Ven conmigo - Pontificia Universidad Javeriana

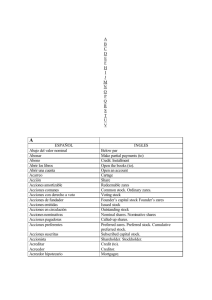

advertisement