B. PG&E's Response to 2003 GRC Decision

advertisement

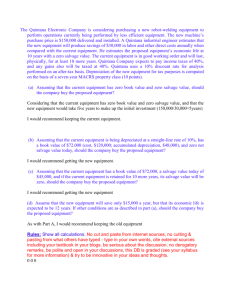

(PG&E-2) PACIFIC GAS AND ELECTRIC COMPANY CHAPTER 10 DEPRECIATION STUDY 1 2 3 4 5 A. Introduction 1. Scope and Purpose 6 This testimony presents the results of the depreciation study for Pacific 7 Gas and Electric Company’s (PG&E or the Company) electric transmission, 8 electric and gas distribution and fleet plant. The scope of this testimony covers the methods used in the study and 9 10 an account-by-account analysis of depreciation characteristics of PG&E’s 11 plant accounts. 12 2. Summary of Results PG&E requests that the California Public Utilities Commission (CPUC or 13 14 Commission) use the depreciation parameters developed in the study to 15 determine the gas and electric depreciation rates for use in developing the 16 2007 General Rate Case (GRC) revenue requirements. Table 10-1 shows a summary of the proposed changes in the 17 18 depreciation parameters from those adopted in the 2003 GRC. The 19 proposed changes are modest and reasonable, and are based on sound 20 depreciation study techniques and reflect my judgment and the judgment of 21 PG&E’s experienced field personnel. Detailed analyses of the depreciation parameters for each plant account 22 23 24 25 are shown in the workpapers supporting this chapter. 3. Support for Request a. Determination of Average Service Life (ASL) and Survivor Curves 26 When a group of similar assets are put in service, not all of the 27 individual assets in the group fail or are retired at the same time in the 28 future. Instead, only a portion of the original group may fail or retire 29 during the first year of service. In the second year, again, only a portion 30 of the surviving group may fail or retire from service. If the portion of the 31 original group that survives is traced until the last asset in the group is 32 retired, a pattern emerges in the shape of a curve called a survivor 10-1 TABLE 10-1 Pacific Gas and Electric Company Test Year 2007 General Rate Case SUMMARY OF ESTIMATED SURVIVOR CURVES AND NET SALVAGE PERCENTS STATISTICAL Asset Class FERC Acct. Description SURVIVOR CURVE INDUSTRY RANGE ADOPTED RECOMMENDED STATISTICAL NET SALVAGE PERCENT INDUSTRY ADOPTED RECOMMENDED INDICATION LIFE CURVE ESTIMATE ESTIMATE INDICATION RANGE ESTIMATE ESTIMATE 60-R3 None 52-R1.5 71-S4 46-R2.5 55-S6 70-R4 50-60 60-70 40-60 35-50 50-70 30-50 35-55 45-65 35-50 50-75 R2,R3,R4 R1,R2 R3,R4,R5 R1,R2,R3 R2-R5 R3-R5,S6 R3,R4,S3 SQ,R3,R5 50-S6 50-S6 40-S3 70-S4 42-R3 52-S6 60-R5 50-R3 60-R5 60-R3 60-R3 40-S1.5 70-S4 46-R2.5 55-S6 60-R5 50-R3 60-R5 (5)-(22) None (25)-(45) (40)-)60) (85)-(140) (50)-(140) 0-(100) (5)-(15) (5)-(35) 0-(30) 5-(20) (10)-(60) (20)-(75) 10-(60) 10-(20) 19-(30) 0 (10) (5) 0 (40) (50) (31) 0 0 0 (20) (20) (30) (50) (80) (60) 0 0 0 ELECTRIC TRANSMISSION PLANT ETP35201 ETP35202 ETP35301 ETP35400 ETP35500 ETP35600 ETP35700 ETP35800 ETP35900 352 352 353 354 355 356 357 358 359 Structures & Improvements Structures & Improvements/Equip Station Equipment Towers & Fixtures Poles & Fixtures OH Conductor/Devices - Twr/Pl Ln UG Conduit UG Conductor/Devices Roads & Trai8ls 10-2 (PG&E-2) TABLE 10-1 Pacific Gas and Electric Company Test Year 2007 General Rate Case SUMMARY OF ESTIMATED SURVIVOR CURVES AND NET SALVAGE PERCENTS STATISTICAL Asset Class FERC Acct. Description SURVIVOR CURVE INDUSTRY RANGE ADOPTED RECOMMENDED STATISTICAL NET SALVAGE PERCENT INDUSTRY ADOPTED RECOMMENDED INDICATION LIFE CURVE ESTIMATE ESTIMATE INDICATION RANGE ESTIMATE ESTIMATE 55-L5 40-60 R3,R4 35-50 R2,R1,L0 40-L0.5 38-R1 58-L3 31-R5 31-S1 24-R5 45-R2 32-S6 32-R0.5 61-L3 28-R0.5 24-S6 20-L0 19-S6 30-50 30-50 40-70 25-45 25-40 25-40 30-45 30-45 25-40 10-40 15-40 15-30 15-30 15-30 15-30 R1,O1,L0 R1,S1,L0 R2,R3,L3 R2,R3,S2 R0.5,S1,L0 R0.5,S1,L0 R1-R3 R1,R3 R2,R3,S2 L0,L1,O1 R1-R3 Low Mode Low Mode Low Mode Low Mode 55-L5 55-L5 41-S1 10 40-R1 40-R1.5 58-L3 36-R4 31-R2.5 31-S1.5 48-R2.5 46-R4 30-R1.5 40-S1 16-S1 30-R0.5 30-L2 22-L0 23-S3 (20)-(100) 8-(20) (50)-(80) (40)-(100) (40)-(130) (10)-(50) 2 (50)-(80) (20)-(35) 0 0-(200) 60-90 (15)-(30) 15-(15) - (5)-(30) 43-R1 55-L5 55-L5 39-R2 10 40-L0.5 38-R1 58-L3 31-R5 31-S1 34-S1 45-R2 43-R4 27-R2 36-S1 16-S1 28-R0.5 29-L2 20-L0 19-S6 (20)-(110) 10-(50) 0-(40) 20-(30) (25)-15 (25)-15 (5)-(60) (5)-(60) 10-(20) 10-(40) 30-(15) 15-(50) 15-(50) 15-(50) 15-(50) (10) 0 0 0 (35) (49) 10 (19) 10 0 (60) (40) 0 0 75 (95) (10) (10) 0 (20) (20) (30) 0 (100) (100) (50) (40) (10) 0 (100) (60) (5) 