7-66 P2 Aging of Accounts Receivable Barton, Co. Schedule of Accounts Receivable by Age December 31, 2009 Accounts Estimated Receivable Percent Uncollectible Days Past Due Balance Uncollectible Amount Not Yet Due 1 - 30 Days Past Due 31 - 60 Days Past Due 61 - 90 Days Past Due Over 90 Days Past Due $ 64,500 18,500 10,000 3,900 3,100 $ 100,000 1% $ 3% 7% 40% 60% $ 645 555 700 1,560 1,860 5,320 7-67 P2 Aging of Accounts Receivable Barton’s unadjusted balance in the allowance account is $900. Allowance for Doubtful Accounts 900 4,420 5,320 We estimated the proper balance to be $5,320. DR Dec. 31 Bad Debts Expense 4,420 Allowance for Doubtful Accounts CR 4,420 To record estimated bad debts 7-68 Percent of Accounts Receivable Method (AGING of A/R) Problem 1, 4(c) Writing Off a Bad Debt under the Allowance Method With the allowance method, when an account is determined to be uncollectible, the debit goes to Allowance for Doubtful Accounts. Barton determines that Martin’s $300 account is uncollectible. Dec. 31 Allowance for Doubtful Accounts Accounts Receivable - Martin DR 300 CR 300 To write-off an uncollectible account 7-70 P2 Recovery of a Bad Debt Subsequent collections on accounts written off require that the original write-off entry be reversed before the cash collection is recorded. Feb. 8 Accounts Receivable - Martin Allowance for Doubtful Accounts DR 300 CR 300 To reinstate account previously written off Feb. 8 Cash 300 Accounts Receivable - Martin 300 To record full payment on account 7-71 Summary of Measurement and Reporting Issues for Accounts Receivable Recognition Depends on the earnings process; for most credit sales, revenue and the related receivables are recognized at the point of delivery. Initial valuation Initially recorded at the exchange price agreed upon by the buyer and seller. Subsequent valuation Initial valuation reduced to net realizable value by: 1. Allowance for sales returns 2. Allowance for uncollectible accounts: The income statement approach The balance sheet approach Classification Almost always classified as a current asset. Notes Receivable A written promise to pay a specific amount at a specific future date. Face amount of the note × Annual interest rate Even for maturities less than 1 year, the rate is annualized. × Fraction of the annual = period Interest Interest-Bearing Notes On November 1, 2014, West, Inc., loans $25,000 to Winn Co. The note bears interest at 12% and is due on November 1, 2015. Prepare the journal entry on November 1, 2014, December 31, 2014, (year-end) and November 1, 2015, for West. November 1, 2014 Notes receivable Cash December 31, 2014 Interest receivable Interest revenue November 1, 2015 Cash Note receivable Interest receivable Interest revenue 25,000 25,000 500 500 28,000 25,000 500 2,500 Interest-Bearing Notes Exercise 14 Noninterest-Bearing Notes Actually do bear interest. Interest is deducted (discounted) from the face value of the note. Cash proceeds or Sales Value equal face value of note less discount. Noninterest-Bearing Notes On Jan. 1, 2014, West, Inc., accepted a $25,000 noninterest bearing note from Winn Co. as payment for a sale. The note is discounted at 12% and is due on Dec. 31,2014. Prepare the journal entries on Jan. 1, 2014, and Dec. 31, 2014. January 1, 2014 Notes receivable Discount on notes receivable Sales revenue (Cash) 25,000 *3,000 22,000 *($25,000 * 12% = $3,000) December 31, 2014 Cash Discount on notes receivable Interest revenue Note receivable 25,000 3,000 ***Effective Interest Rate = (3,000 / 22,000) = 13.64% 3,000 25,000 Noninterest-Bearing Notes Exercise 15 U.S. GAAP vs. IFRS In general, IFRS and U.S. GAAP are very similar with respect to accounts receivable and notes receivable. Differences are highlighted below. U.S. GAAP allows a “fair value option” for accounting for receivables. U.S. GAAP does not allow receivables to be accounted for as “available for sale” investments. U.S. GAAP requires more disaggregation of accounts and notes receivable in the balance sheet or notes. IFRS restricts the circumstances in which a “fair value option” for accounting for receivables is allowed. Until 2015, companies may account for receivables as “available for sale” investments if the approach is elected initially. After January 1, 2015, this treatment is no longer allowed. Financing with Receivables (Not Covered) Companies may use their receivables to obtain immediate cash. Factoring Arrangements 2. Accounts Receivable SUPPLIER (Transferor) RETAILER 1. Merchandise FACTOR (Transferee) A factor is a financial institution that buys receivables for cash, handles the billing and collection of the receivables, and charges a fee for the service. Secured Borrowing On December 1, 2013, the Santa Teresa Glass Company borrowed $500,000 from Finance Bank and signed a promissory note. Interest at 12% is payable monthly. The company assigned $620,000 of its receivables as collateral for the loan. Finance Bank charges a finance fee equal to 1.5% of the accounts receivable assigned. Cash (difference) Finance charge expense (1.5% * $620,000) Liability – financing arrangement 490,700 9,300 500,000 Santa Teresa Glass will continue to collect the receivables, and will record any discounts, sales returns, and bad debt write-offs, but will remit the cash to Finance Bank, usually on a monthly basis. When $400,000 of the receivables assigned are collected in December, Santa Teresa Glass records the following entries. Cash 400,000 Accounts receivable 400,000 Interest expense ($500,000 * 12% * 1/12) Liability – financing arrangement Cash 5,000 400,000 405,000 Sale of Receivables Treat as a sale if all of these conditions are met: receivables are isolated from transferor. transferee has right to pledge or exchange receivables. transferor does not have control over the receivables. Transferor cannot repurchase receivable before maturity. Transferor cannot require return of specific receivables. Sale of Receivables Without