AP Macro Unit 3 Presentation

advertisement

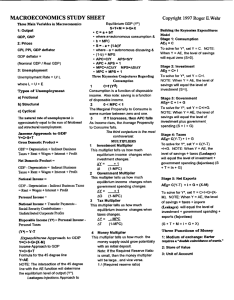

Unit 3: Aggregate Demand and Supply and Fiscal Policy 1 Demand and Supply Review 1. Define Demand and the Law of Demand. 2. Identify the three concepts that explain why demand is downward sloping. 3. Identify the difference between a change in demand and a change in quantity demanded. 4. Identify the Shifters of Demand. 5. Define Supply and the Law of Supply. 6. Why is supply upward sloping? 7. Identify the Shifters of Supply. 8. What does it mean if there is a perfectly inelastic supply curve? 2 9. Name 10 famous male actors. Aggregate Demand 3 What is Aggregate Demand? Aggregate means “added all together.” When we use aggregates we combine all prices and all quantities. Aggregate Demand is all the goods and services (real GDP) that buyers are willing and able to purchase at different price levels. The Demand for everything by everyone in the US. There is an inverse relationship between price level and Real GDP. If the price level: •Increases (Inflation), then real GDP demanded falls. •Decreases (deflation), the real GDP demanded increases. 4 Aggregate Demand Curve Price Level AD is the demand by consumers, businesses, government, and foreign countries What definitely doesn’t shift the curve? Changes in price level cause a move along the curve AD = C + I + G + Xn Real domestic output (GDPR) 5 Why is AD downward sloping? 1. Real-Balance Effect• Higher price levels reduce the purchasing power of money • This decreases the quantity of expenditures • Lower price levels increase purchasing power and increase expenditures Example: • If the balance in your bank was $50,000, but inflation erodes your purchasing power, you will likely reduce your spending. • So…Price Level goes up, GDP demanded goes down. 6 Why is AD downward sloping? 2. Interest-Rate Effect • When the price level increases, lenders need to charge higher interest rates to get a REAL return on their loans. • Higher interest rates discourage consumer spending and business investment. WHY? • Example: An increase in prices leads to an increase in the interest rate from 5% to 25%. You are less likely to take out loans to improve your business. • Result…Price Level goes up, GDP demanded goes down (and Vice Versa). 7 Why is AD downward sloping? 8 Why is AD downward sloping? 3. Foreign Trade Effect • When U.S. price level rises, foreign buyers purchase fewer U.S. goods and Americans buy more foreign goods • Exports fall and imports rise causing real GDP demanded to fall. (XN Decreases) • Example: If prices triple in the US, Canada will no longer buy US goods causing quantity demanded of US products to fall. • Again, Price Level goes up, GDP demanded goes down (and Vice Versa). 9 Shifters of Aggregate Demand GDP = C + I + G + Xn 10 Shifts in Aggregate Demand An increase in spending shift AD right, and decrease in spending shifts it left Price Level AD1 AD2 AD = C + I + G + Xn Real domestic output (GDPR) 11 Shifters of Aggregate Demand 1. Change in Consumer Spending Consumer Wealth (Boom in the stock market…) Consumer Expectations (People fear a recession…) Household Indebtedness (More consumer debt…) Taxes (Decrease in income taxes…) 2. Change in Investment Spending Real Interest Rates (Price of borrowing $) (If interest rates increase…) (If interest rates decrease…) Future Business Expectations (High expectations…) Productivity and Technology (New robots…) Business Taxes (Higher corporate taxes means…) 12 Shifters of Aggregate Demand 3. Change in Government Spending (War…) (Nationalized Heath Care…) (Decrease in defense spending…) 4. Change in Net Exports (X-M) Exchange Rates (If the us dollar depreciates relative to the euro…) National Income Compared to Abroad (If a major importer has a recession…) (If the US has a recession…) “If the US get a cold, Canada gets Pneumonia” AD = GDP = C + I + G + Xn 13 How does this cartoon relate to Aggregate Demand? 14 How does this cartoon relate to Aggregate Demand? 