0 0 (90) (10) 0 (10) ELECTRIC DISTRIBUTION PLANT 10-3 EDP36101 EDP36102 EDP36200 EDP36300 EDP36400 EDP36500 EDP36600 EDP36700 EDP36801 EDP36802 EDP36901 EDP36902 EDP37000 EDP37100 EDP37200 EDP37301 EDP37302 EDP37303 EDP37304 361 361 362 363 364 365 366 367 368 368 369 369 370 371 372 373 373 373 373 Structures & Improvements Structures & Improvements - Equip Station Equipment Storage Battery Poles, Towers & Fixtures OH Conductors & Devices Underground Conduit UG Conductors & Devices Line Transformers-Overhead Line Transformers-Underground Services-Overhead Services-Underground Meters Installation on Customer Premises Leased Property on Cust. Prem. Street Light-Overhead Conductors Street Light-Conduit & Cables Street Light-Lamps & Equipment Street Light-Electroliers 10-(25) GAS DISTRIBUTION PLANT GDP37500 GDP37601 GDP37700 GDP37800 GDP38000 GDP38100 GDP38300 GDP38500 GDP38600 GDP38700 375 376 377 378 380 381 383 385 386 387 Structures & Improvements Mains Compressor Station Equipment Odorizing/Meas & Reg Sta Equipment Services Meters House Regulators Meas & Reg Sta Equip-Industrial Other Property on Customer Premises Other Equipment 60 41-S6 15-30 33-L3 53-L3 34-R2 67-S1 35-60 40-70 15-35 30-50 30-50 25-50 20-50 25-40 10-35 10-35 R1-R4,S0 R,S,L2-3 R,S,L0-1 R,S,L0-1 R,S,L2-3 S2 - 49-R2 54-S3 24-R1.5 37-R2.5 50-R3 24-R1.5 23-R1.5 34-R2 35-R2 28-S0 49-R2 52-S3 29-R1.5 40-R2.5 50-R4 24-R1.5 24-R1.5 40-R2 35-R2 28-S0 (50)-(60) (50)-(100) 0-(20) (50)-(100) (85)-(170) 0-4 0 0 (5)-(30) (5)-(100) (5)-(10) 10-(50) (10)-(200) 35-(20) 25-(30) 20-(20) 0-25 0-(50) (20) (45) (10) (55) (85) 0 0 (15) 0 0 (20) (50) (10) (55) (100) 0 0 (15) 0 5 390 392.02 392.03 392.04 392.05 392.06 392.07 392.08 392.09 396 Structures and Improvements Transp. Equip-Passenger Vehicles Transp. Equip-Light Truck-1/2 Ton Transp Equip-Light Truck-1/2 Ton Transp Equip-Heavy Truck-1 & 2 Ton Transp Equip-Heavy Truck-1 & 2 Ton Transp Equip-Heavy Truck-3 & 5 Ton Transp Equip - Vessels-Barge/Boat Transp Equip - Trailer Power Operated Equipment 43-R1.5 7 7-10 7-10 10-14 10-14 10-14 11-15 14-20 14-L2 35-50 5-7 6-10 6-10 8-12 8-12 8-12 10-15 14-20 12-20 R2,R3 Low Mode Low Mode Low Mode Mid Mode Mid Mode Mid Mode High Mode Low Mode Low Mode 38-R3 6-S2 8 10 13 11 13 12-S4 12-S4 20 43-R1.5 7-R3 9-S2.5 8.5-S2.5 11-L3 11-S2.5 14-S3 8-S4 17-L2 13-S1 0-(10) 8-12 8-12 8-12 8-12 8-12 8-12 8-12 8-12 19 0-(20) 5-25 5-25 5-25 5-25 5-25 5-25 5-25 5-25 10-40 (19) 24 22 24 17 14 14 0 0 20 (10) 10 10 10 10 10 10 10 10 20 COMMON PLANT CMP39000 CMP39202 CMP39203 CMP39204 CMP39205 CMP39206 CMP39207 CMP39208 CMP39209 CMP39600 (PG&E-2) (PG&E-2) 1 curve. Different types of plant assets exhibit different patterns or 2 survivor curves. Since a survivor curve represents actual lives of all of 3 the assets in the group, an ASL of the group can be readily calculated 4 from the survivor curve for the group. 5 PG&E’s plant is grouped in various accounts or asset classes. For 6 most of the asset classes, PG&E has continuous records of retirements 7 from 1969 to 2004. Although these retirements are not known by their 8 original installation dates, there are certain simulation techniques by 9 which survivor curves can be estimated for these asset classes without 10 the installation data. Section C-3 explains the method used in 11 estimating the recommended survivor curves for PG&E’s plant assets. 12 Factors considered in the selection of a survivor curve include accuracy 13 and sufficiency of available data, conformance of data to selected 14 curve, published industry data for similar assets, current maintenance 15 practice, and the judgment and experience of field personnel and 16 project engineers. 17 As an example of how all these factors are considered in 18 determining the life and curve for an asset class, consider the Federal 19 Energy Regulatory Commission (FERC) Account 364 (Asset Class 20 EDP36400) for distribution poles. The simulation analysis based on 21 recorded data indicates a service life of 31 to 44 years for this account. 