Professor Vipin 2014 Unit 8 Financial Statements

advertisement

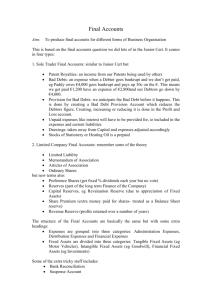

Professor Vipin 2014 Unit 8 Financial Statements Meaning Financial statements are the statements that are prepared at the end of the accounting period, which is generally one year. These include income statement i.e. Trading and Profit & Loss Account and Position statement i.e. Balance Sheet. Uses 1. Ascertaining the results of business operations: Every businessman wants to know the results of the business operations of his enterprise during a particular period in terms of profits earned or losses incurred. Income statement serves this purpose. 2. Ascertaining the financial position: Financial statements show the financial position of the business concern on a particular date which is generally the last date of the accounting period. Position statement i.e. Balance Sheet is prepared for this purpose. 3. Source of information: Financial statements constitute an important source of information regarding finance of a business unit which helps the finance manager to plan the financial activities of the business and making proper utilization of the funds. 4. Helps in managerial decision making: The Manager can make comparative study of the profitability of the concern by comparing the results of the current year with the results of the previous years and make his/her managerial decisions accordingly. 5. An index of solvency of the concern: Financial statements also show the short term as well as long term solvency of the concern. This helps the business enterprise in borrowing money from bank and other financial institutions and/or buying goods on credit. Revenue and Capital Items The preparation of Trading Account and Profit and Loss Account requires the knowledge of revenue expenditure, revenue receipts and capital expenditure and capital receipts. The knowledge shall facilitate the classification of revenue items and put them in the Trading account and Profit and Loss Account on one hand and prepare Balance Sheet based on capital items (expenditure as well as receipts) on the other hand. Capital Expenditure refers to the expenditure incurred for acquiring fixed assets or assets which increase the earning capacity of the business. The benefits of capital expenditure to the firm extend to number of years. Examples of capital expenditure are expenditure incurred for acquiring a fixed asset such as building, plant and machinery etc. Revenue expenditure, on the other hand, is an expenditure incurred in the course of normal business transactions of a concern and its benefits are availed of during the same accounting year. Salaries, carriage etc. are examples of revenue expenditure. www.VipinMKS.com Page 1 Professor Vipin 2014 Difference Between Revenue and Capital Items Basis Purpose Placement in financial statements Capital Expenditure It is incurred for acquiring fixed assets Increases the earning capacity of the business Benefits spread over several years It is an item of balance sheet and is shown as an asset Occurrence of expenditure Non recurring Earning Capacity Periodicity of benefit Revenue expenditure It is incurred for maintenance of fixed asset Helps maintain the earning capacity of the business Benefits accrue only in one year Part of Trading and Profit & Loss account and is shown on the debit side of the two Recurring expense Preparation of Trading Account Stock Stock refers to the goods lying unsold on a particular date. It can be of two types: a) Opening stock: Opening stock refers to the value of goods lying unsold at the beginning of the accounting year. It is shown on the debit side of the Trading Account. In the first year of business there is no opening stock b) Closing stock: It is the value of goods lying unsold at the end of the accounting year. It is valued at the cost price or market price whichever is less. It is shown on the credit side of the Trading Account. Purchases Purchases mean total items purchased for resale during the year. It can be both in cash and on credit. Purchases are shown on the debit side of the Trading account. These are always shown as net purchases i.e. amount of purchases returned (Purchase returns or return outwards) is deducted