SOUTH CAROLINA DEPARTMENT OF ALCOHOL AND OTHER

advertisement

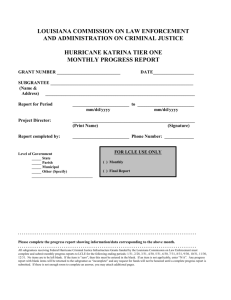

SOUTH CAROLINA DEPARTMENT OF ALCOHOL AND OTHER DRUG ABUSE SERVICES Safe and Drug-Free Schools and Communities Act Governor’s Program State Fiscal Year 2009 Part II – Application Package Mark Sanford Governor W. Lee Catoe Director, DAODAS S.C. DEPARTMENT OF ALCOHOL AND OTHER DRUG ABUSE SERVICES APPLICATION FOR GRANT ASSISTANCE FY 2008 SAFE AND DRUG-FREE SCHOOLS AND COMMUNITIES FOR DAODAS USE ONLY DATE SUBMITTED: DATE NEGOTIATED: SPECIAL CONDITIONS: FUNDED FOR: DATE AWARDED: $ 1. APPLICANT INFORMATION a. Legal Name: b. Address: c. Name, e-mail address, and voice and fax telephone numbers of the person to be contacted on matters involving this application (give area code): 2. EMPLOYER IDENTIFICATION NUMBER (EIN): 3. PROJECT START DATE: 4. PROJECT ENDING DATE: 5. TITLE AND SHORT DESCRIPTION OF THE APPLICANT'S PROJECT 7. TYPE OF APPLICATION: $ 6. REQUESTED FUNDS: ___Three-Year Universal Number of projected participants: Total Budget: $ Total Budget divided by Projected Participants: $ Requested Funds divided by Projected Participants $ ___ Three-Year Selected % Requested Funds divided by Total Budget: 8. CONGRESSIONAL DISTRICT (S) OF: a. Applicant 9. COUNTY (IES) OF: b. Project a. Applicant b. Project TO THE BEST OF MY KNOWLEDGE AND BELIEF, ALL DATA IN THIS APPLICATION ARE TRUE AND CORRECT; THE APPLICATION HAS BEEN DULY AUTHORIZED BY THE GOVERNING BODY OF THE APPLICANT; AND THE APPLICANT WILL COMPLY WITH THE TERMS OF THE GRANT AWARD, IF MADEBY THE GRANTOR AND ACCEPTED BY THE UNDERSIGNED. a. Typed Name of Authorized Representative: b. Title: c. Telephone Number: d. Signature of Authorized Representative: e. Please check one: f. Date Signed ___Authorized representative is the chief executive officer. ___Current Delegation of Authority Letter from the chief executive officer is enclosed. DAODAS Form G1, current as of March 2008 INSTRUCTIONS FOR COMPLETION OF THE APPLICATION FOR GRANT/CONTRACT ASSISTANCE Item Instructions 1 The legal applicant may be a not-for-profit corporation; independent school district; state-controlled or private institution of higher learning; Indian Tribe; state government department, commission, or agency; or a county, municipality or township. The legal name must include the subordinate office or agency that will execute the proposed project. Examples of correct legal names are: "Williamsburg County (Department on Alcohol and Drug Abuse)," "City of Columbia (Department of Public Safety)," "University of South Carolina (College of Nursing)," "or "Lexington/Richland Alcohol and Drug Abuse Council Inc." 2 Each employer receives an employer identification number from the Internal Revenue Service. Generally, this number can be easily obtained from your accountant or comptroller. 3 Indicate the date the proposed project will start. Normally, this would be the same as the start of the state fiscal year (July 1), but refer to the Grant/Contract Assistance announcement for expected start dates that are different. 4 Indicate the date the proposed project will end. Normally, this would be 12 months from the start of the state fiscal year (July 1), but refer to the Grant/Contract Assistance announcement for expected start dates that are different. 5 Type in the title and a short (one to two sentences) description of the project. 6 Type in the amount of funds requested from DAODAS. From the Management Plan, transfer the total number of project participants. From the Budget, transfer the total budget amount. Divide the total budget amount by the projected number of participants and enter. 7 Check the appropriate box. Check "continuation" if the project will continue activities of a project that was started under a prior award. 8 Please fill in Items 8a and 8b, using the county and congressional district numbers listed below. Indicate "state-wide" if applicable. 9 Please fill in Items 9a and 9b, using the county and congressional district numbers listed below. Indicate "state-wide" if applicable. 10 In accordance with 2CFR215, the Authorized Representative is either an officer of the governing body (such as the County Board Chair, Commission Chair or Board of Directors Chair) or someone in the applicant’s organization (such as Executive Director, Director, Director of Development or CEO, if the latter is not an officer of the governing body) to whom the governing body has issued a Delegation of Authority Letter. Such letter must state that the authority to act as the Authorized Representative is delegated to the specified individual for the purposes of applying for the specific grant program. 10a "Authorized Representative" means either the applicant's chief executive officer or a person currently delegated the authority (see Item 10 above). NOTE: An Executive Director, Director, or CEO cannot be the Authorized Representative unless he/she has been currently delegated such authority. 10c Include the area code. 10e Check the appropriate box. If there is a Delegation of Authority Letter, it must have been executed within 30 days of the date of the application. County and Congressional District Numbers COUNTY NAME COUNTY NUMBER DISTRICT NUMBER COUNTY NAME COUNTY NUMBER DISTRICT NUMBER COUNTY NAME COUNTY NUMBER DISTRICT NUMBER Abbeville 1 3 Dillon 17 5 McCormick 33 3 Aiken 2 2, 3 Dorchester 18 1, 6 Marion 34 6 Allendale 3 2 Edgefield 19 3 Marlboro 35 5 Anderson 4 3 Fairfield 20 5 Newberry 36 5 Bamberg 5 6 Florence 21 6 Oconee 37 3 Barnwell 6 2 Georgetown 22 1 Orangeburg 38 2, 6 Beaufort 7 2, 6 Greenville 23 4 Pickens 39 3 Berkeley 8 1, 6 Greenwood 24 3 Richland 40 2, 6 Calhoun 9 2, 6 Hampton 25 2 Saluda 41 3 Charleston 10 1, 6 Horry 26 1 Spartanburg 42 4 Cherokee 11 5 Jasper 27 2 Sumter 43 5, 6 Chester 12 5 Kershaw 28 5 Union 44 4 Chesterfield 13 5 Lancaster 29 5 Williamsburg 45 6 Clarendon 14 6 Laurens 30 3, 4 York 46 5 Colleton 15 2, 6 Lee 31 5, 6 Darlington 16 5, 6 Lexington 32 2 State-Wide 99 9 Safe and Drug-Free Schools and Communities Act Governor’s Program State Fiscal Year 2007 ASSURANCES By signing below, the Subgrantee agrees to comply with all applicable federal and state laws and regulations including Constitutional provisions regarding due process and equal protection of the laws and including, but not limited to: (1) This grant is subject to the provisions of Title IV, Title VI, and Title IX, as applicable, of the Elementary and Secondary Education Act of 1965, as amended (P.O. 107-110). This grant is also subject to the Education Department General Administrative Regulations (EDGAR) in 34 CFR Parts 74, 76, 77, 79, 80, 81, 82, 85, 97, 98, 99, and the regulations in 34 CFR part 299; the Office of Management of Budget (OMB) Circulars, as applicable; A21 Cost Principles for Educational Institutions; A-87 Cost Principles for State and Local Governments; A-110 Uniform Administration of Grants to Institutions of Higher Education, Hospitals and Nonprofit Organizations; Part 