Fiscal Policy

advertisement

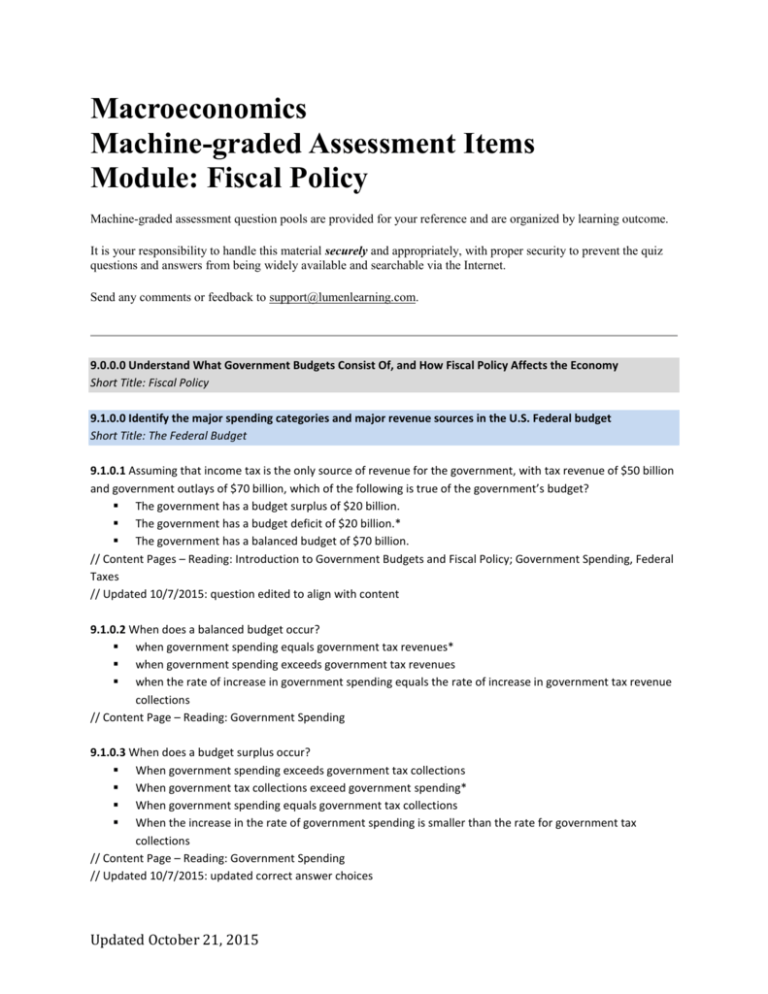

Macroeconomics Machine-graded Assessment Items Module: Fiscal Policy Machine-graded assessment question pools are provided for your reference and are organized by learning outcome. It is your responsibility to handle this material securely and appropriately, with proper security to prevent the quiz questions and answers from being widely available and searchable via the Internet. Send any comments or feedback to support@lumenlearning.com. 9.0.0.0 Understand What Government Budgets Consist Of, and How Fiscal Policy Affects the Economy Short Title: Fiscal Policy 9.1.0.0 Identify the major spending categories and major revenue sources in the U.S. Federal budget Short Title: The Federal Budget 9.1.0.1 Assuming that income tax is the only source of revenue for the government, with tax revenue of $50 billion and government outlays of $70 billion, which of the following is true of the government’s budget? The government has a budget surplus of $20 billion. The government has a budget deficit of $20 billion.* The government has a balanced budget of $70 billion. // Content Pages – Reading: Introduction to Government Budgets and Fiscal Policy; Government Spending, Federal Taxes // Updated 10/7/2015: question edited to align with content 9.1.0.2 When does a balanced budget occur? when government spending equals government tax revenues* when government spending exceeds government tax revenues when the rate of increase in government spending equals the rate of increase in government tax revenue collections // Content Page – Reading: Government Spending 9.1.0.3 When does a budget surplus occur? When government spending exceeds government tax collections When government tax collections exceed government spending* When government spending equals government tax collections When the increase in the rate of government spending is smaller than the rate for government tax collections // Content Page – Reading: Government Spending // Updated 10/7/2015: updated correct answer choices Updated October 21, 2015 9.1.0.4 Which of the following is a major component of US government spending? Net export expenditures Medicare and social security expenditures* Payments to secure gold in order to back money supply // Content Page – Reading: Government Spending 9.1.0.5 Which of the following statements about government spending is true? Federal spending has accounted for 18-22% of GDP most of the time since the 1960’s.* The share of defense spending in GDP has increased substantially since the 1960’s. The shares of social security and health care spending in GDP have grown steadily since the 1960’s.* Interest payments on government debt are not counted as part of government spending. // Content Pages – Reading: Introduction to Government Budgets and Fiscal Policy, Government Spending, Federal Taxes // New 10/7/2015 9.1.0.5 Which of the following statements about an entitlement is true? An entitlement is an item that is included automatically in the government’s budget.* An entitlement is an item that sends money to the owners of a property. An entitlement is an item that the wealthy receive from the government. An entitlement is an item that accounts for changes in new housing starts. // Content Pages – Reading: Introduction to Government Budgets and Fiscal Policy, Government Spending, Federal Taxes // Removed 10/7/2015 9.1.0.6 Which of the following statements accurately differentiates a budget deficit and national debt? A budget deficit occurs every year; the national debt occurs every five years. A budget deficit occurs in one year when the government spends less than it receives; national debt is an accumulation of budget deficits over time. A budget deficit occurs in one year when the government spends more than it receives; national debt is an accumulation of budget deficits over time.