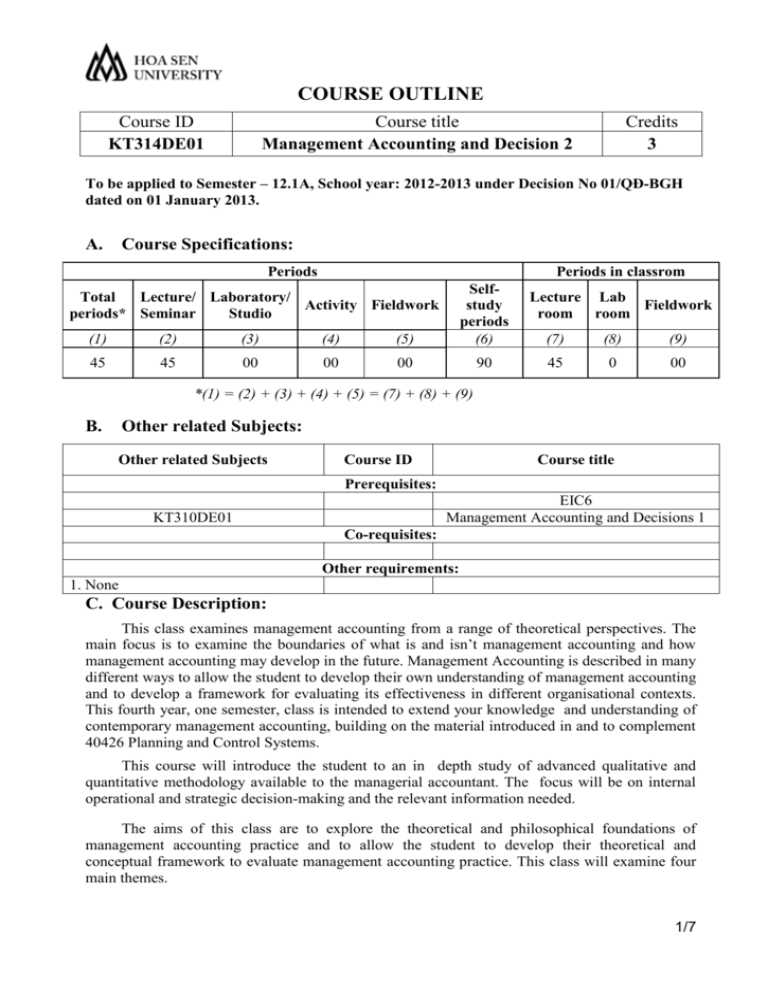

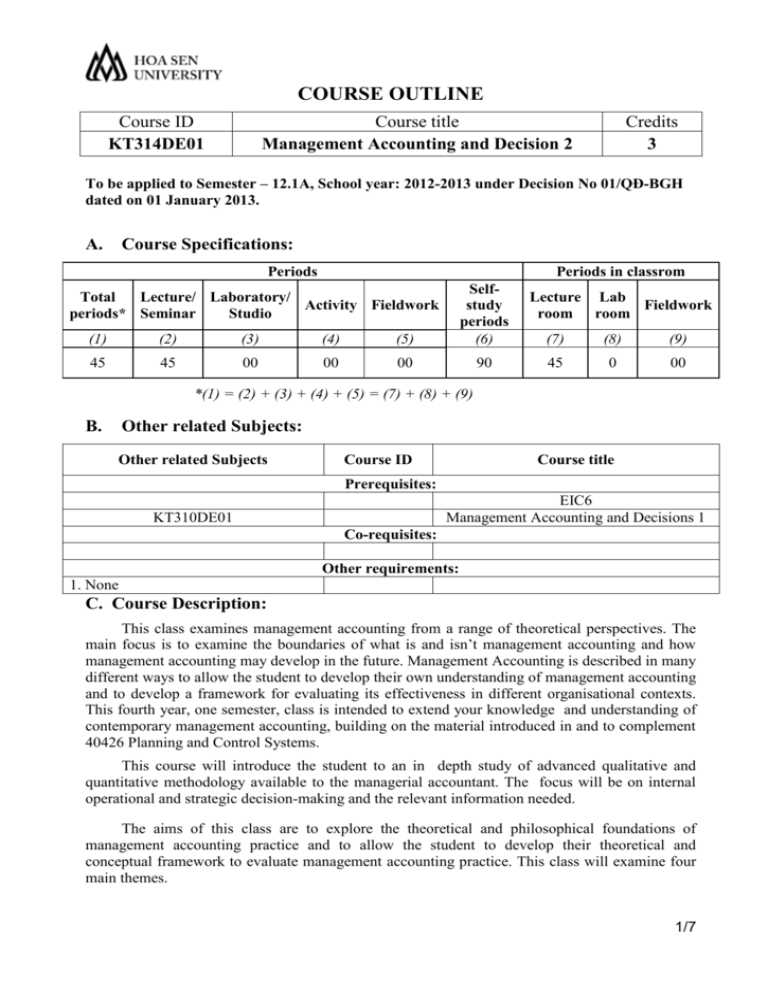

COURSE OUTLINE

Course ID

KT314DE01

Course title

Management Accounting and Decision 2

Credits

3

To be applied to Semester – 12.1A, School year: 2012-2013 under Decision No 01/QĐ-BGH

dated on 01 January 2013.

A.

Course Specifications:

Periods

Periods in classrom

(1)

(2)

(3)

(4)

(5)

Selfstudy

periods

(6)

45

45

00

00

00

90

Total

Lecture/ Laboratory/

Activity Fieldwork

periods* Seminar

Studio

Lecture Lab

Fieldwork

room room

(7)

(8)

(9)

45

0

00

*(1) = (2) + (3) + (4) + (5) = (7) + (8) + (9)

B.

Other related Subjects:

Other related Subjects

Course ID

Course title

Prerequisites:

EIC6

Management Accounting and Decisions 1

KT310DE01

Co-requisites:

Other requirements:

1. None

C. Course Description:

This class examines management accounting from a range of theoretical perspectives. The

main focus is to examine the boundaries of what is and isn’t management accounting and how

management accounting may develop in the future. Management Accounting is described in many

different ways to allow the student to develop their own understanding of management accounting

and to develop a framework for evaluating its effectiveness in different organisational contexts.

This fourth year, one semester, class is intended to extend your knowledge and understanding of

contemporary management accounting, building on the material introduced in and to complement

40426 Planning and Control Systems.

This course will introduce the student to an in depth study of advanced qualitative and

quantitative methodology available to the managerial accountant. The focus will be on internal

operational and strategic decision-making and the relevant information needed.

The aims of this class are to explore the theoretical and philosophical foundations of

management accounting practice and to allow the student to develop their theoretical and