75.561-75568 Direct Grant Programs; Part 76 State-administered Programs; Part 77 Definitions that apply to Department Regulations; Part 78; Part 79 Intergovernmental Review of Department of Education Programs and Activities; Part 80 Uniform Administrative Requirements for Grants and Cooperative Agreements to State and Local Governments; and Parts 98 and 99. Copies may be obtained free of charge by calling (202) 395-7332. (2) All applicable standards, orders or regulations issued pursuant to the Clean Air Act of 1970, as amended (U.S.C. 7401, et seq.). (3) Title VI of the Civil Rights Act of 1964 (P.L. 88-32) (42 U.S.C. 2000d), as amended, which prohibits discrimination on the basis of race, color or national origin and regulations issued pursuant thereto, 45 CFR Part 80. (4) Title VII of the Civil Rights Act of 1964 (P.L. 88-32) (42 U.S.C. 2000e), as amended, in regard to employees or applicants for employment. (5) Section 504 of the Rehabilitation Act of 1973, as amended, (29 U.S.C. 794), which prohibits discrimination on the basis of handicap in programs and activities receiving or benefiting from federal financial assistance, and regulations issued pursuant thereto (45 CFR Part 84, 1994). (6) The Age Discrimination Act of 1975, as amended (42 U.S.C. 6101 et seq.), which prohibits discrimination on the basis of age in programs or activities receiving or benefiting from federal financial assistance. A-1 (7) The Omnibus Budget Reconciliation Act of 1981, P.E. 97-35, which prohibits discrimination on the basis of sex and religion in programs and activities receiving or benefiting from federal financial assistance. (8) Subgrantee shall ensure that its facilities and/or programs are accessible to persons with handicapped conditions, pursuant to 504 of the Rehabilitation Act of 1973, as amended in 29 US 791, et seq. (9) Americans with Disabilities Act (42 U.S.C. Sections 12101 et seq., and regulations issued pursuant thereto, 42 CFR Parts 35 and 36). (10) Drug-Free Workplace Acts, S.C. Code Ann 44-107-10 et seq. (1976, as amended), and the Federal Drug-Free Workplace Act of 1988 as set forth in 45 CFR Part 76, Subpart F (1994). (11) Hatch Act (5 U.S.C. §§1501-1508 and 7324-7328), as amended, that limits the political activities of employees whose principal employment activities are funded in whole or in part with Federal funds. (12) Public Law 102-227, Part C - Environmental Tobacco Smoke, also known as the ProChildren Act of 1994, imposes restrictions on smoking where federally funded children’s services are provided. I hereby certify that the Applicant will comply with the above Assurances. I also certify that I understand and agree to comply with the general and fiscal terms and conditions of this application including special conditions; to comply with provisions of the Act governing these funds and all other federal laws; that all information presented is correct; that there has been appropriate coordination with affected agencies; that I am duly authorized to commit the Applicant to these requirements; that costs incurred prior to grant approval may result in the expenses being absorbed by the Applicant; and, that the receipt of grantor funds through the State Funding Agency will not supplant state or local funds. Applicant’s Legal Name: Name of Authorized Representative: Signature: Date Signed: A-2 Safe and Drug-Free Schools and Communities Act Governor’s Program State Fiscal Year 2008 SPECIAL CONDITIONS AND CERTIFICATIONS (1) Personnel: Subgrantee will secure all personnel required in performing the services under the terms of this grant received from DAODAS. Secured personnel will hold a bachelor’s degree. Such personnel shall not be employees of or have any contractual relationship with DAODAS unless approved by the Ethics Commission. All of the services specified in the grant will be performed by Subgrantee or under the supervision of Subgrantee, and all personnel engaged in the work shall be fully qualified and authorized under state law to perform such services. Subgrantee shall further have in existence personnel standards and a personnel compensation and classification system. (2) Travel: Subgrantee shall adhere to the travel policies and procedures of the State of South Carolina in all program areas which are funded partially or in full by DAODAS, except in instances where Subgrantee is operating under the policies and procedures of county government or when policies and procedures approved by the governing board of Subgrantee do not exceed the provisions of the State of South Carolina. (3) Accuracy of Data and Reports: Subgrantee agrees that all statements, reports, and claims shall be certified to the best of knowledge as true, accurate, and complete. Subgrantee shall not submit for payment purposes those statements, reports, claims that it knows, or has reason to know, are not properly prepared or payable pursuant to federal and state law, applicable regulations, and DAODAS policies. (4) Records Retention: Records with respect to all matters covered by a DAODAS funded grant shall be made available to DAODAS or its duly appointed representatives for audit inspection or monitoring. All pertinent information including financial records, supporting documents, statistical records, and client records shall be retained for a minimum of three years after the final expenditure report. However, if any litigation, claim, or audit is started before the expiration of the three-year period, then records must be retained for three years after the litigation, claim, or audit is resolved. (5) On-site Reviews: DAODAS reserves the right to perform on-site reviews of all programmatic/financial documentation to assure compliance with the grant award. If subsequent visits are required due to Subgrantee not being prepared for the visit, related travel costs will be deducted from the Subgrantee’s grant award. SC-1 (6) Recording and Documenting of Receipts and Expenditures: Subgrantee accounting procedures must provide for accurate and timely recording of receipt of funds by source, of expenditures made from such funds, and of unexpended balances. These records must contain information pertaining to grant amounts, obligations, unobligated balances, assets, liabilities, expenditures, and program income. Controls must be established that are adequate to ensure that expenditures charged to any DAODAS funded grant are for allowable purposes. Additionally, effective control and accountability must be maintained for all cash, real and personal property, and other assets. Accounting records must be supported by such source documentation as canceled checks, paid bills, payrolls, time and attendance records, contract documents, etc. However, documentation should be maintained by Subgrantee; it should not to be sent to DAODAS unless requested. (7) Certification and Privileging: Subgrantee’s prevention staff shall be (a) certified by the South Carolina Association of Prevention Professionals and Advocates (SCAPPA) as a Certified Prevention Professional (CPP) or Certified Senior Prevention Professional (CSPP); or (b) shall be in the process of becoming certified as a Certified Prevention Professional (CPP) for up to 36 months, including the following: a. Be under active and ongoing prevention supervision. b. Have applied for certification with SCAPPA within nine months of beginning a position as a prevention staff. Evidence of application for SCAPPA certification must be placed in the staff privileging or personnel file. c. Have a written plan to obtain and achieve certification within a maximum of two years of application to SCAPPA. Both the staff member and the supervisor must sign this plan. d. Be active and ongoing in a prevention mentoring process. Mentoring must be provided by an individual approved by SCAPPA. A written plan that addresses information on the mentoring progress must be placed in the staff privileging or personnel file. Both the staff member and the supervisor must sign this plan, and documentation that SCAPPA has approved the prevention mentor is to be attached. (8) Notification of Federal Dollars Used to Supplement Program Operations: Subgrantee shall comply with P.L. 101-517 § 511 that requires the federal funding source be clearly identified on any brochure, flyer, poster, press release, public service announcement, or other form of information dissemination, events (i.e., planning, production, or presentation of conferences, workshops, or trainings), publications, or any other document describing projects or programs funded in whole or in part with federal dollars. For this grant program, the acknowledgment should state the following: “This _____ is made possible in part by a Safe and Drug-Free Schools and Communities grant from the U.S. Department of Education.” (9) Allowable Costs: The allowability of costs incurred under any DAODAS funded grant shall be determined in accordance with the general principles of allowability and standards for selected cost items as set forth in the applicable OMB Circulars. SC-2 (10) Audits: The intent of DAODAS’ audit policy and the Single Audit Act (Public Law 98502), the Single Audit Act Amendments of 1996 (Public Law 104-502), and OMB circular A-133 is to establish uniform audit requirements, promote the efficient and effective use of audit services, and to monitor program expenditures according to the provisions of the GRANT PROGRAM, grants, or contracts. To comply with this intent, DAODAS requires Subgrantee to have a single audit conducted for the year by an independent auditor if Subgrantee expends $500,000 or more in Federal awards. The audit must comply with the provisions of OMB circular A-133, Audits of States, Local Governments and Non-Profit organizations. The audit should be conducted in accordance with generally accepted auditing standards and the standards applicable to financial audits contained in Government Auditing Standards, issued by the Comptroller General of the United States. Whenever possible, make (a) positive effort to utilize small businesses, minority-owned firms, and women's business enterprises, in procuring audit services as stated in the A102 Common Rule, OMB Circular A-110. A-133 audits place substantial additional emphasis on the study and evaluation of internal controls and the testing of compliance with laws and regulations. This evaluation is needed to fulfill DAODAS’ responsibility to assure that Federal funds are properly expended. If Subgrantee expends less than $500,000 in Federal awards, Subgrantee will be subject to DAODAS’ monitoring procedures that may include limited scope reviews by independent auditors engaged and paid for by DAODAS. Limited scope audits include only agreed upon procedures conducted in accordance with the American Institute of Certified Public Accountants (AICPA) generally accepted auditing standards. The audit report must be in conformity with Generally Accepted Accounting Procedures. In accordance with OMB circular A-133 subpart B .230 the costs of audits of non-federal entities with less than $500,000 Federal awards expended may not be charged to the federal award as an allowable cost. Audit Standards: The audit will be designed to increase the accountability for the expenditure of federal, state, local, and other funds utilized by the subcontractors and sub-grantees of DAODAS. The audit will apply to the entire operation of an agency. Audits of individual departments and agencies may be considered a single audit when conducted on a county government body by an independent auditor, and comply with subpart E .500(a) of OMB Circular A133. DAODAS audit policy hereby defines "audit" as including financial as well as economy and efficiency audits. GAS (The Yellow Book) describes in chapter two, paragraphs 2.4 and 2.5 financial audits; paragraphs 2.6, 2.7, and 2.8 describe economy and efficiency audits. However, this policy does not require an evaluation of the performance, effectiveness, or objectives of any of the agency’s programs. SC-3 As governmental funds are accounted for on the modified accrual basis of accounting, the audit report must be prepared on the same basis. In addition, the financial statements and schedules must be in conformity with Generally Accepted Accounting Principles (GAAP). Under the modified accrual basis of accounting, expenditures are measurable and should be recorded when the related liability is incurred. Revenues are recognized in the accounting period when they become available and measurable. DAODAS reimbursements not received before the end of the state fiscal year must be shown as accounts receivable in the programs in which they are due in order to match revenue with the proper year. DAODAS adopts the principles for determining allowable and unallowable costs as provided in OMB Circular A-87 Cost Principles for State and Local Governments. All costs allocated to a program must be recorded in that program, supported by proper documentation, and procured competitively. The audit report shall include the following: a. An auditor’s opinion on whether the general purpose financial statements present fairly the financial position of the agency and the results of its financial operations in accordance with generally accepted accounting principles, and an opinion as to whether the schedule of expenditures of federal awards is fairly stated in relation to the financial statements taken as a whole. b. A report on compliance and internal control over financial reporting based on an audit of financial statements in accordance with government auditing standards. The report shall describe the scope of testing, the results of the tests, and where applicable, refer to a separate schedule of findings and questioned costs. An opinion on the overall internal control system is not required. c. A Supplementary Schedule of Expenditures of Federal Awards that complies with OMB Circular A-133 subpart C § .310(b). Federal programs or grants that have not