15 Review 1. Define Aggregate. 2. Define Aggregate Demand. 3. Explain and give an example of the Real Balances Effect. 4. Explain and give an example of the Foreign Trade Effect. 5. Explain and give an example of the Interest-Rate effect. 6. Identify the Shifters of AD. 7. Give examples for each shifter. 8. Name 10 famous actresses. 16 Unit 3: Aggregate Demand and Supply and Fiscal Policy 17 Aggregate Supply 18 What is Aggregate Supply? Aggregate Supply is the amount of goods and services (real GDP) that firms will produce in an economy at different price levels. The supply for everything by all firms. Aggregate Supply differentiates between short run and long-run and has two different curves. Short-run Aggregate Supply •Wages and Resource Prices will not increase as price levels increase. Long-run Aggregate Supply •Wages and Resource Prices will increase as price levels increase. 19 Short-Run Aggregate Supply In the Short Run, wages and resource prices will NOT increase as price levels increase. Example: • If a firm currently makes 100 units that are sold for $1 each. The only cost is $80 of labor. How much is profit? • Profit = $100 - $80 = $20 What happens in the SHORT-RUN if price level doubles? • Now 100 units sell for $2, TR=$200. How much is profit? • Profit = $120 With higher profits, the firm has the incentive to 20 increase production. Aggregate Supply Curve Price Level AS AS is the production of all the firms in the economy Real domestic output (GDPR) 21 Long-Run Aggregate Supply In the Long Run, wages and resource prices WILL increase as price levels increase. Same Example: • The firm has TR of $100 an uses $80 of labor. • Profit = $20. What happens in the LONG-RUN if price level doubles? • Now TR=$200 •In the LONG RUN workers demand higher wages to match prices. So labor costs double to $160 • Profit = $40, but REAL profit is unchanged. If REAL profit doesn’t change the firm has no incentive to increase output. 22 Long run Aggregate Supply In Long Run, price level increases but GDP doesn’t Price level LRAS Long-run Aggregate Supply Full-Employment (Trend Line) QY GDPR We also assume that in the long run the economy 23 will be producing at full employment. Shifters Aggregate Supply I. R. A. P. Shifts in Aggregate Supply An increase or decrease in national production can shift the curve right or left AS2 AS Price AS1 Level Real domestic output (GDPR) 25 Shifters of Aggregate Supply 1. Change in Inflationary Expectations If an increase in AD leads people to expect higher prices in the future. This increases labor and resource costs and decreases AS. (If people expect lower prices…) 2. Change in Resource Prices Prices of Domestic and Imported Resources (Increase in price of Canadian lumber…) (Decrease in price of Chinese steel…) Supply Shocks (Negative Supply shock…) (Positive Supply shock…) 26 Shifters of Aggregate Supply 3. Change in Actions of the Government (NOT Government Spending) Taxes on Producers (Lower corporate taxes…) Subsides for Domestic Producers (Lower subsidies for domestic farmers…) Government Regulations (EPA inspections required to operate a farm…) 4. Change in Productivity Technology (Computer virus that destroy half the computers…) (The advent of a teleportation machine…) 27 Practice 28 Answer and identify shifter: C.I.G.X or R.A.P B A D A D B A A C A A major increase in productivity. 29 Shifters of Aggregate Demand AD = C + I + G + X Change in Consumer Spending Change in Government Spending Change in Investment Spending Net EXport Spending Shifters of Aggregate Supply AS = I + R + A + P Change in Change in Change in Change in Inflationary Expectations Resource Prices Actions of the Government Productivity (Investment) 30 Putting AD and AS together to get Equilibrium Price Level and Output 31 Inflationary and Recessionary Gaps 32 Example: Assume the government increases spending. What happens to PL and Output? Price Level LRAS AS PL and Q will Increase PL1 PLe AD QY Q1 AD1 GDPR 33 Inflationary Gap Output is high and unemployment is less than NRU LRAS Price Level AS Actual GDP above potential GDP PL1 AD1 QY Q1 GDPR 34 Example: Assume the price of oil increases drastically. What happens to PL and Output? Price Level LRAS AS1 AS PL1 Stagflation PLe Stagnate Economy + Inflation AD Q1 QY GDPR 35 Recessionary Gap Output low and unemployment is more than NRU LRAS AS1 Price Level Actual GDP below potential GDP PL1 AD Q1 QY GDPR 36 AD and AS Practice Worksheet 37 How does this cartoon relate to Aggregate Demand? 