BACK TO THE BASICS - Local Government Center

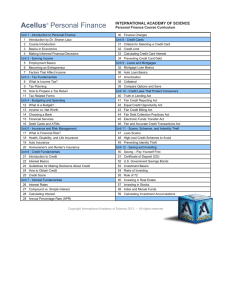

advertisement

BACK TO THE BASICS Presented by Local Government Services Bureau State Accounting Division MT Department of Administration 1 BACK TO THE BASICS • SCHEDULE: • Fundamentals of Debits and Credits • Governmental Accounting ~ Principles ~ Fund Accounting/Basis of Accounting/Measurement Focus • Governmental Accounting - cont. ~ Basis of Accounting/Measurement Focus (cont) • • Application to BARS Chart of Accounts Year end closing procedures ~ (if time permits) 2 BACK TO THE BASICS ACRONYMS COMMON TO GOVERNMENTAL ACCOUNTING CAFR BFS Comprehensive Annual Financial Report Basic Financial Statements GASB Governmental Accounting Standards Board FASB Financial Accounting Standards Board GAAFR Governmental Accounting, Auditing, GAAP and Financial Reporting Generally Accepted Accounting Principles 3 BACK TO THE BASICS ACRONYMS COMMON TO GOVERNMENTAL ACCOUNTING GAAS GLTDAG Generally Accepted Auditing Standards General Long-Term Debt Account Group GFAAG General Fixed Assets Account Group GFOA Government Finance Officers Association 4 BACK TO THE BASICS • PRINCIPLES OF GOVERNMENTAL ACCOUNTING • Accounting and Reporting Capabilities • • Fund Accounting Systems • • Accounting systems should be maintained in accordance with generally accepted accounting principles Accounting systems should be organized and operated on a fund basis Fund Types • Fund financial statements should report governmental, proprietary and fiduciary fund types 5 BACK TO THE BASICS • PRINCIPLES OF GOVERNMENTAL ACCOUNTING • Number of Funds • Only maintain those funds required by law and sound financial management • Reporting Capital Assets • A clear distinction should be made between general capital assets and those of the proprietary and fiduciary funds. • Valuation of Capital Assets • Assets should be reported at historic cost – Donated assets at the estimated fair market value at the time of acquisition 6 BACK TO THE BASICS • PRINCIPLES OF GOVERNMENTAL ACCOUNTING • Depreciation of Capital Assets • Capital assets should be depreciated over their estimated useful lives unless inexhaustible or infrastructure assets using the modified approach • Reporting Long-term Liabilities • A clear distinction should be made between long-term liabilities and general long-term liabilities • Measurement Focus/Basis of Accounting in the BFS • The basic financial statements should display the government-wide financial statements (full accrual) and the fund financial statements (modified accrual) 7 BACK TO THE BASICS • PRINCIPLES OF GOVERNMENTAL ACCOUNTING • Budgeting, Budgetary Control/Reporting • Budgets should be adopted, controlled through monitoring and comparison statements included in reporting. • The budgetary statements should present original budget, final budget, actual amounts and a comparison with actual to final • Transfer, Revenue, Expenditure/Expense Classifications • Revenues should be maintained by fund, major source and other financing sources • Expenditures of governmental funds by fund, function/activity and other financing uses • Expenses of proprietary funds by activity/object 8 BACK TO THE BASICS • PRINCIPLES OF GOVERNMENTAL ACCOUNTING • Common Terminology and Classification • A common terminology and classification should be used consistently throughout the budget, accounts and financial report of each fund • Annual Financial Reports • Preparation of interim financial reports for the benefit of management should be prepared. • A Comprehensive Annual Financial Report should be prepared and made available to the public. • It should include all funds and activities of the primary government including blended component units and an overview of all discretely presented component units of the reporting