US Homeownership rates

advertisement

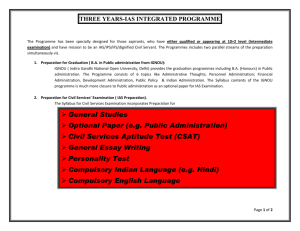

Disclaimer The information in this presentation does not constitute an offer to sell or an invitation to buy shares in George Wimpey Plc or any other invitation or inducement to engage in investment activities. Past performance cannot be relied upon as a guide to future performance 2 George Wimpey Plc Interim Results for the 26 weeks to 3 July 2005 Tuesday 6 September 2005 Welcome John Robinson Chairman Agenda H1 Financial Review Andrew Carr-Locke UK Business Review Pete Redfern US Business Review Peter Johnson Strategy and Outlook Peter Johnson 5 H1 2005 financial review Andrew Carr-Locke Group Finance Director IAS reconciliation Income statement H1 2005 H1 2004 £m UK GAAP* IAS UK GAAP* IAS Operating profit 158.0 156.5 181.6 181.8 Interest (27.3) (34.2) (23.1) (27.9) PBT 130.7 122.3 158.5 153.9 Tax (41.0) (37.9) (49.1) (47.8) 89.7 84.4 109.4 106.1 Profit after tax *Consistent 2004 UK GAAP basis 7 First half results H1 2005 H1 2004* Change Turnover 1,190 1,220 -2% Operating profit 156.5 181.8 -14% Interest charge (34.2) (27.9) +23% Profit before tax 122.3 153.9 -21% Earnings per share 21.5p 27.7p -22% NAV per share 348p 296p +52p Dividend per share 5.7p 5.2p +10% 22.7% 25.6% £m ROACE** 8 *restated for IAS **last 12 months Segmental analysis Turnover Operating profit Operating margin H1 H1 2005 2004 £m Change £m Change GWUK 858 -10% 107 -32% 12.4% 16.4% Morrison Homes* 332 +24% 55 +64% 16.4% 12.4% Other - - (5) - Total 1,190 -2% 157 -14% 9 *Exchange rate in 2005 $/£=1.87, 2004 $/£=1.81 First half completions Completions Ave selling price No Change £/$ Change 4,154 -11% £194,000 - 422 -6% £88,000 +2% GWUK 4,576 -10% £185,000 - Morrison Homes 1,996 +16% $302,000 +9% GROUP TOTAL 6,572 -3% GWUK private GWUK affordable 10 Cash flow summary H1 2005 H1 2004* Operating profit Land spend Land realisations Other working capital movements 157 (502) 284 (134) 182 (462) 284 (137) CASH INFLOW FROM OPERATIONS (195) (133) Interest Tax Dividends Exchange rate effects Other movements (27) (55) (41) (31) (11) (23) (55) (16) 5 (3) INCREASE IN NET DEBT (360) (225) £m *restated for IAS 11 Balance sheet net assets 3 Jul 2005 30 Jun 2004* 45 29 Land 2,136 1,767 Land creditors (240) (147) Other net operating assets 546 451 Tax and provisions (94) (63) Net pension deficit (145) (129) TOTAL NET ASSETS EMPLOYED 2,248 1,908 £m Fixed assets and joint ventures * restated for IAS 12 Balance sheet financing 3 Jul 2005 30 June 2004* 1,367 1,154 881 754 Capital employed £m 2,248 1,908 Gearing 64% 65% Interest cover last 12 months 7.1x 7.6x Cash interest cover last 12 months 9.4x 9.8x Shareholders’ funds £m Net debt £m 13 * restated for IAS Financial summary Results now published under IAS Challenging market conditions in the UK GWUK margins down 4.0pp, volumes down 10% Continued strength in the US Morrison margins up 4.0pp, volumes up 16% Group PBT down 21% at £122m Gearing in line with prior year at 64% ROCE at 22.7% remains healthily above cost of capital Half year dividend increased by 10% to 5.7p 14 Impact of IAS Interest charge – net payable £m UK GAAP basis* Interest charge on discounted pension liabilities under IAS 19 Reallocate JV interest Interest charge on discounted land creditors Notional interest expense booked to cost of inventory Movement on interest rate derivatives IAS basis *Consistent 2004 UK GAAP basis H1 2005 H1 2004 (27.3) (23.1) (4.2) (4.0) 0.6 - (3.1) (1.4) 1.1 0.6 (1.3) - (34.2) (27.9) 15 Financial summary Results now published under IAS Challenging market conditions in the UK GWUK margins down 4.0pp, volumes down 10% Continued strength in the US Morrison margins up 4.0pp, volumes up 16% Group PBT down 21% at £122m Gearing in line with