Analysing Historical Performance

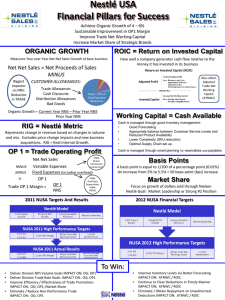

advertisement

Reorganise the financial statements to reflect economic, instead of accounting, performance. Measure and analyse the company’s return on invested capital (ROIC) and economic profit to evaluate the company’s ability to create value Break down revenue growth into four components: organic revenue growth, currency effects, acquisitions and accounting changes Assess the company’s financial health and capital structure to determine whether it has the financial resources to conduct business and make short-and long-term investments Separate operating performance from nonoperating items and the financing obtained to support the business. ROIC and Free Cash Flow (FCF) are independent of leverage and focus solely on the operating performance of the business. OA +NOA = OL + (D +DE) + (E + EE) ◦ ◦ ◦ ◦ ◦ ◦ ◦ OA = Operating assets NOA = Non-operating assets OL = Operating liabilities D = Debt DE = Debt equivalent E = Equity EE =Equity equivalents Invested Capital +NOA = Total Funds Invested = (D+DE) + (E + EE) Invested capital = OA – OL ACCOUNTANT’S BALANCE SHEET Previous year Current year Liabilities and Equity Share capital 50 50 Retained earnings 115 200 Interest-bearing debt 225 200 Accounts payable 125 150 Total liabilities and equity 515 600 300 350 15 25 Inventory 200 225 Total assets 515 600 Assets Net PPE Equity investments INVESTED CAPITAL Net PP&E Previous year 300 Current year 350 Inventory Accounts payable Operating working capital Invested capital Equity investments Total funds invested 200 (125) 75 375 15 390 225 (150) 75 425 25 450 Share capital Retained earnings Interest-bearing debt Total funds invested 50 115 225 390 50 200 200 450 Interest is not subtracted from operating profit. It is considered a payment to company’s financial investors. Exclude any non-operating income, gains, or losses generated from assets excluded from invested capital. Effects of interest expense and non-operating income are removed from taxes. ◦ Start with reported taxes, add back the tax shield caused by interest expense, and remove taxes paid for nonoperating income. Model all financing cost (including interest and tax shield) in the cost of capital. Taxes on non-operating income should be netted against operating income. ACCOUNTANT’S INCOME STATEMENT Revenue Operating cost Depreciation Operating profit Interest Non-operating income Earnings before taxes (EBT) Taxes Net profit Current year 1,000 (700) (20) 280 (20) 4 264 (66) 198 NOPLAT Revenue Operating cost Depreciation Operating profit Operating taxes (assume 25%) NOPLAT After tax non-operating income Total income to all investors Reconciliation with net profit Net profit After tax interest Total income to all investors Current year 1,000 (700) (20) 280 (70) 210 3 213 198 15 213 ROIC = (NOPLAT/Invested Capital) ROIC is used to measure how the company’s core operating performance has changed and how the company compares with its competitors, without the effects of financial structure and non-operating items distorting the analysis. FCF = NOPLAT + Non-Cash Expenses – Investments in Invested Capital Cash flow from non-operating assets should be evaluated separately from core operations ACCOUNTANT’S CASH FLOW Current year Net income 198 Depreciation 20 Decrease (increase) in inventory (25) Increase (decrease) in accounts payable 25 Cash flow from operations 218 Capital expenditures (70) Decrease (increase) in equity investments (10) Cash flow from investing (80) Increase (decrease) in interest-bearing debt (25) Increase (decrease) in common stock 0 Dividends (113) Cash flow from financing (138) FREE CASH FLOW NOPLAT Depreciation Current year 210 20 Gross cash flow 230 Decrease (Increase) in inventory (25) Increase (Decrease) in accounts payable 25 Capital expenditures (70) Gross investment (70) Free cash Flow 160 After tax non-0perating income Decrease (increase) in equity investments 3 (10) Cash flow available to investors 153 After tax interest expense 15 Decrease (increase) in interest-bearing debt 25 Decrease (increase) in share capital 0 Dividends 113 Cash flow available to investors 153 