been assigned a catalog number shall be identified under the caption, "Other Federal Assistance." In addition, an opinion on this supplementary information schedule must be provided either in the report on the financial statements or in a separate report. d. A report on compliance with requirements applicable to each major program and internal control over compliance in accordance with OMB Circular A-133. The report shall include the auditor’s opinion regarding compliance and where applicable, refer to a separate schedule of findings and questioned costs. e. A schedule of findings and questioned costs in accordance with OMB Circular A133 § 505(d) which shall include the following: (1) A summary of the auditor’s results that shall include: (a) The type of report the auditor issued on the financial statements of the auditee (i.e., unqualified opinion, qualified opinion, adverse opinion, or disclaimer of opinion). SC-4 (b) Where applicable, a statement that reportable conditions in internal control were disclosed by the audit of the financial statements and whether any of such conditions were material weaknesses. (c) A statement as to whether the audit disclosed any noncompliance that is material to the financial statements of the auditee. (d) Where applicable, a statement that reportable conditions in internal controls over major programs was disclosed by the audit and whether any such conditions were material weaknesses. (e) The type of report the auditor issued on compliance for major programs (i.e., unqualified opinion, qualified opinion, adverse opinion, or disclaimer of opinion). (f) A statement as to whether the audit disclosed any audit findings which the auditor is required to report under § .510(a). (g) An identification of the major programs. (h) The dollar threshold used in identifying Type A and Type B programs as described in § .520(b). (i) A statement as to whether the auditee qualified as a low-risk auditee under § .530. (2) Findings relating to financial statements that are required to be reported in accordance with GAS. (3) Findings and questioned costs for federal awards which shall include audit findings as described in § .510(a). (a) Audit findings (e.g., internal control findings, compliance findings, questioned costs, or fraud) which relate to the same issue should be presented as a single audit finding. Where practical, audit findings should be organized by Federal agency or pass-through entity. (b) Audit findings which relate to both the financial statements and Federal awards, as reported under paragraphs (d)(2) and (d)(3) of this section, respectively, should be reported in both sections of the schedule. However, the reporting in one section of the schedule may be in summary form with a reference to the detailed reporting in the other section of the schedule. Every governmental unit receiving DAODAS funds will prepare as part of the Audit Report as a minimum the following financial statements and schedules: a. Combined balance sheet - all fund types and account groups; b. Combined statement of revenues, expenditures, and changes in fund balances budget and actual - general and special revenue fund types; SC-5 c. Individual statements of revenues, expenditures, and changes in fund balances for each cost center, i.e., program (Outpatient, ADSAP, etc.) to demonstrate compliance with GRANT PROGRAM provisions. These statements must be in accordance with the requirements promulgated by DAODAS. d. A supplementary schedule concerning any investments, reporting the amount invested in each, such as money market account, certificate of deposit or savings account and the interest earned on each investment. After the above mandatory schedules and statements, any of the following that pertain must be submitted: a. Any management letter associated with the audit. b. A list of federal, state, or local agencies to which the report was distributed. c. Any corrective actions that were recommended or taken on current or prior audit findings. d. Auditors in subsequent audits must also disclose the status of recommendations in prior audits. The Subgrantee shall provide at the time of submission of any audit report to DAODAS, comments on the findings and recommendations contained in the audit report. The submission must include corrective actions planned or taken for each audit finding, and comments on the status of said corrective actions taken before the finalization of the audit. If you do not agree with a finding, or believe that corrective action is not required, then the corrective action plan shall include an explanation and specific reasons. Two original copies of the audit report must be forwarded to DAODAS Division of Finance and Operations no later than six months following the end of the fiscal year or thirty days after the audit is completed, whichever is earlier. A copy of the engagement letter and the audit firm’s peer review document(s) must accompany the audit report. The Subgrantee agrees to engage reliable and competent audit services by a firm licensed by the SC Board of Accountancy or other State Board of Accountancy to assure that the above deadline is met. The Subgrantee further agrees that Federal funding may be suspended by DAODAS if the above deadline is not met, and suspension of funding will exist until such time that the audit report is received and accepted by DAODAS. Generally, these audits will verify compliance with appropriate state and federal governmental fiscal policy, cost management, and programmatic accountability. The Single Audit Act and DAODAS Audit Standards are intended to: a. Improve financial management of Subgrantee with respect to Federal Financial Assistance Programs; b. Establish uniform requirements for audits of all programs and promote the efficient and effective use of audit resources; and SC-6 c. Ensure that federal and state agencies, to the maximum extent practical, can rely on and use audit work pursuant to the act. d. Provide accurate and informative data for reporting to the applicable federal funding source. Reference materials that may assist an independent auditor in conducting the audit and completing the report are listed below: a. OMB Circular A-87 "Cost Principles for State and Local Governments…"(May 17, 1995) b. OMB Circular A-133 "Audits of States, Local Governments, and Non-Profit Organizations” c. DAODAS Guidelines for Preparation of Requests for Audit Proposals d. DAODAS Memorandum of Agreement, Attachments and Amendments thereto e. DAODAS Special Grants or Contracts and Amendments thereto f. DAODAS Quality Assurance Standards g. Audits of State and Local Governmental Units (issued by the AICPA and revised in 1994) h. Governmental Auditing Standards (issued by the Comptroller General of the United States, revised in 1994), generally referred to as "The Yellow Book" i. Codification of Governmental Accounting and Financial Reporting Standards issued by the Governmental Accounting Standards Board May 31, 1990 j. OMB