4 Housing Allowances (demand side subsidies for renters)

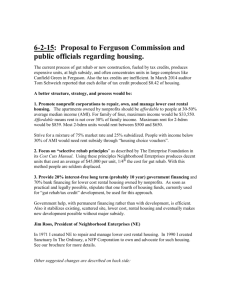

advertisement