General Standard No. 1

advertisement

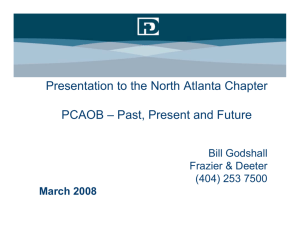

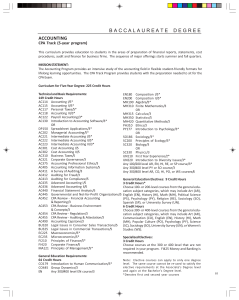

Chapter 2 The CPA Profession I need aCPA ! Presentation Outline I. The Structure of CPA Firms II. The Regulation of Public Corporations III. American Institute of Certified Public Accountants (AICPA) IV. Generally Accepted Auditing Standards V. Quality Control Policies I. The Structure of CPA Firms The legal right to perform audits is granted to CPA firms by regulation of each state. A. Organization Forms With High Personal Liability B. Organization Forms with Limited Liability C. Staff Levels and Responsibilities A. Organizational Forms with High Personal Liability The following forms of firm organization are unpopular because they provide no owner protection against litigation: Proprietorship – Only firms with one owner can operate in this form. General Partnership – Same form as a proprietorship except that there are 2 or more owners. B. Organizational Forms with Limited Liability General corporation – An owner’s loss in a corporation is limited to the amount invested. However, most states prohibit CPA firms from organizing in this manner. Professional corporation (PC) – Although this form provides some legal liability, the amount of protection can vary significantly from state to state. Limited Liability Company (LLC) – Firm is taxed like a partnership, but the partners have limited liability like a corporation. Limited Liability Partnership – Partner’s are personally liable for partnership obligations, their own acts, and the acts of those under their supervision. Not responsible for the acts of other partners or staff not under their supervision. C. Staff Levels and Responsibilities Staff Level Staff Assistant Senior or incharge auditor Manager Partner Average Experience Typical Responsibilities 0-2 years Performs most of the detailed audit work. 2-5 years Responsible for the audit field work, including supervising staff work. 5-10 years Helps the plan, manages the audit, reviews work, and works with the client. 10+ years Reviews overall audit work and is involved in significant audit decisions. Has ultimate II. The Regulation of Public Corporations A. The Public Company Accounting Oversight Board B. The Securities Acts C. The Role of the SEC D. Specific SEC Reports A. The Public Company Accounting Oversight Board (PCAOB) 1. A Primary Responsibility of the PCAOB 2. Meet the Board Members of the PCAOB 3. SEC Oversight Over PCAOB 4. Standard Setting Input from Outside the PCAOB 1. A Primary Responsibility of the PCAOB Establishment of standards for auditing, quality control, ethics, and independence, as well as attestation, for registered accounting firms. Charles D. Niemeier was the Chief Accountant in the Division William Kayla Daniel J. McDonough Gillan L. Goelzer worked served is in a former theaspension General president field Counsel and for more CEO of thethan of the Bill of Gradison Enforcement 2. Meet is athe former of Board thenine-term U.S. Members Securities Congressman of theand PCAOB Exchange from Ohio. Securities Federal Reserve and Exchange 16 Bank years.ofCommission. New York. Commission. 3. SEC Oversight Over PCAOB In addition to appointing or removing members, the SEC, among other things, must approve the Board’s budget and rules, including auditing standards, and may review appeals of adverse Board inspection reports and disciplinary actions against registered accounting firms. 4. Standard Setting Input from Outside the PCAOB The PCAOB Although the Sarbanes-Oxley Act would allow the PCAOB to designate a professional group of accountants to propose standards to the Board, the Board decided early in 2003 that it could best protect investors by developing standards itself. The Board will rely on advice from a standing advisory group, and be involved in soliciting public comment to obtain the views of issuers, accountants, investors, and other interested parties. B. The Securities Acts Securities Act of 1933 Requires most companies planning to issue new securities to the public to submit a registration statement to the SEC for approval. Securities Exchange Act of 1934 Requires companies to file detailed annual reports with the commission in order to have their securities publicly traded on the stock exchanges. C. The Role of the SEC The SEC has legal power to establish rules for any CPA associated with audited financial statements submitted to the commission. The SEC has taken the position that accounting principles and auditing standards should be set by the profession. However, they can override the profession and their opinion is strongly considered. D. Specific SEC Forms Forms S1 to S16 – Completed when new securities are to be issued to the public. Form 8K – Filed at the end of any month in which a significant investor event has occurred (i.e., sale of subsidiary, change of auditor, etc.) Form 10-K – Filed annually within 90 days of the close of each fiscal year. Includes audited financial statements. Form 10-Q – Filed quarterly with financial statements reviewed by the auditor. III. American Institute of Certified Public Accountants The AICPA sets standards and rules that all members and other practicing CPAs must follow. This authority extends to the following areas: 1. Auditing Standards 2. Compilation and Review Standards 3. Other Attestation Standards 4. Consulting Standards 5. Code of Professional Conduct 1. Auditing Standards The Auditing Standards Board (ASB) is responsible for issuing pronouncements on auditing matters for all entities other than publicly traded companies. The pronouncements are known as Statements on Auditing Standards (SASs) Note: For public company engagements, the Sarbanes-Oxley Act of 2002 transferred this power to the Public Company Accounting Oversight Board (PCAOB). 