Just file it! - Michigan Credit Union League

advertisement

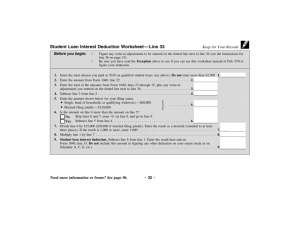

Just File It! Free tax preparation software provided to credit unions for their members Agenda • • • • JFI information for tax filers JFI implementation at your credit union VITA Contacts Information for Tax Filers Just file it! I-CAN! E-FILE www.icanefile.org I-CAN! E-File was created by the Legal Aid Society of Orange County (California) to help individuals complete their federal tax forms and claim EITC without being charged excessive fees. (Adobe Reader is needed. Download is available free of charge online.) – How does it work? • Go to the credit union homepage and click on the Just file it! We’ll help. icon which goes directly to the I-CAN! E-File site. • Taxpayers can access I-CAN! E-File via the Internet from their home, a library, a partner site or any other location with an Internet connection and a printer. • Taxpayers go through a series of secure web pages and input answers to simple, interactive questions in English or Spanish. • Once all of the questions have been answered, the information is compiled and placed on federal and/or state tax forms that can be e-filed or printed and mailed in. • It is similar to other popular tax filing software except it is completely free to use. What tax information is needed to file? • Social Security number • Spouse’s and children’s names as they appear on the Social Security card and their Social Security numbers • All forms that show the income you received in the past year including: – – – – W-2s from employment for filer, spouse if filing jointly and children Bank statements which show interest earned on deposits 1098Ts which list educational expenses Unemployment statements • Child care information: – Name, phone number and address of child care facility or individual – Amount paid during the year for child care – Federal taxpayer identification number or Social Security number of facility or individual – Whether or not employer pays part of the child care Steps in the filing process • Create an account with Name and Social Security Number or Tax Identification Number • Answer questions for federal and state return • Print and review return to make sure it is complete and correct • Mail or e-file return. Note: If e-filed the e-file status will be "Pending". • If e-filed return: • Come back to www.icanefile.org in 2-3 days and click on "Check My E-file Status" on the right. • If your status is "Rejected", the I-CAN! E-file status page correct the return and e-file again. • Once the status is "Accepted", the tax return has been filed with the IRS and state of Michigan. • Click the link on the right sidebar under "Where's my refund?" to track your federal and/or state refund. • YOUR TAX RETURN IS NOT FILED UNTIL YOUR E-FILE STATUS IS "ACCEPTED“ • If status is "pending" or "rejected" your return has not yet been filed with the IRS E-Filing • Electronic filing is available to taxpayers using I-CAN! E-File if those individuals have their own email account. • E-filing allows returns to be processed quickly. Projections are that these returns and credit will be deposited within 10 days. • E-filed returns are directly deposited into credit union accounts so E-filers must have the credit union routing number and their personal share or draft account number. Federal Forms and Worksheets that I-CAN! E-File can complete • • • • • • • • • • • • • • • • • • • • • • • • • • • • • 1040-EZ Tax Return for Single and Joint Filers With No Dependents 1040A US Individual Income Tax Return 1040 US Individual Income Tax Return Schedule A Itemized Deductions Schedule B Interest and Ordinary Dividends Schedule C Profit or Loss from Business Schedule C-EZ Net Profit From Business Schedule D Capital Gains and Losses Schedule D-1 Continuation Sheet for Schedule D Schedule E Supplemental Income and Loss Schedule EIC Earned Income Credit Schedule L Standard Deduction for Certain Filers Schedule M Making Work Pay Credit (1040 and 1040A) Schedule R Credit for the Elderly or the Disabled Schedule SE Self-employment tax Form 982 Reduction of Tax Attributes Due to Discharge of Indebtedness Form 2106 Employee Business Expenses Form 2441 Child and Dependent Care Form 3903 Moving Expenses Form 4137 Social Security and Medicare Tax on Unreported Tip Income Form 4562 Depreciation and Amortization Form 4684 Casualties and Thefts Form 4868 Automatic 6-Month Filing Extension Form 5329 Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts Form 5405 First Time Home Buyer Credit Form 5695 Residential Energy Credits Form 6251 Alternative Minimum Tax (1040) Form 8283 Noncash Charitable Contribution Form 8812 Additional Child Tax Credit • • • • • • • • • • • • • • • • • • • • • • • • • • • Form 8814 Parents' Election