Circular A-133 Compliance Supplement - Provisional 6/97. (11) Confidentiality of Specific Work Products: Any DAODAS reports, information, data, etc. given to, prepared by, or assembled by Subgrantee under a DAODAS funded grant or contract that DAODAS represents as confidential per the Freedom of Information Act, Section 30-4-10, et seq., shall not be made available to any individual or organization by DAODAS or the Subgrantee without the prior written approval of DAODAS. Subgrantee shall ensure that employees are educated about specific confidentiality requirements and informed that disciplinary action may be taken upon inappropriate disclosures of confidential information. (12) Copyrights: If any copyrightable material is developed under a grant funded by DAODAS, DAODAS shall have a royalty free, nonexclusive, and irrevocable right to reproduce, publish, disclose, distribute, and otherwise use, in whole or in part, the material for DAODAS purposes. (13) Political Activity: None of the funds, materials, property, or services provided directly or indirectly by DAODAS shall be used for any partisan political activity, or to further the election or defeat of any candidate for public office, or otherwise be in violation of the provisions of the Hatch Political Activity Act (5 U.S.C. § 7324). SC-7 (14) Reporting of Fraudulent Activity: If at any time during the term of this grant, Subgrantee becomes aware of or has reason to believe by whatever means that, under this or any other program administered by DAODAS, an applicant for services, an employee of Subgrantee or DAODAS, or any of their subcontractors have improperly or fraudulently applied for or received benefits, monies, or services pursuant any contract or grant from DAODAS, such information shall be reported in confidence by Subgrantee directly to DAODAS. (15) Reporting Requirements: a. Subgrantee will submit all service activity information to Kit Solutions, Inc., over the Internet in accordance with the guidelines of the KIT Prevention System. b. The Subgrantee will supply adequate computers and Internet access to allow staff to submit data to Kit Solutions in a timely manner. Subgrantee should enter data by the end of each day. However, minimal standards for timeliness are: c. All pre- and post-test data for all programs required to use the DAODAS Standard Survey must be entered within six weeks of the date the survey was taken; All other data must be entered monthly, with reporting complete by the eighth (8th) day of the subsequent month. For newly hired prevention staff, special arrangements for training them to use the system must be coordinated with the prevention staff at DAODAS. Subgrantee must submit a Mid-Year Progress Report by February 20, 2009 and a Year-End Process and Outcome Evaluation Report by July 31, 2009 to DAODAS. DAODAS will provide subgrantees with specific instructions for the preparation of the report separately. (16) Reimbursement. This Grant reimburses only for actual expenses incurred pursuant to this Subgrant. a. For county alcohol and drug abuse agencies, expenditures incurred for services provided pursuant to this Subgrant will be reimbursed on a monthly basis via the monthly Expenditure Report and reporting codes established by DAODAS. The Cost Center Code for Drug Free Schools expenditure reporting is 8501. Revenue received from this Grant shall be reported under Code 1807. b. Programs not located in county alcohol and drug abuse agencies shall send by mail, e-mail or fax the Miscellaneous Subgrantee Reimbursement Request Form (provided with the Grant Award letter) to the attention of Carmen Tate. c. Subgrantee shall provide monthly reimbursement requests by the eighth working day of the month following the month for which reimbursement is requested. SC-8 d. Final reimbursement request must be received by July 7, 2009. Failure of Subgrantee to provide financial reports within the specified time and in the required format shall result in delay of reimbursement payable under this Grant or suspension of work and/or modification of funding (refer to Section 10 - Suspension of Work and/or Modification of Funding.) Questions and comments concerning the financial aspects of this Subgrant should be directed to Carmen Tate, Tel: (803) 896-1143, Fax: (803) 896-5557, e-mail: ctate@daodas.state.sc.us. (17) Non-allowable Cost. Unless authorized in writing by DAODAS, the costs of the following items or activities shall be unallowable as direct or indirect costs: rent and acquisition, by purchase or lease, of any interest in real property; construction, rearrangement or alternation of facilities to include payments of such loans (except for minor remodeling needed to accomplish the purposes of this part); equipment purchases (equipment is defined as an article of tangible property that has a useful life of more than one year and an acquisition cost of five thousand dollars ($5,000) or more); medical services, drug treatment or rehabilitation, except for pupil services or referral to treatment for students who are victims of or witnesses to crime who use alcohol, tobacco or drugs; vehicles, and meals that are not an integral part of the approved activities; administrative cost in excess of five percent of personnel costs charged to DAODAS (total of salaries and fringe charged to DAODAS), and any costs incurred prior to or after the Grant period. (18) Budget Adjustments. The contract manager must approve budget adjustments that will cause a line item to increase or decrease by more than 15 percent. A revised budget with an explanation of the revision must be submitted to DAODAS for approval. (19) Non-Supplantation of Existing Programs. Subgrantee agrees that funds made available by DAODAS will be used by the Subgrantee to implement or increase the level of funding in the specified services only. Funds received through a DAODAS-funded grant program shall not supplant any other federally funded projects. (20) Non-Waiver of Breach. The failure of DAODAS at any time to require Subgrantee’s performance of any provision of this GRANT PROGRAM or other DAODAS funded grant/contract or the continued payment of SUBGRANTEE by DAODAS in the event of such failure shall in no way affect the right of DAODAS to enforce any provision of this GRANT PROGRAM or other DAODAS funded grant/contract; nor shall the waiver by DAODAS of any breach of any provision hereof be taken or held to be a waiver of any succeeding breach of such provision or as a waiver of the provision itself. (21) Severability. Any provision of this Grant prohibited by the laws of the State of South Carolina shall be ineffective to the extent of such prohibition without invalidating the remaining provisions of this Grant. (22) Arbitration. If at any time the parties to this Grant in their rightful capacity cannot reach a decision based on the guidelines and stipulations within this operating agreement, a disinterested independent person shall be appointed to resolve