22 The current service life adopted by the Commission in the 2003 GRC is 23 40 years. PG&E’s field personnel expect new poles with aggressive test 24 and treat program currently underway using chemicals (metam sodium, 25 copper napthenate, etc.) to last 40-50 years. The Western Wood 26 Preservative Institute states such poles can last up to 75 years with 27 proper inspection and maintenance. This would suggest a longer life for 28 the existing poles. However, there are also limiting factors on pole life: 29 (1) The longevity of the upper portion of the pole which is subject to 30 continued environmental assault can be a determining factor in the 31 useful life of a pole; and (2) field engineers reported that almost a third 32 of PG&E’s poles were treated with cellon in 1960s and are not expected 33 to last more than 10 years from now. Based on all this information, I 10-4 (PG&E-2) 1 propose no change in the service life for this account, thus maintaining 2 40 years. 3 b. Development of Net Salvage and Net Salvage Rates 4 When an asset is retired, it can be sold as scrap or reused at some 5 other location and purpose, thus having a value after its retirement from 6 current service. In most cases, retirement of the asset also requires its 7 removal from its current location for subsequent use or disposal. Net 8 salvage is the amount realized as scrap (or other use) over and above 9 any associated removal cost. If the removal cost exceeds the gross 10 salvage receipts, net salvage is negative. Net salvage is usually 11 expressed as a percentage of the original cost of the retired asset. If 12 the net salvage is positive, it reduces the amount of depreciation 13 expense charged during the useful life of the asset. If the net salvage is 14 negative, it increases the amount of depreciation expense. 15 The net salvage estimates in this study were based on informed 16 judgment that incorporated analyses of historical cost of removal and 17 gross salvage data, consideration of the impacts of age and inflation, as 18 well as expectations of future levels of removal costs and gross salvage. 19 The historical data included in the statistical analysis were the cost of 20 removal and gross salvage for the 36-year period, 1969-2004. 21 However, the most recent 15-year period, 1990-2004, was emphasized 22 in order to be consistent with California regulations and properly match 23 future expectations. Section D explains the estimation techniques, the 24 analysis of historical data, impact of age and inflation, and other factors 25 considered in developing PG&E’s recommendations for net salvage 26 percents. 27 Factors considered in the selection of a net salvage percent include 28 accuracy and sufficiency of available data, published industry data for 29 similar assets, level of inflation between installation and removal, 30 current maintenance practice, and the judgment and experience of field 31 personnel and project engineers. 32 As an example of how all these factors are considered in 33 determining the net salvage percent for an asset class, consider again 34 the FERC Account 364 (Asset Class EDP36400) for distribution poles, 10-5 (PG&E-2) 1 as discussed above. The recorded data for recent years suggest there 2 is very little salvage when poles are retired. Field engineers confirm that 3 poles are disposed of by contractors hired to do the removal. Removal 4 costs are increasing substantially. Data indicate removal costs in the 5 range of 80 percent to 110 percent of the original cost of the poles 6 retired. This would suggest net salvage of about negative 95 percent 7 since the gross salvage amount is negligible. The currently adopted net 8 salvage rate is negative 35 percent. PG&E’s current accounting system 9 assigns a percentage of the total costs of a pole replacement job to the 10 removal orders and the remainder to installation work, which is 11 capitalized as new plant. The removal cost percentage is determined 12 by PG&E’s cost estimating group using estimating tools such as 13 SHERPA JET (Job Estimating Tool) for electric and GasCEP (Gas Cost 14 Estimating Program) for gas. A typical pole replacement job charges 15 about 10 percent of pole replacement costs to removal costs. Although 16 this is a small amount in today’s dollars, field engineers think it could 17 easily be 100 percent of the original cost of the pole if the pole was 18 installed 40-50 years ago. Based on all this information, I propose that 19 negative net salvage be increased to -100 percent for this pole account. 20 B. PG&E’s Response to 2003 GRC Decision 21 In PG&E’s 2003 GRC Decision 04-05-055, the Commission adopted the 22 depreciation parameters in PG&E’s 2003 Depreciation Study except for electric 23 plant net salvage estimates. 