Slides

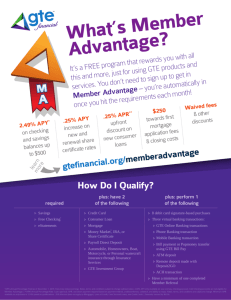

advertisement

FINANCIAL INDUSTRY

STRUCTURE

Chapter 9

Decline of Glass-Steagal Act

• In 1927, interstate banking eliminated.

• In 1933, Glass-Steagal act created FDIC and separated

banking business from securities business.

During 1990’s, these regulations were eliminated and US

banks had a wave of consolidation and concentration.

Concentration

% of US Banking Assets held by Banks larger than

$10Billion

90.00%

80.00%

70.00%

60.00%

50.00%

40.00%

30.00%

20.00%

10.00%

0.00%

2014

2007

2000

1993

Bank Holding Companies

•

Bank holding companies have a corporate structure in

which a parent company owns many subsidiaries in

different financial industries.

1.

2.

3.

4.

Subsidiaries engage in banking, securities, real estate and

insurance business.

Subsidiaries are separate legal entities so the bankruptcy of

one does not mean losses for the other.

Losses at one subsidiary do result in losses for

shareholders of the holding company.

Banks mostly protected from risk of sister companies.

Advantages: Protects depositors & bank capital from market

risk. One stop shopping can help build relationships.

Disadvantages: Bank holding company bankruptcies may

force bankruptcy of commercial banking. Hard for senior

management to align practices.

Financial Innovation and The Decline of

Traditional Banking

• Banking is traditionally the business of accepting

short-term retail deposits and making long-term

loans.

• A number of financial innovations have led to

changes in the financial industry and financial

regulation.

• Due to reductions in information & transaction

costs, the banking industry in US, Japan, and

Europe faces competition for both deposits and

credit.

Shadow Banking System

• Over the last 30 years, competitors to banks in providing

traditional banking services. The competitors include

• Investment/Merchant Banks

• Mutual Funds

• Hedge Funds

• GSE’s

• Pension Funds/Insurance Companies

• Finance Companies

• The FSB defines shadow banking as “credit intermediation

involving entities and activities (fully or partially) outside the

regular banking system”. In the Global Shadow Banking

Monitoring Report 20121, the term “Other Financial

Intermediaries” (OFIs) which include NBFIs except insurance

companies, pension funds or public sector financial entities, was

used as a conservative proxy for the size of shadow banking.

IMF Global Financial Stability Report - Chapter 2: Global Shadow Banking

Decline in Advantage in Providing Liquidity

• New Competition: Money Market Mutual Funds – Mutual funds

that are redeemable at a fixed price by writing checks. Mutual

funds invest in money markets. These are essentially checking

accounts issued by non-financial institutions that pay interest.

Decline in Advantage in Providing Credit

• Another of banks comparative advantage is their

ability to provide loans quickly and provide credit

to small or new firms.

• New Competition

• Commercial Paper: Short-term corporate bonds.

Many firms that relied on banks for short-term loans

now issue commercial paper.

• Junk Bonds: Bonds issued by firms with noninvestment grade credit ratings. Many firms that relied

on banks for credit now issue junk bonds.

