13D/13F Filings

advertisement

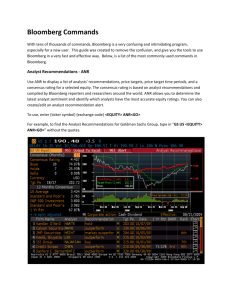

13D/13F Filings Filings required by the SEC for filing of beneficial holdings of a US Company (public shares that are publicly traded). 13D filings relate to the ownership of more than 5% of beneficial ownership of a US company with filing required within 10 days as well as for 1% increments and is designed to allow for transparency of intentions as such ownership in publicly traded stock may relate to hostile takeovers. 13F is a quarterly filing related to investment managers that own at least $100 million in equity assets under management. Dilemma: Many compliance teams struggle with creating automated reports for monitoring threshold requirements related to 13F and 13D. In actuality this task is very simple with technology that most asset managers have available to them in one way or another. For example if your firm uses Bloomberg directly as a trade order entry system or for feeding data into other systems, you have access to data that can be used for 13F and D reports. It’s as simple as using the API or TSAPI function built into Excel or identifying the data point for inclusion in other reporting tool that utilize Bloomberg data. Below are some simple steps you can take to build your own customized 13F and D reports. TSAPI TSAPI was developed by Bloomberg in conjunction with Microsoft Excel to allow you to easily build reports directly from Excel utilizing information that your firm stores in Bloomberg trading systems. Over the years it has become increasingly simpler to use and build these reports. Step 1: In the MS Excel spreadsheet click on the Bloomberg tab Step 2: Choose the “Import Trading Systems Data” icon and select either an account or account group in your Bloomberg database that you would like to run a report from Step 3: Select the fields that you would have appear in your report. Below are some examples of fields that might help with the threshold requirements involved in 13F reporting however you may want to add others. Note the “Security is Section 13F Member” field. This is the calc route or data point associated with 13F filings and returns a Y or N. Step 4: Click “Next” and then click “Finish” through the next two screens displayed below NOTE: Something similar to the below formula will display in Excel and then populate the information. In the future you’ll be able to use the formula that is given to automatically populate the report without opening the wizard. =BTSM("1234: ABC Corporation LLC","Account ID or Group ID","TRADER_NAME,SECURITY_TYP,POS_CN,PAR_AMT,US_SECTION_13F_SECURITY","SecFmt=ST","SecF ltr=AL","ResBy=SC","PosBy=C","PosIn1K=No","SecRisk=No","IncCash=No") ABC Corporation LLC/ACC-123 Book Security ID Security Name TRADER_N SECURITY_ POS_CN AME TYP ACC-123 ABC US ACC-123 DEF US ACC-123 GHI US ACC-123 JLM US ACC-123 NOP US ACC-123 QRS US ACC-123 TUV US ACC-123 ACC-123 ACC-123 ACC-123 ACC-123 ACC-123 ACC-123 ABC US Equity DEF US Equity GHI US Equity JLM US Equity NOP US Equity QRS US Equity TUV US Equity Common Stock Common Stock Common Stock Common Stock Common Stock Common Stock Common Stock PAR_AMT US_SECTI ON_13F_S ECURITY 1344400 0.01288 Y 575800 0.01 Y 627500 0.01 N 3438600 6.25E-06 Y 552200 0.4 N 1732600 0.02 N 902000 0.0123 Y From the above you can add your own formulas to measure thresholds or design VBA Macros to assign further automation. API Another method that Bloomberg users can employ is the standard API function. If you use Bloomberg and you have another system or reporting tool providing you with holdings information, than you can use the API function to pull Bloomberg data into your spreadsheet. As long as you format your data to display a ticker with exchange code and “EQUITY” as seen below in Column A and you enter the calc route field mnemonic in Column which in this case is “US_SECTION_13F_SECURITY” than you can enter a formula to retrieve the Y or N for each field. Step 1: Upon receiving a report ensure that at least one column of data displays the ticker with space and exchange code with space “EQUITY” together in one cell. Step 2: Enter a mnemonic “US_SECTION_13F_SECURITY” in a free cell Step 3: As per the below enter formula =BDP(A2, B$1). In this case A2 references the first cell of data I want to look up against B1 which is the mnemonic I want Excel to retrieve from Bloomberg. A $ in B1 allows me to copy this formula down the entire column. A 1 2 IBM US EQUITY 3 APPL US EQUITY B US_SECTION_13F_SECURITY =BDP(A2, B$1) Bloomberg will work with Excel to pull the data IBM US EQUITY APPL US EQUITY US_SECTION_13F_SECURITY Y …NA Requesting Data Eventually al the Y and N’s will appear automaticall IBM US EQUITY APPL US EQUITY US_SECTION_13F_SECURITY Y N Now you can further automate with VBA Macros and Excel formulas for designing the remainder of the report. No API or TSAPI? It is not uncommon for firms to use other systems for trade order management and Compliance. There are a number of suitable systems such as FrontArena, Charles River Development, etc. However, quite often firms use a data pipeline from Bloomberg to feed information and data into these other systems. If that is the case reach out to your IT teams and ask them about the Calc Route field mnemonic below. It may very well be possible to include this data into existing reports for the purpose of designing 13F threshold requirement reports. US_SECTION_13F_SECURITY