Executive Summary

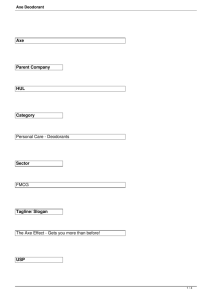

advertisement

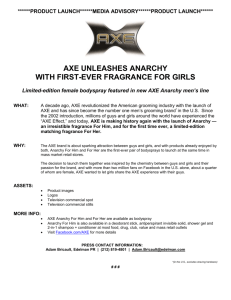

Executive Summary Nimal Nithyanandam Nivedita Sen Rammohan.M.P Sriram.S.R History of Maggi Noodles Due to the robust growth of male interest in improving Body image, new light started shining on the grooming product market. A 21.7 billion dollar industry and growing- it is becoming a target for many cosmetic companies. But if we go back 26 years to 1983, the British –Dutch company Unilever launched its brand of male grooming products marketed towards the young male demographic, called axe in France. Inspired by another of Unilever’s brands, Impulse a fragranced deodorant body spray for women that promised wearers’ male attention Unilever were keen to capitalise on Axe’s French success and the rest of Europe from 1985 onwards, later introducing the other products in the range. Unilever were unable to use the name axe in the United Kingdom and Ireland due to trademark problems so it was launched as Lynx in the United Kingdom, the Republic of Ireland, Australia, and New Zealand. Positioning Axe markets itself as the naughtiest brand in the Indian market. The brand is targeted at males aged 16-25.all its campaigns revolve round this central theme of seduction where the girl makes the first move. This has a lot of subliminal implications. The brand assumes that men like to be seduced. That feeling of being seduced gives a big boost of self-confidence to a man. Although many brands take this proposition, axe just made it perfect. Axe has been transformed into an icon in the “game of seduction,” ”a seduction tool, easing the transition from adolescence to manhood.” To the straight men in age from 16 to 25, who portray normal yet cool, trendy and confident, AXE is a leader brand in male grooming products that provides cool, adventurous and designed to help them look, smell, feel their best, and to keep them a step ahead in the dating game. Advertising and Sales Promotion In all its tv commercials, print ads and bill boards,axe has tried to attract people with it’s humor.The mainstay of Axe’s communication strategy has been its advertisements. It has something to do with the nature of the retail trade in the country. Deodorants, like other skincare products, are still bought by and large in grocery stores. Such stores do not stock testers. So all that a consumer can do is use the imagery that the various brands have created in his mind. The Axe ads are imported from abroad and tweaked for India. Lowe Lintas is the agency for Axe. Lowe does not talk about this account, because it isn’t authorized by Hindustan Unilever to do so. But the advertisement has done well. The Axe ads have 60,000 to 500,000 views on YouTube, which is way above Set Wet Zatak (15,000 views) and Garnier Men (2,000 views). Increased competition has forced Hindustan Unilever to increase its advertising budget. However, Axe will not experiment with altering its brand’s perception, but will look for ways to enforce its products’ original appeal. Analysis of the Product Strength 1. Each of the fragrances created by international fragrance diva Ann Gottlieb 2. The formulation is a base with higher efficacy 3. Excellent advertising and branding targeting the youth 4. Good distribution, Promotions and campaigns for luring customers 5. Also provides grooming range like shaving gel, foam, After-Shave lotion, and Cologne Talc Weakness 1. Only an urban market phenomenon 2. High pricing reduces the target market 3.Controversial advertising often leads to legal issues Opportunity 1. Coming up with Limited Edition fragrances 2. Tie up with hotel chains and large organizations like gym chains etc Threats 1. Deodorants sales are seasonal. Maximum sales happen in the summer months (April to September) 2. Competition from Premium Segment Deodorants like Burberry, Body Shop Strategies followed to tackle competition Hindustan Unilever created the deodorant market in India from scratch in 1999 when it launched Axe. At a time when conservatives still ruled the roost, Axe was positioned as an instant babe magnet. The brand proposition was cheeky: Dude, wear Axe and women will begin to fall over you. It clicked. The deodorant market in 2009 touched Rs 500 crore, according to Nielsen. Skincare companies say sales are growing in excess of 40 per cent per annum. In a couple of years, deodorant sales should overtake talcum powder which is a Rs 900-crore category growing in single digits. With the Indian male more conscious of his looks (body odor included) than ever before, this is a market which will only grow in the days to come; the upside is huge. The penetration in the deodorant market is just 2 to 3 per cent. This has attracted over a dozen brands. Hypotheses Hypothesis 1: Axe is able to differentiate itself from other male deodorants through its advertisements. Hypothesis 2: Axe customers have a low brand loyalty. Take away from the Project Hypotheses I is proven to be true that Axe is able to differentiate itself from other male deodorants through its advertisements. Hypothesis 2 has been disproved.