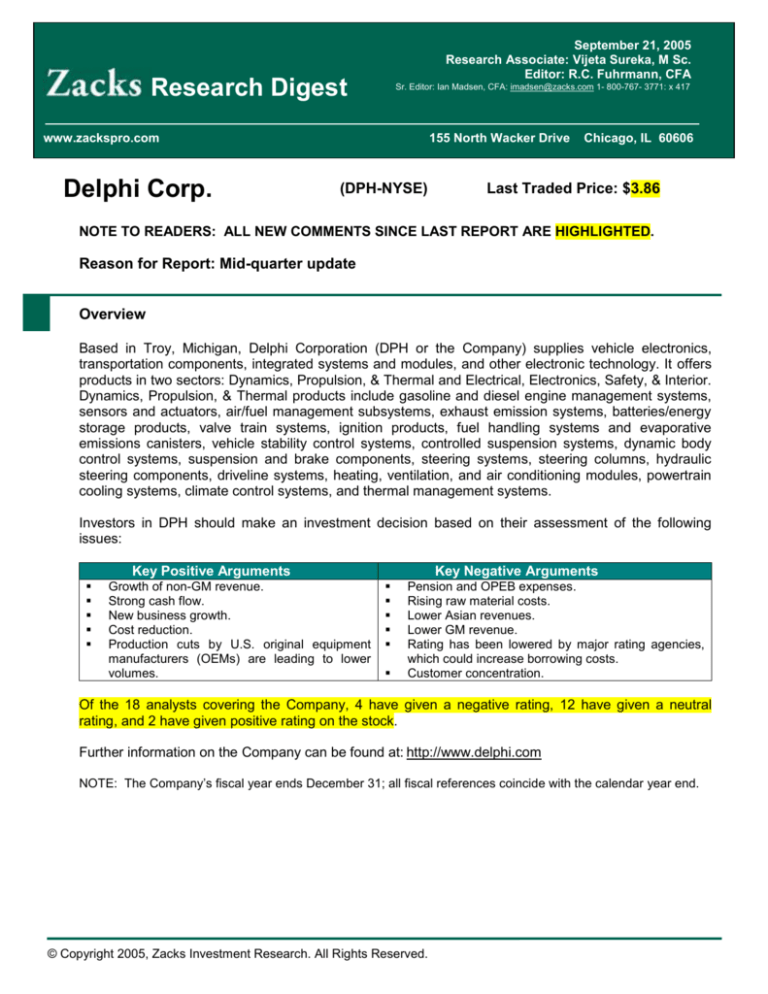

September 21, 2005

Research Associate: Vijeta Sureka, M Sc.

Editor: R.C. Fuhrmann, CFA

Research Digest

Sr. Editor: Ian Madsen, CFA: imadsen@zacks.com 1- 800-767- 3771: x 417

pmadsen@zacks.com

www.zackspro.com

Delphi Corp.

155 North Wacker Drive

(DPH-NYSE)

Chicago, IL 60606

Last Traded Price: $3.86

NOTE TO READERS: ALL NEW COMMENTS SINCE LAST REPORT ARE HIGHLIGHTED.

Reason for Report: Mid-quarter update

Overview

Based in Troy, Michigan, Delphi Corporation (DPH or the Company) supplies vehicle electronics,

transportation components, integrated systems and modules, and other electronic technology. It offers

products in two sectors: Dynamics, Propulsion, & Thermal and Electrical, Electronics, Safety, & Interior.

Dynamics, Propulsion, & Thermal products include gasoline and diesel engine management systems,

sensors and actuators, air/fuel management subsystems, exhaust emission systems, batteries/energy

storage products, valve train systems, ignition products, fuel handling systems and evaporative

emissions canisters, vehicle stability control systems, controlled suspension systems, dynamic body

control systems, suspension and brake components, steering systems, steering columns, hydraulic

steering components, driveline systems, heating, ventilation, and air conditioning modules, powertrain

cooling systems, climate control systems, and thermal management systems.

