Union Pacific PowerPoint Specs

advertisement

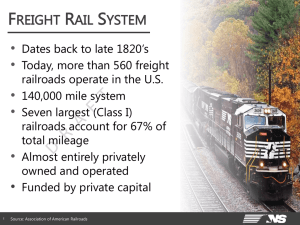

Denver Chamber of Commerce January 16, 2009 Joseph Bateman, VP Public Affairs – Northern Region Union Pacific System Seattle Eastport Portland Duluth Fast Facts Twin Cities • Miles of Track 32,200 in 23 States • Employees 49,000 • Annual Payroll $3.9 B • Customers 25,000 • Locomotives 8,700 • Freight Cars 106,000 Chicago Omaha SLC Oakland Denver KC St. Louis LA Memphis Dallas Calexico Nogales El Paso Eagle Pass Houston New Orleans Laredo Brownsville Denver Service Unit Sioux City Granger Council Bluffs North Platte Phippsburg Lincoln Denver Marysville Provo Grand Jct. Topeka Salina Paola Sharon Springs Arco Pueblo Hutchinson Walsenburg Wichita Stratford Dalhart Denver Service Unit 2008 Revenue $2.2 Billion Denver Service Unit Facts • Employees: 2354 • Miles of Track: 2937 •Main Track: 2448 •Branch Line: 489 Subdivision Train Mix Moffat Tunnel Subdivision • Union Pacific: 16 / 17 Trains per day • Amtrak: 2 Trains per day • Ski Train: 2 Trains, 4 days a week • BNSF: 4 Trains per day Subdivision Train Mix Colorado Springs Subdivision • Union Pacific: 6 / 7 Trains per day • BNSF: 40 Trains per day Subdivision Train Mix Greeley Subdivision • Union Pacific: 16 / 17 Trains per day Limon Subdivision • Union Pacific: 14/16 Trains per day Freight Railroads in Colorado 2006 • Number of Freight Railroads • Miles Operated* • Total Carloads Carried • # of Freight RR Employees • Average per Freight RR Employee Denv er Grand Junction Limon Colorado Springs 14 2,645 2,873,787 – Wages $69,900 – Benefits $27,100 Total Compensation Pueblo Durango • 3,042 $97,000 Total Wages of Freight Employees $ 212 M RR Retirement Beneficiaries 7,349 RR Retirement Benefits Paid $112 M * excludes trackage rights Freight Railroads in Colorado, cont. Tons Originated 2006 Millions % Coal 24.3 73% Food Products 2.0 6 Petroleum Products 1.3 4 Nonmetallic Minerals 1.4 4 Glass & Stone Prod. 1.1 3 All Other 3.2 10 Total 33.5 100% 200 150 100 50 0 Tons Terminated 2006 Millions % Coal 16.1 49% Nonmet. Minerals 2.9 9 Glass & Stone Prod. 2.3 7 Lumber & Wood 1.8 6 Chemicals 1.3 4 All Other 8.4 26 Total 33.1 •100% Millions of Rail Tons Carried 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 UP Colorado Capital Spending 2003 $64 2004 $108 2005 2006 2007 $65 $53 $64 Total 5 years $354M or Average $71M/year Freight Railroads Are the Transportation Backbone of America Connect businesses and consumers across the country and overseas Most efficient and costeffective in the world ~$25 billion in wages and payments to retirees each year Billions of dollars in local purchases and taxes The Fundamentals of Railroad Economics Cannot be Ignored Railroads are networks: what happens in one place affects many others. Can’t be easily picked up and moved. “Density is the god of transportation.” Huge differences in customer demands and options. U.S. Freight Railroads Have Certain General Characteristics Vast majority privately-owned Typically, same company owns the track and operates trains over it No forced access Low government funding Freight & passenger are separate America’s Freight Railroads: Freight Transportation Leaders •(ton-miles) 45% 40% 35% 30% 25% 20% 15% 10% 5% 0% •Railroads •Trucks •Water •Pipeline '80 '82 '84 '86 '88 '90 '92 '94 '96 '98 '00 '02 '04 '06 •Pipeline does not include natural gas. Source: Bureau of Transportation Statistics U.S. Freight Railroads in 2007 Type of Railroad Freight Revenue Employees ($ billions) Number Miles Operated* Class I Non-Class I Regional Local Linehaul S&T Canadian** 7 556 33 324 199 2 94,313 45,821 16,930 22,298 6,593 561 167,216 19,596 7,805 5,602 6,189 n/a $52.9 3.9 1.8 1.3 0.8 n/a Total 565 140,695 186,812 $56.8 *Excludes trackage rights. **Includes CN and CP operations that are not part of a CN- or CP-owned Class I carrier. Source: AAR U.S. Railroad Performance: 1964-2007 300 270 240 210 180 150 120 90 60 30 0 •(Index 1981 = 100) •Productivity •Volume •Staggers Act Passed Oct. 1980 •Revenue •Price '64 '68 '71 '74 '77 '80 '83 '86 '89 '92 '95 '98 '01 '04 '07 •Source: AAR A Variety of Forces Have Been Pushing Freight to Railroads 8% 6% 4% 2% 0% -2% GDP Growth Armour Yellow Outside -- Green Inside • Rail Transportation Is Three Times More Fuel Efficient Than Trucks. • UP Can Haul One Ton 790 Miles on One Gallon of Diesel Fuel. • One Intermodal Train Takes up to 280 Trucks off the Highway, the equivalent of 1,100 automobiles. • One slot for a passenger train consumes 2 freight train slots. • 2 freight train slots therefore equal 560 trucks or the equivalent of 2,220 autos. UP “Green Goat” Hybrid Locomotive Double the Freight on Same Amount of Fuel! •(Index 1980=100) 200 175 150 RR Fuel Consumption RR Volume Avg. RR Price of Fuel 125 100 75 50 25 0 1980 1983 1986 1989 1992 1995 1998 2001 2004 2007 •Volume = revenue ton-miles. Source: AAR Ways Railroads Conserve Fuel New locomotives “Gensets” Hybrids Technology Monitoring systems Idle reduction Trip planning software Training Component design Freight Rail is Cleaner Ratio of Emissions Per Ton-Mile: Freight Rail vs. Trucks 24 20 16 12 8 •1:7 •1:1 3 •1:4 •1:2 2 4 0 NOX CO Railroads •*Volatile organic compounds Particulates VOC* Trucks Source: Univ. of Iowa Public Policy Center for the U.S. DOT Freight RRs Account for <1% of Greenhouse Gas Emissions U.S. Greenhouse Gas Emissions by Source: 2006 •Non-transportation •72.4% •Trucking 5.7% •Freight RRs 0.7% •Other freight transport •1.2% •Passenger transport* •20.0% •Source: EPA •*On-road vehicles, aircraft, recreational boats, passenger rail Steady Rise in Rail Carloads •(millions of carloads originated) 34 32 30 28 26 24 22 20 18 16 1991 1993 1995 1997 1999 2001 2003 2005 2007 •Data are for Class I railroads. Includes WRPI from 1991-1995. Source: AAR One Result of Traffic Growth: Tight Capacity on Parts of the Rail Network •Millions of Class I Ton-Miles Per Mile of Road Owned 20 18 16 14 12 10 8 6 4 2 0 '90 '91 '92 '93 '94 '95 '96 '97 '98 '99 '00 '01 '02 '03 '04 '05 '06 '07 •Source: AAR What Are Railroads Doing to Increase Capacity? Aggressive hiring Massive equipment and infrastructure investment New operating plans Cooperative alliances Working with customers Technology Record Capital Spending •Class I RR Capital Spending $8.5 •$9. 2 2006 2007 •($ Billions) $5.7 2002 •Source: AAR $5.9 2003 $6.2 2004 $6.4 2005 Railroads Spend More Than Most State Highway Agencies! •Class I Railroad Spending* on Way & Structures •vs. •State Highway Agency Spending* - 2006 •($ billions) •*Data include capital outlays and maintenance expenses. •Sources: FHWA Highway Statistics Table SF-12, AAR •1. •2. •3. •Texas •Florida •California •Union Pacific •BNSF •4. •New York •5. •Pennsylvania •6. •Illinois •CSX •7. •Michigan •8. •North Carolina •9. •Ohio •Norfolk Southern •10. •Georgia •$7.57 •$5.69 •$4.19 •$4.17 •$3.89 •$3.59 •$3.30 •$3.30 •$2.62 •$2.61 •$2.48 •$2.14 •$2.12 •$1.88 National Rail Freight Infrastructure Capacity and Investment Study Prepared for the National Surface Transportation Policy and Revenue Study Commission. First effort of its kind involving the freight railroads. Objective: estimate cost to expand rail infrastructure to handle traffic forecast by DOT for 2035 % Growth in Trains Per Day From 2005 to 2035 by Primary Rail Corridor •0-50 •50-100 •100-2,500 Future Corridor Volumes Compared to Current Corridor Capacity •2035 without improvements •Below capacity •Near capacity •At capacity •Above capacity Support Passenger Rail - But Not at the Expense of Freight Rail Passenger service should complement, not conflict with, freight service. Adequate liability protection. Fully compensate freight railroads for passenger use of their property. No forced commuter rail access to freight-owned property. Freight railroads should not be expected to subsidize passenger service. True High-Speed Passenger Rail Can’t Work on Freight Tracks Safety Operating differentials Capacity and efficiency Engineering requirements Points to Remember Regarding High-Speed Passenger Rail If we’re going to do it, do it right. Fast, dependable service necessary to compete with air and highway. Piggy-backing on freight railroads will give yield a third-rate passenger rail system. Goals of reducing pollution and highway congestion can be realized if we ensure that passenger trains don’t interfere with freight service. Denver Chamber of Commerce January 16, 2009 Joseph Bateman, VP Public Affairs – Northern Region