Specifically excess cash and marketable securities are excluded. ◦ Excess cash represents temporary imbalances in the company’s cash position. Operating liabilities should not be considered as a form of financing. ◦ Assumption that operating liabilities are a form of financing is inconsistent with the definition of NOPLAT. The book value of net property, plant and equipment is always included in the operating assets. Adjust reported goodwill upwards to recapture historical amortisation and impairments. ◦ To maintain consistency, amortisation and impairments are not deducted from revenues to determine NOPLAT. An unrecorded goodwill should be added to recorded goodwill. Operating lease Expensed investments: advertising, and research and development Excess cash and marketable securities. ◦ To asses the minimum cash needed to support operations, look for a minimum clustering of cash to revenue across the industry. Illiquid investments, non-consolidated subsidiaries and other equity investments. Pre-paid and intangible pension assets Unfunded retirement liabilities Operating lease Reserves for plan decommissioning Reserve for restructuring Deferred tax liability ◦ To be consistent use cash taxes to compute NOPLAT Earnings before interest, tax, and amortisation of goodwill (EBITA) is the starting point Exclude non-operating incomes, gains and losses Adjust income for hidden assets Consider operating cash taxes on EBITA ◦ Use marginal tax rate to eliminate tax effect ◦ Use cash taxes actually paid ◦ Subtracting the increase in deferred taxes lead to cash taxes Reconcile net income to NOPLAT to ensure that the reorganisation is complete It represents the cash available for investment and investor payout, without having to sell nonoperating assets or raise additional capital. ◦ Gross cash flow has two components: NOPLAT and Noncash operating expenses. The two most common non-operating expenses are depreciation and employee stock option. ◦ ESOPs represent value being transferred from shareholders to company employees. ◦ If ESOPs are added back to NOPLAT, those must be valued separately. ◦ If they are not added back, there is no need to value them separately. Change in operating working capital Net capital expenditure ◦ It is estimated by taking the change in the net PP&E plus depreciation. ◦ Change in the gross PP&E should not be considered as gross investment because when assets are retired gross PP&E is reduced without any cash flow implication. Change in capitalised operating leases Investment in acquired intangibles and goodwill ◦ For acquired intangible assets, where cumulative amortisation has been added back, investment is estimated by computing the change in net acquired intangibles. ◦ For intangibles that are being amortised, the method that is being used for estimating net investment in PP&E is used. Change in other long-term operating assets, net of long-term liabilities. Non-cash increase should be adjusted (e.g. exchange difference, and change in fair value) Reinvestment ratio = Gross investment/Gross cash flow If the ratio is rising without a corresponding increase in growth, examine: ◦ Whether the company’s investments are taking longer to blossom than expected; or ◦ Whether the company is adding capital in efficiently ROIC = NOPLAT/Average Invested Capital When ROIC is used to measure historical performance for company’s shareholders, ROIC should be measured with goodwill. ROIC excluding goodwill measures the company’s internal performance and is useful for comparing operating performance across companies and for analysing trends. Economic profit = Invested capital × (ROIC – WACC) ◦ Invested capital is measured at the beginning of the year. Economic profit measures the one-year performance on historical book value. The change in market value measures changing expectations about future economic profits. ROIC = (1 – Cash tax rate) × (EBITA/Revenues) × (Revenues/ Average invested capital) Components of ROIC Pre-tax ROIC 25.5 Operating margin 11.0 ROIC Gross margin 31.8 SG&A/Revenues 19.1 31.8 Depn /Revenues 1.7 18.2 Cash tax rate 28.6 Average capital turns 2.3 Op WC /Revenues 4.2 FA /Revenues 38.9 Compare historical