Investors in DPH should make an investment decision based on their assessment of the following

issues:

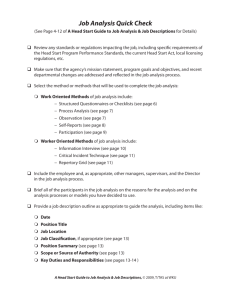

Key Positive Arguments

Growth of non-GM revenue.

Strong cash flow.

New business growth.

Cost reduction.

Production cuts by U.S. original equipment

manufacturers (OEMs) are leading to lower

volumes.

Key Negative Arguments

Pension and OPEB expenses.

Rising raw material costs.

Lower Asian revenues.

Lower GM revenue.

Rating has been lowered by major rating agencies,

which could increase borrowing costs.

Customer concentration.

Of the 18 analysts covering the Company, 4 have given a negative rating, 12 have given a neutral

rating, and 2 have given positive rating on the stock.

Further information on the Company can be found at: http://www.delphi.com

NOTE: The Company’s fiscal year ends December 31; all fiscal references coincide with the calendar year end.

© Copyright 2005, Zacks Investment Research. All Rights Reserved.

Recent Events

The Company is expected to announce its next quarterly earnings on October 17, 2005.

Ratings have been lowered by major rating agencies such as Moody’s, Standard & Poor’s, etc., which

is expected to increase borrowing costs of the Company.

On August 9, 2005 Delphi, during its talks with GM and the United Auto Workers (UAW) union, spoke

about cutting costs but would consider a bankruptcy filing for U.S. operations if it does not obtain

concessions. The Company is seen as needing to restructure operations in order to reduce its U.S.

fixed cost structure. Management is currently in discussions with its largest union, the UAW, as well as

its largest customer and former parent, GM. If Delphi reaches agreements with the UAW and GM, it

would be the second such three-way pact in recent months after parts maker Visteon Corp (VC). The

UAW incentive to negotiate concessions out of court, given the lesser influence it would have in a

bankruptcy scenario according to analysts.

One analyst (Goldman) thinks bankruptcy could be avoided because a filing would be damaging for

DPH, GM, and the UAW. Another analyst (Deutsche Bank) continues to believe DPH, GM, and the

UAW will come to terms as they believe the path to this point will entail significant volatility. Their belief

that DPH will survive is based upon not only the potential disruptions to GM, but also upon outstanding

benefit guarantees in place where GM guarantees certain benefits to DPH's UAW employees.

However, another analyst (Thomas Weisel) thinks that a potential bankruptcy filing is likely to maintain

pressure on the stock but they believe the possibility is discounted in the price. In addition, they believe

that the possibility of successful negotiations with the union and GM should limit downside risk in the

near term. Another analyst (Prudential) sees long-term potential at Delphi as the Company restructures

to dramatically scale back its UAW head count, the risk of a bankruptcy cannot be dismissed and

therefore they cannot recommend buying the stock at this time.

On July 1, 2005 DPH completed the sale of most of its battery business to auto interiors supplier

Johnson Controls Inc. (JCI) for $202.5 million under its plan to sell non-core assets. The deal includes

plants in France, Brazil and Mexico and joint ventures in China, Korea and Saudi Arabia. It covers

2,700 of Delphi's 3,470 battery business workers worldwide.

On June 30, DPH announced the completion of its financial restatement and that its periodic filings with

the SEC are now up to date. In conjunction with the restatement, the Company’s audit committee

concluded its internal investigation of certain accounting transactions over the past five years.

On June 29, 2005 Delphi Medical Systems, a subsidiary of DPH, acquired the principal assets of

Caretools, a provider of technologically advanced electronics medical record (EMR) systems.

On June 23, the Board of Directors of DPH named Robert S. Miller (Steve Miller) as the Company's

new chairman and chief executive officer, effective from July 1.

