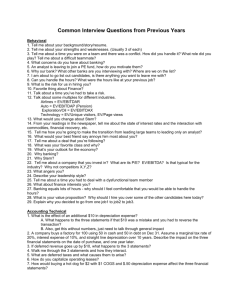

Capitalizing Rent Expense

advertisement

Cash Flow Equity Valuation Chris Argyrople, CFA Concentric LLC Enterprise Valuation & Cash Flow Analysis (Continued) 1 Reminder to Review Paine Webber Research: Chris Dixon • Review Paine Webber’s Free Cash Flow Calculation 2 Greater Fool Theory of Investing John Maynard Keynes said: Imagine a beauty pagent, where the judges knew that, because beauty was in the eye of the beholder, the contest would be decided on the judge’s perception of beauty. Someone who wanted to predict the outcome would have to assess the judge’s perceptions, not the contestant’s beauty. As a result, your vote for the winner would not depend on who you thought was prettiest. Instead, your vote would depend on how you thought the judges would vote. THIS IS THE GREATER FOOL 3 THEORY. Suggestion: Don’t use Greater Fool Justification • Using greater fool justification does not add value, although it may work on occasion • Suggestion: Analyze Cash Flows, Business Models, & Management Teams 4 Topic Review • What Earnings are Relevant? – Trailing 4 Quarters – Last Quarter times 4 – Forward 4 Quarters – Current Calendar Year – Current Fiscal Year (Fiscal Year <> Calendar Year) – 5 year Average Earnings (cyclicals) – Peak Earnings (cyclicals) – Five Year Forecasted Earnings 5 Valuation: Cash Flow Ratios • TEV / EBITDA = Firm Value to OCF • TEV / Revenue = Firm Value to Revenue • EBITDA / Sales = Cash Flow Margins • MV Equity/FCF = “Real” P/E, Free Cash Flow (FCF) Mult. • EBITDA / Interest = Interest Coverage • Debt / EBITDA = Leverage Indicator 6 Valuation Review • All ratios are based on a similar concept: • Numerator: What you are paying • Denomin: What you get • TEV : The Value of the Firm (Price Paid) • EBITDA: What you get (Cash Flow Bought) • P : Stock Price Paid • E : Earnings Bought 7 LBOs: Magnifies Directional Effects Start Sales 500 Costs 400 EBITDA 100 % Chg, CashFlow Incr. 520 416 104 +4% Decr. 480 384 96 - 4% MV Debt 700 MV Equity 100 TEV 800 % Chg Stock Price 700 132 832 +32% 700 68 768 -32% Unlevered 520 416 104 +4% 0 832 832 +4% 8 LBOs: Reasons Why • Leverage Spurs Efficiency Gains • People perform when they have no option BUT to perform • Gains from leverage are huge (to equity) • Managers can control the firm in an LBO • No money down strategy (where else can you buy a company without money) 9 Cheap Stocks & Catalysts • A stock that appears tantilizingly cheap on a valuation basis is often very cheap for a good reason. • Find the reason that it is cheap. • YOU NEED A CATALYST TO NARROW THE GAP BETWEEN YOUR FAIR VALUE ESTIMATE & THE CURRENT PRICE • Without a near-term catalyst, the stock could remain cheap indefinitely. 10 This Lecture -- More Cash Flows • Finer points of Free Cash Flows • How Free Cash Flows work • Alternate definitions of Free Cash • My thoughts on M&M and Finance Theory • How Multiple Changes affect a Stock 11 Free Cash Defined 2 Ways • FCFE = NI + D&A - Capex • FCFE = EBITDA - Interest - Taxes - Capex • Subtract: – Preferred Dividends – Capitalized Interest (Usually) – SEPARATE MAINTENANCE CAPEX FROM EXPANSION CAPEX. THIS IS KEY. – Add back noncash taxes shown on income statement. 