24 The following steps have been followed to complete the 2007 depreciation 25 study: 26 First, I met with PG&E’s field personnel familiar with the maintenance and 27 operation of electric transmission, electric distribution, gas distribution and 28 equipment, as well as fleet assets; 29 30 31 Second, I conducted statistical analyses to develop historical indications of service life and net salvage characteristics; Third, I conducted field reviews of various electric and gas plant assets 32 throughout the system to evaluate physical conditions and actual function of 33 the assets; 10-6 (PG&E-2) 1 Fourth, I used my own extensive experience and industry-wide data, including 2 the depreciation parameters adopted for other California utilities, to reach 3 my initial study conclusions; 4 5 6 Fifth, I talked with witnesses responsible for managing and maintaining PG&E’s electric transmission and electric and gas distribution assets; Sixth, the Asset Managers and their field staff reviewed my conclusions and 7 accompanying narratives in the study workpapers for reasonableness and 8 accuracy; and 9 Finally, I incorporated the feedback I received from the asset managers to 10 finalize my conclusions and recommendations in the study. 11 In summary, the conclusions included in this depreciation study take into 12 account the actual experience of PG&E’s gas and electric distribution field 13 personnel familiar with the maintenance and operation of gas and electric 14 distribution equipment. 15 16 17 C. Average Service Life and Survivor Curves 1. Determination of Average Service Lives As described in the Section A-3 above, the first step in determining ASL 18 for a group of assets is to identify a standard survivor curve that fairly 19 represents the actual retirement history of plant for the group. There are 20 basically two methods widely used in a typical depreciation study to 21 estimate a survivor curve for a group of plant assets: (1) The Retirement 22 Rate Method; and (2) The Simulated Plant Record (SPR) Method. The 23 Retirement Rate Method is used when retirement data by installation (aged) 24 dates is available. The SPR method is used when retirements by 25 installation year are not known or available. The SPR method can be used 26 to simulate either plant balances or plant retirements. Only the SPR method 27 using simulated plant balances was used in this study. All methods use 28 survivor curves to estimate ASL. 29 30 2. Characteristics of Survivor Curves The survivor curve graphically depicts the amount of property existing at 31 each age throughout the life of an original group. From the survivor curve, 32 the average life of the group, the remaining life expectancy, the probable 10-7 (PG&E-2) 1 life, and the frequency curve can be calculated. In Figure 10-1, a typical 2 smooth survivor curve and the derived curves are illustrated. The average 3 life is obtained by calculating the area under the survivor curve, from age 4 zero to the maximum age, and dividing this area by the ordinate at age zero. 5 The remaining life expectancy at any age can be calculated by obtaining the 6 area under the curve, from the observation age to the maximum age, and 7 dividing this area by the percent surviving at the observation age. For 8 example, in Figure 10-1 the remaining life at age 30 years is equal to the 9 cross-hatched area under the survivor curve divided by 29.5 percent 10 surviving at age 30. The probable life at any age is developed by adding the 11 age and remaining life. If the probable life of the property is calculated for 12 each year of age, the probable life curve shown in the chart can be 13 developed. The frequency curve presents the number of units retired in 14 each age interval and is derived by obtaining the differences between the 15 amount of property surviving at the beginning and at the end of each 16 interval. 17 Iowa Type Curves. The range of survivor characteristics usually 18 experienced by utility and industrial properties is encompassed by a system 19 of generalized survivor curves known as the Iowa type curves. There are 20 four families in the Iowa system, labeled in accordance with the location of 21 the modes of the retirements in relationship to the average life and the 22 relative height of the modes. The left-moded curves, presented in 23 Figure 10-2, are those in which the greatest frequency of retirement occurs 24 to the left of, or prior to ASL. The symmetrical-moded curves, presented in 25 Figure 10-3, are those in which the greatest frequency of retirement occurs 10-8 100 90 Survivor Curve Probable Life Curve 80 70 60 Average Life 50 10-9 Maximum Life 40 Probable Life Age 30 Expectancy Mode 20 4 Frequency Curve 3 10 