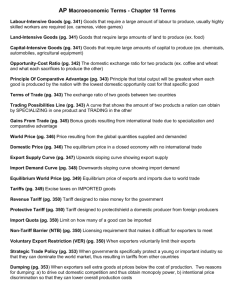

Ch5

advertisement

Ch. 5: The Standard Trade Model 1 Introduction The standard trade model combines ideas from the Ricardian model and the Heckscher-Ohlin model. 1. Differences in labor, labor skills, physical capital, land and technology between countries cause productive differences, leading to gains from trade. 2. These productive differences are represented as differences in production possibility frontiers, which represent the productive capacities of nations. 3. A country’s PPF determines its relative supply curve. 4. National relative supply curves determine world relative supply, which along with world relative demand determines an equilibrium under international trade. 2 Standard Model Food Cloth 3 Indifference Curves Consumer preferences and prices determine consumption choices. Consumer preferences are represented by indifference curves: combinations of goods that make consumers equally satisfied (indifferent). 4 Indifference Curves Indifference curves are downward sloping to represent the fact that if a consumer has more cloth he could have less food and still be equally satisfied. Indifference curves farther from the origin represent larger quantities of food and cloth, which should make consumers more satisfied and better off. Indifference curves are flatter when moving to the right: the more cloth and the less food that is consumed, the more valuable an extra calorie of food becomes relative to an extra m2 of cloth. 5 Standard Model Food -Pc/Pf Cloth 6 Why The Price Has to Change Given the high price of cloth and the relatively low price of food, more cloth is produced and less food is produced. In the absence of trade, the population wants more food and less cloth. Demand will raise the price of food and lower the price of cloth until the price line, PPF and indifference curves are all equal to each other. 7 Standard Model Food -Pc/Pf Qd Qs Cloth 8 Market for Cloth Price S D Qd Qs Quantity 9 Questions Show the same situation in terms of Supply and Demand in the Food Market. Using the PPF and indifference curves, show the amount of food produced and demanded at the given relative price line. 10 Market for Food Price S D Qs Qd Quantity 11 Standard Model Food -Pc/Pf -Pc/Pf Cloth 12 Determining Relative Prices 13 Introducing Trade Food -Pc/Pf Exports -Pc/Pf Cloth 14 Welfare Changes The change in welfare (income) when the price of one good changes relative to the price of another is called the income effect. The income effect is represented graphically by shifting the indifference curve. The substitution of one good for another when the price of the good changes relative to the other is called the substitution effect. This substitution effect is represented graphically by a moving along a given indifference curve. 15 Welfare and the Terms of Trade The terms of trade refers to the price of exports relative to the price of imports. When a country exports cloth and the relative price of cloth increases, the terms of trade increase or “improve”. Because a higher price for exports means that the country can afford to buy more imports, an increase in the terms of trade increases a country’s welfare. A decrease in the terms of trade decreases a country’s welfare. 16 Welfare Effect of Terms of Trade When a country’s Terms of Trade improves, i.e., the price of its exports rise relatively to the price of its imports, welfare increases. Question 3: Show the effect on welfare when the Terms of Trade worsens. 17 Welfare Effect of Terms of Trade Food -Pc/Pf -Pc/Pf Exports Cloth 18 The Effects of Economic Growth Growth is usually biased: it occurs in one sector more than others, causing relative supply to shift. Rapid growth has occurred in US computer industries but relatively little growth has occurred in US textile industries. According to the Ricardian model, technological progress in one sector causes biased growth. According to the Heckscher-Ohlin model, an increase in one factor of production (e.g., an increase in the labor force, arable land, or the capital stock) causes biased growth. 19 20 The Effects of Economic Growth Biased growth and the resulting shift in relative supply causes a change in the terms of trade. Biased growth in the cloth industry (in either the domestic or foreign country) will lower the relative price of cloth and lower the terms of trade for cloth exporters. Biased growth in the food industry (in either the domestic or foreign country) will raise the relative price of cloth and raise the terms of trade for cloth exporters. Suppose that the domestic country exports cloth and imports food. 21 22 Biased Growth Y The growth of the economy is biased toward X. In the diagram the relative prices, Px/Py, are constant. In fact, the higher relative supply of X would have lowered the Px/Py. X 23 Welfare Effect of Biased Growth Y If the bias is in favor of the exported good X, then the Terms of Trade change will be negative (Px down). The welfare of the citizens will be lower as the new indifference curve will be to the left of the one under constant Terms of Trade. X 24 The Effects of Economic Growth (cont.) Export-biased growth reduces a country’s terms of trade, generally reducing its welfare and increasing the welfare of foreign countries. Import-biased growth increases a country’s terms of trade, generally increasing its welfare and decreasing the welfare of foreign countries. 