* A budget deficit is the result of Democratic control of Congress; national debt is something we can pay off next year. // Content Page – Reading: Government Spending 9.1.0.7 A government annually collects $210 billion in tax revenue and allocates $70 billion to military spending. What percentage of this government’s budget is spent on its military? 27% 36% 33% * 41% // Content Page - Reading: Government Spending // Updated 10/7/2015: answer choices updated 9.1.0.8 A government annually collects $320 billion in tax revenue and allocates $80 billion to education spending. What percentage of this government’s budget is spent on education? Updated October 21, 2015 25%* 12% 30% 1% // Content Page – Reading: Government Spending 9.1.0.9 By June 2010, the U.S. government owed $13.6 trillion dollars ___________ that, over time, has remained unpaid. from decreases in excise tax from decreases in income tax in accumulated government debt * from decreases in corporate tax // Content Page – Reading: Government Spending 9.1.0.10 A ______________________ is created each time the federal government spends more than it collects in taxes in a given year. budget deficit* budget surplus corporate tax regressive tax // Content Page – Reading: Government Spending 9.1.0.11 Which of the following terms is used to describe the set of policies that relate to government spending, taxation, and borrowing? financial policies monetary policies fiscal policies* economic policies // Content Page – Reading: Introduction to Government Budgets and Fiscal Policy 9.1.0.12 A ______________________ means that government spending and taxes are equal. fiscal budget balanced budget* contractionary fiscal policy discretionary fiscal policy // Content Page – Reading: Government Spending // Updated 10/7/2015: answer choices edited 9.1.0.13 A __________________________ policy will cause the same share of income to be collected from those with high incomes than from those with lower incomes. proportional tax* regressive tax flat tax* excise tax // Content Page – Reading: Federal Taxes // Updated 10/7/2015: answer choices edited to align with content Updated October 21, 2015 9.1.0.14 If government tax policy requires Jane to pay $25,000 in taxes on annual income of $250,000 and Mary to pay $10,000 in tax on annual income of $100,000, then the tax policy is: regressive. flat.* proportional.* optional. // Content Page – Reading: Federal Taxes // Updated 10/7/2015: answer choices edited 9.1.0.15 If government tax policy requires Peter to pay $15,000 in tax on annual income of $200,000 and Paul to pay $10,000 in tax on annual income of $100,000, then the tax policy is: optional. progressive. proportional. regressive.* // Content Page – Reading: Federal Taxes // Removed 10/7/2015 9.1.0.16 A __________________________ policy will cause a greater share of income to be collected from those with high incomes than from those with lower incomes. proportional tax regressive tax progressive tax * excise tax // Content Page – Reading: Federal Taxes // Removed 10/7/2015 9.1.0.17 What do goods like gasoline, tobacco, and alcohol typically have in common? A proportional tax is imposed on each of them. A regressive tax is imposed on each of them. They are all subject to government excise taxes. * They are not subject to government fiscal taxes. // Content Page – Reading: Fiscal Policy, Glossary // Updated 10/7/2015: answer choices edited 9.1.0.18 In 2010, Microsoft will pay corporate income tax to the federal government based on the company’s __________________. proportional tax rate profits* progressive tax rate holdings // Content Page - Reading: Federal Taxes // Updated 10/7/2015: answer choices edited Updated October 21, 2015 9.1.0.19 A government annually collects $200 billion in tax revenue and allocates $20 billion to its universal healthcare spending. What percentage of this government’s budget is spent on healthcare? 12% 10% * 16% 21% // Content Page – Reading: Government Spending 9.1.0.20 A government collects $600 billion annually in tax revenue. Each year it allocates $35 billion to healthcare and $25 billion for education. What percentage of annual tax revenue is allocated to these two categories of government spending? 