Brand loyal to Axe

advertisement

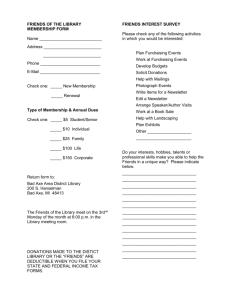

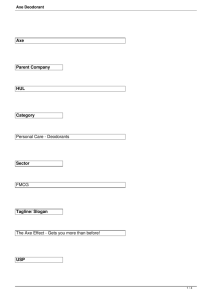

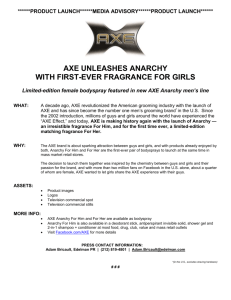

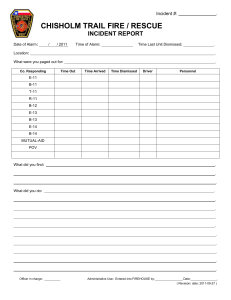

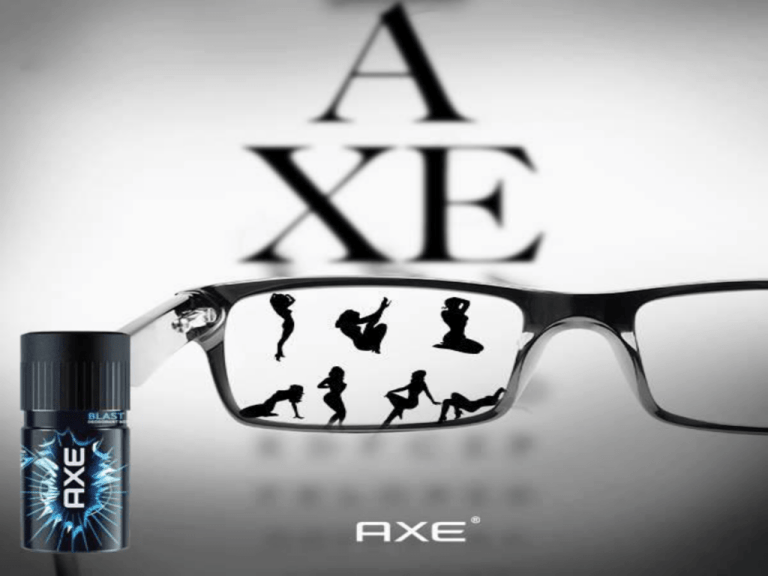

BRAND DOSSIER AXE DEODORANTS DEVELOPED BY NIMAL NITHYANANDAM RAM MOHAN M.P. NIVEDITA SEN SRIRAM S.R. Agenda • • • • • • • • • • • • Brand history and its global expansion Positioning Advertisement – AIDA Segmentation SWOT Analysis Competition Diversification Distribution System Future Directions Survey Hypotheses & Inferences Recommendation Brand history and it’s global expansion • 1983 – UNILEVER launched AXE in France inspired by another of its brands IMPULSE • 1985 – renamed AXE to LYNX in UK,Ireland, Australia, New Zealand AXE launched next in Latin America, Asia, Africa • 1999 - launched in India • 2000 - launched in USA, Canada Global Expansion in 40 countries Positioning • Naughtiest • Seductive becoming a babe-magnet is just a spray away • Young,Trendy same positioning space as a Fastrack or Pepsi Advertisement Advertisement • A- Awareness • I – Interest • D – Desire • A – Action Awareness • WHY? to accelerate market penetration • HOW? Describing fragrance by using a simple descriptor eg : AXE Dark Temptation – as irresistible as chocolate • WHY? Testers not available everywhere • THEREFORE? Unique descriptors for each variant for the clear understanding of the customer Interest • HOW? Humour Desire • HOW? Brand positioning as “babemagnet” raised to sublime heights with campaigns such as “Even Angels/Goddesses will fall” Action • HOW? Promotional campaigns CALL ME FREE WAKE UP SERVICE • Sales promotions Sweepstakes : AXE chits with phone nos. in Levis jeans, where AXE customers could call to connect to an AXE angel Fragrance cards in CCD, bar, club outlets Promotional campaigns AXE CALL ME 3.5 million calls 35% repeatcallers AXE WAKE-UP SERVICE Segmentation GEOGRAPHIC DEMOGRAPHIC URBAN AGE GROUP : 16 -25 YRS. GENDER : MALE INCOME GROUP : MIDDLE AND UPPER MIDDLE OCCUPATION : STUDENTS AND BACHELORS SEMI - URBAN PSYCHOGRAPHIC BEHAVIORAL LIFESTYLE : OUTDOOR ORIENTED PERSONALITY : FASHION ORIENTED, TRENDY OCCASSIONS : REGULAR BENEFIT : QUALITY, ECONOMICAL USER STATUS : REGULAR USER USER RATE : MEDIUM SWOT Analysis Strength Weakness Opportunity Threats 1. Each of the fragrances is created by international fragrance diva Ann Gottlieb. 2. The formulation is a base with higher efficacy. 3. Excellent advertising targeting the youth. 4. Good distribution, Promotions and campaigns for luring customers. 5. Also provides grooming range like shaving gel, foam, After-Shave lotion, Cologne Talc, shampoo & conditioner, face wash, shower gel. 1. Only an urban market phenomenon. 2. High pricing reduces the target market. 3.Controversial advertising often leads to legal issues. 1. Coming up with Limited Edition fragrances. 2. Tie up with gym chains. 1. Deodorants’ sales are seasonal. Maximum sales happen in the summer months (April to September). 