38 Draw AD and AS at full employment Price Level LRAS AS P2 P1 AD2 AD=C+I+G+X Qf Q2 (Y*or FE) Output Increases GDPR PL Increases 39 Short Run and Long Run 40 Shifts in AD or AS change the price level and output in the short run Price Level LRAS AS PLe AD QY GDPR 41 Example: Assume consumers increase spending. What happens to PL and Output? Price Level LRAS AS PL1 PLe AD QY Q1 AD1 GDPR 42 Now, what will happen in the LONG RUN? Inflation means workers seek higher wages and production costs increase LRAS AS1 Price Level AS PL2 Back to full employment with higher price level PL1 PLe AD QY Q1 AD1 GDPR 43 Example: Consumer expectations fall and consumer spending plummets. What happens to PL and Output in the Short Run and Long Run? Price Level LRAS AS AS1 AS increases as workers accept lower wages and production costs fall PLe PL1 PL2 AD1 Q1 QY AD GDPR 44 Review 1. Explain the results of Calvin’s proposal using AS and AD. 2. Draw an Inflationary Gap. 3. Draw a Recessionary Gap. 4. Define Stagflation. 5. Explain the Ratchet Effect. 6. Name 10 College Majors. 45 Adam Smith 1723-1790 Classical vs. Keynesian John Maynard Keynes 46 1883-1946 47 Video: Classical vs. Keynesian 48 Debates Over Aggregate Supply Classical Theory 1. A change in AD will not change output even in the short run because prices of resources (wages) are very flexible. 2. AS is vertical so AD can’t increase without causing inflation. Price level AS AD Qf Real domestic output, GDP 49 Debates Over Aggregate Supply Classical Theory 1. A change in AD will not change output even in the short run because prices of resources (wages) are very flexible. 2. AS is vertical so AD can’t increase without causing inflation. Price level AS Recessions caused by a fall in AD are temporary. Price level will fall and economy will fix itself. No Government Involvement Required AD AD1 Qf Real domestic output, GDP 50 Debates Over Aggregate Supply Keynesian Theory 1. A decrease in AD will lead to a persistent recession because prices of resources (wages) are NOT flexible. 2. Increase in AD during a recession puts no pressure on prices Price level AS AD Qf Real domestic output, GDP 51 Debates Over Aggregate Supply Keynesian Theory 1. A decrease in AD will lead to a persistent recession because prices of resources (wages) are NOT flexible. 2. Increase in AD during a recession puts no pressure on prices AS Price level AD1 “Sticky Wages” prevents wages to fall. The government should increase spending to close the gap AD Q1 Qf Real domestic output, GDP 52 Debates Over Aggregate Supply Keynesian Theory 1. A decrease in AD will lead to a persistent recession because prices of resources (wages) are NOT flexible. 2. Increase in AD during a recession puts no pressure on prices AS Price level AD1 When there is high unemployment, an increase in AD doesn’t lead to higher prices until you get close to full employment AD2 AD3 Q1 Qf Real domestic output, GDP 53 Three Ranges of Aggregate Supply 1. Keynesian Range- Horizontal at low output 2. Intermediate Range- Upward sloping 3. Classical Range- Vertical at Physical Capacity AS Price level Classical Range Keynesian Range Intermediate Range Qf Real domestic output, GDP 54 2006B Practice FRQ 55 2006B Practice FRQ 56 The Phillips Curve Shows tradeoff between inflation and unemployment. What happens to inflation and unemployment when AD increase? In general, there is an inverse relationship between unemployment and inflation 58 Short Run Phillips Curve When the economy is overheating, there is low unemployment but high inflation Inflation When there is a recession, unemployment is high but inflation is low 5% 1% SRPC 2% 9% Unemployment 59 Short Run Phillips Curve What happens when AS falls causing stagflation? Increase in unemployment and inflation Inflation 5% SRPC1 1% SRPC 2% 9% Unemployment 60 Short Run vs. Long Run What happens when AD increases? What happens in the long run? Inflation Long Run Phillips Curve In the long run, wages and resource prices increase. AS falls. SRPC shifts right. 