Sales

Revenue declined 6.9% to $7,023 million from $7,542 million in 2Q04 and increased 2.3% from $6,862

million in 1Q05. DPH may have to file for bankruptcy if it cannot reduce high wage and benefit costs

according to analysts. Volumes and prices are under pressure due to a weakening automotive market.

Cost reduction programs are also in the works. Production cuts by U.S. original equipment

manufacturers (OEMs) are leading to lower volumes according to analysts.

Non-GM revenues reached a record high of 51.5% in 2Q05. Non-GM revenue for the quarter was

$3,616 million, up 6.1% from $3,409 million in 2Q04. The business outside the United States performed

Zacks Investment Research

Page 2

www.zackspro.com

well according to analysts. Beside lower production from GM, high commodity cost and increasing

costs for pension and health care benefits contributed to the quarterly loss. An 18% decline in sales to

GM more than offset growth in non-GM revenue.

Management expects North American volumes to fall by 10% in 2005 as compared to 2004 levels. In its

outlook for 3Q05, management expects revenue to fall in the range of $6.1-$6.3 billion. Management

also expects that GM North America production will decline 10% in 2005.

Provided below is a summary of revenue as given by Zacks Digest:

Total Revenue ($ MM)

FY ends December

Digest High

Digest low

Digest Average

Zacks Consensus

Digest YoY growth

Digest sequential

growth

FY2004

$28,622.0

$28,622.0

$28,622.0

1Q05A

$6,862.0

$6,862.0

$6,862.0

2Q05A

$7,023.0

$7,023.0

$7,023.0

-6.9%

3Q05E

$6,377.0

$6,100.0

$6,248.8

$6,442.0

-5.9%

4Q05E

$7,337.0

$6,563.7

$6,940.8

$7,195.0

-1.4%

1.9%

-7.3%

-2.5%

2.3%

-11.0%

11.1%

FY2005E

$27,573.0

$26,631.4

$27,102.0

$27,181.0

-5.3%

FY2006E

$28,873.0

$25,327.0

$27,263.4

$27,817.0

0.6%

1.9%

One analyst (Goldman) sees 1% GM revenue growth and expects non-GM revenue growing at a 9%10% rate beyond 2005.

Margins

Depth’s gross margin has declined for the past four quarters, indicating long-term deterioration issues.

Gross margin before restructuring charges declined to 6.7% in 2Q05 from 12.4% in 2Q04. Gross profit

for 2Q05 was $474 million as compared to $935 million in 2Q04. The decline in margin was attributed

primarily to lower production volumes, particularly GM North America (GMNA). Delphi indicated that

price givebacks, higher wage and benefit costs, and higher raw material costs accounted for

approximately 1.8%, 1.4%, and 1%, respectively, of the decline in gross margin. Management indicated

that excluding the impact of foreign currency fluctuations, higher commodity cost and costs associated

with troubled suppliers reduced operating earnings by $100 million on a year-over-year basis. The

operating loss was $227 million as compared to operating income of $210 million in 2Q04. The loss

was exacerbated by lower volumes, higher raw material costs, and increased payments for workers in

the jobs bank.

Provided below is a summary of margins as compiled by Zacks Digest:

Margin

Gross

Operating

Net

FY2004

9.9%

-1.7%

-16.6%

1Q05A

5.3%

-4.7%

-5.9%

2Q05A

6.7%

-3.2%

-4.8%

3Q05E

4.5%

-5.9%

-7.6%

4Q05E

6.6%

-3.6%

-4.7%

FY2005E

5.8%

-4.3%

-5.4%

FY2006E

8.0%

-1.9%

-2.9%

Management projects that margins will be down from 1H05 owing to mounting legacy costs. DPH will

not be able to adjust its cost structure for weaker production according to analysts

One analyst (Goldman) expects EBIT margins to grow to about 0.3% in 2007 and to 1.2% in 2008,

assuming modest raw materials cost declines and cost savings from annual head count reductions in

the mid-4,000 area beyond 2005. They assume almost zero raw materials cost reductions in 2006, as

Zacks Investment Research

Page 3

www.zackspro.com

they do for all the suppliers under their coverage, because they see lower steel pricing being largely

offset by higher resin and other costs.