2 1 5 10 15 20 25 30 35 40 45 50 Age In Years Figure 10-1. A Typical Survivor Curve and Derived Curves 55 60 (PG&E-2) 0 100 S S1 O S 2 S 3 S 4 50 S S 5 6 S 6 45 90 40 35 S5 30 80 25 S4 20 S3 70 15 S2 S1 10 SO 5 60 0 25 50 75 100 125 150 175 200 225 250 275 300 Age, Percent of Average Life 10-10 50 40 30 20 10 0 25 50 75 100 125 150 175 200 225 250 275 Figure 10-3. Symmetrical or "S" Iowa Type Survivor Curves (PG&E-2) Age, Percent of Average Life 300 100 50 R1 90 R2 R3 R4 R5 45 40 35 80 R5 30 25 R4 20 70 R3 15 R2 10 60 R1 5 10-11 0 25 50 75 100 125 150 175 200 Age, Percent of Average Life 225 250 275 300 50 40 30 20 10 0 25 50 75 100 125 150 175 200 225 250 275 Age, Percent of Average Life Figure 10-4. Right Modal or "R" Iowa Type Survivor Curves 300 100 20 18 90 16 14 80 12 10 O4 8 70 O3 6 O2 O1 4 60 2 0 50 10-12 O4 O3 25 50 75 100 125 150 175 200 225 Age, Percent of Average Life 250 275 300 O2 O1 40 30 20 10 0 25 50 75 100 125 150 175 200 225 250 275 300 Age, Percent of Average Life (PG&E-2) Figure 10-5. Origin Modal or "O" Iowa Type Survivor Curves (PG&E-2) 1 at ASL. The right-moded curves, presented in Figure 10-4, are those in 2 which the greatest frequency occurs to the right of, or after ASL. The 3 origin-moded curves, presented in Figure 10-5, are those in which the 4 greatest frequency of retirement occurs at the origin, or immediately after 5 age zero. The letter designation of each family of curves (L, S, R or O) 6 represents the location of the mode of the associated frequency curve with 7 respect to the ASL. The numerical subscripts represent the relative heights 8 of the modes of the frequency curves within each family. The Iowa curves were developed at the Iowa State College Engineering 9 10 Experiment Station through an extensive process of observation and 11 classification of the ages at which industrial property had been retired. A 12 report of the study, which resulted in the classification of property survivor 13 characteristics into 18 type curves, which constitute three of the 14 four families, was published in 1935 in the form of the Experiment Station’s Bulletin 125.[1] These type curves have also been presented in subsequent 15 17 Experiment Station bulletins and in the text, “Engineering Valuation and Depreciation.”[2] In 1957, Frank V. B. Couch, Jr., an Iowa State College 18 graduate student, submitted a thesis[3] presenting his development of the 19 fourth family consisting of the four O type survivor curves. 16 3. Methods Used in Estimating Survivor Curves 20 The following describes the two methods widely used in a typical 21 22 depreciation study to estimate a survivor curve for a group of plant assets. 23 a. Retirement Rate Method of Analysis 24 The retirement rate method is an actuarial method of deriving 25 survivor curves using the average rates at which property of each age 26 group is retired. The method relates to property groups for which aged 27 accounting experience is available or for which aged accounting [1] [2] [3] Winfrey, Robley. Statistical Analyses of Industrial Property Retirements. Iowa State College, Engineering Experiment Station, Bulletin 125. 1935. Marston, Anson, Robley Winfrey, and Jean C. Hempstead. Engineering Valuation and Depreciation, 2nd Edition. New York, McGraw-Hill Book Company. 1953. Couch, Frank V. B., Jr. “Classification of Type O Retirement Characteristics of Industrial Property.” Unpublished M.S. thesis (Engineering Valuation). Library, Iowa State College, Ames, Iowa. 1957. 10-13 (PG&E-2) 1 experience is developed by statistically aging unaged amounts. The 2 method (also known as the annual rate method) is illustrated through 3 the use of an example in the Attachment 1 to this chapter, and is also 4 5 explained in several publications, including “Statistical Analyses of Industrial Property Retirements,”[4] “Engineering Valuation and 6 Depreciation,”[5] and “Depreciation Systems.”