to Report Child's Interest and Dividends Form 8829 Expenses for Business Use of Your Home Form 8862 Information To Claim Earned Income Credit After Disallowance Form 8863 Education Credits (American Opportunity Credit and Lifetime Learning Credit) Form 8880 Credit for Qualified Retirement Savings Contributions Form 8888 Direct deposit into multiple accounts Form 8889 Health Savings Accounts (HSAs) Form 8917 Tuition and Fees Deduction Form 6251 Alternative Minimum Tax Form 1040-V Payment voucher Making Work Pay Credit (1040-EZ) EIC Worksheet A or B EIC Investment Income Child Tax Credit Worksheet Standard Deduction Worksheet Student Loan Interest Worksheet Social Security Benefits Worksheet IRA Deduction Worksheet Pensions and Annuities Simplified Method Worksheet Qualified Mortgage Worksheet Capital Loss Carryover Worksheet (Sch D) 28% Rate Gain worksheet (Sch D) Unrecaptured Section 1250 Gain (Sch D) Qualified Dividends and Capital Gain Tax (Sch D) Schedule D Tax (Sch D) Tax Computation (Sch D) Alternative Minimum Tax (1040A) Michigan Forms and Worksheets that I-Can E-File can Complete • • • • • • • • • • • MI-1040 Michigan Individual Income Tax Return MI-1040 Schedule 1 & 2 MI-1040CR Michigan Homestead Property Tax Credit Claim MI-1040CR-2 Michigan Homestead Property Tax Credit Claim For MI-1040CR-7 Michigan Home Heating Credit Claim Schedule CT Michigan College Tuition and Fees Credit Schedule W MI-4642 Michigan Voluntary Contributions Schedule MI-1040v Payment voucher Form 4 Application for Extension of Time to File Michigan Tax Returns Worksheets: Use Tax Worksheet, Worksheet 2 Filer eligible to be claimed as a dependent Credits and Deductions Federal Credits Federal Deductions • • • • • • • • • • • • Making Work Pay Earned income credit Child tax credit Additional child tax credit Child and dependent care credit Education credits (American Opportunity Credit and Lifetime Learning Credit) First-Time Homebuyer Credit for the elderly and disabled Savers credit Advance tax payments Excess social security and Tier 1 RRTA tax withheld • • • • • • • • • • • • Standard deduction (with additional property tax and vehicle sales tax deductions) Itemized deductions (including casualties and thefts, noncash charitable contributions, the qualified mortgage insurance premium deduction, and employee business expenses) Exemption for dependents, seniors and the blind Business expenses (including expenses for business use of the home, vehicle expenses, and depreciation) Self-employed health insurance deduction IRA deduction Tuition and fees deduction Student loan interest deduction Deduction for alimony paid Deduction for penalty on early withdrawal of savings Educator expenses Health savings account contribution deduction Moving expenses Credits and Deductions Michigan Specific Credits • • • • • • • • • • College tuition and fees credit Community foundation credit Home heating credit Homeless shelter/food bank credit Homestead property tax credit Homestead property tax credit for veterans and blind people Income tax paid to Michigan cities Michigan earned income tax credit Public contributions credit Vehicle donation credit Michigan Specific Deductions • Dividend/interest/capital gains deduction for seniors • Michigan education savings program deduction • Pension and annuity exclusion Because of the scope of I-CAN! E-File, you should NOT use it if: • • • • • • • • • • • • • You do NOT have Social Security Numbers (SSN) or Individual Taxpayer Identification Numbers (ITIN) that allow you to work in the U.S. You have lived and/or worked in more than one state during the year (if you are filing your state return) Your home address or your employer's address is in another country (including Mexico and Canada) You (or your spouse if filing together) own a business You (or your spouse if filing together) individually have more than one source of statutory income (W-2 Box 13) or nonemployee income (1099-MISC Box 7) You (or your spouse if filing together) are in the military You have an agreement to split credits, deductions or exemptions for your dependents with someone else You are disabled and you think you may be eligible to claim a deduction for care provided to you so your spouse could work (or vice versa) You received non-gaming tribal revenue You are a church employee or clergy member You received dependent care benefits You have a long-term care insurance contract You have a SEP (Simplified Employee Pension) or SIMPLE (Savings Incentive Match Plan for Employees of Small Employers) Income Limitations of I-Can E-File Because of the scope of I-CAN!