12 Free Cash Flow: Finer Points • Should You Subtract? – Principal Paydowns? – Preferred Dividends? – Proceeds of Asset Sales? NO YES NO • WHY? – Principal payments result in value transfer to equityholders. Not different than no payout and adding free cashflow to balance sheet cash – Treat Preferred Dividends as Debt – Asset Sales not Generated from ongoing 13 operations Include Working Capital in FCFE? • Should working capital be included in the Free Cash Flow calculation? Answer: • YES, especially if growth requires extra investment in working capital. • NO, if growth is independent of an investment in working capital. Suggestion: • Normalize (smooth out) Working Capital 14 The Maintenance Capex Problem • Some students have trouble determining maintenance capex. • Ask the company (IR department) • Or, to be conservative, use all PP&E expenditures. This is the most conservative way (for the stock buyer). • In general, I include all PP&E (Capex) unless I know about specific expansion projects. 15 Value = PV(Terminal Bal. Sheet) • Two approaches to valuation – 1) DCF Method – 2) Asset Value Method • Think, for a moment, that a stock is worth the Present Value of the Terminal Balance Sheet. Why? • Think of personal finance. • Your personal net worth is your personal balance sheet. 16 Value = PV(Terminal Bal. Sheet) • So, your Net Worth = Assets - Liabilities • Companies are the same, but you must use Economic Balance Sheets, not Accounting Balance Sheets. • Economic Bal. Sheet = f(future cash flows) • But, at Terminal time t: • Valuet= Assetst - Liabilitiest • FREE CASH FLOW DOMINATES Terminal Valuet -- LT, Cash Flow doesn’t 17 Asset Valuation • Asset Value = PV(cash flows) • Cash flows are independent of financing, BUT • Financing can dominate the Enterprise Value of a company • What does this Mean??? 18 One Point Multiple Change Sales Costs EBITDA 500 400 100 Start MV Debt 600 MV Equity 200 TEV 800 % Chg Stock Price MUST KNOW THIS Effect of One Multiple Point Change Upward Down 600 600 300 100 900 700 50% -50% 19 Adjusting TEV for Off B/S Items • Enterprise Value should be adjusted for off Balance Sheet Items • TEV = Debt + Equity - Cash + Off B/S Liab - Hidden Assets (off B/S assets) • The Most Common off B/S Liability is Rentals. Remember the lease vs. buy decision? Leasing is functionally equivalent to taking on debt. Thus, analysts should capitalize rent expense. 20 Off B/S Example • TEV = 550 • Rent Expense is as follows – year 1 : 20 year 2: 20 year 3: 20 – year 4 : 22 year 5: 22 – bond rate of 9% – PV(rent) = 20 / 1.09 + 20 / 1.092 + 20 / 1.093 + 22 / 1.094 + 22 / 1.095 – IT IS YOUR CALL WHETHER YOU DISCOUNT A TERMINAL VALUE HERE 21 Standard vs. Adjusted TEV Adjusted TEV Debt + MV Equity - Cash or Working Capital + Capitalized Rentals - Hidden Assets = Adjusted TEV Compare Adjusted TEV to EBITDAR (pre- rentals)22 Capitalizing Rent Expense • Determine the Correct amount of years to discount (no hard & fast rule here) • Discount annual rent expense at the company’s LT Borrowing rates • Add the PV of the Rent expense to TEV • I Call this Adjusted TEV • Thus, you will have 2 calculations, – 1) STANDARD TEV – 2) ADJUSTED TEV 23 Cash Flow Capitalization Table 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 5 4.33 4.21 4.10 3.99 3.89 3.79 3.70 3.60 3.52 3.43 3.35 3.27 3.20 3.13 3.06 2.99 10 7.72 7.36 7.02 6.71 6.42 6.14 5.89 5.65 5.43 5.22 5.02 4.83 4.66 4.49 4.34 4.19 15 10.38 9.71 9.11 8.56 8.06 7.61 7.19 6.81 6.46 6.14 5.85 5.58 5.32 5.09 4.88 4.68 20 12.46 11.47 10.59 9.82 9.13 8.51 7.96 7.47 7.02 6.62 6.26 5.93 5.63 5.35 5.10 4.87 25 14.09 12.78 11.65 10.67 9.82 9.08 8.42 7.84 7.33 6.87 6.46 6.10 5.77 5.47 5.20 4.95 30 15.37 13.76 12.41 11.26 10.27 9.43 8.69 8.06 7.50 7.00 6.57 6.18 5.83 5.52 5.23 4.98 24 EBITDAR Example Sales Costs EBITDAR Rentals EBITDA 750 (500) 250 (50) 200 TEV = 2000 TEV / EBITDA = 2000 / 200 = 10 X Adj TEV = 2000 + 6.71 * 50 = 2335.5 Adj TEV / EBITDAR = 2335.5 / 250 = 9.34 X25 EBITDAR Changes: • EBITDAR Will alter your debt ratios. • Firms with no debt still can have huge rental / lease commitments. • EBITDAR may alter the TEV ratio, but usually not significantly. 