10%* 14% 17% 26% // Content Page – Reading: Government Spending 9.1.0.21 A government collects $700 billion annually in tax revenue. Each year it allocates $140 billion to interest payments that it must pay on its accumulated debt. What percentage of annual tax revenue is allocated to make these interest payments? 17% 28% 20%* 27% // Content Page – Reading: Government Spending 9.2.0.0 Identify the major spending categories and major revenue sources in U.S. state and local budgets Short Title: State and Local Budgets 9.2.0.1 If the state of Washington’s government collects $75 billion in tax revenues in 2013 and total spending in the same year is $74.8 billion, the result will be a: budget deficit. budget surplus.* decrease in payroll tax. decrease in proportional taxes. // Content Page – Reading: State and Local Government Spending // Removed 10/7/2015 9.2.0.1 State and local government spending is mostly allocated to: education.* police and fire protection.* national defense. Updated October 21, 2015 Social Security. // Content Page – Reading: State and Local Government Spending // New 10/7/2015 9.2.0.2 Most spending on K-12, college, and university’s is provided by: state and local spending.* federal spending. federal, state, and local spending equally. local spending only. // Content Page – Reading: State and Local Government Spending // New 10/7/2015 // 3. If the government for the state of Washington collects $65.8 billion in tax revenues in 2013 and total spending in the same year is $74.8 billion, the result will be: // A. an increase in payroll tax. // B. an increase in excise tax. // C. a budget surplus. // D. a budget deficit.* // Removed 10/7/2015 // 1. If South Dakota's governor reports a budget surplus in 2011, that state government likely: // A. received more in taxes than it spent in that year. * // B. increased the proportional tax level. // C. equalized spending and taxes in that year. // D. increased the corporate income tax rate. // Removed 10/7/2015 9.2.0.3 If a state with a balanced budget law runs a budget surplus, its options include: a tax increase. a tax cut.* a spending increase.* draw down of previous budgetary savings. // Content Page – Reading: State and Local Government Spending // New 10/7/2015 9.2.0.4 State and local tax revenue sources include: sales taxes.* income taxes.* social security taxes. revenues from the federal government.* // Content Page – Reading: State and Local Taxes // New 10/7/2015 9.3.0.0 Define fiscal policy and identify the roles of tax rates and government spending Short Title: Fiscal Policy and Tax Rates Updated October 21, 2015 9.3.0.1 Which of the following terms is used to describe the set of policies that relate to government spending, taxation, and borrowing? financial policies monetary policies fiscal policies* economic policies // Content Page – Reading: Fiscal Policy // Removed 10/7/2015 9.3.0.1 Which of the following affect aggregate demand? Federal government spending.* Tax rates on consumption.* Crop failures due to weather events. Tax rates on corporate investment.* // Content Page - Reading: Fiscal Policy // New 10/7/2015 9.3.0.2 The government can use _____________ in the form of ____________________ to increase the level of aggregate demand in the economy. an expansionary fiscal policy; an increase in government spending* a contractionary fiscal policy; a reduction in taxes a contractionary fiscal policy; an increase in taxes an expansionary fiscal policy; an increase in corporate taxes // Content Page - Reading: Fiscal Policy // Moved to enabling outcome “Discretionary Fiscal Policy” 10/7/2015 9.3.0.3 Fiscal policy includes: changes in taxes.* changes in government expenditure.* changes in the money supply. // Content Page – Reading: Fiscal Policy // New 10/7/2015 9.3.0.2 When the government increases its spending, it is conducting fiscal policy.