Exercises on Valuation Using Option Pricing Theory

advertisement

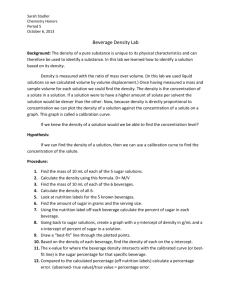

Relative Valuation and Real Options Approach 20. Consider a stable growth firm with the following characteristics: ROIC=12%, WACC=10%, ROE=18%, ke=15%, g=5%, net margin=3%, after-tax operating margin=4%. Please calculate the following multiples for this firm 1) PE ratio 2) PEG ratio 3) V/FCF ratio 4) Price-to-book ratio 5) Value-to-book ratio 6) price-to-sales ratio 7) value-to-sales ratio Hint: dividend payout ratio=1-g/ROE, NOPLAT reinvestment rate=g/ROIC 21. A project requires an investment of 104 at time 0. It will produce 5 units of some durable good in one year. The current price of this good is 20. In one year, the price can either go up by 80% (the good state) or go down by 40% (the bad state). The risk free rate is 8% per annum. (1) What is the value of this project if you have no options? (2) What is the value of this project if you can postpone your investment decision by one year, assuming the required investment will increase at the risk free rate? (3) What is the value of the project if you can adjust your input/output mix, assuming that the alternative mix can give you a cash inflow of 144 in the good state and a cash inflow of 72 in the bad state? 22. Firm X is considering building a sugar plant. The plant will generate cash flows (stated in millions) two years from now, as described in the following exhibit: 200m if sugar price = Suu -140 double cap? 150m if sugar price = Sud 100m if sugar price = Sdd The initial cost of the plant is 140 million. However, the firm can invest another 140 million in order to double the plant’s capacity. This decision has to be taken after one year. The branches of the above-stated tree correspond to different ways in which the sugar price may change from its initial value of S=1. The volatility of the sugar price is 20% p.a. The risk-free rate of interest is 5% p.a. 1 1) Compute the value of the plant without the option to double the capacity. 2) Compute the value of the plant with the option to double the capacity. 23. You buy the right to exploit an oil field. You can produce 100,000 barrels of oil in 6 months. The current oil price is €10. You have variable production cost of €9.5. You have the option not to produce. The volatility of oil price is approximately 20% per annum. The annual riskfree interest rate is 5%. (Hint: you might have to convert it into a continuously compounded rate.) What is the project worth, excluding and including the option? Calculate the option value using Black/Scholes, the binomial model and Monte Carlo Simulations. Which model works best? How many Monte Carlo Simulations do you need to get a result close to the Black/Scholes result? 24. Consider again exercise 25, but assume that you can produce oil for three years. Every six months, you can decide whether you produce. Use Monte Carlo Simulation for valuation of this project. 2