26 What are “Hidden Assets” ?? Hidden Assets Include: 1. Shares in other Firms Owned 2. Real Estate or other non-EBITDA producing assets that could be sold off piecemeal 27 Windfall of Ignorance • The Bull Markets have Rewarded Ignorant Managers and Young Unsophisticated Investors. With Markets rising 20% to 30% per year, anything that prevented you from purchasing a stock was painful. • Including Warrants in the TEV Capitalization usually makes justifying purchase a bit more difficult. • The Next 15 years WILL NOT reward fools 28 Most Analysts Ignore Warrants • Most Wall Street Analysts Ignore the Dilutive Effect of Options and Warrants in the TEV Calculation • Why? Simple. They are Incentivized to Recommend Stocks, thus they Conveniently Ignore the Dilutive Effect of Warrants. This Ignorance makes TEV based ratios more attractive, and it makes the stocks appear cheaper than they are. 29 More TEV Bells & Whistles • Management Options and Warrants Outstanding Prove to be a Small Hassle • One Method: Add All Potentially Dilutive Securities to Shares Outstanding & Subtract the Resulting Cash Inflow from TEV • Example: Debt = 10 , Cash = 2, Shares = 20, Stock = $11, Warrants = 1 struck at $4 • TEV = 10 + (20 + 1) * 11 - 2 - 1 * 4 = 235 30 Method 2: Delta Weight Options • Delta Weight all Option and Warrant Traunches, then Adjust TEV Example: Stock Price = $10 500,000 Warrants struck at $4 500,000 Warrants struck at $10 1,300,000 Warrants struck at $15 Deltas Cash Inflow = 1 * 0.5 * $4 + 0.5 * 0.5 * 10 + 1.3 * 0.3 * 15 31 Model Formatting Tips Chris Argyrople Delta Partners 32 Model Formatting Tips • Full Years on Right, Quarters on Left • Decimals ($ millions) make it easier to read (can keep more digits hidden) • Underline Totals • Full Years only : Partial Years no good • Add Standard Ratios like DuPont Ratios (look in textbook for ratios) • Break out #’s by business line if possible • Look for rationality in your ratios !! 33 Model Formatting Tips • Graphs and Charts help !! • Year-over-year growth is Key • EBITDA Margin = EBITDA / Revenue (THIS IS A KEY METRIC OF MARKET POWER) • Quarterly TEV / EBITDA (or any other ratio is usually meaningless) • Financial Statements on 1 page each (need headers) • KEY: Want to be able to see trends !!! 34 Comments on HW #1 • Presentation & Clarity are key • Add: Gross Margin%, SG&A%, Depreciation%, EBITDA%, EBIT%, PBT%, PAT% • Calc. y-o-y change in EBITDA, Sales, NI etc. • Have an easy to read Valuation Box • 1) Prepare an EPS forecast. 2) State fcst. assumptions, 3) compare EPS to consensus (on AOL, or call me), 4) measure growth, 5) state what you think the stock is worth and why. 35 Helpful Hints on Forecasting • Call Investor Relations (IR) (I can give you the phone numbers) • Graph the stock and handwrite what drove major price moves. This will help you understand what drives this particular stock. • Try to break out revenues & cost by product line or division (sometimes this is impossible) • Net out finance subsidiaries • Use annual TEV / EBITDA & Revenue -- NEVER QUARTERLY 36 Helpful Forecasting Hints • Partial years are not too useful (2 or 3 quarters) • Round off decimals and state units (ie $millions etc.) • Football important numbers 2.0 • Add verbal comments (example: Duracell) • Use Excel / Lotus fit to page commands for formatting • Avoid submitting work with n/a or div#0 etc 37 Helpful Forecasting Hints • Add Annual numbers going as far back as possible. Quarterly numbers are good, but annual numbers are imperative. • Ratios are key: Debt Ratios, DuPont Ratios, Inventory Ratios etc. • Start collecting fundamental data: – Market Share – Insider holdings – Units & Price (market size) 38 Historical Presentation • Have a table that has TEV/EBITDA and P/E going back historically (board example) • Have a line for every possible margin • Graph the stock price and handwrite in explanation for significant moves. This will help you understand what drives this company’s valuation (USA Waste example) • At top, have a nice summary table 39 showing: price, shares, debt, ebitda, ni, fcf, Idea Generation • There are many viable methods of generating stock selection ideas. • My Method: follow a few stocks, get to know them well, trade < 13 times per year. Just do your best ideas. • Suggestion: screen for ideas. • Why? Harness the power of the computer. Generate lots of candidates that meet selected criteria. 40 My Thoughts on Screening • If you can’t follow an industry, and you don’t get good “tips”, then screen for candidates. • My rule: 30% twelve-month E(r) for stocks in your industry(s) or core competency. 50% twelve-month E(r) for stocks outside area of expertise. HIGHER HURDLE OFFSETS LESS KNOWLEDGE 41 Split Adjust Historical Shares • • • • Intel: 4q96 1q97 Shares 823 1639 NI 1910 1983 EPS 2.32 1.21 (4q96 is WRONG) • Should be = 1910 / (823 * 2) = $1.16 42 Why the EBITDA Framework? • Why not just use Cash Flow from Operations (CFO) instead of EBITDA and Cash Flow before Financing instead of Free Cash Flow? • EBITDA normalizes for capital structure differences, allowing for apples to apples. To normalize CFO, could add back interest, taxes, and non-operating items to CFO. • Cash Flow pre-Financing is a good proxy for Free Cash Flow (maint. capex only). Deduct Pref Dividends and non-recurring charges. 43 Helpful Crosschecks: Barrons Example Barrons, September 15, 1997 article AOL has long claimed 9 million customers. Revenue / customer / month = $19.95 Every quarter has 3 months Last quarterly Revenue = $385.6 million $385.6 / ( 3 * 19.95 ) = 6.44 million customers So, WHY THE DISCREPANCY??? 44 America Online Example, (contd.) AOL is trading a subsidiary valued at $425 million for a Compuserve’s 2.6 million customers & $175 million cash. Netting out the cash, AOL is getting 2.6 million subs for $250 million. The price/subscriber works out to $96.15. So, at $80 per AOL share, AOL is trading at $1204.84 per customer -- a big discrepancy versus the $96.15 that they 45 paid !!! AOL Conclusion 1) AOL potentially lying about 9 million subs 2) AOL got a good deal on Compuserve OR 3) AOL overvalued (worth only Compuserve) So, it can go either way. a) Smart Management, Accretive Deal b) Lying Management, Overvalued Stock 46 Measure the Fundamentals • Media & Telecommunications firms: Market Value / Subscriber • Airlines: Cost / Available Seat Mile • Retailers: Average Sales / Square Foot versus Market Value / Square Foot or Market Value / Store etc. • Hotels: Market Value / Room • Autos: Cost and Market Value / Unit There are many metrics that can be used 47 Valuation -- Relative Value Relative Value Matrix Helps Stockpicking IBM GATE DELL TEV / EBITDA 7 11 15 P/E 16 27 35 P/Book 1.9 4.0 3.5 P/Sales 1.1 4.4 5.1 Yield 2.3% 0.0 0.0 Growth Estimate 12% 16% 21% 48