the issue in accordance with the Uniform Arbitration Act (SC Code Ann. § 15-48-10, as amended). SC-9 (23) Appeals Procedures. Administrative appeals shall be performed in accordance with the South Carolina Administrative Procedures Act (SC Code Ann. § 1-23-310, et seq., as amended.) If any dispute shall arise subsequent to inconclusive arbitration, either party shall have the right to appeal within thirty (30) days of receiving written notice of arbitration conclusion that forms the basis of the appeal. (24) Venue of Actions. Any and all suits or actions for the enforcement of the obligations of this GRANT PROGRAM and for any and every breach thereof, or for the review of a DAODAS final agency decision with respect to this Grant or audit disallowances, and any judicial review sought thereon and brought pursuant to the SC Code § 1-23-380, as amended, shall be instituted and maintained in any court of competent jurisdiction in the County of Richland, State of South Carolina. (25) Suspension of Work and/or Modification of Funding. d. a. DAODAS will inform Subgrantee of pending suspension of work and/or modification of funding in whole or in part for failure of Subgrantee to comply with any of the requirements of this Grant. Subgrantee will be given thirty (30) days to cure performance problem. b. Upon written notice, DAODAS may order suspension of the work and/or modification of funding in whole or in part for such time as it deems necessary because of failure of Subgrantee to comply with any of the requirements of this Grant, including but not limited to the failure to meet expenditure goals. Expenditure goals are Subgrantee’s estimated expenditures for services covered by this Grant. Progress towards expenditure goals will be reviewed by DAODAS on a quarterly basis, and reimbursement requests must reflect consistent effort throughout the Grant period to prevent a suspension of work or modification of funding. The Grant’s completion date shall not be extended on account of any such suspension of work and/or modification of funding. c. When DAODAS orders a suspension of the work under this section, Subgrantee shall not be entitled to any payment for work with respect to the period during which such work is suspended and shall not be entitled to any costs or damages resulting from such suspension. When DAODAS orders a modification to the funding level of a Subgrantee, such an order will reflect anticipated expenditures throughout the completion of this Grant as determined by DAODAS. (26) Termination of Grant. a. Termination for Breach of Grant. Either party may terminate this Grant at any time within the Grant period whenever it is determined by such party that the other party has materially breached or otherwise materially failed to comply with its obligations. The terminating party must give the other party thirty (30) days written notice explaining the nature of the alleged breach. The party receiving notification shall have the thirty-day period, running from the date of notification, or any further period in which the parties may agree to cure the alleged breach. SC-10 This Grant will automatically terminate upon expiration of the cure period if the notifying party is not satisfied that the alleged breach has been remedied, which shall be deemed a default. (1) In the event of an automatic termination, Subgrantee shall not be entitled to any costs or damages resulting from a termination under this Section. (2) Subgrantee and its sureties shall be liable for any damage to DAODAS resulting from the Subgrantee’s default. Any wrongful termination for default shall be deemed by the parties as a termination for convenience. b. Termination for Convenience. DAODAS, with thirty (30) days advance written notice, may terminate this Grant when it is in the best interests of the South Carolina Department of Alcohol and Other Drug Abuse Services. If this Grant is so terminated, Subgrantee shall be compensated for all necessary and reasonable costs of performing the work actually accomplished. Subgrantee will not be compensated for any other costs in connection with a termination for convenience. Subgrantee will not be entitled to recover any damages in connection with a termination for convenience. c. Termination for Lack of Available Funds. The parties hereto covenant and agree that their liabilities and responsibilities, one to another, shall be contingent upon the availability of federal, state, and local funds for the funding of services and that this grant may be reduced or terminated immediately if such funding ceases to be available. DAODAS will determine the availability of such funds and notify Subgrantee in writing if this grant must be terminated under this provision. d. Unilateral Termination. Either party may terminate this Grant without cause by giving the other party thirty (30) days written notice. (27) Notice. Notice to either party will be sent by certified mail, return receipt required, and postage prepaid to the address stated in the introductory paragraph of this Grant. (28) Independent Contractor. Subgrantee shall not be deemed as the agent or employee of DAODAS for any purpose whatsoever. Neither Subgrantee nor any of its members, employees, or agents identifies themselves as an employee of DAODAS. Subgrantee shall have no power or authority to bind or obligate DAODAS in any manner, except the DAODAS shall make payments to the Subgrantee for the work provided under this grant. The Subgrantee shall obtain and maintain all licenses and permits required by law for performance of any DAODAS funded grant by themselves or their employees, contractors, agents, and servants. The Subgrantee shall be liable for and pay all taxes required by local, state, or federal governments, including but not limited to Social Security, Workman’s Compensation, Employment Security, and any other taxes and licenses or insurance premiums required by law unless specified in the Grant. (29) Indemnification. Subgrantee shall be solely responsible, to the extent permitted by South Carolina law, for the payment of any and all claims for loss, personal injury, death, property damage, or otherwise arising out of any act or omission of its employees or agents acting within the scope of their employment in connection with the performance of work under this grant. SC-11 (30) Force Majeure. Both parties will not be liable for any loss or delay resulting from causes, including but not limited to acts of God, vandalism, burglary, defective hardware, personal injury of either party or their agents, civil commotion, or any other causes beyond either party’s control. (31) Assignment. Subgrantee shall not assign this Grant without the prior written consent of DAODAS. Certifications Certification Regarding Debarment and Suspension Subgrantee’s Authorized Representative certifies to the best of his or her knowledge and belief, that the Subgrantee, defined as the primary participant in accordance with 45 CFR Part 76, and