entity) 9 BACK TO THE BASICS ACCOUNTING FORMULA DR = CR 10 BACK TO THE BASICS ACCOUNTING FORMULA EXPENSES/ EXPENDITURES ASSETS + DR REVENUES + = = LIABILITIES + EQUITY CR 11 BACK TO THE BASICS ACCOUNTING FORMULA EXPENSES/ ASSETS + EXPENDITURES = REVENUES + LIABILITIES + EQUITY ASSETS = LIABILITIES + EQUITY DR = CR 12 BACK TO THE BASICS SELF-BALANCING SET OF ACCOUNTS ACCOUNTING FORMULA ASSETS + EXPENSE = REVENUES + LIABILITIES + EQUITY DR = CR 13 14 BACK TO THE BASICS • QUIZ #1 – Account Type & Normal Balance Accounts to use: * Asset * Liability * Equity * Revenue * Expenditure/Expense * Contra-asset (use 2 times) Normal Balances: * Debit * Credit 15 BACK TO THE BASICS QUIZ #1 – Account Type & Normal Balance TYPE OF NORMAL ACCOUNT NAME ACCOUNT BALANCE Depreciation __________ _________ Accounts Payable __________ _________ Deferred Revenue __________ _________ Interest Receivable __________ ________ Assigned Fund Balance __________ _________ 16 BACK TO THE BASICS QUIZ #1 - CONT. TYPE OF NORMAL ACCOUNT NAME ACCOUNT BALANCE Cash __________ _________ Amount To Be Provided __________ _________ Interest Earnings __________ _________ Allowance For Depreciation __________ ________ City Court Fines (Collected) __________ _________ 17 BACK TO THE BASICS QUIZ #1 - CONT. TYPE OF NORMAL ACCOUNT NAME ACCOUNT BALANCE Real Estate Taxes (Collected) __________ _________ Capital Outlay __________ _________ Warrants Payable __________ _________ Inventories __________ ________ Net Assets __________ _________ 18 BACK TO THE BASICS QUIZ #1 - CONT. TYPE OF NORMAL ACCOUNT NAME ACCOUNT BALANCE Due To Other Governments __________ _________ Accounts Receivable __________ _________ Debt Service Interest __________ _________ Judgments & Losses __________ ________ Prepaid Expense __________ _________ 19 BACK TO THE BASICS QUIZ #1 - CONT. TYPE OF NORMAL ACCOUNT NAME ACCOUNT BALANCE Bonds Payable __________ _________ Taxes Receivable __________ _________ Gas Tax Apportionment __________ _________ Deposits Payable __________ ________ Animal Licenses __________ _________ 20 BACK TO THE BASICS QUIZ #1 - CONT. TYPE OF NORMAL ACCOUNT NAME ACCOUNT BALANCE Supplies purchased _________ _________ Sale of Capital Assets __________ _________ Allowance For Uncollectible Accounts __________ _________ County Option Tax __________ ________ Federal Disaster Aid __________ _________ 21 BACK TO THE BASICS QUIZ #1 - CONT. TYPE OF NORMAL ACCOUNT NAME ACCOUNT BALANCE Street & Road Maintenance _________ _________ Due From Other Funds __________ _________ Machinery & Equipment __________ _________ Fund Balance __________ ________ Charge for Copying Services (collected) __________ _________ 22 BACK TO THE BASICS QUIZ #1 - CONT. TYPE OF NORMAL ACCOUNT NAME ACCOUNT BALANCE Jury Services _________ _________ Penalty & Interest on Delinq. Taxes __________ _________ Restricted for Revenue Bond __________ _________ Advance to other Funds __________ ________ 23 24 BACK TO THE BASICS • Quiz #2 – Common entries – Accounts to use for this quiz: Cash Supplies Gas Tax Apportionment Taxes Receivable Accounts Receivable Accounts Payable Interest Receivable Interest Revenue Prepaid Expense Expense (Enterprise Funds)/Expenditure (Governmental Funds) Depreciation Allowance for Depreciation Deferred Revenue Tax Revenue 25 BACK TO THE BASICS QUIZ #2 – ENTRIES DEBIT CREDIT Record Receipt of Gas Tax Apportionment from State ______________________________ $______ ___________________________ $_______ Record Purchase of Supplies ______________________________ ___________________________ $______ $_______ 26 BACK TO THE BASICS QUIZ #2 – ENTRIES CONT. DEBIT CREDIT Record the Receipt of Taxes ______________________________ $______ ___________________________ $_______ Record the Accrual of Expenditures ______________________________ ___________________________ $______ $_______ 27 BACK TO THE BASICS QUIZ #2 – ENTRIES CONT. DEBIT CREDIT Record the Payment of the Expenditure Accrual ______________________________ $______ ___________________________ $_______ Record the Accrual of Interest Revenue ______________________________ ___________________________ $______ $_______ 28 BACK TO THE BASICS QUIZ #2 – ENTRIES CONT. DEBIT CREDIT Record the Receipt of the Interest Revenue ______________________________ $______ ___________________________ $_______ Record Annual Depreciation Expense ______________________________ ___________________________ $______ $_______ 29 BACK TO THE BASICS QUIZ #2 – ENTRIES CONT. DEBIT CREDIT Record the Payment for a Prepaid Expense ______________________________ $______ ___________________________ $_______ Record the Use of a Prepaid Expense __________________________ ___________________________ $______ $_______ 30 BACK TO THE BASICS FUND ACCOUNTING GOVERNMENTAL FUNDS • General •Special Revenue •Debt Service •Capital Projects •Permanent 31 BACK TO THE BASICS FUND ACCOUNTING – CONT. PROPRIETARY FUNDS • Enterprise • Internal Service 32 BACK TO THE BASICS FUND ACCOUNTING - CONT. FIDUCIARY FUNDS • Pension Trust • Private Purpose Trust • Investment Trust • Agency 33 BACK TO THE BASICS FUND ACCOUNTING - CONT. ACCOUNT GROUPS ~ no longer required to be reported. I recommend updating for your records. • General Fixed Assets (GFAAG) • General Long-Term Debt (GLTDAG) 34 BACK TO THE BASICS BASIS OF ACCOUNTING Deals with the timing and recognition of transactions and events Full Accrual Basis Modified Accrual Basis Cash Basis 35 BACK TO THE BASICS MEASUREMENT FOCUS Deals with the types of events or transactions reported in the Operating Statement Economic Resources Changes in Net Assets Current Financial Resources Changes in Resources Available for spending 36 BACK BACK TO TO THE THE BASICS BASICS A FUND’S MEASUREMENT FOCUS AND BASIS OF ACCOUNTING CANNOT BE SEPARATED Funds that Focus on Economic Resources Use Full Accrual Accounting (Enterprise) Funds that Focus on Current Financial Resources use Modified Accrual Accounting (Governmental) 37 BACK BACK TO TO THE THE BASICS BASICS Full Accrual Basis of Accounting • Recognizes increases and decreases in economic resources (Net Assets) as soon as the underlying event or transaction occurs •Revenues are recognized as soon as they are earned •Expenses are recognized as soon as the liability is incurred • Regardless of the time of related cash inflow and outflows 38 BACK TO THE BASICS Modified Accrual Basis of Accounting •Recognizes increases and decreases in financial spendable resources only to the extent that they reflect near-term inflows and outflows of cash • Amounts are recognized as revenues when earned, only so long as they are collectible within the period or soon enough thereafter to be used to pay liabilities of the current period. • In other words, when they are available to pay expenditures of the current period. 39 BACK TO THE BASICS The Cash Basis of Accounting • Is the simplest to achieve and provides the least disclosure • Only revenues received and expenses or expenditures disbursed are recognized • The Balance Sheet of the Governmental Unit displays only a balance in cash and the fund balance accounts. • The Operating Statement presents results of only the cash transactions for the reporting fund. 40 BACK TO THE BASICS Application of the Basis of Accounting and Measurement Focus by Fund Type Modified Accrual Basis/Flow of Current Financial Resources Measurement Focus Governmental funds: • General fund • Special revenue funds • Debt service funds • Capital projects funds • Permanent funds 41 BACK TO THE BASICS Application of the Basis of Accounting and Measurement Focus by Fund Type Modified Accrual Basis/Flow of Current