* monetary policy. supply-side policy. // Content Page – Reading: Fiscal Policy 9.4.0.0 Differentiate between discretionary and automatic fiscal policy Short Title: Discretionary and Automatic Fiscal Policy 9.4.a.0 Define Automatic Stabilization Tools Short Title: Automatic Fiscal Policy Updated October 21, 2015 9.4.a.1 Which of the following is an example of an automatic fiscal policy stabilizer? Decrease in tax revenues as real GDP decreases.* A law passed by Congress to raise taxes. The government decides to cut its spending. Personal tax rates are changed. // Content Page – Reading: Fiscal Policy and Stabilizers: Automatic Stabilizers 9.4.a.2 _____________________ are a form of tax and spending rules that can affect aggregate demand in the economy without any additional change in legislation. Standardized employment budgets Discretionary fiscal policies Automatic stabilizers* Budget expenditures // Content Page – Reading: Fiscal Policy and Stabilizers: Automatic Stablizers 9.4.a.3 If an economy moves into a recession, causing that country to produce less than potential GDP, then: automatic stabilizers will cause tax revenue to decrease and government spending to increase.* automatic stabilizers will cause tax revenue to increase and government spending to decrease. tax revenue and government spending will be higher because of automatic stabilizers. tax revenue and government spending will be lower because of automatic stabilizers. // Content Page – Reading: Fiscal Policy and Stabilizers: Automatic Stabilizers 9.4.a.4 If Canada’s economy moves into an expansion while its economy is producing more than potential GDP, then: government spending and tax revenue will increase because of automatic stabilizers. government spending and tax revenue will decrease because of automatic stabilizers. automatic stabilizers will increase government spending and decrease tax revenue. automatic stabilizers will decrease government spending and increase tax revenue.* // Content Page – Reading: Fiscal Policy and Stabilizers // Removed 10/7/2015 9.4.a.4 If an economy moves into a recessionary period, examples of fiscal policies that act as automatic stabilizers include(s): An increase in transfer spending, such as unemployment benefits.* A decrease in tax revenues as household incomes fall.* A flat tax on households’ income. An increase in government defense spending. // Content Page – Reading: Fiscal Policy and Stabilizers: Automatic Stabilizers // New 10/7/2015 9.4.a.5 _____________________ are a form of tax and spending rules that can affect aggregate demand in the economy without any additional change in legislation. Standardized employment budgets Discretionary fiscal policies Automatic stabilizers* Fixed budget expenditures Updated October 21, 2015 // Content Page – Reading: Fiscal Policy and Stabilizers: Automatic Stabilizers // Updated 10/7/2015: answer choices edited 9.4.a.6 During a recession, if a government uses an expansionary fiscal policy to increase GDP, the: aggregate supply curve will shift to the right. aggregate supply curve will shift to the left. aggregate demand curve will shift to the left. aggregate demand curve will shift to the right.* // Removed 10/7/2015 9.4.a.6 During a recession, automatic stabilizers include(s): Unemployment benefits.* Income tax revenues.* Income tax rates. Social Security payments. // Content Page – Reading: Fiscal Policy and Stabilizers: Automatic Stabilizers // New 10/7/2015 9.4.b.0 Define discretionary fiscal policy Short Title: Discretionary Fiscal Policy 9.4.b.1 When inflation begins to climb to unacceptable levels in the economy, the government should: use contractionary fiscal policy to shift aggregate demand to the right. use contractionary fiscal policy to shift aggregate demand to the left.