conceptual framework to evaluate management accounting practice. This class will examine four

main themes.

1/7

• What is management accounting? Where are its origins, its theoretical framework, its historical

development?

• What do management accountants do?

• How important is the operational context when evaluating management accounting practice?

• Are there any new 'solutions' or developments that claim to improve 'management accounting'?

The class achieves these aims through the student reading and developing an understanding of a

set of academic articles and student-led seminar discussions and presentations.

D. Course Objectives:

No.

Course Objectives

1.

Identify, understand, and discuss the nature, purpose, and importance of different

types of decision-relevant managerial accounting information;

2.

Identify, understand, and apply fundamental quantitative techniques used to

generate decision-relevant managerial accounting information;

3.

Make sound strategic and operational business decisions based on your

development and evaluation of supporting management accounting information;

and

4.

Identify some seminal theories that explain why we observe certain cost

management and performance measurement techniques in practice.

5.

Apply advanced managerial accounting concepts in order to make more informed

and more effective decisions in simulated and actual business situations.

6.

Demonstrate critical thinking through effective writing skills in describing,

analyzing and evaluating ideas and experiences.

7.

Prepare professional management reports using proper citation standards, that

require judgement and analytical skills based on quantitative and qualitative

information resulting from research.

8.

Develop, prepare and deliver effective oral presentations clearly demonstrating a

mastery of the case strategy, performance results and optimal recommendations.