[6] 7 Since PG&E’s accounting system does not keep retirement data for 8 mass property accounts (e.g., poles, towers, conductors) by the original 9 installation dates, the retirement rate method was not used in this study. b. Simulated Plant Balance Method of Life Analysis 10 I used the simulated plant balance method in this study to estimate 11 12 survivor curves. The simulated plant balance method is used for 13 property groups for which the retirements of property by age are not 14 known. However, it does require continuous records of vintage plant 15 additions and year-end plant balances which are available in PG&E’s 16 accounting system. The method suggests probable survivor curves for a property group 17 18 by successively applying a number of alternative survivor curves to the 19 group’s historical additions in order to simulate the group’s surviving 20 balances over a selected period of time. One of the several survivor 21 curves which result in simulated balances that conform most closely to 22 the book balances may be considered to be the survivor curve which 23 the group under study is experiencing. The simulated plant balance method is illustrated through the use of 24 26 an example in Attachment 2, and is more fully explained in several publications, including “Depreciation Systems,”[7] “Methods of 27 Estimating Utility Plant Life”[8] and “Public Utility Depreciation 25 [4] [5] [6] [7] [8] Winfrey, Robley, supra, at Note 4. Marston, Anson, Robley Winfrey, and Jean C. Hempstead, supra, at Note 5. Wolf, Frank K. and W. Chester Fitch. Depreciation Systems. Iowa State University Press. 1994. Wolf, Frank K. and W. Chester Fitch, supra, at Note 9. A report of the Engineering Subcommittee of the Depreciation Accounting Committee, Edison Electric Institute. Publication No. 51-23. Published 1952. 10-14 (PG&E-2) 1 Practices.”[9] The simulated plant balance method requires an 2 understanding of the retirement rate method. The simulated plant 3 balance method illustration in Attachment 2 uses the same data as used 4 in the example of the retirement rate method in Attachment 1. The simulated plant balance method requires a relatively long 5 6 history of plant additions, the plant balances for a period of recent years 7 and the tables of percents surviving for a standard set of survivor 8 curves. The percents surviving tables for the Iowa curves were used in 9 the study. The period of years during which the simulated and book 10 balances are compared is referred to as the term of comparison. For 11 this study, the terms of comparison used were the recorded plant 12 balances from 1980 to 2004 and 1985 to 2004. 13 D. Estimation of Net Salvage Rates 14 The estimates of future net salvage are expressed as percents of the 15 surviving plant in service, the sum of all future retirements. In cases in which 16 removal costs are expected to exceed gross salvage receipts, a negative net 17 salvage percent is estimated. The net salvage estimates were based on 18 informed judgment that incorporated analyses of historical cost of removal and 19 gross salvage data, consideration of the impacts of age and inflation, as well as 20 expectations with respect to future levels of removal costs and gross salvage. 21 The historical data included in the statistical analysis were the cost of removal 22 and gross salvage for the 36-year period, 1969-2004, however, the most recent 23 15-year period, 1990-2004, was emphasized. A more detailed discussion of the 24 factors considered in the estimation of net salvage percents are presented in the 25 workpapers. A description of the method of analyzing historical net salvage is 26 presented in the sections that follow. 27 1. Analysis of Historical Data 28 Historical net salvage data, separated between cost of removal and 29 gross salvage, were analyzed as percents of the original cost retired on 30 annual, 3-year moving average and the most recent 5-year average bases. 31 The average percents for the entire study period, 1969-2004, also were [9] National Association of Regulatory Utility Commissioners. Public Utility Depreciation Practices. 1996. 10-15 (PG&E-2) 1 determined. The percent of original cost is calculated for cost of removal 2 and gross salvage separately in order to assist in detecting trends in these 3 components of net salvage. Moving averages are used to smooth the 4 indications of net salvage that can fluctuate from year to year. The analysis 5 of historical net salvage data is illustrated through the use of an example in 6 the text that follows. 7 The property group used to illustrate the analysis of net salvage data is 8 the same property group that is used to illustrate the service life analyses in 9 Attachments 1 and 2. Regular retirements used in the service life analyses 10 are shown in Table 10-2. The additional data required for the analysis are 11 the amounts of cost of removal and gross salvage for the period 1995-2004. 