* use expansionary fiscal policy to shift aggregate demand to the right. use expansionary fiscal policy to shift aggregate demand to the left. // Content Page – Reading: Fiscal Policy and Stabilizers & Counter Balancing Recession and Boom 9.4.b.2 The government can use _____________ in the form of ____________________ to increase the level of aggregate demand in the economy. an expansionary fiscal policy : an increase in government spending * a contractionary fiscal policy : a reduction in taxes a contractionary fiscal policy : an increase in taxes an expansionary fiscal policy : an increase in corporate taxes // Content Page – Reading: Fiscal Policy and Stabilizers // Updated 10/7/2015 9.4.b.3 If a government reduces tax rates in order to increase the level of aggregate demand, what type of fiscal policy is being used? discretionary.* contractionary. automatic. expansionary.* // Content Page – Reading: Counter Balancing Recession and Boom // Updated 10/7/2015: question and answer choices edited Updated October 21, 2015 9.4.b.4 A typical ____________________________ fiscal policy allows government to decrease the level of aggregate demand, through increases in tax rates. expansionary contractionary * discretionary* automatic // Content Page – Reading: Fiscal Policy and Stabilizers // Updated 10/7/2015: question and answer choices edited 9.4.b.5 When the government passes a new law that explicitly increases overall tax rates and reduces spending levels, it is enacting: discretionary fiscal policy.* automatic fiscal policy. contractionary fiscal policy.* monetary policy. // Content Page – Reading: Fiscal Policy and Stabilizers: Discretionary Fiscal Policy Tools // Updated 10/7/2015: question and answer choices edited 9.4.b.6 Which of the following is an example of an expansionary fiscal policy? Increase in defense spending to promote national security* Increase in interest rates Decrease in interest rates Change taxes and/or government expenditure to reduce the current account deficit // Content Page – Reading: Fiscal Policy and Stabilizers // Removed 10/7/2015 9.4.b.6 Which of the following is an example of an expansionary, discretionary fiscal policy? Increase in government purchases.* Increase in tax rates. Reduction in tax rates.* Increase in transfer payments.* // Content Page – Reading: Fiscal Policy and Stabilizers: Discretionary Fiscal Policy Tools // New 10/7/2015 9.4.c.0 Differentiate between structural and cyclical budget balance Short Title: Standardized vs. Actual Budget Figures 9.4.c.1 If the economy is producing less than its potential GDP, _____________________ will show a smaller deficit than the actual deficit. discretionary fiscal policy the automatic stabilizers the standardized employment deficit * expansionary fiscal policy // Content Page – Reading: The Standardized Employment Deficit or Surplus Updated October 21, 2015 9.4.c.2 When a country’s economy is producing at a level that exceeds its potential GDP, the standardized employment deficit will show a __________________ than the actual deficit. smaller surplus smaller deficit larger deficit * // Content Page – Reading: The Standardized Employment Deficit or Surplus // Updated 10/7/2015: answer choices edited 9.4.c.3 A standardized deficit differs from an actual budget deficit because it: eliminates the impacts of automatic stabilizers on the government deficit.* includes the impacts of automatic stabilizers on the government deficit. includes the impacts of discretionary countercyclical spending on the deficit. // Content Page – Reading: The Standardized Employment Deficit or Surplus // Removed 10/7/2015 9.4.c.3 When a country’s economy is producing at a level that is below its potential GDP, the standardized employment deficit will show a __________________ than the actual deficit. smaller surplus smaller deficit* larger deficit // Content Page – Reading: The Standardized Employment Deficit or Surplus // New 10/7/2015 9.5.0.0 Compare and contrast expansionary and contractionary fiscal policies Short Title: Expansionary and Contractionary Fiscal Policies 9.5.0.1 A decrease in government expenditure shifts the AD curve to the ________________ and a decrease in taxes shifts the AD curve to the _______________. right : left right : right left : right* left : left // Content Page – Reading: Using Fiscal Policy to Fight Recession Unemployment and Inflation // Updated 10/7/2015 9.5.0.2 Assume that laws have been passed that