prior year at 64% ROCE at 22.7% remains healthily above cost of capital Half year dividend increased by 10% to 5.7p 16 UK business review Pete Redfern Chief Executive, GWUK Financial summary George Wimpey Laing Homes H1 2005 H1 2004 H1 2005 H1 2004 Total completions 4,177 4,560 399 533 Private completions 3,793 4,220 361 423 Private ASP £182,900 £183,600 £316,400 £308,100 Turnover £m 739.3 809.3 119.1 142.9 Gross margin % 24.3% 26.8% 20.3% 23.1% GWUK H1 2005 H1 2004* Operating profit £m 106.7 156.2 Operating margin % 12.4% 16.4% 18 * restated for IAS UK market conditions Market continues to be tough but steady very price sensitive and incentive led Second hand market (down 30%) affecting new build sales and conversion rates. Summer visitor levels are slightly better than last year cancellation rates below peak in November 2004 Geographically no clear difference in market conditions, in the South slightly more confidence in the short term Apartment market is particularly price sensitive - occupier and investor 19 Ave weekly sales rates GWUK 2003 – 2005 1.2 Sales per site per week 1 0.8 0.6 0.4 0.2 0 Jan Feb Mar Apr May 2003 Jun 2004 Jul Aug 2005 Sep Oct Nov Dec 20 Net sales prices on reservations GWUK 2003 – 2005 210 ASP achieved on reservations £000s 200 190 180 170 160 150 140 Jan Feb Mar Apr May 2003 Jun 2004 Jul Aug 2005 Sep Oct Nov Dec 21 Price points 1400 1200 2005 Total completions 1000 2004 800 600 400 200 0 £0-50k £51-100k £101-150k £151-200k £201-250k Price band £251-300k £301-500k £500k+ 22 Product mix H1 2005 H2 2004 H1 2004 Apartments 34% 29% 32% 2 / 3 bed houses 32% 29% 35% 4 / 5 bed houses 34% 42% 33% 100% 100% 100% PD completions % 23 Margin reconciliation H1 2005 H1 2004 Change FY 2004 Turnover 100% 100% - 100% Land costs 26.5% 23.9% (2.6)% 24.2% Build & other costs 49.7% 49.7% 0.0% 49.5% Direct selling expenses 4.7% 3.8% (0.9)% 3.3% Overhead costs 6.6% 6.1% (0.5)% 5.2% Operating profit 12.4% 16.4% (4.0)% 17.8% 24 Build Costs Underlying cost pressures remain, pressure on labour rates and availability has reduced Material cost pressure remains high, driven by higher energy and other input costs, partly balanced by scale Cost management program enabled us to hold build costs Confident of £20m cost saving program, c.£17m impacts on 2005 with much of the balance locked up in WIP and build Key initiative is rationalisation of house types September 2004 - every business had own house designs no core national range since 2001 today - a ‘preferred range’ of 30 products 25 Landbank Owned and controlled plots Jun 2005 Jun 2004 Long term acres Jun 2005 Jun 2004 North 15,555 15,630 4,784 4,908 Midlands 12,360 12,147 5,329 5,497 South 16,648 16,078 6,218 7,720 City 3,559 2,398 - - Laing 6,258 4,648 - - TOTAL 54,380 50,901 16,331 18,125 Planning approvals achieved on 14,500 plots in last 12 months 26 Land cost Cost per plot of 2005 acquisitions is higher due to Laing / South mix Continued focus on larger sites where competition slightly reduced and scale gives advantage Significant skills developed since 2003 on partnership schemes like Bracknell and Dartford For PD owned plots only H1 2005 Landbank 194.5 194.3 Cost per plot £000s 52.3 54.0 Land value % ASP 26.6% 27.8% ASP £000s 27 Bracknell case study Existing planning consent - 584 PD units, 146 affordable units Phased land payment terms, above standard gross margin Pursuing enhanced planning application, including 38% affordable provision c.£260k average selling price Mix includes c.20% 1&2 bed apartments 2-5 bed houses EcoHomes ‘Very Good’ Anticipated site start Feb 06 based on existing consent 28 Dartford case study 794 private development units, 340 affordable units Phased land payment terms, above standard gross margin 39% apartments across the development c.