25 The Effects of Economic Growth Export-biased growth is growth that expands a country’s PPF disproportionally in production of that country’s exports. Import-biased growth is growth that expands a country’s PPF disproportionally in production of that country’s imports. 26 27 Welfare Effect of Biased Growth Y If the bias is in favor of the imported good X, then the Terms of Trade change will be positive. The new indifference curve will be situated northeast of the old one. X 28 Immiserizing Growth Y Growth in the export sector reduces the international price of the export commodity to such an extend that the country is worse off than it was before the growth: the brown indifference curve is below the white one. X 29 Has Growth in Asia Reduced the Welfare of US? The standard trade model predicts that import biased growth in China reduces the US terms of trade and the standard of living in the US. Import biased growth for China would occur in sectors that compete with US exports. But this prediction is not supported by data: there should be negative changes in the terms of trade for the US and other high income countries. In fact, the terms of trade for high income countries have been positive and negative for developing Asian countries. 30 Has Growth in Asia Reduced the Welfare of High Income Countries? 31 Income Transfers If a country were to donate a substantial amount of its income to the rest of the world, would its T/T improve or worsen? Say, US gave $1 trillion of its income away. If the marginal propensity to spend for each good is the same around the world, then no T/T will take place. Whatever US has reduced in demand for both products is matched by the increase in demand in rest of the world. 32 Income Transfers Again, suppose US donates income abroad. Suppose marginal propensity to spend for US exports is larger in US than abroad. The demand for products US exports will fall more due to lower US demand than the increase due to increase in foreign demand. The price for the US export good will fall. Terms of trade for US will worsen. 33 Income Transfers US gives foreign aid. Marginal propensity to spend for its export products is higher abroad. Terms of trade improves for US. Typically, foreign aid is tied to purchases from US, i.e. marginal propensity to spend by foreigners is one (100%). Foreign aid by US improves welfare in the US. 34 Aid Feb 19th 2009 From The Economist print edition http://www.economist.com/markets/indicators/displaystory.cfm?story_id=13145257 35 Income Transfers Typically, the marginal propensity to spend for domestic products is larger than that of imports. US has ¼ of world income; Americans “should” spend 25% of their income on American goods! For example, Americans spend 83% of their income on domestically produced goods and only 17% on imports. Foreigners spend 9% of their income on US products. Transfer of income from US without any restrictions should worsen US terms of trade. 36 Asian Crisis Loss of confidence in the ability of fast growing Asian countries to be able to pay their foreign debts made the investors pull out their savings. Dropping currency values made everyone shift their savings away. Transfer of income outside reduced the demand for their products; price of their exports fell and welfare was even more reduced. 37 Tariffs and Terms of Trade If a large country imposes an import tariff, internally, higher price of the product increases the supply but decreases the demand. International price of the imported good decreases. The large country benefits from an improvement of terms of trade. 38 Import Tariff and Welfare Home is exporting cheese and importing wine. Home imposes 50% tariff on imported wine. Internal price of wine has increased. Home produces more wine and less cheese. At the world relative prices, the relative supply of wine is increased if home is a large country. 39 Import Tariff and Welfare The higher price of wine at home will decrease demand for wine but increase demand for the relatively cheaper cheese. The relative demand curve for wine will shift left for a large country. TT for home (large country) rises; international Pw down because world demand is down. TT for foreign worsens unless foreign retaliates. If foreign is small, retaliation will not matter. 