Final Accounts - St Kevins College

advertisement

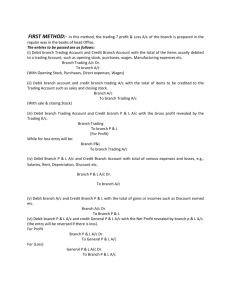

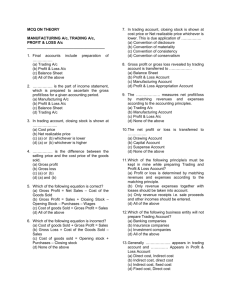

Final Accounts Aim: To produce final accounts for different forms of Business Organisation This is based on the final accounts question we did lots of in the Junior Cert. It comes in four types: 1. Sole Trader Final Accounts: similar to Junior Cert but Patent Royalties: an income from our Patents being used by others Bad Debts: an expense when a Debtor goes bankrupt and we don’t get paid, eg Paddy owes €4,000 goes bankrupt and pays up 30c on the €. This means we get paid €1,200 have an expense of €2,800and our Debtors go down by €4,000. Provision for Bad Debts: we anticipate the Bad Debt before it happens. This is done by creating a Bad Debt Provision Account which reduces the Debtors figure. Creating, increasing or reducing it is done in the Profit and Loss account. Unpaid expenses like interest will have to be provided for, ie included in the expenses and current liabilities Drawings: taken away from Capital and expenses adjusted accordingly Stocks of Stationery or Heating Oil is a prepaid 2. Limited Company Final Accounts: remember some of the theory Limited Liability Memorandum of Association Articles of Association Ordinary Shares but new terms also: Preference Shares (get fixed % dividends each year but no vote) Reserves (part of the long term Finance of the Company) Capital Reserves, eg Revaluation Reserve (due to appreciation of Fixed Assets) Share Premium (extra money paid for shares- treated as a Balance Sheet reserve) Revenue Reserve (profits retained over a number of years) The structure of the Final Accounts are basically the same but with some extra headings: Expenses are grouped into three categories: Administration Expenses, Distribution Expenses and Financial Expenses Fixed Assets are divided into three categories: Tangible Fixed Assets (eg Motor Vehicles), Intangible Fixed Assets (eg Goodwill), Financial Fixed Assets (eg Investments) Some of the extra tricky stuff includes: Bank Reconciliation Suspense Account Writing Off Goodwill Goods in Transit not recorded Goods on “Sale or Approval” included in Sales Using stocks and workers for building premises 3 Departmental Accounts: where the firms Trading, Profit and Loss is divided into a number of departments. So the incomes and expenses have to be allocated to the different departments using an appropriate basis (like Absorption Costing). The accounts involve more calculations and columns, though it isn’t as tricky as Company Final Accounts. You may also be asked to give advice on departments in difficulty. 4. Manufacturing Accounts: used for firms who produce goods, instead of simply buying and selling. The Manufacturing Account is used to calculate the Cost of Production as follows: Materials (Raw Materials Purchases + Opening – Closing Stocks) Direct Labour + Direct Expenses (eg renting a production machine) = Prime Cost + Indirect Expenses (eg repairs, factory insurance) + Opening Work in Progress less Closing Work in Progress less Sale of Scrap Materials = Cost of Production The Cost of Production is compared to the Current Market Value of the goods made to see if there is a Gross Manufacturing Profit. The Current Market Value is then used in the Trading Account to replace Purchases. The Gross Manufacturing Profit is added to Gross Profit from the Trading Account to find Total Gross Profit. The rest of the Final Accounts are no more complicated than what we have already seen.