Biopure Corporation

advertisement

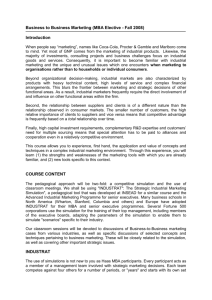

Biopure Corporation Pricing and Marketing a High-Tech Product Biopure: Invested so far: $200m Sales to date: $0 Only 2 products • “Blood substitutes” from bovine blood Oxyglobin Hemopure Veternary market Human market Just FDA approved 2 years to FDA approval Tolerates small hemoglobin molecules No small hemoglobin molecules (otherwise identical) Manager: Ted Jacobs Manager: Andy Wright The dilemma • What to do with Oxyglobin • Launch now – market is small and price sensitive • Or • Wait till Hemopure (market is large and price insensitive) is launched • Why the dilemma? Jacobs believes Oxyglobin price will influence Hemopure’s Questions raised in the case 1. Reasons for and against launching Oxyglobin 2. The market potential for Oxyglobin and Hemoglobin 3. The impact of Oxyglobin’s price on Hemopure 4. The challenge of how to go to market with Oxyglobin Reasons against launching Oxyglobin • O (@ ± $150/unit) will create downward pressure on H (@planned price $600-800) • Human market potential very large, animal market relatively small • No foreseeable competition in animal market, so launch after, not before H • H is bovine sourced, open to attacks from competitors with human sourced products. O will aggravate this position • Biopure is a “human products” company – why jeopardize this? • Biopure has limited production capacity – why devote this to O? • We don’t need the money – we have VC funding Reasons for launching Oxyglobin • Timing for H launch is still uncertain, no guarantee of FDA approval • Delaying O launch means giving up 2-3 years’ revenues • The products are in different markets, not interchangeable, no real opportunity for cross market comparisons • O has a 2 year first mover advantage in animal market • O marketing team is in place and ready to go The Potential for O Estimate 1 (from p5) 15000 practices (# of vet practices) X 800 dogs/yr/practice (dogs with acute blood loss) X 2.5% (% of dogs who get a transfusion) = 300000 units/year X $150/unit = $45 000 000 per year Estimate 2 (from p5, based on primary care vs emergency) 242250 units per year (=15000 practices X 95% primary care X 17 units/year) + 112500 units per year (=15000 practices X5% emergency care X 150 units/year) = 354750 units/year X $150/unit = $53 200 000 per year What’s your view on this forecast? It could be VERY conservative • While only 2.5% of dogs suffering from acute blood loss receive a transfusion, 30% would benefit from it • Transfusions in vet market are constrained due to : • Lack of adequate donor suply • Potential for –ve reaction • 84% dissatisfaction with current transfusion alternatives Viewed this way: • Then if all dogs who needed transfusions got them (i.e. 30% vs. 2.5%) • Then the market could be 12X times bigger • So 12 x the first forecast of $45m above = $540 000 000 p.a. • And 12 x the second of $53.2 = $638 500 000 • And we haven’t even begun to look at cats (35% of vet market) or bunny rabbits!! The Market for a Human Blood Substitute • As a wholesale replacement for donated blood (Exh 5) • Potential market = 11.3m units/year (8.1m acute blood loss; 3.2m chronic anemia) • At price of $700/unit the market is worth $7.9Bn/year • H is limited in chronic anemia • But, market is still HUGE! • As an alternative in Select Applications Only • Donated blood is – Well entrenched, widely accepted – Readily available, wellssupplied – Relatively inexpensive, (between $125-$225 unit) – Relatively safe • So, maybe only look at trauma cases, and borderline trauma cases Trauma Cases • 500 000 each year, in 90% transfusion is delayed; this delay partly responsible for 30% fatality rate (p.4) • H is well suited for these: – Easy to use (no typing) – Easy storage (long shelf life no refrigeration) – Low price sensitivity of consumer (pay or die?) The Trauma Market • 10% of trauma victims received ave 4 units blood each (i.e. 200 000 units [exh 5] to 50 000 patients) • Assume now that all patients now receive transfusions, then market is 2 000 000/year, X $700, and is worth $1.4Bn. The Borderline Transfusion Market • Surgeries in which here is only small blood loss (about 1.5 units, case p. 4) • IF this deamnd were to materialise then, then 1 000 000 cases x 1.5 units X $700/unit = ± $1bn/year Under these more conservative scenarios • The market is worth only between $1.4Bn and 2.4Bn/year • So human market cold be smaller than at first appeared The Competitive Environment Animal Market Human Market Potential about $500m/year Potential as high as $8Bn/year Biopure has a 2-5 year first mover advantage 2 significant competitors who have already entered phase 3 trials. Baxter especially is a major player Most likely competition would come from Baxter or Northfield; however their products are human based, so they are unlikely to divert resources Both Baxter and Northfield will likely highlight the fact that their products are based on human blood as opposed to bovine So what's a likely scenario in the human blood market? • Baxter takes lion’s share (50%), Biopure and Northfield fight for the rest (lets say 25% each). • Lets say the market also just turns out to be the trauma market. • A 25% share of that would mean 500 000 units and sales of $350 000 000 Will O impact on the Price of H? • According to Jacobs, yes. But is O the appropriate benchmark for H? Some price benchmarks: Some reference prices Description $101.50 $150 VC of goods sold (p.9) 150000 units of H@ a cost of $15m, independent of volume. Raw materials cost $1.50/unit, so COGS = $101.50 Jacobs’ estimate of O to vet $175 Ave cost of donated RBCS (case Exh 6) $300 Price of O to pet owner, simple doubling $350 Ave cost of autologous RBCs (case Exh 6) $600-$800 Planned price of competitor products $$$ The value of a human life For consumers, just how much of a guide is O to the price of H? • Most visible benchmark will be donated human blood – price = $175/unit • For risk averse recipients, benchmark is autologous blood = $350/unit • For trauma victims: “What is water worth to someone dying of thirst in the desert?” • If Baxter and Northfield price at $600-$800, then these, not O, become the benchmark prices • And……the products are not really interchangeable (the small molecules) SO……O looks like a “good thing” • But, it has to “go to market” and is anything but a “sure thing” • Biopure has never launched a product before • Biopure is new to the veterinary market • Company is dominated by technical and manufacturing types (see Exh 2) • Only recently employed someone to market O, and only 7 people supporting him • Vet market can be price sensitive and vets can be gatekeepers (“Mrs. Jones, your Fluffy needs a blood transfusion, but is expensive, and he’s old) Target Markets • Comprehensive (whole vet market) • Or • Selective (those practices that perform the greatest number of transfusions) • Distribution – Independent – Direct salesforce O Pricing • Options: • Price low (e.g., $100) – pros and cons • Price high (e.g. $200) – target emergency care • Price very high (e.g. $400) • Also look at consumer’s willingness to pay (tables A & B) – vets are more price sensitive than pet owners So….. Would you launch Oxyglobin? Oxyglobin was launched in April 1998 • Price = $150, sold directly to vets, focusing on emergency care practices • Initial sales promising and product received praise from customers • But, vets viewed O in one of 2 ways: – 50% saw it as a replacement for donated blood – 50% saw it as an “emergency alternative” to donated blood – thus used it only in special cases • By end of 1998, annualized sales were 50 000 units, penetration of between 15-20% of all vet practices