Jan, 1991

Aug, 1991

Mar, 1992

Oct, 1992

May, 1993

Dec, 1993

Jul, 1994

Feb, 1995

Sep, 1995

Apr, 1996

Nov, 1996

Jun, 1997

Jan, 1998

Aug, 1998

Mar, 1999

Oct, 1999

May, 2000

Dec, 2000

Jul, 2001

Feb, 2002

Sep, 2002

Apr, 2003

Nov, 2003

Jun, 2004

Jan, 2005

Aug, 2005

Mar, 2006

Oct, 2006

May, 2007

Dec, 2007

Jul, 2008

Feb, 2009

Sep, 2009

Apr, 2010

Nov, 2010

Jun, 2011

Jan, 2012

Aug, 2012

Mar, 2013

Oct, 2013

May, 2014

Millions US$

Commercial Paper Outstanding: sa: Total

2500000

2000000

1500000

1000000

500000

0

US Corporate Bond Issuance US$ Billions

1,600.0

1,400.0

1,200.0

1,000.0

800.0

600.0

400.0

200.0

0.0

1996

1997

1998

1999

2000

2001

2002

2003

2004

Investment Grade

2005

2006

High Yield

2007

2008

2009

2010

2011

2012

2013

Loan Commitments & Letters of Credit

Banks collect fees for additional off balance sheet

activities

1. Loan Commitment: A line of credit giving

company ability to borrow when desired.

2. Letter of Credit: Promise by a bank to make

good on customer’s credit from another party.

Commercial LOC: Customer buys goods on credit.

If they get LOC from bank, the bank promises to pay

trade bill if the customer does not.

B. Standby LOC: If issuers of commercial paper, get

LOC from bank, the bank promises to pay bond

investors if issuer defaults.

A.

Loan Commitments

5,000,000,000

4,500,000,000

4,000,000,000

3,500,000,000

3,000,000,000

2,500,000,000

2,000,000,000

1,500,000,000

1,000,000,000

500,000,000

0

2014

2009

2004

Credit Card & Home Equity Line of Credit

1999

Loan Commitments

1994

Loan Securitization

• Banks make loans in a certain class, bundle the

loans into a portfolio, sell securities, and dedicate

the principal and interest payments on the loans to

making coupon and face value payments on the

securities.

• Banks profits come as fee for setting up loan back

securities.

• Banks reduce the maturity mismatch between

assets and liabilities by raising funds this way

instead of deposits reducing interest rate and

liquidity risk.

• Primarily mortgage loans are securitized but also

securitization of credit card receivables, auto loans and

even leasing payments by rental companies.

Securitization

Banks collect fees for

making loans and

collecting repayment

Borrower

Borrower

Borrower

Borrower

Borrower

Loans

Bank

Will bundle loans

And sell to 3rd party

Bundle

3rd Party

Securitization

Company

(typically GSE)

Bonds

Bond Market

Mortgage Debt by Owners

16000000

14000000

12000000

Millions US$

10000000

8000000

6000000

4000000

2000000

0

Axis Title

Mortgage Debt: Mortgage or Pool Trusts

Mortgage Debt: Federal & Related Agencies

Mortgage Debt: Major Financial Institutions

Individuals & Others

Other Tyes of Securitization, Billions USD

900.0

800.0

700.0

600.0

500.0

400.0

300.0

200.0

100.0

0.0

19851986198719881989199019911992199319941995199619971998199920002001200220032004200520062007200820092010201120122013

Automobile

Credit Card

Equipment

Student Loans

Vanilla Mortgage Backed Security

• A bond that raises funds to buy a bundle of mortgages

and uses income to repay bondholders.

• Usually sold to or guaranteed by GSE (Govt. Natl

Mortgage Assoc., Fed. Natl Mortgage Association,

Federal Home Loan Mortgage Corp.)

Mortgages

MBS

Bondholders

Mortgages

Mortgages

Single Tranche

Collateralized Mortgage Obligations

• A special purpose vehicle that buys mortgages and

structures payments into tranches.

• Usually private label, SPV/SPE , in order to expand base

of allowable mortgages.

Special purpose vehicle/entity: Quasi-independent company set

up to manage asset.

Senior Tranche AAA

Mortgages

CMO

Mortgages

Mortgages

Junior Tranche

CMO: Collateralized Mortgage Obligations

Sample

• An SPV is set up to

purchase mortgages

and issue bonds which

pay out in tranches.

Tranches are

orderings of payments

in terms of seniority.

Each tranche is has itsM. Brunnermeier, Princeton U. Slides.

Commercial and Investment Banks

own credit rating.

often set up SPV

Special purpose vehicle: Quasiindependent company set up to

manage asset.

