2012 Marketing Plan

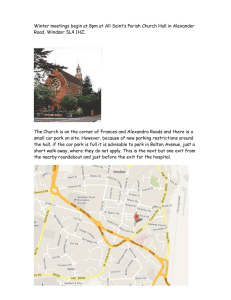

advertisement