require the federal government to run a balanced budget. During a recession, the government will want to implement _____________________, but may be unable to do so because such a policy would ____________________________. contractionary fiscal policy; lead to a budget deficit discretionary fiscal policy; lead to a budget surplus contractionary fiscal policy; lead to a budget surplus expansionary fiscal policy; lead to a budget deficit * // Content Page – Reading: Using Fiscal Policy to Fight Recession Unemployment and Inflation // Removed 10/7/2015 Updated October 21, 2015 9.5.0.2 An expansionary fiscal policy can increase the level of aggregate demand by ___________________________. cutting tax rates to increase disposable income and spending.* reducing corporate tax rates to increase investment spending.* decreasing government purchases. reducing grants to state and local governments. // Content Page – Reading: Using Fiscal Policy to Fight Recession Unemployment and Inflation // New 10/7/2015 9.5.0.3 A decrease in aggregate demand as a consequence of government decisions to alter its levels of expenditure and revenues involves which of the following? Increases in tax rates and collections and decreases in spending* Decreases in tax rates, collections, and spending Decreases in spending Increases in spending and decreases in tax rates and collections // Content Page – Reading: Using Fiscal Policy to Fight Recession Unemployment and Inflation 9.5.0.4 An increase in aggregate demand as a consequence of government decisions to alter its levels of expenditure and revenues involves which of the following? Increases in tax rates and collections, and decreases in spending. Decreases in tax rates, collections, and spending. Decreases in spending. Increases in spending and decreases in tax rates and collections.* // Content Page – Reading: Using Fiscal Policy to Fight Recession Unemployment and Inflation 9.6.0.0 Compare and contrast the way tax changes and government spending changes work Short Title: Changes in Tax and Spending 9.6.0.1 In an attempt to boost the economy, the government’s expansionary fiscal policy would include which of the following? Increased taxation Cutting government expenditure Cutting tax rates* Control the money supply // Content Page – Reading: Tax Changes 9.6.0.2 If an economy’s potential GDP is at $ 300 billion, but it has a real GDP of $ 350 billion, what should the government do in order to move the economy to the level of potential GDP? Increase taxes and increase government expenditure. Increase taxes and decrease government expenditure.* Decrease taxes and increase government expenditure. Decrease taxes and decrease government expenditure. // Content Page – Reading: Tax Changes // Removed 10/7/2015 Updated October 21, 2015 9.6.0.2 An increase in government purchases shifts the aggregate demand curve to the right by an amount equal to the: initial increase in government purchases. multiplier. initial increase in government purchases times the multiplier.* change in government purchase divided by the multiplier. // Content Page – Reading: Tax Changes // New 10/7/2015 9.6.0.3 Which of the following can the government use as a tool of fiscal policy if it wants to increase the level of real GDP in the economy? A cut in taxes* A decrease in government expenditure An increase in government expenditure* // Content Page – Reading: Tax Changes 9.6.0.4 Which of the following can the government use as a tool of fiscal policy if it wants to decrease the level of real GDP in the economy? A cut in taxes A decrease in government expenditure* An increase in government expenditure // Content Page – Reading: Tax Changes 9.6.0.5 Suppose that a rise in business confidence has led to more investment in the economy and higher levels of output. In the short-run, the rise in aggregate demand will: lower unemployment. * cause government to lower taxes. cause government to increase spending. exports will drop. // Content Page – Reading: Tax Changes // New 10/15/2015 Updated October 21, 2015