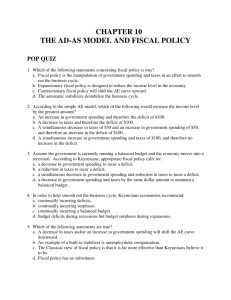

How does fiscal policy affect economic activity and income

advertisement

How does fiscal policy affect economic activity and income distribution in the Australian economy? Fiscal policy is the use of government expenditure and revenue collection to influence the economy. Fiscal policy is used to achieve sustainable growth, reallocation of resources and the redistribution of income. The primary tool used to exercise fiscal policy is the budget; it outlines the governments planned revenues and expenditures over the following financial year. Changes in government spending, direct (personal and company) and indirect taxation (GST, custom duties), public revenues and the budget balance can be used “counter-cyclically” to help smooth out some of the volatility of national output particularly in the distribution of income sector and when the economy has experienced an external shock and is in a recession. Fiscal policy involves the use of government spending, taxation and borrowing to affect the level and growth of aggregate demand, output and jobs. The Keynesian model argues that fiscal policy can have powerful effects on demand, output and employment when the economy is operating below full capacity national output, and where there is a need to provide a demand-stimulus. An expansionary stance of fiscal policy involves a net increase in government spending (G > T) through rises in government spending or a fall in taxation revenue or a combination of the two. This will lead to a larger budget deficit or a smaller budget surplus than the government previously had. This is done in times of recession to stimulate the economy. If the budget goes into deficit, this can have a significant impact on the level of savings in an economy. Therefore, the government must fund spending by borrowing from the private sector. This will hence lead to an increase in public sector debt which will ultimately lead to dis-savings and a reduction on the level of national savings in an economy. Dis-saving will lead to the crowding out effect, which will in turn lead to an increase in foreign liabilities as the economy looks overseas to fund domestic investment. Hence, this will therefore contribute to a larger deficit on the net income account, thus raising the CAD. An expansionary policy will lead to a multiplied increase in consumption and investment, thus impacting aggregate demand and economic activity. Conversely, fiscal policy can shift economic activity in the opposite direction by discouraging consumption and aggregate demand through an increased tax system. A contractionary fiscal policy (G < T) occurs when net government spending is reduced either through higher taxation revenue or reduced government spending or a combination of the two. This would lead to a lower budget deficit or a larger surplus than the government previously had. This is done in times of excessive growth to slow the economy. Currently, the Abbot government has implemented the Budget 2014 fee on medical visits ($7), increased university fees, levy, reduction of welfare payments – in order to achieve a fiscal surplus (A positive balance that occurs when total government revenue will exceed total expenditure) and reduce Australia’s deficit. The likely result of the Budget 2014 will be a restrain on economic growth as it will limit low income earners to spend due to reduced welfare payments and increased taxation as well as restricting high income earners because of the levy. A contractionary policy will lead to a multiplied decrease in consumption and investment, thus dampening aggregate demand and economic activity. Furthermore, governmental changes to social welfare and unemployment benefits are another way that the government can produce a more equitable distribution of income. An expansionary policy will increase government spending, hence impacting consumption and aggregate demand and making a more equitable gap between the rich and the poor through reducing unemployment. A reduction in unemployment largely impacts lower income earners, because they tend to be the section of the labour force prone to cyclical unemployment, while higher income earners are less affected. As such, expansionary spending to reduce unemployment tends to improve income distribution. However, government spending cuts can increase income inequality as government spending is often relied upon by low income earners. A contractionary fiscal policy, such as lifting tax rates, disproportionately impacts lower income earners, because rising unemployment occurs and is known to broaden the inequality as less people are receiving income. A contractionary stance can widen the inequitable level of income in Australia even though it is substantially equal on the Lorenz curve (0.3) in comparison to other nations. As seen by the current budget; according to the ABS the unemployment rate has risen to 6.5% over the past 6 months. Hence, the government’s progressive tax system enables them to redistribute income from the rich to the poor and can also cause the vice versa. Hence, through the examination of the impact of fiscal policy, it can be determined that this form of macroeconomic policy can have both beneficial and detrimental effects on economic activity as it is able to shift the level of aggregate demand and consumption. Similarly, it has the same influence on the distribution of income as it has varying impacts similar to the level of economic activity.