One analyst (R W. Baird) looks for weak operating results through most of 2005.

Earnings per Share

DPH reported a net loss of $338 million or $0.60 per share on a GAAP basis as compared to 2Q04 net

income of $143 million or $0.25 per share. Excluding $49 million of restructuring charges, Delphi

reported a loss of $0.52 per share, down 316% from $0.25 per share in 2Q04. The Company is also

expected to report losses in the coming years, according to analysts. Most of the analysts have

reduced EPS estimates for 2005 based on revised revenue estimates.

Forward and quarterly EPS estimates for DPH are as follows:

EPS

FY ends December

Zacks Consensus

Company Guidance

Digest Avg.

Digest High

Digest Low

Digest YoY growth

Digest sequential

growth

FY2004

1Q05A

2Q05A

3Q05E

($0.73)

4Q05E

($0.47)

FY2005E

($2.39)

FY2006E

($1.03)

($8.47)

($8.47)

($8.47)

42250.0%

($0.73)

($0.73)

($0.73)

($0.52)

($0.52)

($0.52)

($0.75)

($0.42)

($1.00)

($0.49)

($0.23)

($0.73)

($2.44)

($2.00)

($2.83)

($1.41)

($0.55)

($2.47)

-763.6%

-308.0%

-255.5%

-441.2%

71.2%

42.0%

-711.1%

28.8%

-43.6%

29.8%

Highlights from the above chart are as follows:

• 2005 forecasts (Total 17) range from ($2.83) to ($2.00); the average is ($2.44).

• 2006 forecasts (Total 14) range from ($2.47) to ($0.55); the average is ($1.41).

• 2007 forecasts (Total 3) range from ($1.54) to ($0.21); the average is ($0.68).

Target Price/Valuation

The average Zacks Digest price target quoted by the analysts providing such a number is $5.25

(approximately 36% upside from the current price). The price target ranges from $3.50 (approximately

5% downside from the current price) to $10.00 (approximately 160% upside from the current price),

with a median price of $4.78.

The lowest target price is $3.50 (BMO Nesbitt) and the highest price target is $10.00 (Lehman). Target

price of $2.50 is based on 5x EV multiples while the target price of $10.00 is based on a sum of parts

analysis. Most of the analysts have used an EBITDA and/or EPS-based methodology to arrive at the

target price. Valuation targets provided by individual analysts vary significantly due to differences in

valuation techniques and underlying model assumptions. Please refer to the accompanying

spreadsheet for details.

Zacks Investment Research

Page 4

www.zackspro.com

Capital Structure/Solvency/Cash Flow/Governance/Other

Capital expenditure was $319 million in 2Q05, including approximately $101 million paid to purchase

certain previously leased facilities.

GAAP cash flow used in operations was $305 million in 2Q05 including $625 million in pension

contributions during the quarter as compared to GAAP cash flow from operations of $549 million in

2Q04. In 1H05, GAAP cash flow from operations was $224 million.

Management expects that cash flow from operations is likely to fall in the negative territory in 3Q05.

On September 9, 2005 DPH, which may file for bankruptcy, eliminated its quarterly dividend for the rest

of the year. The Company said that it would not pay the $0.015 per share dividend on Delphi stock as a

way to preserve liquidity. Already twice this year, Delphi had cut its quarterly dividend, first to $0.03

from $0.07 then to $0.015 from $0.03.

On June 22, the Board of Directors declared a quarterly dividend of $0.015 per share on its common

stock. The previous quarterly dividend was $0.03 per share paid in May 2005.