5% 3% SRPC1 1% SRPC 2% 5% 9% Unemployment 61 Short Run vs. Long Run In the long run there is no tradeoff between inflation and unemployment Inflation Long Run Phillips Curve 5% The LRPC is vertical at the Natural Rate of Unemployment 3% 1% 2% 5% 9% Unemployment 62 Short Run vs. Long Run What happens when AD falls? What happens in the long run? Inflation Long Run Phillips Curve 5% In the long run wages fall and there is no tradeoff between inflation and unemployment 3% 1% 2% 5% SRPC SRPC1 Unemployment 9% 63 AD/AS and the Phillips Curve AD/AS and the Phillips Curve Show what happens on both graphs if AD increases Price Level LRAS Inflation LRPC AS PLe AD1 AD QY GDPR SRPC UY Unemployment 65 AD/AS and the Phillips Curve Correctly draw the LRPC and SRPC with the recessionary gap. What happens when AD falls? Price Level LRAS Inflation LRPC AS PLe AD AD1 QY GDPR SRPC UY Unemployment 66 AD/AS and the Phillips Curve Correctly draw the LRPC and SRPC at full employment. What happens when AS falls? Price Level LRAS Inflation LRPC AS1 AS PLe SRPC1 AD QY GDPR SRPC UY Unemployment 67 AD/AS and the Phillips Curve Correctly draw the LRPC and SRPC with an recessionary gap. What happens when AS goes up? Price Level LRAS AS Inflation LRPC AS1 PLe SRPC AD QY GDPR SRPC1 UY Unemployment 68 Price Level LRAS SRAS Inflation LRPC SRPC QY GDPR UY Unemployment 69 Price Level SRAS LRAS Inflation LRPC PLe AD AD3 QY GDPR AD2 SRPC UY Unemployment 70 Price Level LRAS AS1 SRAS Inflation LRPC AS2 PLe SRPC1 AD QY GDPR SRPC2 SRPC UY Unemployment 71 Price Level LRAS AS2 AS Inflation LRPC PLe AD2 AD QY GDPR SRPC1 SRPC UY Unemployment 72 Analyzing the Economy Graphically 73 Use the following models to show full employment, a recessionary gap, and an inflationary gap. 1. PPC 2. Business Cycle 3. AD/AS 4. Phillips Curve 74 The Good, the Bad, and the Ugly Unemployment Inflation GDP Growth Good 6% or less 1%-4% 2.5%-5% Worry 6.5%-8% 5%-8% 1%-2% Bad 8.5 % or more 9% or more .5% or less 75 Review 1. Draw an Inflationary Gap with your fingers. 2. Draw a Recessionary Gap with your fingers. 3. Explain the difference between the Classical and Keynesian philosophies. 4. Explain why the Aggregate supply curve is shaped like a backwards “L.” 5. Name 10 Universities in California. 76 Fiscal Policy 78 The Car Analogy The economy is like a car… • You can drive 120mph but it is not sustainable. (Extremely Low unemployment) • Driving 20mph is too slow. The car can easily go faster. (High unemployment) • 70mph is sustainable. (Full employment) • Some cars have the capacity to drive faster then others. (industrial nations vs. 3rd world nations) • If the engine (technology) or the gas mileage (productivity) increase then the car can drive at even higher speeds. (Increase LRAS) The government’s job is to brake or speed up when needed as well as promote things that will improve the engine. 79 (Shift the PPC outward) How does the Government Stabilizes the Economy? The Government has two different tool boxes it can use: 1. Fiscal PolicyActions by Congress to stabilize the economy. OR 2. Monetary PolicyActions by the Federal Reserve Bank to stabilize the economy. 80 For now we will only focus on Fiscal Policy. 