40 Import Tariff and Welfare Pw/Pc RS1 RS2 RD2 RD1 Wine/Cheese 41 Import Tariff and Welfare for Large Countries Wine Pc/Pw Cheese 42 Import Tariffs and Distribution of Income Across Countries If the domestic country imposes a tariff on food imports, the price of food relative to price of cloth that domestic citizens face is higher. Likewise, the price of cloth relative to the price of food that domestic consumers and producers pay is lower. Domestic producers will receive a lower relative price of cloth, and therefore will be more willing to switch to food production: the relative supply curve will shift. Domestic consumers will pay a lower relative price of cloth, and therefore be more willing to switch to cloth consumption: the relative demand curve will shift. 43 Import Tariffs and Distribution of Income Across Countries 44 Import Tariffs and Distribution of Income Across Countries When the domestic country imposes an import tariff, the terms of trade increases and the welfare of the country may increase. The magnitude of this effect depends on the size of the domestic country relative to the world economy. If the country is small part of the world economy, its tariff (or subsidy) policies will not have much effect on world relative supply and demand, and thus on the terms of trade. But for large countries, a tariff rate that maximizes national welfare at the expense of foreign countries may exist. 45 Import Tariff and Welfare For a small country, world prices will not change. Draw the PPF and world prices, indicating exports and imports. Show the effect of a tariff on imported wine on internal prices. Show the new production point and the effect on welfare. 46 Import Tariff and Welfare for Small Countries Wine Pc/Pw Cheese 47 Import Tariff and Welfare 48 Export Subsidies and Terms of Trade for Large Countries An export subsidy will increase the internal price and hence the production of the exported good. On the other hand, the internal demand for the exported good will fall because higher priced good is substituted by the lower priced import. International price of the exported good will fall leading to a deterioration of the terms of trade. 49 Export Subsidies and Distribution of Income Across Countries Cloth is exported and Food is imported. 50 Export Subsidy and Welfare (Large Country) Cheese Internal prices External prices (TT) Pw/Pc Wine 51 Export Subsidy and Welfare (Small Country) Cheese Internal prices External prices (TT) Pw/Pc Wine 52 Export Subsidies and Distribution of Income Across Countries When the domestic country imposes an export subsidy, the terms of trade decreases and the welfare of the country decreases to the benefit of the foreign country. 53 Distribution of Income Across Countries The two country, two good model predicts that an import tariff by the domestic country can increase domestic welfare at the expense of the foreign country. an export subsidy by the domestic country reduces domestic welfare to the benefit of the foreign country. 54 Import Tariffs and Export Subsidies in Other Countries A foreign country may subsidize the export of a good that the US also exports, which will reduce its price in world markets and decrease the terms of trade for the US. The EU subsidizes agricultural exports, which reduce the price that American farmers receive for their goods in world markets. A foreign country may put a tariff on an imported good that the US also imports, which will reduce its price in world markets and increase the terms of trade for the US. 55 Import Tariffs and Export Subsidies in Other Countries Export subsidies by foreign countries on goods that the US imports reduce the world price of US imports and increase the US terms of trade. Export subsidies by foreign countries on goods that the US also exports reduce the world price of US exports and decrease the US terms of trade. Import tariffs by foreign countries on goods that the US exports reduce the world price of US exports and decrease the US terms of trade. Import tariffs by foreign countries on goods that the US also imports reduce the world price of US imports and increase the US terms of trade. 56 Import Tariffs and Export Subsidies Export subsidies on a good decrease the relative world price of that good by increasing relative supply of that good and decreasing relative demand of that good. Import tariffs on a good decrease the relative world price of that good (and increase the relative world price of other goods) by increasing the relative supply of that good and decreasing the relative demand of that good. 57 Perverse Policies on Export Subsidies Many countries provide export subsidies to their industries and vigorously oppose export subsidies by its trading partners. Economic logic says just the opposite should be the case. Internal income distribution explains why governments undertake these impoverishing measures. 58 Import Tariffs, Export Subsidies and Distribution of Income Within a Country Generally, a domestic import tariff increases income for domestic import-competing producers by allowing the price of their goods to rise to match increased import prices, and it shifts resources away from the export sector. Generally, a domestic export subsidy increases income for domestic exporters, and it shifts resources away from the import-competing sector. 59