12 These data are used to determine the net salvage amount (gross salvage 13 minus cost of removal) and to calculate each element of net salvage as a 14 percent of the original cost retired. For example, as presented in 15 Table 10-2, the cost of removal in 2000 was $23,000 and the gross salvage 16 was $6,000. These amounts result in a negative net salvage of $17,000. 17 Each of these amounts is then expressed as a percent of the original cost 18 retired of $157,000. These percents are 15 for cost of removal, 4 for gross 19 salvage and negative 11 for net salvage. Similar calculations are performed 20 for each year and for the total period, 1995-2004. 21 To smooth fluctuations that normally occur in such data, moving 22 averages are calculated. Table 10-3 presents the 3-year moving averages 23 throughout the period 1995-2004 and the most recent 5-year average, 24 2000-2004. The determination of the moving averages will be explained for 25 the period 1999-2001. The average of the regular retirements for the period 26 1999-2001 is $160,000 ((128,000+157,000+196,000)/3). The average of 27 the cost of removal amounts for the same period is $22,000 28 ((17,000+23,000+27,000)/3). Dividing $22,000 cost of removal by $160,000 29 of regular retirements results in a cost of removal percent of 14 for the 30 3-year moving average 1999-2001. The gross salvage and net salvage 31 moving averages and percents are similarly determined. As can be 32 observed, the 3-year moving average has smoothed the fluctuations that 33 occurred in the annual amounts and enabled the discernment of the trend in 34 the net salvage components as a percent of the original cost. 10-16 (PG&E-2) 1 2 3 4 5 6 TABLE 10-2 PACIFIC GAS AND ELECTRIC COMPANY SUMMARY OF BOOK SALVAGE – ANNUAL BASIS COST OF REMOVAL, GROSS SALVAGE AND NET SALVAGE AS A PERCENT OF THE ORIGINAL COST RETIRED ($000) Cost of Removal Line No. Amount ($) Percent (%) Amount ($) Percent (%) Amount ($) Percent (%) 1 2 3 4 5 6 7 8 9 10 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 53 68 86 106 128 157 196 231 273 308 5 8 10 12 17 23 27 32 40 49 9 12 12 11 13 15 14 14 15 16 3 6 3 6 5 6 7 7 8 9 6 9 3 6 4 4 4 3 3 3 (2) (2) (7) (6) (12) (17) (20) (25) (32) (40) (4) (3) (8) (6) (9) (11) (10) (11) (12) (13) 11 Total 1,606 223 14 60 4 (163) (10) TABLE 10-3 PACIFIC GAS AND ELECTRIC COMPANY SUMMARY OF BOOK SALVAGE – MOVING AVERAGE BASIS COST OF REMOVAL, GROSS SALVAGE AND NET SALVAGE AS A PERCENT OF THE ORIGINAL COST RETIRED ($000) Cost of Removal 14 Net Salvage Year 7 8 9 10 11 12 13 Gross Salvage Regular Retirements ($) Line No. 1 2 3 4 5 6 7 8 9 Gross Salvage Net Salvage Year Regular Retirements ($) Amount ($) Percent (%) Amount ($) Percent (%) Amount ($) Percent (%) 1995-1997 1996-1998 1997-1999 1998-2000 1999-2001 2000-2002 2001-2003 2002-2004 2000-2004 69 87 107 130 160 195 233 271 233 8 10 13 17 22 27 33 40 34 11 12 12 13 14 14 14 15 15 4 5 5 6 6 7 7 8 7 6 6 4 4 4 3 3 3 3 (4) (5) (8) (12) (16) (21) (26) (32) (27) (5) (6) (8) (9) (10) (11) (11) (12) (12) 2. Impact of Age and Inflation The analysis of net salvage described above does not incorporate any 15 variability of net salvage with age. The analysis simply related all cost of 16 removal or gross salvage during a year to all retirements during the same 17 year. The analyses of service life reflected models, i.e., Iowa curves, that 10-17 (PG&E-2) 1 incorporated variable rates of retirement dependent on the age of the asset. 2 Models of salvage variability with age are not available. Identification of the 3 cost of removal and gross salvage by the age of plant to which they relate is 4 not usually possible, particularly for mass plant items such as poles, 5 conductor, mains and services. Work orders that capture such costs of 6 removal and gross salvage usually include retirements of plant from multiple 7 years of installation. 8 The inability to analyze the variability of net salvage by age does not 9 mean that such variability does not exist. The variability of net salvage with 10 age is a function of inflation and the ability to reuse or scrap an item of plant 11 as it ages. Inflation has its greatest impact on cost of removal. The effort 12 required to remove an asset represents a certain percent of the cost to 13 install the same asset when both costs are measured at the same price 14 level. As the time between installation and removal increases, the price 15 level at which the removal will occur increases in comparison to the price 16 level at which the plant was installed. The result is that cost of removal 17 represents a greater percent of original cost retired for older plant 18 retirements than it does for younger plant retirements. 