81 Two Types of Fiscal Policy Discretionary Fiscal Policy- • Congress creates a new bill that is designed to change AD through government spending or taxation. •Problem is time lags due to bureaucracy. •Takes time for Congress to act. •Ex: In a recession, Congress increase spending. Non-Discretionary Fiscal Policy •AKA: Automatic Stabilizers •Permanent spending or taxation laws enacted to work counter cyclically to stabilize the economy •Ex: Welfare, Unemployment, Min. Wage, etc. •When there is high unemployment, unemployment benefits to citizens increase consumer spending. 82 Contractionary Fiscal Policy (The BRAKE) Laws that reduce inflation, decrease GDP (Close a Inflationary Gap) • Decrease Government Spending • Tax Increases • Combinations of the Two Expansionary Fiscal Policy (The GAS) Laws that reduce unemployment and increase GDP (Close a Recessionary Gap) • Increase Government Spending • Decrease Taxes on consumers • Combinations of the Two How much should the Government Spend? 83 Price level • What type of gap and what type of policy is best? • What should the government do to spending? Why? • How much should the government spend? LRAS AS The government should increasing spending which would increase AD They should NOT spend 100 billion!!!!!!!!!! If they spend 100 billion, AD would look like this: WHY? P1 AD2 AD1 $400 $500 FE Real GDP (billions) 84 The Multiplier Effect Why do cities want the Superbowl in their stadium? An initial change in spending will set off a spending chain that is magnified in the economy. Example: • • • • Bobby spends $100 on Jason’s product Jason now has more income so he buys $100 of Nancy’s product Nancy now has more income so she buys $100 of Tiffany’s product. The result is an $300 increase in consumer spending The Multiplier Effect shows how spending is magnified in the economy. 85 Review 1. Explain how to show full employment, inflation, and unemployment on the PPC. 2. Explain how to show full employment, inflation, and unemployment on the Business Cycle. 3. Draw an Inflationary Gap with your elbow. 4. Draw a Recessionary Gap with your foot. 5. Explain why the economy is like a car. 6. Identify what Congress can do to put on the brakes. 7. Identify what Congress can do to put on the gas. 8. Explain the difference between discretionary and non-discretionary Fiscal Policy. 9. Name 10 Universities outside California. 86 Effects of Government Spending If the government spends $5 Million, will AD increase by the same amount? • No, AD will increase even more as spending becomes income for consumers. • Consumers will take that money and spend, thus increasing AD. How much will AD increase? • It depends on how much of the new income consumers save. • If they save a lot, spending and AD will increase less. • If the save a little, spending and AD will be increase a lot. 87 Marginal Propensity to Consume Marginal Propensity to Consume (MPC) •How much people consume rather than save when there is an change in income. •It is always expressed as a fraction (decimal). MPC= Change in Consumption Change in Income Examples: 1. If you received $100 and spent $50. 2. If you received $100 and spent $80. 3. If you received $100 and spent $100. 88 Marginal Propensity to Save Marginal Propensity to Save (MPS) •How much people save rather than consume when there is an change in income. •It is also always expressed as a fraction (decimal) MPS= Change in Saving Change in Income Examples: 1. If you received $100 and save $50. 2. If you received $100 your MPC is .7 what is your MPS? 89 MPS = 1 - MPC Why is this true? Because people can either save or consume 90 How is Spending “Multiplied”? Assume the MPC is .5 for everyone •Assume the Super Bowl comes to town and there is an increase of $100 in Ashley’s restaurant. •Ashley now has $100 more income. •She saves $50 and spends $50 at Carl’s Salon •Car now has $50 more income •He saves $25 and spends $25 at Dan’s fruit stand •Dan now has $25 more income. This continues until every penny is spent or saved Change in GDP = Multiplier x Initial Change in Spending 91 Calculating the Spending Multiplier If the MPC is .5 how much is the multiplier? 