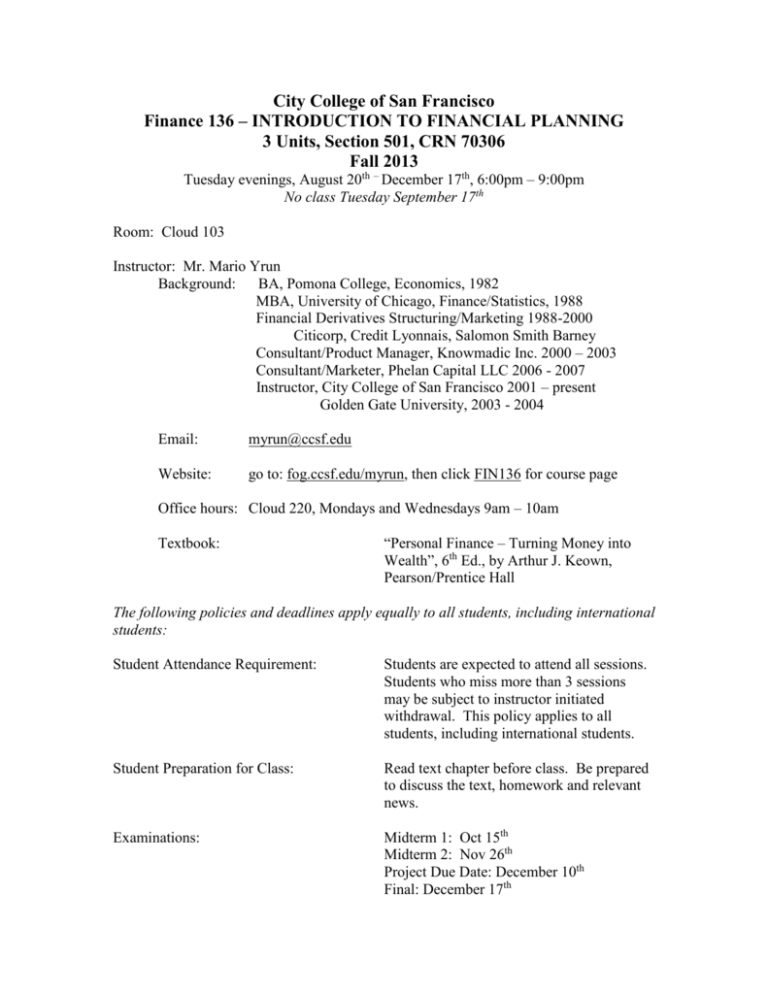

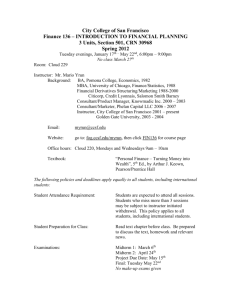

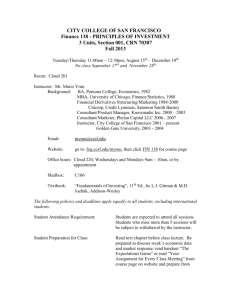

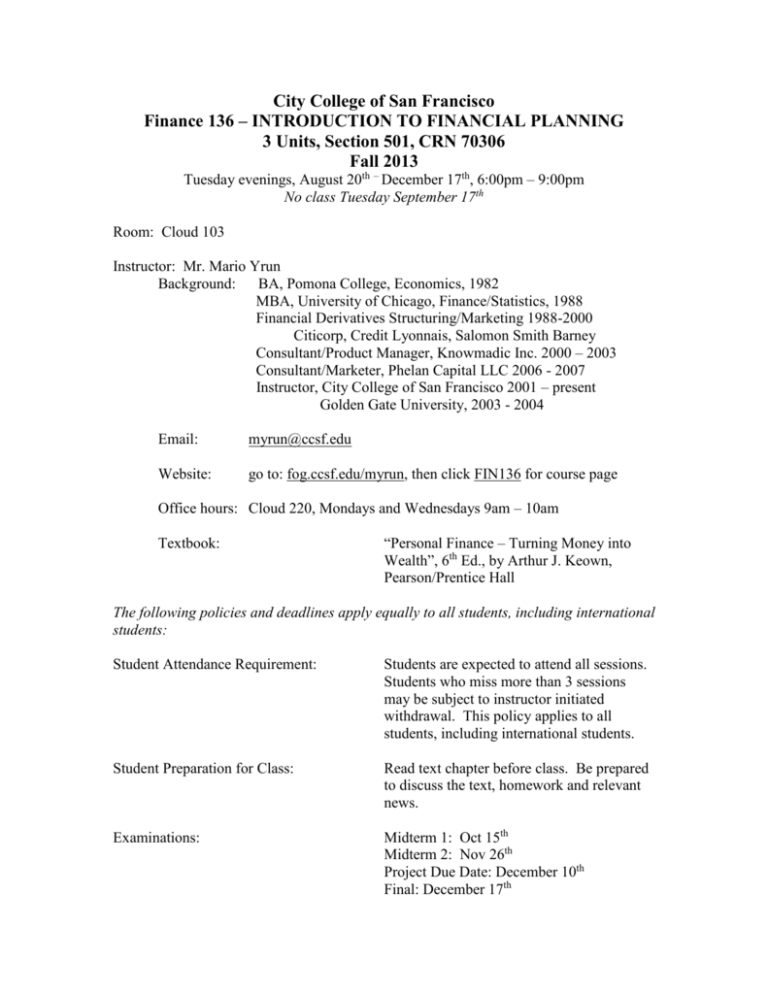

City College of San Francisco

Finance 136 – INTRODUCTION TO FINANCIAL PLANNING

3 Units, Section 501, CRN 70306

Fall 2013

Tuesday evenings, August 20th – December 17th, 6:00pm – 9:00pm

No class Tuesday September 17th

Room: Cloud 103

Instructor: Mr. Mario Yrun

Background:

BA, Pomona College, Economics, 1982

MBA, University of Chicago, Finance/Statistics, 1988

Financial Derivatives Structuring/Marketing 1988-2000

Citicorp, Credit Lyonnais, Salomon Smith Barney

Consultant/Product Manager, Knowmadic Inc. 2000 – 2003

Consultant/Marketer, Phelan Capital LLC 2006 - 2007

Instructor, City College of San Francisco 2001 – present

Golden Gate University, 2003 - 2004

Email:

myrun@ccsf.edu

Website:

go to: fog.ccsf.edu/myrun, then click FIN136 for course page

Office hours: Cloud 220, Mondays and Wednesdays 9am – 10am

Textbook:

“Personal Finance – Turning Money into

Wealth”, 6th Ed., by Arthur J. Keown,

Pearson/Prentice Hall

The following policies and deadlines apply equally to all students, including international

students:

Student Attendance Requirement:

Students are expected to attend all sessions.

Students who miss more than 3 sessions

may be subject to instructor initiated

withdrawal. This policy applies to all

students, including international students.

Student Preparation for Class:

Read text chapter before class. Be prepared

to discuss the text, homework and relevant

news.

Examinations:

Midterm 1: Oct 15th

Midterm 2: Nov 26th

Project Due Date: December 10th

Final: December 17th

No make-up exams given

Grading System:

Project 35%, Midterm and Final Exams 50%

Class Participation 15%: 90–100 = A, 80–

89 = B, 70–79 = C, 60–69 = D and <60 = F

Late submission of project is docked one full

grade point. No project is accepted after

December 17th final examination date.

Important Dates:

August 27, 2013: Last day to withdrawal,

drop or reduce course load in order to obtain

enrollment fee and 100% nonresident and

foreign student tuition fee refund

August 30, 2013: Last day to add credit

classes

September 5, 2013: Last day to drop credit

classes with no “W” on transcript, Last day

to drop classes to qualify for 50%

nonresident tuition fee refund;

September 12, 2013: Last day to request

pass/no-pass grading option

November 14, 2013: Last day for studentinstructor initiated withdrawal. Instructor

must assign grade or incomplete after this

date.

It is your responsibility to withdraw from the class by November 14th if you should chose

not to continue for any reason. To receive an incomplete grade you must submit a

request in writing to the instructor on or before December 10th with your reason and

supporting documentation. You must also receive written approval for the incomplete.

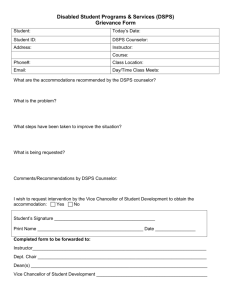

Reasonable accommodation of disabled students is required by law under the Americans

with Disabilities Act. Any disabled student who would like disability related

accommodations (special arrangements of any sort) must register with DSPS (Disabled

Students Programs and Services) and receive an official document from DSPS that

outlines reasonable accommodations determined by the DSPS counselor. The document

from DSPS should be shown to the instructor. If you do not have this document or you

have yet to register with DSPS, please call a counselor at (415) 452-5481. DSPS is

located in room 323 of the Rosenberg Library.

FIN 136 CLASS SCHEDULE

Fall 2013

8/20:

Course Introduction and Chapter 1 – Financial Planning

8/27:

Chapter 2 – Measuring Your Financial Health and Making a Plan

9/3:

Chapter 3 – Understanding the Time Value of Money

Motley Fool Video Documentary: “The Motley Fool Money-Making

Life-Changing Special”

9/10:

Chapter 3 – Understanding the Time Value of Money (con’t)

Homework due: Time Value of Money problems from text Ch 3

Chapter 4 – Tax Planning and Strategies

9/17:

no class

9/24:

Chapter 4 – Tax Planning and Strategies (con’t)

Frontline Video Documentary: “Inside the Meltdown”

10/1:

Homework due: Case - IRS 1040A and schedule A tax forms

Chapter 5 - Cash or Liquid Asset Management

PBS documentary: “The Credit Card Game”

10/8:

Chapter 6 – Using Credit Cards: The Role of Open Credit

Midterm Review

10/15:

Midterm Exam #1: Chapters 1 - 6

10/22:

Chapter 7 – Using Consumer Loans

NOW on PBS – “Credit and Credibility”

10/29:

Chapter 8 – The Home and Automobile Decision

Frontline documentary: “Mind over Money”

11/5:

Homework due: Buy vs Rent analysis

Chapter 9 – Life and Health Insurance

11/12:

Chapter 10 – Property and Liability Insurance

Chapter 11 - Investment Basics

11/19:

Chapter 11 – Investment Basics (con’t)

Chapter 12 – Securities Markets

Midterm Review

FIN 136 CLASS SCHEDULE (con’t)

Fall 2013

11/26:

Midterm Exam #2: Chapters 7 - 12

12/3:

Chapter 13 – Investing in Stocks

Chapter 14 – Investing in Bonds and Other Alternatives

Frontline Documentary “The Retirement Gamble”

12/10:

Projects Due

Chapter 16 – Retirement Planning

Chapter 15 – Mutual Funds: An Easy Way to Diversify

Final Exam Review

12/17:

Final Exam