19 Gross salvage also varies with age as a result of inflation, particularly for 20 plant that can be scrapped for its metal content. Although scrap metal 21 prices are very volatile, they do tend to increase over time. As such prices 22 increase, gross salvage, as a percent of original cost, will increase with age. 23 On the other hand, as plant ages and is removed from service, the 24 likelihood that it can be reused or scrapped decreases depending on its 25 condition. Inflation and the ability to reuse or scrap retired items act against 26 one another and result in less variability with age for gross salvage as 27 compared to cost of removal. 28 Consideration of the variability of net salvage is necessary when 29 interpreting analyses of gross historical data because the age at which the 30 historical retirements occurred and the age at which the current surviving 31 plant will be retired are usually very different. As a result of growth, real and 32 inflationary, in the original cost of plant, the weighted average age of plant 33 retirements is typically a fraction of the average service life of the account. 34 In contrast, the average age of future retirements is the probable life of the 10-18 (PG&E-2) 1 surviving original cost. The probable life of the surviving original cost is 2 greater than the average service life. Thus, the estimates of future net 3 salvage percent should be a percent applicable to retirements at an age 4 greater than the average life. Careful interpretation of historical analyses of 5 retirements occurring at ages less than average life is required in order to 6 make such a forecast. 7 8 A more in-depth treatment of the impact of age and inflation on net salvage is presented in “Depreciation Systems”[10] and “A Preliminary 9 Study of the Effect of Salvage on Depreciation.”[11] 3. Evaluating the Results 10 The analyses of historical net salvage as presented in Tables 10-2 11 12 and 10-3 indicate a trend toward increasing cost of removal and 13 decreasing gross salvage. The overall average for the period 14 1995-2004 is negative 10 percent net salvage. However, more recent 15 averages, the three-year average 2002-2004 and the five-year average 16 2000-2004, have decreased from negative 5 percent in 1995-1997 to 17 negative 12 percent. Cost of removal has increased as a percent of the original cost 18 19 retired from slightly greater than 10 percent in the mid-1990s to 20 approximately 15 percent in the past several years. Gross salvage has 21 decreased from 6 percent of original cost to 3 percent of original cost. 22 The net of the recent levels, as noted previously, is negative 12 percent. 23 The average age of the retirements during the period 1995-2004 24 was 5.8 years. The average service life estimate is 12 years. The 25 average age of future retirements will be in excess of 12 years, 26 significantly greater than the historical average of 5.8 years. Thus, it is 27 reasonable to expect that the trend to increasing cost of removal as a 28 percent of original cost will continue. Based on the survivor curve 29 estimate for this account, the current surviving plant will be retired over 30 the next 25 years. Given the trend in removal cost and the future [10] [11] Wolf, Frank K. and W. Chester Fitch, supra, at Note 9. White, Bob E. “A Preliminary Study of the Effect of Salvage on Depreciation.” A report prepared for the Interstate Commerce Commission. June 1982. 10-19 (PG&E-2) 1 impact of increasing age and inflation, it is reasonable to project 2 average future cost of removal of 20 percent of the original cost retired. 3 Gross salvage may increase as a percent of original cost to 4 approximately 5 percent for the same reasons. This logic supports a 5 future net salvage percent of negative 15 percent in comparison to the 6 recent indications of negative 12 percent. It is probable that, assuming 7 no contrary relevant factors external to the historical analysis, a net 8 salvage estimate of negative 12 to negative 15 percent is reasonable. 9 10 E. Account-by-Account Analysis and Recommendations The workpapers supporting this chapter analyze historical data for each 11 account, the statistical indication of ASL and net salvage based on these 12 historical data, the range of values for these parameters in the industry, insights 13 obtained from PG&E’s engineering and field personnel, and final recommended 14 parameters. The results of the study by account are shown in Table 10-1. 10-20