1 1 Simple or 1 - MPC MPS Multiplier = •If the multiplier is 4, how much will an initial increase of $5 in Government spending increase the GDP? •How much will a decrease of $3 in spending decrease GDP? Change in GDP = Multiplier x initial change in spending 92 The Multiplier Effect Let’s practice calculating the spending multiplier 1 1 Simple or 1 - MPC MPS Multiplier 1. If MPC is .9, what is multiplier? 2. If MPC is .8, what is multiplier? 3. If MPC is .5, and consumption increased $2M. How much will GDP increase? 4. If MPC is 0 and investment increases $2M. How much will GDP increase? = Conclusion: As the Marginal Propensity to Consumer falls, the Multiplier Effect is less 93 Fiscal Policy Practice Congress uses discretionary fiscal policy to the manipulate the following economy (MPC = .8) LRAS Price level AS P1 AD2 $500 1. What type of gap? 2. Contractionary or Expansionary needed? 3. What are two options to fix the gap? 4. How much initial government spending is needed to close gap? AD1 $100 Billion $1000FE Real GDP (billions) 94 Fiscal Policy Practice Congress uses discretionary fiscal policy to the manipulate the following economy (MPC = .5) LRAS Price level AS P2 AD1 1. What type of gap? 2. Contractionary or Expansionary needed? 3. What are two options to fix the gap? 4. How much needed to close gap? AD -$10 Billion $80FE $100 Real GDP (billions) 95 What about taxing? •The multiplier effect also applies when the government cuts or increases taxes. •But, changing taxes has less of an impact of changing GDP. Why? Expansionary Policy (Cutting Taxes) •Assume the MPC is .75 so the multiplier is 4 •If the government cuts taxes by $4 million how much will consumer spending increase? •NOT 16 Million!! •When they get the tax cut, consumers will save $1 million and spend $3 million. •The $3 million is the amount magnified in the economy. •$3 x 4 = $12 Million increase in consumer spending .96 Cutting Tax Practice Congress uses discretionary fiscal policy to the manipulate the following economy (MPC = .5) LRAS Price level AS 1. What to options does the government have? 2. How much should they increase government spending? P1 $10 Billion AD2 $80 3. How much should they cut taxes? AD1 -$20 Billion $100FE Real GDP (billions) 97 Multiplier Effect 98 Non-Discretionary Fiscal Policy 99 Non-Discretionary Fiscal Policy Legislation that act counter cyclically without explicit action by policy makers. AKA: Automatic Stabilizers The U.S. Progressive Income Tax System acts counter cyclically to stabilize the economy. 1. When GDP is down, the tax burden on consumers is low, promoting consumption, increasing AD. 2. When GDP is up, more tax burden on consumers, discouraging consumption, decreasing AD. The more progressive the tax system, the greater the economy’s built-in stability. 100 Problems With Fiscal Policy 101 Problems With Fiscal Policy •When there is a recessionary gap what two options does Congress have to fix it? •What’s wrong with combining both? Deficit Spending!!!! •A Budget Deficit is when the government’s expenditures exceeds its revenue. •The National Debt is the accumulation of all the budget deficits over time. •If the Government increases spending without increasing taxes they will increase the annual deficit and the national debt. Most economists agree that budget deficits are a necessary evil because forcing a balanced budget would not allow Congress to stimulate the economy. 102 Paul Solomon Video: Deficit and Debt US Debt Clock 103 Explain this cartoon 2003 104 Who ultimately pays for excessive government spending? 105 2008 Practice FRQ 106 2008 Practice FRQ 107 Review 1. Identify the two types of tool boxes the government has to fix the economy 2. Explain and give examples of Expansionary Fiscal Policy 3. Explain and give examples of Contractionary Fiscal Policy 4. Explain the Multiplier Effect 5. Explain how to calculate the spending multiplier 6. Name 10 University Mascots 108 Draw and Practice Congress uses discretionary fiscal policy to the manipulate the following economy (MPC = .9) LRAS Price level AS P2 AD1 1. What type of gap? 2. Contractionary or Expansionary needed? 