2. Compilation and Review Standards The Accounting and Review Services Committee is responsible for issuing pronouncements of the CPAs responsibilities when the CPA is associated with financial statements of non-public companies that are not audited. The Statements on Standards for Accounting and Review Services (SSARS), provide guidance for providing compilation (no assurance on financials) and review services (limited assurance on financials). 3. Other Attestation Services Forms of attestation are often performed for other than historical financial statements. Examples of other attestation services involve prospective financial information in forecasts and projections. 4. Consulting Standards The Management Consulting Services Executive Committee is responsible for issuing pronouncements on consulting services. Consulting differs from attestation in that the CPA does not report on another party’s assertion. Rather, the CPA develops findings, conclusions, and recommendations. 5. Code of Professional Conduct The AICPA Committee on Professional Ethics sets rules of conduct that CPAs are required to meet. IV. Generally Accepted Auditing Standards A Measure of the Quality of Audit Work Generally Accepted Auditing Standards (GAAS) SAS No. 1 A. 3 General Standards B. 3 Standards Of Field Work C. 4 Standards Of Reporting Apply to every phase of audit engagement Apply to performance of audit work Apply to development of audit report Note: Although the term generally accepted auditing standards continues to be used for audits of private companies, public company audits should refer to PCAOB auditing standards. General Standard No. 1 The audit is to be performed by a person or persons having adequate technical training and proficiency as an auditor. What does auditor training and proficiency involve? a. Specific education in auditing b. Professional experience c. Continuing education General Standard No. 2 In all matters relating to the assignment, an independence in mental attitude is to be maintained by the auditor or auditors. Independence in fact An auditor must also be independent in appearance CPA General Standard No. 3 Due professional care is to be exercised in the performance of the audit and the preparation of the report. The Standard of the Prudent Practitioner An auditor must exercise both … Professional Skepticism Professional Judgment Standard of Fieldwork No. 1 The work is to be adequately planned and assistants, if any, are to be properly supervised. Yes, that is the part of the audit you will be performing. Standard of Fieldwork No. 2 A sufficient understanding of internal control is to be obtained to plan the audit and to determine the nature, timing, and extent of tests to be performed. First, we need to size up your organization’s system of internal control! Audit Customer CPA Standard of Fieldwork No. 3 Sufficient competent evidential matter is to be obtained through inspection, observation, inquiries, and confirmations to afford a reasonable basis for an opinion regarding the financial statements under audit. Sufficient competent evidence does not require a fine tooth comb. Financial Statements Standard of Reporting No. 1 The report shall state whether the financial statements are presented in accordance with generally accepted accounting principles Standard of Reporting No. 2 The report shall identify those circumstances in which such principles have not been consistently observed in the current period in relation to the preceding period. Consistent Application of Accounting Principles Prior Year Accounting Principles Current Year Accounting Principles Standard of Reporting No. 3 Informative disclosures in the financial statements are to be regarded as reasonably adequate unless otherwise stated in the report. Financial Statement Wording Disclosures Include Notes to Financial Statements Standard of Reporting No. 4 The report shall contain either an expression of opinion regarding the financial statements, taken as a whole, or an assertion to the effect that an opinion cannot be expressed. Financial Statements Cash Flows Balance Sheet Profit & Loss V. Quality Control Policies To Control the Quality of Audit Work AICPA Quality Control Structure A. Elements of Quality Control B. Peer Review Program C. Division of CPA Firms A. Elements of Quality Control The AICPA has not set specific quality control standards because such procedures should depend upon features of the practice. However, five elements have been identified that firms should consider in setting up their own policies and procedures.. B. Peer Review Program A peer review is an examination of one CPA firm’s compliance with its quality control system and whether it has developed and followed adequate policies and procedures for the five elements of quality control. All CPA firms that are members of the AICPA must be reviewed at least once every 3 years. Note: The peer review program for SECPS members has been replaced by the quality inspections conducted by the PCAOB for registered firms responsible for auditing public companies. C. Division for CPA Firms There are two sections in the Division of CPA Firms: > SEC Practice Section (SECPS) > Private Companies Practice Section (PCPS) Designed to establish a self-regulation process for the profession. Note: Many of the self-regulatory activities of the SECPS have been taken over by the PCAOB. As a result, the SECPS has reorganized as the Center for Public Company Audit Firms to share information and promote member firms’ positions before the SEC and PCAOB. Summary 1. Organization and staffing of CPA firms 2. Public company regulation 3. The role of the AICPA 4. General Standards – all audit phases 5. Fieldwork Standards – performance of audit work 6. Reporting Standards – development of audit report 7. Quality control in the form of standards, peer review, and AICPA divisions.