£230k average selling price Design codes for integrated mixed use development Land acquired fully serviced ‘Fastrack’ - dedicated transport service Anticipated site start mid 06 29 Summary Challenging first half market tough, use of incentives essential order book at 90% of expected full year volumes, margins below first half build cost pressures significant but balanced by savings Outlook for H2 early to call autumn market balance between customer demand and supply availability is critical factor cost pressures remain but mitigated by savings operating margins improved by volume weighting 30 US business review Peter Johnson Group Chief Executive US housing market continued healthy economic data… Employment 240,000+ new jobs in July, 169,000 in August unemployment at four-year low Consumer confidence up to 105.6 in August (vs. 106.2 max 2004 and 2005) 30-year mortgage rates 5.71% - still near record lows 32 US housing market underpinned by demographics US Homeownership rates 71% 70% 69% A homeownership rate of 70% in 2010 would imply the creation of c.1.28m households pa from 20042010, compared to the 800,000 created pa from 1999-2004 68% 67% 66% 70.0 69.2 65% 68.0 68.3 68.6 67.5 66.9 66.4 64% 65.1 63% 63.9 64.1 64.1 64.0 64.1 1990 1991 1992 1993 1994 65.4 65.7 62% Source: CSFB 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2010E 33 Morrison Homes H1 performance H1 2005 H1 2004 Change Visitor rates per site 19.6 18.2 +8% Sales rates per site 1.15 1.08 +6% $302,000 $278,000 +9% Ave selling price More outlets open in continuing businesses 1 Jan = 89 outlets 1 Sep = 98 outlets 34 Financial summary H1 2005 H1 2004* Change 1,996 1,714 +16% $302,000 $278,000 +9% 621 484 +28% Operating profit $m 101.9 60.3 +69% Operating margin % 16.4% 12.4% +4.0pp Legal completions Ave selling price Revenue $m 35 * restated for IAS Margin performance H1 2005 H1 2004 Change Gross margin 27.1% 24.0% +3.1pp Operating margin 16.4% 12.4% +4.0pp Margins above these levels in sales proceeding Implied operating margin LPEs year to date = 16.5% H1 cost inflation c.7% annualised (Source: CSFB) Some labour and material shortages in strongest markets 36 Land Jun 05 Dec 04 Jun 04 Plots owned / under option 19,661 18,892 17,456 Plots controlled 3,058 2,687 2,606 Total landbank 22,719 21,579 20,062 Net additions (plots, last 6 months) 2,765 4,144 3,866 156 174 108 Land spend $m (last 6 months) Land in place for growth in 2006 and largely in place for 2007 Good regional balance 37 Progress on strategy: four platforms for growth Focus on growing markets major beneficiaries of underlying trends Establish satellites in neighbouring markets land in place to support 2006 growth in Reno, Ft Myers and Daytona Beach Product development continued success of townhome product Performance improvement in Texas and exit from Atlanta Texas completions + sales proceeding up 53% in H1 Atlanta exit largely complete 38 Morrison Homes markets major beneficiaries of underlying trends 000s Job Growth Rank last 12 mths SF Permits Rank H1 2005 California 321 1 104 2 Florida 262 2 106 1 Texas 185 3 82 3 Arizona 116 6 43 6 Colorado 58 18 21 12 TOTAL 941 - 355 - Total US 2,947 887 Morrison Markets 32% 40% 39 Morrison Homes markets major beneficiaries of underlying trends 000s Job Growth Rank last 12 mths SF Permits Rank Morrison completions last 12 mths H1 2005 California 321 1 104 2 1,004 Florida 262 2 106 1 1,954 Texas 185 3 82 3 780 Arizona 116 6 43 6 528 Colorado 58 18 21 12 184 TOTAL 941 - 355 - 4,450 Total US 2,947 887 Morrison Markets 32% 40% 40 Progress on strategy: four platforms for growth Focus on growing markets major beneficiaries of underlying trends Establish satellites in neighbouring markets land in place to support 2006 growth in