value drivers with drivers of other companies in the same industry What are the sources of competitive advantage? Is the competitive advantage sustainable? Convert every line item to some type of ratio, for example: ◦ Operating ratios ◦ Each line item in the balance sheet as a percentage of revenue If, available, analyse the operating data. By evaluating operating drivers, one can better assess the sustainability of financial spreads among competitors. Example: Airlines industry ◦ ◦ ◦ ◦ (Labour expense/Revenue) = (Labour expense/Total employees) × (Total employees/Available seat miles flown ) × (Available seat miles flown /Revenue) Value of a company is driven by ROIC, WACC and growth Growth is defined as growth in cash flows Assuming profit margins and reinvestment rates stabilise to a long-term level, long-term growth in cash flows will be directly ties to long-term growth in revenues. By analysing historical revenue growth, one can assess the potential for growth going forward. IBM: Revenue Growth analysis (Per cent) [Ref: Valuation Mc Kinsey Exhibit 7.16] 2001 2002 2003 Organic revenue growth 0.5 (1.8) (2.6) Acquisition 0.5 2.1 5.4 Divestiture 0 (3.3) 0 Currency effects (3.9) (2.5) 7.0 Reported revenue growth (2.9) (5.5) 9.8 Revenues earned in different currencies are translated in the reporting currency. Reported revenue is affected by the weakening or strengthening o currencies against the reporting currency during the reporting period. Thus a rise in revenue may not reflect increased pricing power or greater quantities sold, but just a depreciation of the company’s home currency. Revenues = (Revenue/Unit) × Units Revenue per unit does not represent the price If revenue per unit is rising, the change could be due to rising prices or due to the change in the product mix from low-priced to highpriced items Revenue Growth Analysis: Retail Chain (Per cent) (Ref: Valuation, McKinsey, Exhibit 7.19 Number of transactions per store (3.7) Revenue 11.3 Revenue per store (0.1) Dollar per transaction 3.7 11 90.1) Number of stores 11.4 Square feet per store 4.2 Number of transactions per square foot 4.2 New store development is an investment choice, where as same-store sales growth reflects store-by-store operating performance. New stores require large capital investments, where as comparable (that is, year-to-year sale store sales) requires little incremental capital. ◦ Higher revenue and less capital leads to higher ROIC Interest coverage ratio EBIT/Interest or EBIDTA/Interest ◦ (EBITA/Interest) measures the company’s ability to repay interest without having to cut expenditures intended to replace depreciating equipment. EBITDAR/(Interest + Rental Expense) ◦ Important for companies engaged in industries like retailing business ROE = ROIC + [ROIC – (1 – T) kd] × (D/E) ◦ ROE is a direct function of its ROIC, its spread of ROIC over its after-tax cost of debt, and bookbased debt-equity ratio To assess leverage, measure company’s (market) debt-to-equity ratio over time and against peers. Look back as far as possible (at least 10 years) ◦ This allows to determine whether the company and industry tend to revert to some normal level of performance, and whether short-term trends are likely to be permanent. Disaggregate value drivers, both ROIC and revenue growth ◦ If possible, link operational performance measures with each key value driver. If there is any radical change in performance, identify the source. ◦ Determine whether the change is temporary or permanent, or merely an accounting effect. Value the operating leases: Capitalise the asset value on the balance sheet, and the implied debt as liability ◦ Rental Expenset = Asset Valuet - 1× [kd + (1/Asset Life)] ◦ Asset Valuet – 1 = [Rental Expenset ] ÷ [kd + (1/Asset Life)] Break down the rental expenses into two components: interest expense and depreciation ◦ Implied interest payment should be added back to EBITA and taxes should be adjusted to remove the interest tax shield Capitalising R&D expense: ◦ Choose an amortisation period, for example 10 years; use product and industry characteristics to guide your choice Unlike ROIC, FCF does not change when expenses are capitalised