Structured Securities

• Securitized bonds w/o GSE guarantees are risky because

in a slump not all mortgage borrowers will repay their debts.

But income is highly diversified.

• CMO’s structure payments according to seniority. Most

senior tranches have first call on income, so only lose

money if a large fraction of borrowers fail to repay.

• CMO’s concentrate risk among most junior tranches,

synthetically creating safe senior securities.

Collateralized Debt Obligations

• A special purpose vehicle that buys quantities of debt

securities (often MBS or CMO tranches) that might be low

rated and turn it into tranches some of which might be

better rated.

Senior Tranche AAA

BBB Securities

SPV

Junior Tranche

BBB Securities

BBB Securities

AAA tranches may have paid

higher returns than typical

AAA securities. Attractive to

institutions restricted to AAA

Sub-prime Lenders

• An industry of financial intermediaries that specialized in

making mortgage loans pre-packaged for securitization

arose.

• Many of these specialized in the sub-prime market.

• Typically, these were sold to SPV’s rather than GSE’s.

• Investors in CMO’s and CDO’s financed their purchases

with short-term borrowing and issuing commercial paper

often sold to MMMF’s.

• Shadow banking reduced maturity mismatch in traditional

banking sector but only shifted it to investment banks and

mutual funds.

End of Housing Bubble

• In 2005, housing prices reached a peak.

• However, by reducing lending standards and increasing

reliance on sub-prime lending, mortgage lending

continued to grow.

• By 2007, housing prices began to fall.

Jan, 2000

Apr, 2000

Jul, 2000

Oct, 2000

Jan, 2001

Apr, 2001

Jul, 2001

Oct, 2001

Jan, 2002

Apr, 2002

Jul, 2002

Oct, 2002

Jan, 2003

Apr, 2003

Jul, 2003

Oct, 2003

Jan, 2004

Apr, 2004

Jul, 2004

Oct, 2004

Jan, 2005

Apr, 2005

Jul, 2005

Oct, 2005

Jan, 2006

Apr, 2006

Jul, 2006

Oct, 2006

Jan, 2007

Apr, 2007

Jul, 2007

Oct, 2007

Jan, 2008

Apr, 2008

Jul, 2008

Oct, 2008

Jan, 2009

Apr, 2009

Jul, 2009

Oct, 2009

Jan, 2010

Apr, 2010

Jul, 2010

Oct, 2010

Jan, 2011

Apr, 2011

Jul, 2011

Oct, 2011

House Price Index: FHFA: Purchase Only: US: Jan1991=100

235

225

215

205

195

185

175

165

155

145

135

10

8

1985Q1

1985Q3

1986Q1

1986Q3

1987Q1

1987Q3

1988Q1

1988Q3

1989Q1

1989Q3

1990Q1

1990Q3

1991Q1

1991Q3

1992Q1

1992Q3

1993Q1

1993Q3

1994Q1

1994Q3

1995Q1

1995Q3

1996Q1

1996Q3

1997Q1

1997Q3

1998Q1

1998Q3

1999Q1

1999Q3

2000Q1

2000Q3

2001Q1

2001Q3

2002Q1

2002Q3

2003Q1

2003Q3

2004Q1

2004Q3

2005Q1

2005Q3

2006Q1

2006Q3

2007Q1

2007Q3

2008Q1

2008Q3

2009Q1

2009Q3

2010Q1

2010Q3

2011Q1

2011Q3

2012Q1

2012Q3

2013Q1

2013Q3

2014Q1

12

Mortgage losses

estimated at

$1.4 trilion by

IMF

Credit

performance

worse at subprime lenders.

6

4

2

0

Delinquency rate on all loans; All commercial banks (Seasonally adjusted)

Delinquency rate on loans secured by real estate; All commercial banks (Seasonally adjusted)

Liquidity of CMO’s and CDO’s

• There is much uncertainty and asymmetric info in CMO’s.