2. Competition from Premium Segment Competition Tackling competition – ARMPIT WARRIORS Principle of Defensive Warfare : Brand Cannibalisation launched “AXE” anti-perspirant to take on NIVEA Silver Protect & Garnier Mineral Widening the cake, not the slice Market penetration of deodorants - 2-3% AXE – 25% market share 2009 - Rs.500 cr, now - Rs.900 cr Diversification Capturing the entire male grooming kit AXE Deodorants AXE AXE AXE AXE Anti–perspirants Hair – shampoo & conditioner Face – scrub, face wash, shaving gel, after shave Shower gel AXE ANARCHY for HIM & for HER Future directions • Move to digital medium to understand young men’s consumption habits Consumer engagement through online games AXE Instinct • Played by over 3mn , 55% repeat players AXE Musicstar • Played by over 4 mn AXE Angels fan page on facebook – over 7 lac friends Survey Target Group : young males between 15-25 yrs. Sample size : 60 Hypothesis 1 • AXE is able to differentiate itself from other male deodorants through its advertisements. Advertisements as differentiators Attributes through Ads Frequency of Ads seen Chart Title Chart Title 4.5 100% 4 90% 3.5 80% Axis Title 3 2.5 2 1.5 1 0.5 0 70% Park avenue 60% Set Wet Zatak Adidas 50% Axe 40% Garnier Men 30% Cinthol 20% Wildstone 10% 0% set wet Adidas Never seen Park Avenue Garnier Men Sometimes seen Axe Cinthol Seen a lot of times Wild Stone Inference Positioning established as the naughtiest brand, highly youth-centric, extremely sexy, and highly masculine. Ads conveyed the same and differentiated the brand from its competitors. Hence, hypothesis 1 is proven to be true. Hypothesis 2 • Axe customers have low brand loyalty. Repeat purchase Change of Brand Per Year Never 10% 1 time 18% Never 27% Four times or more 23% Once 20% All 5 times 2% 2 times 23% 4 times 8% Thrice 25% Twice 22% 3 times 22% Brand loyalty I'll search for my brand and if still not available ,i'll buy another brand. 18% I'll buy another brand 42% I'll go to another shop to buy my brand 40% Brand loyal to Axe Brand loyalty I'll go to another shop to buy my brand I'll search for my brand,if it's still not available,i'll buy another brand Axe 33% 33% Others 67% 67% Latest purchase of Axe loyal customer 4 times 17% 2 times 33% Never 17% 3 times 17% All 5 times 16% Inference • 33% of 30% of AXE loyal customers never change or change their deodorant once on an average per yr . • Out of these 33% no AXE loyal customer is ready to buy another deodorant in the absence of AXE, and their last 5 purchase behavior of AXE is shown below. Hence, Hypothesis 2 is disproven. Recommendation • The central theme of seduction is also being played with by other brands too as Set wet Zatak and Wildstone for the young male. Hence, the differentiator factor of AXE is reducing. • Our recommendation is that AXE should reposition itself for a TG which is above 25yrs aged males focusing on other attributes such as cool and adventurous which it’s low on scale presently. Thank you