Financial Resources Measurement Focus Trust and Agency funds: • Agency funds (only the basis of accounting applies; measurement focus is not applicable) 42 BACK TO THE BASICS Application of the Basis of Accounting and Measurement Focus by Fund Type Accrual Basis/Flow of Economic Resources Measurement Focus Proprietary funds: Enterprise funds Internal service funds 43 BACK TO THE BASICS Application of the Basis of Accounting and Measurement Focus by Fund Type Accrual Basis/Flow of Economic Resources Measurement Focus Trust funds: Investment trust funds Pension trust funds Private purpose trust funds 44 BACK TO THE BASICS PRACTICAL DIFFERENCES: • Receipt of long-term debt proceeds • Repayment of the principal of long-term debt • Capital acquisition • Exhaustion of capital assets • Deferrals and amortizations 45 BACK TO THE BASICS ILLUSTRATIVE ENTRIES RECEIPT OF LONG-TERM DEBT PROCEEDS: PROPRIETARY FUNDS: Cash DR CR $20,000 Bonds Payable $20,000 GOVERNMENTAL FUNDS: Cash Other Financing Sources $20,000 $20,000 46 BACK TO THE BASICS ILLUSTRATIVE ENTRIES REPAYMENT OF THE PRINCIPAL OF LONG-TERM DEBT: PROPRIETARY FUNDS: Bonds Payable Interest Expense DR CR $5,000 300 Cash $5,300 GOVERNMENTAL FUNDS: Expenditure- Bond Principal Expenditure-bond Interest Cash $5,000 300 $5,300 47 BACK TO THE BASICS ILLUSTRATIVE ENTRIES CAPITAL ACQUISITION: DR CR PROPRIETARY FUNDS: Equipment $20,000 Cash $20,000 GOVERNMENTAL FUNDS: Expenditure-capital Outlay Cash $20,000 $20,000 48 BACK TO THE BASICS ILLUSTRATIVE ENTRIES PROPRIETARY FUNDS: Depreciation Expense DR CR $2,000 Accumulated Depreciation $2,000 GOVERNMENTAL FUNDS: Depreciation is Recorded in the GFAAG – Not in the Governmental Fund Itself 49 50 BACK TO THE BASICS • Chart of Accounts is the framework of an accounting system • Is a uniform system for Local Governments • Provides the information needed for administration & reporting purposes • Allows for comparisons • Funds have 4 numbers • Accounts have 6 numbers • Objects have 3 numbers 51 BACK TO THE BASICS FUND CLASSIFICATION 1000 - General Fund 2000 - Special Revenue Funds 3000 - Debt Service Funds 4000 - Capital Projects Funds 52 BACK TO THE BASICS FUND CLASSIFICATION 5000 - Enterprise Funds 6000 - Internal Service Funds 7000 - Trust and Agency Funds 8000 - Permanent Funds 9000 - GFAAG/GLTDG 53 BACK TO THE BASICS BALANCE SHEET ACCOUNTS 100000 - Assets and Other Debits 200000 - Liabilities, Equity and Other Credits 54 BACK TO THE BASICS REVENUE ACCOUNTS 310000 320000 330000 340000 350000 360000 370000 380000 390000 - Taxes Licenses and Permits Intergovernmental Revenues Charges for Services Fines and Forfeitures Miscellaneous Revenues Investment Earnings Other Financing Sources Internal Services 55 BACK TO THE BASICS EXPENDITURE ACCOUNTS 410000 420000 430000 440000 450000 460000 470000 480000 490000 - General Government Public Safety Public Works Public Health Social/Economic Services Culture and Recreation Housing and Community Dev. Conversation of Natural Resources Debt Service 56 BACK TO THE BASICS EXPENDITURE ACCOUNTS – CONT. 500000 510000 520000 - Internal Services Miscellaneous Other Financing Uses 57 BACK TO THE BASICS OBJECT EXPENDITURE CLASSIFICATIONS 100 200 300 400 500 600 700 800 900 - Personal Services Supplies Purchased Services Building Materials Fixed Charges Debt Service Grants, Contributions, Indemnities Other Objects Capital Outlay 58 BACK TO THE BASICS BUDGETARY, ACCOUNTING AND REPORTING SYSTEM (BARS) FOR MONTANA, CITIES, TOWNS AND COUNTIES BARS ACCOUNT STRUCTURE Asset & Liability Accounts - (Illustration 1) 1st Digit 1 = Assets & Other Debits 1st Digit 2 = Liabilities& Other Credits Fund Account Number Number XXXX XXXXXX 59 BACK TO THE BASICS BARS ACCOUNT STRUCTURE - CONT. Revenue Accounts - (Illustration 2) 1st Digit 3 = Revenue Organization Fund