3. What are two options to fix the gap? 4. How much needed to close gap? AD -$5 Billion $50FE $100 Real GDP (billions) 109 Draw and Practice Congress uses discretionary fiscal policy to the manipulate the following economy (MPC = .8) LRAS Price level AS P1 AD2 $800 1. What type of gap? 2. Contractionary or Expansionary needed? 3. What are two options to fix the gap? 4. How much initial government spending is needed to close gap? AD1 +$40 Billion $1000FE Real GDP (billions) 110 Paul Solomon Video: Deficit and Debt 111 Video: Government Stages Coup 112 113 114 Additional Problems with Fiscal Policy 1. Problems of Timing • Recognition Lag- Congress must react to economic indicators before it’s too late • Administrative Lag- Congress takes time to pass legislation • Operational Lag- Spending/planning takes time to organize and execute ( changing taxing is quicker) 2. Politically Motivated Policies • Politicians may use economically inappropriate policies to get reelected. • Ex: A senator promises more welfare and public works programs when there is already an inflationary gap. 115 Additional Problems with Fiscal Policy 3. Crowding-Out Effect • In basketball, what is “Boxing Out”? • Government spending might cause unintended effects that weaken the impact of the policy. Example: • We have a recessionary gap • Government creates new public library. (AD increases) • Now but consumer spend less on books (AD decreases) Another Example: • The government increases spending but must borrow the money (AD increases) • This increases the price for money (the interest rate). • Interest rates rise so Investment to fall. (AD decrease) The government “crowds out” consumers and/or investors 116 Additional Problems with Fiscal Policy 4. Net Export Effect International trade reduces the effectiveness of fiscal policies. • • • • • Example: We have a recessionary gap so the government spends to increase AD. The increase in AD causes an increase in price level and interest rates. U.S. goods are now more expensive and the US dollar appreciates… Foreign countries buy less. (Exports fall) Net Exports (Exports-Imports) falls, decreasing AD. 117 Explain this cartoon 118 Activity 119 Congressional Committees As a group, analyze the situation, identify the problem, and identify your solution The Good, the Bad, and the Ugly Unemployment Inflation GDP Growth Good 6% or less 1%-4% 2.5%-5% Worry 6.5%-8% 5%-8% 1%-2% Bad 8.5 % or more 9% or more .5% or less 120 1.) 1933 Situation: • GDP fell -1.2% • Inflation rate= -.5% • Unemployment Rate=25% Your Solution: What actually happened: • FDR increased public works via the New Deal programs. 121 2.) 1944 Situation: • GDP grew 8% • Inflation rate= 3.7% • Unemployment Rate=1.2% Your Solution: What actually happened: • War ended the next year and government orders for war materials decreased. • Many public works programs were discontinued 122 3.) 1980 Situation: • GDP fell -0.3% • Inflation rate= 13.5% • Unemployment Rate=7.1% Your Solution: What actually happened: • The next year, President Regan and congress lowered taxes on individuals and corporations by about 30%. (Supply-side Economics) 123 4.) 2003 Situation: • GDP fell 0.5% • Inflation rate= 1.5% • Unemployment Rate=12.0% Your Solution: What actually happened: • Congress voted to give tax cuts to citizens. (Bush Tax Cuts) 124 List the 25 Concepts we have covered 1. 2. 3. 4. 5. Aggregate Demand Real Balance Effect Interest Rate Effect Foreign Trade Effect Shifters of AD (C,I,G,X) 6. Aggregate Supply 7. Shifter of AS (R.A.P.) 8. Short Run AS 9. Long Run AS 10.Two Types of Inflation 11.Ratchet Effect 12.Classic vs. Keynesian 13.Three Ranges of AS 14. Fiscal Policy 15. Discretionary vs. NonDiscretionary 16. Expansionary Policy 17. Contractionary Policy 18. The Car Analogy 19. Multiplier Effect 20. Calculating the Spending Multiplier 21. MPC and MPS 22. Deficit Spending 23. Timing Problems 24. Crowding-Out Effect 25. Net Exports Effect 125