® E-File, you should NOT use it if you have income from any of the following this year: • Capital gains or loss • Farm income, Rental income, Barter income • Bonds, Treasury bills • A child's interest or dividends (unless it is the Alaska Permanent Fund Dividend and the child is under age 14 at the end of 2009) • IRA lump sum or rolling distributions • You (or your spouse if filing together) received one or more 1099-R's with a distribution code OTHER THAN 1, 1&8, 2, 2&8, 3, 4, 4&G, 7, 8 or G • On a 1099-R (Pension, Annuity or IRA) if the distribution code is 1, 1&8, 2 or 2&8, I-CAN!® E-File will calculate an additional tax (10 % penalty on the taxable amount) on the early withdrawal that will appear on line 60 of Form 1040. Helpful Tips • Have ALL of tax documents before e-filing to speed up the filing process • In I-CAN! E-file you can "Save and Exit" • Once taxes are e-filed, information cannot be changed • Once the return is accepted, taxes cannot be efiled again • If returns need to be amended I-CAN! E-File cannot be used Just file it! We can help. I-Can E-File Launch Date : January 14, 2011 Go to www.icanefile.org to learn more Information for Participating Credit Unions Just File It! • Nearly 125 Credit Unions enrolled to participate as Just File It! Partners for the 2009 tax filing season • Over $13.5 million was returned to Michigan tax payers who used Just file it! through a local credit union Just file it! Timeline • After the webinar – MCUL will email credit unions a link to the Just file it! marketing materials (includes posters, teller tents, statement stuffers, press release, and newsletter fodder) found on MCUL’s website to use in promoting Just file it! to members – Staff can review the Just file it! demo for help in understanding the program. Link is sent via e-mail by MCUL. • Late December/early January – MCUL will send instructions to put Just file it! on the credit union homepage • • • • It includes a user name and password to access the MCUL website From the MCUL website, credit unions get the code to add the Just file it! credit union-specific link to your credit union website . Your Partner ID is embedded in this link we provide you. This is how you can track your progress. To allow members easy access to Just file it! place the link on the credit union homepage January 14, 2011 – The launch date for the Just file it! is January 14, 2011. Credit union specific links will be activated that day. • Late January/Early February – Credit unions will receive information to access the Taxpayer Reports – Reports contain how many people filed their taxes using the link on your website and the dollar amounts of the credits and refunds. Tracking Your Outreach Efforts • I-CAN! E-File provides real time usage information tracked by partner. – Number of filers – Amount returned broken down by federal and state – You will have an I-CAN! E-File Partner ID number – This ID number is embedded in the link that the MCUL will send you to put Just File It! on your homepage. – When a user completes their tax return with I-CAN! E-File, the totals of their tax dollars are added to the totals under your credit union/program name. You will also see how many filers used your site to file their taxes. Instructions to access these “Taxpayer Reports” will be sent to you by the MCUL. You will be directed to the I-CAN! E-File site to access these Reports. Promoting Just file it! • • • Publicize the availability and success of the program in your newsletters, statement stuffers and press releases to increase use Set up a computer kiosk and printer in a branch lobby for members without online access at home to file their taxes Just file it! can also be used by non-members – – Partner with a local college or library to designate days and times for their computers to be used for Just file it! by the community Work with organizations in the community to further promote use of Just file it! • • • • • VITA sites Local United Way Community Action Agencies Neighborhood organizations Local colleges Please let MCUL know the creative and successful ways credit unions promote Just file it! Just file it! Website • Materials ready to download and use – – – – – Posters teller tents newsletter articles statement stuffers all designed to help promote the Just file it! to members and within the community http://www.mcul.org/client/MCUL/Community_Reinvestment_Initiative/About_CRI/JFI/marketing_promo.php VITA Volunteer Income Tax Assistance • One-on-One hands on free tax preparation for low-income individuals • Tax preparer’s are volunteers who must pass IRS testing to participate • Sites located throughout Michigan VITA Resources How to find free tax preparation services • Call 2-1-1 • http://www.michiganeic.org/freetaxprep Contact Information • Stacy Dugan – Michigan Credit Union League – 1-800-262-6285 Ext. 458 or stacy.dugan@mcul.org • Kathryn Hall • Michigan Credit Union League • 1-800-262-6285 Ext. 470 or kathryn.hall@mcul.org