9.

Assess, interpret and evaluate different issues that may be faced by business

organizations and learn how to effectively document an analysis and provide a

preliminary recommendation.

10.

Develop management accounting information systems that will play an important

role in the overall success of an organization.

2/7

E. Learning Outcomes:

No.

Learning Outcomes

1.

Develop intellectual and professional competencies by analysing and evaluating

evidence, logical reasoning and practical applications.

2.

Develop communication skills – explaining, listening, discussion, questioning,

presenting and defending a position, giving feedback, writing

3.

Develop group management skills.

4.

Develop intellectual understandings, clarifying concepts and theories by thinking,

discussion, doing, observing and constructing connections.

5.

Develop a mature learning stance by accepting personal responsibility for

progress and direction of learning, questioning authority, using feedback from

mistakes

6.

Explain cost management concepts, product costing techniques, and planning &

control systems;

7.

Use relevant information for making decisions and Prepare a master budget and a

flexible budget, compare the budgets with actual results, analyze and interpret

variances;

8.

Apply Management Accountants’ Codes of Ethics to resolve an ethical situation;

Develop verbal and writing communication skills and teamwork ability.

F. Instructional Modes:

– This course was conducted in the class as lecture.

– Teaching in the class: 30 hours (3 hours per day) and learning in class room by face-toface discussion.

– Hour for doing exercises: 15 hours (1 hour per day) and learning in class room.

– Students will be divided into some small groups to exchange, discuss, handle the situation,

do homework and declare taxes.

– Translation some exercise from Vietnam to English and solving them. This work is helped

the students knowing the academic terms in Auditing and Accounting.

– Do the seminar: comparison between Vietnamese auditing standards and system of foreign

countries in the world.

G. Textbooks and teaching aids:

Required Textbooks and Materials:

3/7

– Cost Accounting, Prentice Hall, 5th Canadian edition, Horngren, Foster, Datar, Teall, and

Gowing (ISBN 0-13-197190-5).

– Cost accounting, FAA UEH in Ho Chi Minh City, Vietnam

Suggested Course Materials:

– May, C.B. & May, G.S.. Effective Writing: A Handbook for Accountants. 9th edition.

Pearson Prentice-Hall , 2012. Type: Textbook, ISBN: 978-0-13-256724-4

– Horngren, Foster, Data & Gowing. Cost Accounting: A Managerial Emphasis. 5th Cdn

edition. Pearson, 2010. Type: Textbook, ISBN: 978-0-13-508407-6

– Horngren, Foster, Data & Gowing. Student solutions Manual for Cost Accounting: A

Managerial Emphasis. 5th Cdn edition. Pearson, 2010. Type: Textbook, ISBN: 978-0-13611021-7

– Managerial Accounting; Garrison, Noreen & Brewer, 13th. Ed. (ISBN 10: 0390447501 or

ISBN 13: 9780390447500)

– American Accounting Association. (2010). American Accounting Association/Financial

Accounting Standards Board: AAA/FASB. Available at http://aaahq.org/acdLogin.cfm

– The American Institute of Certified Public Accountants. (2012). AICPA: American

Institute of CPAs. Available at http://www.aicpa.org/

Teaching aids:

– Projector and Micro

– Blackboard, chalk or pen for writing onto the board

– Internet Access: you will need convenient access to the Internet. While not all assignments

will be on-line, there will be submission requirements requiring connection. Investigate as

soon as possible getting connected or plan on using university resources.

H. Assessment Methods (Requirements for Completion of the Course):

1. Description of learning outcomes assessment

This is an advanced course in strategic management accounting which examines

the integrative and interdisciplinary role of management accounting, and its contribution

to strategic management processes. The course uses a case-based and business

simulation approach. The course focuses on building competencies, including the

application of management accounting tools and techniques, and the effective

evaluation, assessment and interpretation of information. These competencies should

improve decision making, performance evaluation and strategic processes leading to the

overall success of a business organization.

Learning in this course results primarily from in-class discussion and participation

of comprehensive assurances cases as well as out-of-class analysis. The balance of the

learning results from the lectures on strategic concepts, from related readings, and from

researching your presentations, cases, assignments, simulation decisions and projects.