Program X Job XXX Optional Code Major Code (Department) Source XXXX XXX XX Sub-Source Detail X XX X Optional 60 BACK TO THE BASICS BARS ACCOUNT STRUCTURE - CONT. Expenditure Accounts - (Illustration 3) 1st Digit 4 & 5 - Expenditures Organization Fund Code Program Job Code (Department) X XXX XXXX XXX Optional Optional Sub Major Function Activity Activity Object XX XX XX X SubObject Detail X X Optional 61 BACK TO THE BASICS BARS ACCOUNT STRUCTURE Asset & Liability Accounts - (Illustration 1) 1st Digit 1 = Assets & Other Debits 1st Digit 2 = Liabilities& Other Credits Fund Account Number Number 1000 GENERAL 101000 CASH 62 BACK TO THE BASICS BARS ACCOUNT STRUCTURE - CONT. Revenue Accounts - (Illustration 2) 1st Digit 3= Revenue Organization Fund Program X Job XXX Optional Code Major Code (Department) Source 1000 GENERAL XXX Optional Sub-Source Detail 31 1 010 TAXES GENERAL PROPERTY TAXES REAL ESTATE TAXES 63 BACK TO THE BASICS BARS ACCOUNT STRUCTURE - CONT. Expenditure Accounts - (Illustration 3) 1st Digit 4 & 5 - Expenditures Organization Fund Code Program Job Code (Department) X 1000 Optional XXX GENERAL XXX Optional Sub Major Function Activity Activity Object 42 01 40 PUBLIC SAFETY LAW ENFORCEMENT SERVICES 2 SUPPLIES CRIME CONTROL & INVESTIGATION SubObject 2 Detail 1 Optional UNIFORMS OPERATING SUPPLIES 64 65 BACK TO THE BASICS 66 BACK TO THE BASICS 67 BACK TO THE BASICS REVENUE QUIZ Identify the appropriate revenue code number for the following revenue items: Fund # Account # 1. Accruing monthly fees for garbage collections services _____________________________ 2. The receipt of real estate taxes in the general fund _____________________________ 3. The receipt of payments for weed spraying services _____________________________ 4. The receipt of a bequest from the estate of a deceased member _______________________ of the community for use in the general fund _____________________________ 5. The receipt of interest on an investment in the road fund ____________________________ 6. The receipt of money from the state as an allocation from taxes on fuel _____________________________ 7. The receipt of personal property taxes in the road fund _____________________________ 8. The receipt of money for the preparation of a burial plot at the cemetery _______________ 9. The receipt of proceeds from fair activity ______________________________ 10. The receipt of fees collected by the clerk and recorder ______________________________ 68 BACK TO THE BASICS Expenditure Quiz Identify the appropriate expenditure code number for the following expenditure items: Fund Account Object 1. Payment for personal services for the clerk and recorder _____________________ 2. The purchase of tires for a dump truck in the road department _______________ 3. The purchase of machinery for use in garbage collection _____________________ 4. The purchase of envelopes for the justice of the peace ______________________ 5. Payment for electricity for the building at the cemetery _____________________ 6. Payments for the rental of a backhoe paid for with gas tax monies ___________________ 7. The purchase of a riding lawn mower for the park __________________ 8. Recording the depreciation of garbage equipment __________________ 9. Payment of the employer's contribution to sheriff's retirement ________________ 10. Payment for the cost of the audit of the county __________________ 69 YEAR END CLOSING 72 CHECKLIST FOR YEAR-END CLOSING ENTRIES GENERAL 1. Review year-end budget to actual expenditure report for budget overdrafts Cover budget overdrafts by a resolution of the governing body authorizing the transfer of appropriations per Section 7-6-4031, MCA. However, total budget appropriations should remain the same within each fund as amended by resolution. 