from the total amount of purchases made. Goods received on consignment basis are never treated as purchases. Similarly, goods received on ‘sale or return’ basis are never treated as purchases. Sales Sales refer to the total revenue from sale of goods of the business enterprise for which the Trading account is being prepared. It includes both cash sales and credit sales. These are recorded on the credit side of the Trading Account. Sales are shown at their net value i.e. sales return or returns inward is deducted from the total sales. Cash sales plus credit sales minus sales returns constitute net sales. Goods sent on ‘sale or approval’ are not part of sales until approval is received. www.VipinMKS.com Page 2 Professor Vipin 2014 Direct Expenses Direct expenses are the expenses that can be attributed directly to the purchase of goods or goods manufactured. These are shown on the debit side of the Trading Account. These are shown at the amount as shown in the Trial balance. For example, wages are recorded on the debit side of Trading Account at the amount shown in the Trial balance. Important items of direct expenses a) Wages i.e. wages relate to production. If amount under this head includes wages paid for construction of building or manufacturing of furniture for office it will be subtracted from the amount of wages. b) Carriage Cartage Freight i.e. amount paid for carriage of goods purchased for sale or raw material purchased for manufacturing. c) Other such direct expenses are customs and import duty, packing, materials, gas, electricity water, fuel, oil, gas, grease, heating and lighting, factory rent and insurance and many more such items. Gross Profit/Gross Loss It is the excess of net sales revenue over cost of goods sold. Gross Profit is equal to net sales minus cost of goods sold. If total of the credit side exceeds the total of debit side, the excess amount is termed as ‘gross profit’ and is shown on the debit side of Trading Account. On the other hand if debit side is more than the credit side, the difference in amount is called gross loss and is shown on the credit side of the Trading Account. Gross profit = Net sales – Cost of goods sold Gross loss = Cost of goods sold – Net sales www.VipinMKS.com Page 3 Professor Vipin 2014 Trading Account Particulars Opening Stock Purchases (Less) Returns Direct Expenses Carriage Inward Freight Wages Fuel and Power Excise Duty Factory Rent Heating and Lighting Insurance Work Manager's Salary Gross Profit transferred to P&L A/c Amount Particulars Sales (Less) Returns Amount Closing Stock Gross Loss transferred to P&L A/C Preparation of P&L Account Gross Profit / Gross Loss The value of gross profit or gross loss brought down from Trading A/C. There will be only value, either gross loss or gross profit Salaries / Salaries after Taxes / Salaries after Deductions Salaries are the payable to employees. In some cases it is required to deduct taxes and other charges such as provident fund deductions. Interest Interest on loans, either short or long term is an indirect expense and will be credited to the P&L account in case the firm has given loans to third parties. Commission Commission is both an income and an expense. If the firm has given commissions to its employees its an expense, however if the firm has received commission it becomes an income. Trade Expenses www.VipinMKS.com Page 4 Professor Vipin 2014 These are small expenses and are debited to P&L account. Printing and Stationery This includes printing of bills, invoices, and other items of stationery. It is an indirect expense. Advertisements Advertisement expenses incurred for the purchasing of goods should be charged to the trading account, while advertisement expenses incurred for the purchase of capital asset should be considered as a capital expense and be charged to the concerned asset account. Advertisement expense expenditure incurred for the sale of a capital asset must be deducted out of the sale proceeds of the asset concerned. Bad Debts It is a loss due to debtors whom the goods were sold on credit. It is a loss and hence must be debited to the P&L account. Depreciation It is an expense which denotes the value of an asset due to wear and tear, lapse of time and