Reno, Ft Myers and Daytona Beach Product development continued success of townhome product Performance improvement in Texas and exit from Atlanta Texas completions + sales proceeding up 53% in H1 Atlanta exit largely complete 41 Summary Excellent first half performance visitor levels, sales rates, selling prices all up Strongly placed for second half 94% sold or completed for 2005 order book margins and prices above first half volumes may be held back by materials shortages Well-positioned for continued growth land already in place to support continuing volume growth in 2006 and largely in place for 2007 42 Strategy and outlook Peter Johnson Group Chief Executive Strategy Market background UK underpinned by continuing supply shortfall price growth likely to be limited opportunities at lower price points US underpinned by demographics and economy remains strong with wide regional variations will come off peak but remain at historically high levels 44 Strategy UK - focus remains on volume growth plans in place to deliver through expanding existing regions new Laing regions new George Wimpey satellites Government initiatives offer potential for new business implementation depends on market and land prices US - sustained volume growth “four platforms” growth plan in place land and detailed business plans in place to support growth these plans could deliver 10,000 unit business within 5 years 45 Outlook UK current sales rates ahead of same period 2004 premature to draw conclusions on autumn market if sales rates sustained, full year total volumes similar to 2004 by 1 September 90% completed or in order book margins in order book below first half actuals US visitor and sales rates remaining strong full year volumes still expected to be up c.10% small volume risk from materials and labour shortages by 1 September 94% completed or in order book margins and prices in order book above first half actuals 46 George Wimpey Plc Interim Results for the 26 weeks to 3 July 2005 APPENDIX Impact of IAS Balance sheet H1 2005 H1 2004 £m IAS UK GAAP IAS UK GAAP 45 44 29 29 Land 2,136 2,143 1,767 1,771 Land creditors (240) (244) (147) (151) Other current assets* 547 544 451 452 Tax & provisions (94) (103) (63) (69) Net pension deficit / SSAP 24 prepaid (145) - (129) - TOTAL NET ASSETS EMPLOYED 2,248 2,384 1,908 2,032 Fixed assets & JVs *Primarily elimination of interim dividend for IAS 48 Group reservations Reservations H1 2005 Ave sites Per outlet / per week H1 2004 H1 2005 H1 2004 H1 2005 H1 2004 GWUK private 5,936 6,641 321 294 0.71 0.87 GWUK affordable 1,201 - - - - GWUK TOTAL 7,137 7,476 321 294 - - US TOTAL 2,804 2,932 93 104 1.16 1.08 GROUP TOTAL 9,941 10,408 414 398 - - 835 49 GWUK turnover analysis H1 2005 H1 2004 H2 2004 full year volume 4,154 4,643 6,631 11,274 ave price £000s 194.5 194.9 192.4 193.5 turnover £m 808 905 1,276 2,181 volume 422 450 508 958 ave price £000s 87.7 85.9 92.5 89.8 37 39 47 86 Other turnover 13 8 26 34 TOTAL £m 858 952 1,349 2,301 Private - Affordable - turnover £m 2004 50 GWUK margin analysis H1 2005 H1 2004* H2 2004* 2004 full year* Gross profit £m 203.7 250.0 352.8 602.8 Gross margin % 23.7% 26.2% 26.1% 26.2% Selling expenses £m (40.5) (36.2) (39.8) (76.0) Overhead costs £m (56.5) (57.6) (59.4) (117.0) OPERATING PROFIT £m 106.7 156.2 253.6 409.8 Operating margin % 12.4% 16.4% 18.8% 17.8% 51 * restated for IAS GWUK PD product mix H1 2005 H2 2004 H1 2004 full year Apartments 34% 29% 32% 31% 2 / 3 bed houses 32% 29% 35% 32% 4 / 5 bed houses 34% 42% 33% 37% 100 100 100 100 Completions % 2004 52 GWUK PD price mix H1 2005 H1 2004 Completions % Completions % 0 0% 8 0% £51 – 100k 162 4% 344 7% £101 – 150k 1250 30% 1332 29% £151 – 200k 1325 32% 1400 30% £201 – 250k 792 19% 831 18% £251 – 300k 311 