73 CHECKLIST FOR YEAR-END CLOSING ENTRIES - cont. 2. Verify that Transfers In (383XXX) equal Transfers Out (521XXX) within all funds. 3. Verify that interfund loans receivable (131XXX – short-term 133XXX – long-term) equal interfund loans payable (211XXX – short-term or 233XXX – long-term). 4. Verify that the trial balance for each fund is in balance. 74 CHECKLIST FOR YEAR-END CLOSING ENTRIES - cont. 5. Verify that the expenditure detail is equal to the expenditure control (242000), and that the revenue detail is equal to the revenue control (172000) in those systems where control accounts are used. 75 CHECKLIST FOR YEAR-END CLOSING ENTRIES - cont. 6. Taxes/Assessments Receivable A. Reconcile all taxes/assessment receivable accounts (11XXX) with the County Treasurer’s receivables, including protested taxes. B. Adjust deferred revenue accounts (223XXX) to the corresponding receivable accounts for real, personal, protested and special assessments, and offset to the appropriate revenue accounts. (Do not defer taxes for proprietary funds.) 76 CHECKLIST FOR YEAR-END CLOSING ENTRIES - cont. 6. Taxes/Assessments Receivable C. Reconcile the deferred assessment receivable account (119000) for each special improvement district (S.I.D.) with the future year’s principal assessments. Verify that all prepaid assessments have been deducted from the deferred assessment receivable account. 77 CHECKLIST FOR YEAR-END CLOSING ENTRIES - cont. GOVERNMENTAL FUNDS AND ACCOUNT GROUPS 1. Review payroll and claims expenditures for possible accruals, if deemed material. This would include any goods or services received prior to the end of the fiscal year. Also, review debt service funds for accruing any bond interest payable at year-end or for bond principal payable within the next fiscal year. (Reclassify principal from general long-term debt account group to short-term payable of debt service fund.) 78 CHECKLIST FOR YEAR-END CLOSING ENTRIES - cont. GOVERNMENTAL FUNDS AND ACCOUNT GROUPS 2. Review revenue accounts for possible accruals, if deemed material, But, keep in mind that these revenues must meet the revenue recognition criteria of measurable and available. Revenue for federal and/or state grants that are reimbursed upon expenditure, should be recognized when the expenditure is made. (Some revenue susceptible to accrual may be interest on investments, state shared revenue, P & I on delinquent taxes, etc.) 79 CHECKLIST FOR YEAR-END CLOSING ENTRIES - cont. GOVERNMENTAL FUNDS AND ACCOUNT GROUPS 3. If inventory of supplies is deemed material, establish or adjust inventory account (15XXXX) and offset non-spendable fund balance for inventory of supplies (250100). 4. Capital assets purchased by governmental funds should be added to the general fixed asset account group (GFAAG). Any assets traded-in or disposed of should be deleted. The balance in this account group should be reconciled with the capital asset inventory. Depreciation is required to meet the requirements of GASB Statement #34. (Note: The GFAAG is not longer required to be reported under GASB #34 but can be maintained to generate information for the government-wide statements) 80 CHECKLIST FOR YEAR-END CLOSING ENTRIES - cont. GOVERNMENTAL FUNDS AND ACCOUNT GROUPS 5. Prepare worksheet on unused vacation, sick leave, compensatory time and employer’s related payroll obligation. Adjust compensated absences payable account within the general long-term debt account group (GLTDAG). (Note: The GLTDAG is not longer required to be reported under GASB #34 but can be maintained to generate information for the government-wide statements) 81 CHECKLIST FOR YEAR-END CLOSING ENTRIES - cont. GOVERNMENTAL FUNDS AND ACCOUNT GROUPS 6. Adjust the appropriate long-term liability account (GLTDAG) for principal paid from governmental funds on contracts, loans, lease-purchase agreements, general obligation bonds and/or special improvement district (S.I.D.) bonds. 