obsolescence. Profit and Loss Account Particulars To Gross Loss b/d To Admin Expenses Salaries Rent Taxes Printing and stationery Postage and Telegram Telephone Expenses Legal Charges Insurance Audit Fees Directors Fees General Expenses To Selling and Distribution Expenses Showroom Expenses Advertising Commission Paid www.VipinMKS.com Rs Particulars By Gross Profit b/d By Dividends Received By Interest Received By Discount Received By Commission Received By Rent Received By Profit on Sale of Assets By Sundry revenue receipts By Net Loss Transferred to capital A/C (Bal fig) Rs Page 5 Professor Vipin 2014 Bad Debts Provision for Doubtful Debts Godown Rent Carriage Outward Upkeep of Delivery Vans To Depreciation and Maintenance Depreciation Repairs To Financial Expenses Interest on Borrowings Discount Allowed To Abnormal Losses Loss on Sale of Assets To Net Profit Transferred to Capital A/C Adjustment Entries Adjustment Journal Entry Closing Stock A/C to Trading A/C Closing Stock Outstanding Expenses Expenses A/C To Outstanding Expenses A/C Prepaid Expenses A/C To Expenses A/C Treatment in Trading and P&L A/C Credit Side of Trading A/C Added to respective expenses on debit side Treatment in Bal Sheet Assets Side Liabilities Side Deducted from respective expenses on debit side Assets Side Income earned but not received Accrued Income A/C To Income A/C Added to respective income on credit side Assets Side Income received in advance Income A/C To Income Received in Advance A/C Dedicted from respective income on the credit side Liabilities Side Prepaid / Unexpired Expenses Depreciation A/C To Assets A/C Debit Side of P&L Deducted from the value of asset on assets side Appreciation Assets A/C To Appreciation A/C Credit side of P&L Added to the value of asset on assets side Further bad debts Bad Debts A/C To Sundry Debtors A/C Debit Side of P&L Deducted from debtors on assets side Depreciation www.VipinMKS.com Page 6 Professor Vipin 2014 Provision for doubtful debts P&L A/C To Provision for Doubtful Debts A/C Provision for discount on debtors P&L A/C To Provision for discount on Debtors a/c Provision for discount on creditors Provision for discount on Creditors A/C To P&L A/C Debit Side of P&L Shown as deduction from debtors on asset side Debit Side of P&L Shown as deduction from debtors on asset side Credit side of P&L Shown as deduction from creditors on liabilites side Example 1 From the following trial balance of Vijay, prepare the trading & profit and loss account for the year ending 30-12-11 and balance sheet as on that date. Name of the Account Vijay Capital Vijay Drawings Purchases and Sales Stock (1/11/11) Returns Inwards Returns Outward Wages Salaries Rent and Insurance General Expenses Debtors Creditors Bills Receivable Bills Payable Provision for Doubtful Debts Provision for Discount on Debtors Bad Debts Discount Allowed Plant and Machinery Furniture and Fixtures Cash and Bank Balance Debit Credit 40000 10000 74000 112500 18000 2500 1500 6000 5500 1400 4600 20000 27000 8000 12000 2400 900 1200 320 30000 5000 9780 Adjustments: 1. Wages and Salaries unpaid Rs. 500 each 2. Insurance prepaid Rs. 200 www.VipinMKS.com Page 7 Professor Vipin 2014 3. General expenses include prepaid amount of Rs. 400 4. A provision for doubtful debts is to be maintained at 5% on debtor and provision for discount on debtor at 2% 5. Depreciation at 5% on Machinery and 10% on furniture. 6. Stock on 31/12/11 was Rs. 15000 Solution 1 Particulars To Opening Stock To Purchase Returns Less: Returns To Wages Add: Outstanding To P&L A/C (Gross Profit c/d) Amount Amount 18000 By Sales 74000 Less: Returns 1500 72500 By Closing Stock 6000 500 6500 28000 125000 To Salaries 5500 Add: Outstanding TO Rent & Insurance Less: Prepaid To General Expenses 500 1400 200 4600 Less: Prepaid To Depreciation Add: Machinery Add: Furniture To Net Profit www.VipinMKS.com Amount Amount 112500 2500 110000 15000 400 1500 500 By Gross Profit b/d By Prov for Doubtful Debts (old 6000 Prov) Less: Bad Debts 1200 Less: New Prov By Prov for discount on debtors (old 4200 prov) Less: Discount 2000 Less: New Prov 15000 28400 125000 28000 2400 1200 1200 1000 200 900 320 580 380 200 28400 Page 8 Professor Vipin 2014 Balance Sheet as on 31/12/11 Liabilities