8% 323 7% £301 – 500k 268 6% 357 8% £500k + 46 1% 48 1% 4,154 100% 4,643 100% £0 – 50k Total 53 GWUK PD activity analysis Ave house size sqft Ave selling price £ / sqft H1 2005 H1 2004 H2 2004 2004 full year 1,015 1,069 1,008 1,033 192 182 190 187 54 GWUK PD geographic mix H1 2005 Legals Size sqft ASP £000 H1 2004 Legals Size sqft ASP £000 H2 2004 Legals Size sqft ASP £000 North 1,205 1,084 172 1,459 1,150 169 2,123 1,095 171 Midlands 1,307 979 168 1,593 1,033 173 1,983 953 166 South 1,202 970 206 1,055 1,036 212 1,843 958 204 City 79 Laing 361 1,129 316 423 1,088 308 506 1,149 329 Total 4,154 1,015 195 4,643 1,069 195 6,631 1,008 192 713 242 113 776 267 176 699 237 55 GWUK landbank by region Owned and controlled plots June June 2005 2004 Long term acres June 2005 June 2004 North 15,555 15,630 4,784 4,908 Midlands 12,360 12,147 5,329 5,497 South 16,648 16,078 6,218 7,720 City 3,559 2,398 - - Laing 6,258 4,648 - - Total 54,380 50,901 16,331 18,125 56 GWUK short term land H1 2005 H1 2004 H2 2004 full year - Start of period 37,222 33,559 34,191 33,559 Net additions 7,138 5,725 10,170 15,895 Legal completions (4,576) (5,093) (7,139) (12,232) End of period 39,784 34,191 37,222 37,222 CONTROLLED 14,596 16,710 13,897 13,897 TOTAL LANDBANK 54,380 50,901 51,119 51,119 OWNED 2004 57 GWUK owned land H1 2005 Short term Plots H1 2004 Cost per Value plot £k £m Plots Cost per Value plot £k £m Opening landbank 37,222 45.6 1,698 33,559 44.6 1,497 Additions 7,138 52.3 373 5,725 47.6 272 Completions (4,576) (47.9) (219) (5,093) (44.6) (227) End of period 39,784 46.6 1,852 34,191 45.1 1,542 Long term End of period Acres Value £m Acres Value £m 16,331 49 18,125 61 58 Morrison Homes turnover analysis H1 2005 H1 2004 H2 2004 full year 1,996 1,714 2,708 4,422 Ave selling price $000s 302 278 296 289 Turnover $m 603 476 801 1,277 Other turnover 18 8 5 13 TOTAL $m 621 484 806 1,290 Volume 2004 59 Morrison Homes margin analysis H1 2005 H1 2004* H2 2004* 2004 full year* Gross profit $m 168.3 116.4 200.5 316.9 Gross margin % 27.1% 24.0% 24.9% 24.6% Selling expenses $m (31.6) (26.7) (37.3) (64.0) Overhead costs $m (34.8) (29.4) (35.2) (64.6) OPERATING PROFIT $m 101.9 60.3 128.0 188.3 Operating margin % 16.4% 12.4% 15.9% 14.6% 60 * restated for IAS Morrison Homes price mix H1 2005 H1 2004 Completions % Completions % $0 – 200k 390 19% 344 20% $201 – 250k 395 20% 442 26% $251 – 300k 332 17% 318 19% $301 – 350k 265 13% 281 16% $351 – 400k 215 11% 190 11% $401 – 450k 172 9% 75 4% $451 – 500k 128 6% 20 1% $500k + 99 5% 44 3% 1,996 100% 1,714 100% Total 61 Morrison Homes activity analysis Ave house size sqft Ave selling price $ / sqft H1 2005 H1 2004 H2 2004 2004 full year 2,322 2,409 2,371 2,386 130 115 125 121 62 Morrison Homes geographic mix H1 2005 H1 2004 H2 2004 full year West 460 402 728 1,130 Southeast 932 816 1,276 2,092 Southwest 604 496 704 1,200 1,996 1,714 2,708 4,422 West 428 372 413 398 Southeast 282 260 263 262 Southwest 237 231 234 233 TOTAL 302 278 296 289 Completions TOTAL 2004 Average selling price 63 Morrison Homes regional performance Turnover H1 2005 H1 2004 $m $m Operating profit* Operating margin H1 2005 $m H1 2004 $m H1 2005 % H1 2004 % West 204 153 56.5 32.1 27.7% 21.0% Southeast 266 215 39.2 24.9 14.8% 11.6% Southwest 149 117 16.8 9.3 11.3% 8.0% Corporate 2 - (10.6) (6.0) - - 621 484 101.9 60.3 Total 16.4% 12.4% 64 * restated for IAS Morrison Homes short term land OWNED AND OPTIONS H1 2005 H1 2004 H2 2004 full year Start of period 18,892 15,304 17,456 15,304 Net additions 2,765 3,866 4,144 8,010 Legal completions (1,996) (1,714) (2,708) (4,422) End of period 19,661 17,456 18,892 18,892 End of period 3,058 2,606 2,687 2,687 TOTAL LAND BANK 22,719 20,062 21,579 21,579 156 108 174 282 2004 CONTROLLED LAND SPEND $m 65