Difficult for a potential investor to evaluate quality of the

mortgage loan bundle while bundler/seller may have

better idea.

• Increased risk has generated lemon’s problem.

• Wide bid/ask spreads makes it difficult to reasonably

implement M2M accounting.

Issues

• Capitalization: Banks and other holders of mortgage

backed securities are likely to take large losses on

defaults.

• Liquidity: MMMF are supposed to be safe investments;

once risk becomes known MMMF‘s pull out of commercial

paper market go into treasuries.

• Complexity: CDO’s and CMO’s are complicated

instruments; difficult to tell good from bad. In hard times,

adverse selection may make selling them w/o huge

discount problematic.

• Business cycle issue. Large contraction in consumption

and investment likely to make default rates rise.

Shadow Banking and Asia

• FSB uses OFI’s (non-bank financial institutions less

insurance, pension funds & public institutions) as indicator

of shadow banking (Unit Trusts/Mutual Funds, Finance

Companies, Credit Unions, Brokerage Companies,

Structured Finance).

• Shadow banking in Asia generally:

• Small relative to banking sector but growing

• Mostly not financed through financial markets.

• Mostly finances simple loans or vanilla securities.

FSB Shadow Banking in Asia

• IMF Global Financial Stability Report

Chinese Banking System

1.

2.

3.

4.

5.

6.

Major Commercial Bank (BoC, ICBC, CCB, ABC)

Joint-Stock Commercial Bank (CITIC Industrial Bank, Bank of

Communications, Everbright)

City Commercial Bank (Bank of Shanghai, Bank of Beijing, Bank of

Tianjian)

Credit Cooperatives (Collective Banks – Urban and Rural)

Policy Banks (Export Import Bank, China Development Bank)

Trust Companies

2014 Q1 China Banking Regulatory

Commission RMB Billion

Total

Other (NBFI & Public)

Rural FI

City

Joint Stock

Major Commercial

CBRC

0

20000

40000

60000

80000 100000 120000 140000 160000 180000

Chinese Trust Companies

• China has heavily

regulated deposit

rates.

• Rich people seek

higher yields. WMP

direct funds to trust

companies –

specialized lenders

that finance projects

that cannot access

traditional banks.

Increasing Share of Lending through nonstandard channels.

160000

• Entrusted Loan: Firm

140000

120000

100000

80000

60000

40000

20000

Non Financial Enterprise Equity Financing

Net Corporate Bond Financing

Banker's Acceptance Bill

Trust Loan

Entrusted Loan

Loan in Foreign Currency

Loan in Local Currency

01-Sep-15

01-Mar-14

01-Dec-14

01-Jun-13

01-Sep-12

01-Dec-11

01-Jun-10

01-Mar-11

01-Sep-09

01-Dec-08

01-Mar-08

01-Jun-07

01-Dec-05

01-Sep-06

01-Mar-05

01-Jun-04

01-Sep-03

01-Dec-02

0

to firm loans with

bank/trust company

intermediation.

• Trust loan: Loan from

trust company, less

likely to SOE’s.

Link

Growth in Debt

Aggregate Financing/GDP

200.00%

190.00%

180.00%

170.00%

160.00%

150.00%

140.00%

130.00%

120.00%

110.00%

100.00%

Banking System in 2002/2004:

(Source: Asian Wall Street Journal {2002}/ BusinessWeek {2004})

Big Four Banks

Official

NPL

Ratio

Industrial & Commercial Bank of 21.56%

China

Bank of China

18.07%/

5.46%

China Construction Bank

11.92%/

3.08%

Agricultural Bank of China

30.07%

Reasons that NPL’s fell so fast

• [AMC’s] Asset Management Companies

have purchased Yuan 1.4 Trillion worth of

bad loans from banks.

• Credit Management : Banks have

improved their lending practices.

• More Loans- Banks have gone on a

lending binge and fresh loans may not

have gone bad yet.