its principals: are not presently debarred, suspended, proposed for debarment, declared ineligible, or voluntarily excluded from covered transactions by any Federal Department or agency; have not within a three- (3) year period preceding this Grant been convicted of or had a civil judgment rendered against them for commission of fraud or a criminal offense in connection with obtaining, attempting to obtain, or performing a public (Federal, State, or local) transaction or contract under a public transaction; violation of Federal or State antitrust statutes or commission of embezzlement, theft, forgery, bribery, falsification, or destruction of records, making false statements, or receiving stolen property; are not presently indicted or otherwise criminally or civilly charged by a governmental entity (Federal, State, or local) with commission of any of the offenses enumerated in paragraph 2) above; and have not within a three- (3) year period preceding this Grant had one or more public transactions (Federal, State, or local) terminated for cause or default. Should the Subgrantee not be able to provide this certification, an explanation as to why must be reported to DAODAS in confidence before this Grant’s execution. The Subgrantee agrees that it will include, without modification, the clause titled “Certification Regarding Debarment, Suspension, Ineligibility, and Voluntary Exclusion-Lower Tier Covered Transactions” in all lower tier covered transactions (i.e., transactions with Subgrantees and/or contractors) and in all solicitations for lower tier covered transactions in accordance with 45 CFR Part 76. To check if an entity is debarred or suspended, visit the www.arnet.gov/epls website for the Excluded Procurement Listing System. SC-12 Certification Regarding Program Fraud Civil Remedies Act (PFCRA) Subgrantee’s Authorized Representative certifies that the statements herein are true, complete, and accurate to the best of his or her knowledge, and that he or she is aware that any false, fictitious, or fraudulent statements or claims may subject him or her to criminal, civil, or administrative penalties. The Authorized Representative agrees that the Subgrantee’s organization will comply with the Public Health Service terms and conditions of award if a grant is awarded. I hereby certify that the Applicant will comply with the above Special Conditions and Certifications. I also certify that I understand and agree to comply with the general and fiscal terms and conditions of this application including special conditions; to comply with provisions of the Act governing these funds and all other federal laws; that all information presented is correct; that there has been appropriate coordination with affected agencies; that I am duly authorized to commit the Applicant to these requirements; that costs incurred prior to grant approval may result in the expenses being absorbed by the Applicant; and, that the receipt of grantor funds through the State Funding Agency will not supplant state or local funds. Applicant’s Legal Name: Typed Name of Authorized Representative: Signature: Date Signed: SC-13 BUDGET and BUDGET NARRATIVE FY 2009 Safe and Drug-Free Schools and Communities, Governor’s Program Applicant: _____________________________________________________________________ Line Item I. Total Personnel Services A. Employees-Salaries Narrative: B. Employees-Benefits (Fringe) Narrative: C. Volunteers Narrative: SUBTOTAL PERSONNEL SERVICES II. Administrative Cost. Not to exceed 5% of Subtotal Personnel Services charged to DAODAS: SUBTOTAL ADMINISTRATIVE COST III. Contractual Services A. Contractual Services (Personnel) Narrative: B. Contractual Services (Other) [Do not include KIT Prevention fees] Narrative: SUBTOTAL CONTRACTUAL SERVICES IV. Fixed Charges Narrative: SUBTOTAL FIXED CHARGES VI. Supplies and Materials Narrative: SUBTOTAL SUPPLIES AND MATERIALS V. Travel Narrative: DAODAS Funds Grantee Cash Grantee In-Kind SUBTOTAL TRAVEL VIII. Other Expenses Narrative: Total Percentages of Total Applicants may submit worksheets in lieu of tables as long as the format is preserved. Statement on Private School Participation Federal Law requires each Local Education Agency (LEA) to offer comparable Safe and Drug-Free Schools and Communities services to local private schools. The Governors Program is under this same requirement. In the table below, please check the appropriate statement: Statement ___ There are no private schools located within our targeted catchment area. ___ The private schools located within our catchment area have all been notified of their eligibility to receive services but they do not wish to participate. (If applicable, you may provide a copy of a letter from the local LEA stating this fact. If not, then list below the private schools that have been contacted and have declined to participate in this project. Finally, describe how these private schools were contacted.) ___ The private schools located within our catchment area have all been notified of their eligibility to receive services and the following private school(s) will participate in the Safe and Drug-Free Schools program. Below is a listing of the private schools that have been contacted and have decided to participate in this project. (Please note from Part I that you will develop a separate and distinct management plan that will address the programming you will provide to these stated school(s).) Safe and Drug-Free Schools and Communities Governor’s Program NOTE: This form may be filled out on the computer, or typed. No handwriting, please. AGENCY: MANAGEMENT PLAN NO. ________________________________________- DFS 2009-1 Agency Name PREPARED BY: APPROVED BY: GETTING TO OUTCOMES - STEP ONE Identify the problem after studying your data. (Few sentences or a short paragraph) (Required Principle of Effectiveness: Your analysis must be based on an analysis of the data (that is reasonably available at the time) of the prevalence of: risk factors, including high or increasing rates of reported cases of child abuse and domestic violence; protective factors, buffers or assets; or other variables identified through scientifically based research that occur in schools and communities) GETTING TO OUTCOMES – STEP TWO Identify your target group: Identify key risk and protective factors (at least one of each type). Risk: Protective: Additional risk or protective factor(s): Goal Statement(s): Create process and outcome objectives that will help you achieve the goal. Process Objective: Specific statements describing the activities you want to implement. Who is the target population? What are you hoping to do? Where do you want to implement these activities (community)? When do you want to complete these activities? How much are you hoping to do or how many are you trying to reach? Outcome Objective: Specific statements describing the change you hope to accomplish. (Provide a minimum of two outcome objectives based on the DAODAS Standard