All work will be evaluated on an individual basis except in certain cases where group

work is expected. In these cases group members will share the same grade adjusted by

peer evaluation (where appropriate).

The classroom format will be interactive and I will assume that you have read and

prepared all of the assigned discussion questions, though we may not have time to cover

every one. Case studies for class discussion will also be handed out or made available on

WebCT ahead of the class when they will be discussed. Examination materials are drawn

from readings, cases, class presentations, and in-class and written assignments.

4/7

2. Summary of learning outcomes assessment

* For main semester:

Components Duration

Mini-Test 1

Hour

Mid-term

Test

Mini-Test 2

60 mins

Final Test

90 mins

-

Assessment Forms

Individual or group

exercises

Multiple choices or/and

Problem

-

Percentage

20%

-

-

Multiple choices and

Problem

50%

Based on Education

Department’s schedule

Total

Schedule

Every week

Week 8

30%

100%

3. Academic Integrity

Academic integrity is a fundamental value that affects the quality of teaching, learning,

and research at a university. To ensure the maintenance of academic integrity at Hoa Sen

University, students are required to:

Work independently on individual assignments

Collaborating on individual assignments is considered cheating.

Avoid plagiarism

Plagiarism is an act of fraud that involves the use of ideas or words of another

person without proper attribution. Students will be accused of plagiarism if they:

i. Copy in their work one or more sentences from another person without proper

citation.

ii. Rephrase, paraphrase, or translate another person’s ideas or words without

proper attribution.

iii. Reuse their own assignments, in whole or in part, and submit them for another

class.

Work responsibly within a working group

In cooperative group assignments, all students are required to stay on task and

contribute equally to the projects. Group reports should clearly state the

contribution of each group member.

Any acts of academic dishonesty will result in a grade of zero for the task at hand and/or

immediate failure of the course, depending on the seriousness of the fraud. Please consult

Hoa Sen University’s Policy on Plagiarism at http://thuvien.hoasen.edu.vn/chinh-sachphong-tranh-dao-van. To ensure the maintenance of academic integrity, the university asks

that students report cases of academic dishonesty to the teacher and/or the Dean. The names

of those students will be kept anonymous.

I. Teaching Staff:

No.

Professor’s name

1

Pham Quang Huy

Email, Phone number,

Office location

pqh.huy@gmail.com

Office hours

-

Position

Visiting

5/7

2

-

lecturer

Guest

speaker

3

4

J. Outline of Topics to be covered (Learning Schedule):

Main semester: Once per week

Subordinate semester: Twice per week

Week/ Meeting

Topics

References

Homework

/Assignment

1.

Management accounting and responsibility

management

- Application of financial information in

responsibility management

- Types of responsibility centers and the ways

of their management

2.

Management accounting and responsibility

management (cont)

- Costs, transfer prices and their reflection in

responsibility centres revenues, types of

responsibility centres results

- Cash flow and its application in responsibility

management

3.

Flexible Budgets, Direct-Cost Variances, and

Management Control

4.

Flexible Budgets, Direct-Cost Variances, and

Management Control (cont)

5.

Systems Design: Job Order Costing

6.

Systems Design: Process Costing

7.

Cost Behavior Analysis and Use

8.

Review and Mid term test in class+ continue

teaching

9.

Profit Planning

10.

Flexible Budgets and Performance Analysis

11.

Flexible Budgets and Performance Analysis

6/7

Week/ Meeting

Topics

References

Homework

/Assignment

(cont)

12.

System of plans and budgets and its realtion

to management accounting

- Relation of plans and budgets to company

policies

- Long term and short term company budgets

- Master Budgets and its relation to partial

company plans and budgets

- Company budgets transformation to lower

intra-company budgets

- Budgets verification

13.

Calculation the cost of finished goods – Case 1

14.

Calculation the cost of finished goods – Case 2

15.

General Review – Revision – Q&A

Notice:

Subject is designed with the participant of guest speaker who will share reality from

experience or students will be attended the seminar during the subjects

7/7