82 CHECKLIST FOR YEAR-END CLOSING ENTRIES - cont. GOVERNMENTAL FUNDS AND ACCOUNT GROUPS 7. Adjust the appropriate amount available account (173XXX) in GLTDAG to the corresponding fund balance in the debt service fund types (3XXX) for general obligation bonds and special improvement district (S.I.D.) bonds. 83 CHECKLIST FOR YEAR-END CLOSING ENTRIES - cont. GOVERNMENTAL FUNDS AND ACCOUNT GROUPS 8. Adjust appropriate amount to be provided account (174XXX) for all long-term liability accounts within GLTDAG. This includes contracts, notes, capital lease purchases, compensated absences, G.O. bonds and S.I.D. bonds payable. 9. Close out revenue and expenditure accounts to fund balance (271000). (Data systems will do this automatically) 84 CHECKLIST FOR YEAR-END CLOSING ENTRIES - cont. PROPRIETARY FUNDS 1. If interim revenue accounts are used for bond/loan proceeds, close these accounts to the appropriate general ledger account. 2. If interim expense accounts are used for capital asset acquisition or principal payments, close these accounts to the appropriate general ledger account. (18XXX for capital asset purchases and 23XXX for principal payments.) 85 CHECKLIST FOR YEAR-END CLOSING ENTRIES - cont. PROPRIETARY FUNDS - cont. 3. Prepare journal vouchers for accrual of revenue and/or expenses, if deemed material. a. Utility charges b. Interest receivable on investments c. Other revenue accruals d. Claims payable 86 CHECKLIST FOR YEAR-END CLOSING ENTRIES - cont. PROPRIETARY FUNDS - cont. 3. Prepare journal vouchers for accrual of revenue and/or expenses, if deemed material. e. Payroll payable f. Interest payable g. Reclassify long-term payable to short-term h. Prepaid expenses 87 CHECKLIST FOR YEAR-END CLOSING ENTRIES - cont. PROPRIETARY FUNDS - cont. 4. Reconcile accounts receivable and deposits payable with detail of customer records. 5. If inventory of supplies is deemed material, adjust inventory and offset to supply expense account(s). 6. Reconcile appropriate capital asset accounts with with capital asset schedules. Adjust for assets traded in, sold or disposed of. 88 CHECKLIST FOR YEAR-END CLOSING ENTRIES - cont. PROPRIETARY FUNDS - cont. 7. Prepare a depreciation schedule for the fiscal year. Prepare a journal voucher for depreciation expense for each proprietary fund. 8. Adjust reserved retained earnings accounts (25XXXX) to agree with appropriate restricted cash accounts (102XXX). 89 CHECKLIST FOR YEAR-END CLOSING ENTRIES - cont. PROPRIETARY FUNDS - cont. 9. Determine the changes in closure and postclosure costs and liability for the solid waste fund and adjust the necessary accounts appropriately. (430800580 Expense/236000 Liability) (Determined from a new engineer’s estimate). (GASB #18) 10. If interest expense is to be capitalized for assets constructed with tax exempt borrowings, close appropriate interest earnings/interest expense on borrowings to the appropriate asset account. (Limited to construction period only.) 90 CHECKLIST FOR YEAR-END CLOSING ENTRIES - cont. PROPRIETARY FUNDS - cont. 11. Adjust compensated absences payable schedule and offset to payroll expense. per 12. Close revenue and expense accounts to retained earnings (272000). 91 92 Local Government Services Bureau Website: http://doa.mt.gov/lgsb Address: 301 S Park Ave ~ Room 340 PO Box 200547 ~ Helena, MT 59620-0547 Phone: 841-2909 Staff members: Kay Gray, Bureau Chief Darla Erickson, Accounting Program Manager ~ 841-2911 Accounting Fiscal Officers: Magda Nelson, Kalispell region ~ 257-5245 Jamie Cain, Helena region ~ 841-2902 Jason Sunderland, Billings region ~ 252-5564 Dorianne Minkoff-Brown, Miles City region ~ 234-5057 Audit Review Staff: Kim Smith, Helena office Larry Donovan, Helena office 93