recourse An ordinary sale of receivables to the factor. Factor assumes all risk of uncollectibility. Control of receivable passes to the factor. Receivables are removed from the books, fair value of cash and other assets received is recorded, and a financing expense or loss is recognized. With recourse Transferor (seller) retains risk of uncollectibility. If the transaction fails to meet the three conditions necessary to be classified as a sale, it will be treated as a secured borrowing. Sale of Receivables In December 2013, the Santa Teresa Glass Company factored accounts receivable that had a book value of $600,000 to Factor Bank. The transfer was made without recourse. Under this arrangement, Santa Teresa transfers the $600,000 of receivables to Factor, and Factor immediately remits to Santa Teresa cash equal to 90% of the factored amount (90% × $600,000 = $540,000). Factor retains the remaining 10% (estimated to have a fair value of $50,000) to cover its factoring fee (equal to 4% of the total factored amount; 4% × $600,000 = $24,000) and to provide a cushion against potential sales returns and allowances. Assume the same facts as above, except that Santa Teresa Glass sold the receivables to Factor with recourse and estimates the fair value of the recourse obligation to be $5,000. Sale of Receivables Securitization: Transfer receivables to a SPE Special Purpose Entity (SPE) Qualifying Special Purpose Entity (QSPE) New rules eliminate QSPE and require consolidation! Participating Interests: Transfer portion of a receivable Example: transfer right to interest, but retain right to principal New rules require a partial transfer be treated as a secured borrowing, unless specific conditions are met! Transfers of Notes Receivable On December 31, Stridewell accepted a nine-month 10 percent note for $200,000 from a customer. Three months later on March 31, Stridewell discounted the note at its local bank. The bank’s discount rate is 12 percent. Before preparing the journal entry to record the discounting, Stridewell must record the accrued interest on the note from December 31 until March 31. Interest receivable Interest revenue $200,000 × 10% × 3/12 5,000 5,000 Transfers of Notes Receivable Face amount of note receivable Interest to maturity ($200,000 × 10% × 9/12) Maturity value of note receivable Discount fee ($215,000 × 12% × 6/12) Cash proceeds Cash Loss on sale of note receivable Notes receivable Interest receivable $ $ 200,000 15,000 215,000 (12,900) 202,100 202,100 2,900 $205,000 $202,100 200,000 5,000 Deciding Whether to Account for a Transfer as a Sale or a Secured Borrowing U.S. GAAP vs. IFRS The U.S. GAAP and the IFRS approaches often lead to similar accounting treatment for transfers of receivables. U.S. GAAP focuses on whether control of assets has shifted from the transferor to the transferee. IFRS requires a more complex decision process. The company has to have transferred the rights to receive the cash flows from the receivable, and then considers whether the company has transferred “substantially all of the risks and rewards of ownership,” as well as whether the company has transferred control. Receivables Management Receivables Turnover = Ratio Net Sales Average Accounts Receivable This ratio measures how many times a company converts its receivables into cash each year. Average Collection Period 365 = Receivables Turnover Ratio This ratio is an approximation of the number of days the average accounts receivable balance is outstanding. Receivables Management Symantec Corp. vs. CA, Inc., comparison (All dollar amounts in millions) Accounts receivable (net) Net sales Receivables turnover Average collection period Symantec Corp. CA, Inc. 2011 2010 2011 2010 $ 1,013 $ 856 $ 849 $ 931 6,190 4,429 Symantec Corp 6.62 55.14 days CA, Inc 4.98 73.29 days Industry Average 5.96 61.3 days Appendix 7-B: Accounting for Impairment of a Receivable and a Troubled Debt Restructuring When a company holds a receivable from another company, there is some potential that the receivable will eventually be impaired. Impairment of a receivable occurs if the company believes it is probable that it will not receive all of the cash flows (principal and any interest payments) associated with the receivable. Appendix 7-B: Accounting for Impairment of a Receivable and a Troubled Debt Restructuring Bad debt expense Accrued interest receivable Allowance for uncollectible accounts ($30,000,000 - $24,132,330) 8,867,670 3,000,000 5,867,670 Appendix 7-B: Accounting for Impairment of a Receivable and a Troubled Debt Restructuring A troubled debt restructuring occurs when a creditor makes concessions in response to a debtor’s financial difficulties. Sometimes a receivable in a troubled debt restructuring is actually settled at the time of the restructuring by the debtor making a payment of cash, some other noncash assets, or even shares of the debtor’s stock. Land (fair value) Bad debt expense Accrued interest receivable Notes receivable (in millions) 20 13 3 30 U.S. GAAP vs. IFRS The U.S. GAAP and the IFRS approaches to impairments of receivables are similar, but the process and criteria are somewhat different. Under U.S. GAAP the level of analysis is individual receivables. U.S. GAAP provides an illustrative list of information to consider when evaluating receivables for impairment, and requires measurement of potential impairment if impairment (a) is viewed as probable and (b) can be estimated reliably. Both U.S. GAAP and IFRS treat reversal of impairments the same. Under IFRS the level of analysis starts with consideration of impairment for individually significant receivables. IFRS provides an illustrative list of “loss events” and requires measurement of an impairment if there is objective evidence that a loss event has occurred that has an impact on the future cash flows collected and that can be estimated reliably. Both U.S. GAAP and IFRS treat reversal of impairments the same. End of Chapter 7