Capital Add: Net Profit Less: Drawings Sundry Creditors Bills Payable Outstanding Expens Wages Salaries Amount Amount 40000 15000 55000 10000 45000 27000 12000 500 500 Assets Plant and Machinery Less: Depreciation Furniture and Fixture Less: Depreciation Closing Stock Sundry Debtors Less: Prov for Doubtful debts 1000 Less: Prov for discount Bills Receivable Prepaid Insurance Prepaid Expenses Cash and Bank Balances 85000 Amount Amount 30000 1500 28500 5000 500 4500 15000 20000 1000 19000 380 18620 8000 200 400 9780 85000 Example 2 The following is the trial balance of Shri Om as on 31/03/99. You are requested to prepare Trading & Profit and Loss A/c for the year 31/03/99 and Balance Sheet as on the date after making necessary adjustments Particulars Sundry Debtors Sundry Creditors Outstanding Liability for Expenses Wages Carriage Outwards Carriage Inwards General Expenses Cash Discount Bad Debts Motor Car Printing and Stationery Furniture Advertisements Insurance Salesman Commission Postage and Telephone www.VipinMKS.com Debit Credit 500000 200000 55000 100000 110000 50000 70000 20000 10000 240000 15000 110000 85000 45000 87500 57500 Page 9 Professor Vipin 2014 Salaries Rates and Taxes Drawings Capital Account Purchases Sales Stock on 1/4/90 Cash at Bank Cash at Hand 160000 25000 20000 1443000 1550000 1987500 250000 60000 10500 3630500 3630500 The following adjustments are to be made: 1. Stock 31/03/99 was valued at Rs. 725000 2. A provision for bad and doubtful debts is to be created to the extent of 5% on Sundry Debtors 3. Depreciate: a) Furniture – 10% b) Motor Car – 20% 4. Shri Om had withdrawn goods worth Rs. 25000 during the year 5. Sales made include Rs. 75000 sent to Shanti & Co on approval and remaining unsold as on 31/03/99. The cost of goods was Rs. 50000 6. Salesman is entitled to a commission of 5% on total sales. 7. Debtors include Rs. 25000 bad debts 8. Printing and stationery expenses of Rs. 55000 relating to 1997-98 had not been provided in that year but was paid in this year by debiting outstanding liabilities. 9. Purchases include purchase of furniture worth Rs. 50000 Shri Om Trading & Profit and Loss A/C as on 31/09/99 Particulars To Opening Stock To Purchases Less: Drawings Less: Furniture To Wages To Carriage Inwards To Gross Profit To Salaries www.VipinMKS.com Amount Amount Particulars 250000 By Sales Less: Goods Sent on 1550000 Approval 25000 By Closing Stock 50000 1475000 Add: Stock at Approval 100000 50000 812500 2687500 160000 To Gross Profit Amount Amount 1987500 75000 725000 50000 1912500 775000 2687500 812500 Page 10 Professor Vipin 2014 To Rates and taxes To Postage and Telephone To Insurance To Printing and Stationery To General Expenses To Depreciation Furniture Motor Car To Sales Commission (5%) To Advertisement To Carriage Outwards To Bad Debts Add: Addl Bad Debts Add: Prov for Bad Debts (5%) To Cash Discount To Net Profit 25000 57500 45000 15000 70000 16000 48000 64000 95625 85000 110000 10000 25000 20000 55000 20000 10375 812500 812500 Shri Om Balance Sheet as on 31/09/99 Liabilities Capital Add: Net Profit Less: Drawings (20000+25000) Less: Printing and Stationery Sundry Creditors Salesman's Commission Outstanding (95625-87530) Amount Amount 144300 10375 1453375 Assets Furniture Add: Additions during the yr 45000 Less: Depreciation 55000 1353375 Motor Car 200000 Less: Depreciation 8125 Closing Stock (725000+50000) Sundry Debtors Less: Goods sent on approval Less: Addl Bad Debts Less: Prov for doubtful debts (5% of 400000) Cash at Bank Cash at Hand 1561500 www.VipinMKS.com Amount Amount 110000 50000 160000 16000 240000 48000 144000 192000 775000 500000 75000 400000 20000 380000 60000 10500 1561500 Page 11 Professor Vipin 2014 Working Note: 1. Both sales and sundry debtors have been reduced by Rs. 75000 representing invoice value of goods sent on approval. Rs. 50000 have been added to the closing stock being the cost of goods sent on approval. 2. Last year’s short provision for printing and stationery has not been charged to the current year’s profit and loss A/C. It is preferable to charge it directly to the capital account. 3. Sundry Debtors = Rs. 500000 [Rs. 75000 (goods on approval) + Rs. 25000 (Bad debts)] = Rs. 400000 www.VipinMKS.com Page 12