On June 15, DPH announced the completion of its $2.8 billion refinancing plan comprising $1.8 billion

in secured revolving credit facility and $1.0 billion in secured term loan. DPH believes the completion of

this refinancing plan provides the Company with access to sufficient liquidity to continue to address its

U.S. legacy cost issues during the current low GM North American production environment.

Long-Term Growth

The global auto industry is highly cyclical, vulnerable to sudden shifts in consumer sentiment,

employment, interest rates, and general economic activity. Growth in the auto industry is likely to be

stagnant because of weak demand and pricing. There is continuing price pressure from OEMs to

reduce costs. Generally, if a supplier is unable to generate sufficient cost savings in the future to offset

customer cost reductions, margins could be adversely affected. The only way to get pricing power is by

improving mix. This can occur by shifting to SUVs and trucks from cars. However, the SUV and truck

sectors have begun to suffer as higher oil prices are stifling demand for large, less fuel-efficient

vehicles. Option packages that include safety features also have led to pricing power.

Costs are much higher than seen in other countries, and this is creating a loss of market share in the

U.S. Costs are being impacted by the new UAW agreement, which will require significant pension and

health care funding. In general, many of the companies in this sector are leveraged because of this,

although lower interest rates are making this liability more manageable. The new UAW agreement

allows for the closure of plants and limited wage increases. The industry is increasing the utilization of

its facilities by minimizing line changeovers and improving the speed to market. Generally speaking, the

companies are becoming more cost competitive.

The Company's non-General Motors business is growing at a 10% annual rate. Non-GM business is

typically for more competitive than the legacy GM business, and therefore generates a higher return on

invested capital.

Zacks Investment Research

Page 5

www.zackspro.com

Individual Analysts Opinions

POSITIVE RATINGS

J.P. Morgan – Overweight (No- target price): 09/13/05- The analysts have changed their under

weight rating to Overweight, and have not set a 12-month price objective. They think DPH offers

significant upside potential with a likely GM/UAW bailout and the subsequent start of broader capacity

reductions. They rate bankruptcy risk at 25% based on compelling risk/reward for DPH.

Lehman – Overweight (1) ($10.00- target price): 08/19/05- The analysts have changed their Under

weight (3) rating to Overweight (1), and have set a 12-month price objective of $10.00 (from $5.00)

based on the stock’s expected value under different scenarios. Based on GM's production update, the

analysts adjusted quarterly and full year 2005 GMNA production estimates.

NEUTRAL RATINGS

Calyon Sec. – Neutral (No- target price): 09/12/05- The analysts have changed their Sell rating to

Neutral, and have not set a 12-month price objective. They continue to believe 2005 results will be

‘dismal’. The analysts also believe that the near-term fundamental picture will become bleaker and

result in larger than expected losses and that DPH has ‘serious structural issues’. They believe that the

Company’s liquidity position is tenuous.

Wall Street Strategy – Hold ($4.50- target price): 09/09/05- The analysts have changed their Hold (3)

rating to Hold, and have set a 12-month price objective of $4.50 (from $4.75).

B. of America – Neutral ($6.00- target price): 08/09/05- The analysts have maintained a Neutral

rating, and have set a 12-month price objective of $6.00 (from $5.00) due to the timing of the cash flow

and potential for a modestly better deal then they modeled.

Bernstein –– Market perform ($4- target price): 08/31/05- The analysts have maintained a Market

perform rating and have set a 12-month price objective of $4. The analysts continue to see restructured

value in DPH. They believe that poor performance is attributed to GMNA production combined with

fixed labor costs.

Deutsche Bank –– Hold ($4.80- target price): 08/08/05- The analysts have maintained a Hold rating,

and have set a 12- month price objective of $4.80. The analysts believe that DPH has sufficient nearterm liquidity. They are of the opinion that long-term survival for the Company depends on labor cost

relief from the UAW and reversing losses related to GM businesses. They believe that higher than

anticipated GM production volume will lead to reduced operating losses in 2005 and 2006.

