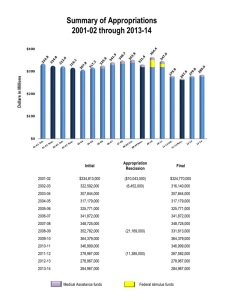

Portfolio Additional Estimates Statements 2011 12

advertisement