Survey.) Who is the target population? What is being changed? Where do you want this change to occur (community)? When do want this change to occur by? How much change do you want to see? GETTING TO OUTCOMES – STEP THREE Describe program selected to help you achieve the objective. If more than one program has been selected to help you achieve this objective, please answer parts a) through i) for each program selected. What is the name of the program or strategy? Is the program’s focus ___universal Is the program/strategy selected from the DAODAS Prevention Toolkit? ___Yes ___No If not, can the applicant clearly document rigorous evaluation efforts as depicted in the National Registry of Effective Programs and Practices (NREPP) program through the Center of Substance Abuse Prevention (CSAP)? ___Yes ___No Does the program/strategy require specific training? If “yes,” will the facilitator be trained to implement the program by qualified personnel? ___No Will the facilitator use the required number of sessions for the required length of time, as specified by the curriculum? ___Yes ___No Will the facilitator use all required materials? ___Yes ___No Will you discuss any adaptations related to setting, target population or other issues with the developer? ___Yes ___No Are the educational levels and cultural considerations of the target group appropriate for the program/strategy? ___Yes ___No ___selected ___Yes ___No ___Yes GETTING TO OUTCOMES – STEP FOUR Choice of Program(s): Are the educational levels and cultural considerations of the target group appropriate for the program/strategy? ___Yes ___No Explain in a brief paragraph why your program choice “fits” best in your community. Remember to explain how the program is culturally relevant to the target population. Deconfliction: Tell us about other programs and services that already exist in your community to serve the targeted population. Is your proposed program duplicative of existing programs identified above or will it complement them either by expanding services to underserved populations or by providing new services to a needy population? Will your organization partner with other organizations to accomplish the objective? Explain. Will you use funding under this program to replace a same or similar program? Required Principle of Effectiveness: Did you include meaningful and ongoing consultation with and input from parents in the development of the application? ___Yes ___No If yes, please enclose Letters of Support from those parents who were involved. Do required two Letters of Commitment from parents clearly show a commitment to meaningful and ongoing consultation with and input from parents in administration of the proposed project? ___Yes ___ No How will you document parental involvement during the administration of the project? GETTING TO OUTCOMES – STEPS FIVE AND SIX Plan for Implementation and Capacity: Identify the plan for implementation of the program(s) and/or strategies within the community. Include a timeline of the plan for implementation. Please use the attached Management Plan Timelines Form and enclose it with your application, right after the Management Plan. Describe how you will recruit participants for the program(s). Also include the training that will be needed to carry out implementation as well. Consider the resources (money and people) that will be needed to implement the program/strategy in the community. Refer to letters of support that you will attach. Please attach job description(s) for project staff. Organizational Capacity: How long has your agency been in operation? Is your agency accredited, by whom, and for what period of time? What are your agency’s mission and major programs? Briefly summarize the highlights of your last yearly audit (major income and expense figures, as well as any management findings): Briefly tell us how you have worked with key members/agencies in the community (be sure to address and get a letter of support from the local school district(s) and the county alcohol and drug abuse authority [if the applicant is not one], as well as other agencies/persons relevant to the proposed program): Briefly summarize the qualifications of your agency’s key personnel (education, training, certifications/licensure, time in the position, and time in the field): o Director/Executive Director/CEO: o Project Director/Prevention Director (if any): o Finance Director: Please tell us your past data for other programs implemented which have similarities to what you are proposing to do here; List of program titles with short descriptions: was the program evidence-based? Please summarize: number of participants reached and impacted: demographics of the participants (age, sex, and race/ethnicity): program dates: programs length: indirect or direct service time: did the programs follow the basic plan for service delivery? what was the staff’s perception of the programs? what was the participants’ satisfaction? did you use a fidelity checklist? What were your yearly outcome results for the life of the program: Outcome Measures (Use as many rows as you need) 2005 Results by year 2006 2007 2008 to date GETTING TO OUTCOMES – STEPS SEVEN AND EIGHT Program evaluation: Will you use a fidelity checklist? ___Yes ___No As stated in Part I, PIRE will be able to provide a quarterly report based on the completed pre/post DAODAS Standard Surveys you will enter into KIT. Do you intend to request these quarterly reports? GETTING TO OUTCOMES – STEPS NINE AND TEN Continuous Quality Improvement (CQI) How often will you monitor for continuous quality improvement of multi-session programs? after every class/group meeting? ___Yes ___No at the end of the cycle? ___Yes ___No at the end of the year? ___Yes ___No all of the above? ___Yes ___No Sustainability: Explain how you intend to sustain the program: Please fill out the following flow chart (indicate milestones by an ‘X” and continuous actions by a series of “+.” Sustainability Action Step Year 1 Year 2 Year 3 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 (Use as many rows as you need) Management Plan Timelines Grant Year: Jul 1, 2008 – June 30, 2009 Milestone/Activity LEGEND: + = Continuous activity Jul Aug x = milestone Sep Grant months (Fiscal Year) Oct Nov Dec Jan Feb Mar Apr May Jun CHECKLIST Please use this checklist to help you in putting the application together. The total package contains: ___One original package, stapled. ___ Three stapled copies. Each application contains, in the following order: ___ Application for Grant Assistance ___ Assurances ___ Special Conditions and Certifications ___ Budget Worksheet ___ Budget Narrative ___ Management Plan (Included a separate plan for addressing private schools when necessary.) ___ Management Plan Timelines (Included a separate timeline for addressing private schools when necessary.) ___ Statement on Private Schools ___ Job Descriptions ___ Letters of Support ___ Other Attachments, if any ___ Completed Checklist