Goldman – In-Line (No- target price): 08/09/05- The analysts have maintained an In-line rating, and

have not set a 12-month price objective. They see fair value in the low-to-mid 44 range assuming no

assistance from the UAW and GM.

Merrill – Neutral (No- target price): 08/08/05- The analysts have maintained a Neutral rating, and

have not set a 12-month price objective. The analysts expect that 2005 will be weak as GM volumes

continue to decline and commodity prices, pension, and healthcare expenses continue to rise.

MorganStanley – Equal weight (No- target price): 08/09/05- The analysts have maintained an Equal

weight rating, and have not set a 12-month price objective. The analysts do not view a lack of financial

guidance as an indication that the financial situation has improved. According to the analysts, risks

Zacks Investment Research

Page 6

www.zackspro.com

include soft retail demand, high inventory, weakening mix, rising raw material prices, and decelerating

growth in international markets.

Prudential – Neutral ($5.00- target price): 09/06/05- The analysts have maintained a Neutral rating,

and have set a 12-month price objective of $5.00. They reduced 2H05 estimates on lower revenue,

volume and margin assumption but expect DPH has a long-term potential.

R W. Baird – Neutral ($7.00- target price): 08/23/05- The analysts have upgraded the rating from

Under perform to Neutral, and have set a 12-month price objective of $7.00 (from $3.00). According to

the analysts, key positive swing factors are GM production rates, market share gains by GM in the car

business and head count reduction, and negative factors are costs of downsizing the GM business, GM

build rates and weakening cash flow trends. They are long-term buyers of the stock in the low $50s.

Thomas Weisel– Peer perform (No- target price): 08/09/05- The analysts have maintained a Peer

perform rating, and have not set a 12-month price objective. The analysts continue to view DPH as a

core holding for ‘deep value’ investors, seeking exposure to restructuring and customer diversification

through the marketing of new technologies. Strong efficiency improvements and new product

technology are driving cash flow and non-GM sales. The analysts believe that the stock is currently

discounting the Company’s operational challenges appropriately.

UnionBankSwitz. – Neutral (2) ($5.00- target price): 08/08/05- The analysts have maintained a

Neutral (2) rating, and have set a 12-month price objective of $5.00. The analysts believe that DPH is

trading at or below its time value. According to the analysts, fundamentals remain poor, however, with

costs relatively fixed and GM revenue under pressure.

NEGATIVE RATINGS

Zacks Investment Research – Sell ($4.50- target price): 08/09/05- The analysts have maintained a

Sell rating, and have set a 12-month price objective of $4.50. They believe that volumes and prices are

under pressure due to a weakening automotive market.

BMO Nesbitt – Under perform ($3.50- target price): 08/09/05- The analysts have maintained an

under perform rating, and have set a 12-month price objective of $3.50. The analysts forecast a

significant industry production downturn in 2006 in North America because of rising interest rates.

Smith Barney – Sell (3) ($4.00- target price): 08/09/05- The analysts have maintained a Sell (3)

rating, and have set a 12-month price objective of $4.00. According to the analysts, risks to the stock

are weak global volumes and higher commodity cost. The analysts believe that the new management

team may improve the cost structure but expect the stock to trade around the $4 target price in the near

term. However, a meaningful recovery in earnings power is years away and highly dependent on both

operational improvement and on concessions from DPH’s principal labor union, the UAW.

Wachovia – Under perform ($4.75- average target price): 08/09/05- The analysts have maintained

an under perform rating, and have set a 12-month price objective range of $4.50 to $5.00. According to

the analysts, key risks include the Company's substantial operating leverage to GM North America

production, above-average operating and legacy costs relative to other suppliers.

Copy Editor: Uttara G.

Zacks Investment Research

Page 7

www.zackspro.com