Currency Internationalization

• China creating an offshore Renminbi market by

allowing Hong Kong residents to keep quota of

RMB deposits .

MacCauley Renminbi internationalisation and China’s financial

Development BIS Quarterly Review, December 2011

http://www.bis.org/publ/qtrpdf/r_qt1112f.pdf

Dec, 1980

Oct, 1981

Aug, 1982

Jun, 1983

Apr, 1984

Feb, 1985

Dec, 1985

Oct, 1986

Aug, 1987

Jun, 1988

Apr, 1989

Feb, 1990

Dec, 1990

Oct, 1991

Aug, 1992

Jun, 1993

Apr, 1994

Feb, 1995

Dec, 1995

Oct, 1996

Aug, 1997

Jun, 1998

Apr, 1999

Feb, 2000

Dec, 2000

Oct, 2001

Aug, 2002

Jun, 2003

Apr, 2004

Feb, 2005

Dec, 2005

Oct, 2006

Aug, 2007

Jun, 2008

Apr, 2009

Feb, 2010

Dec, 2010

Oct, 2011

Aug, 2012

Jun, 2013

Apr, 2014

Hong Kong Deposits

Deposits: HK$

Deposits: US Dollar: Exclude Foreign$ Swap

Deposits: Renminbi: Total Outstandings

Other

12000000

10000000

8000000

6000000

4000000

2000000

0

Issuance of RMB denominated bonds by Chinese and

overseas issuers in “dim sum” market.

Link

Trade Settlement

Link

Offshore RMB FX Market

RMB Daily Turnover, April 2013

20

18

16

Billions US$

14

12

Delivarable Forward

10

Spot

8

6

4

2

0

Onshore

Hong Kong

Other Offshore

Shu, He, and Cheng, 2013

Advantages

• Chinese (and other!) companies can settle and invoice in

Renminbi.

• In 2010, 2% of China’s trade was settled in RMB. In 2011, nearly

7%

• Create more balanced international portfolio of assets.

• Questions: Can China have international currency without

capital account convertibility.

• Over the last decade,

rapid increase in

globalization of

banking.

• Retrenchment after

2008

1995-Q4

1996-Q3

1997-Q2

1998-Q1

1998-Q4

1999-Q3

2000-Q2

2001-Q1

2001-Q4

2002-Q3

2003-Q2

2004-Q1

2004-Q4

2005-Q3

2006-Q2

2007-Q1

2007-Q4

2008-Q3

2009-Q2

2010-Q1

2010-Q4

2011-Q3

2012-Q2

2013-Q1

2013-Q4

2014-Q3

2015-Q2

Cross border lending

Global Bank Lending by Recipient

25

20

15

10

5

0

B:Banks, total

N:Non-banks, total

Regional Lending Growth

• International banking

to the Asian region is

growing.

• Increasing regional

exposure.

Dec, 1980

Oct, 1981

Aug, 1982

Jun, 1983

Apr, 1984

Feb, 1985

Dec, 1985

Oct, 1986

Aug, 1987

Jun, 1988

Apr, 1989

Feb, 1990

Dec, 1990

Oct, 1991

Aug, 1992

Jun, 1993

Apr, 1994

Feb, 1995

Dec, 1995

Oct, 1996

Aug, 1997

Jun, 1998

Apr, 1999

Feb, 2000

Dec, 2000

Oct, 2001

Aug, 2002

Jun, 2003

Apr, 2004

Feb, 2005

Dec, 2005

Oct, 2006

Aug, 2007

Jun, 2008

Apr, 2009

Feb, 2010

Dec, 2010

Oct, 2011

Aug, 2012

Jun, 2013

Apr, 2014

Millions HK$

8000000

7000000

6000000

5000000

4000000

3000000

2000000

1000000

0

To Finance Imports to and Exports & Re-exports from HK

To Finance Merchandising Trade Not Touching HK

Other Loans for Use in HK

Other Loans for Use outside HK

Other Loans where the Place of Use is Not Known