November 2007

advertisement

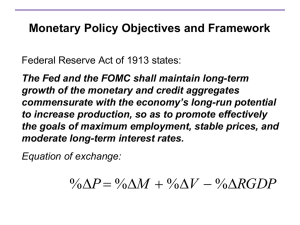

Money & Banking News November 2007 Click on these links to read some recent readings related to the textbook Money and Banking: A Policy-Oriented Approach by Dean Croushore. In this issue: 1. Recent Events in Financial Markets 2. Headline versus Core Inflation in the Conduct of Monetary Policy 3. Monetary Policy Under Uncertainty 4. The Role of Money in Monetary Policy: Why Do the Fed and ECB See It So Differently? Recent Events in Financial Markets In the turmoil of financial markets in 2007, it is easy to wonder why sensible investors put their funds in securitized assets backed by subprime mortgages. As we discussed in Chapter 2, investors care about risk, so why would they invest in assets whose risks they do not understand. In this article, Federal Reserve governor Randall Kroszner explains why he thinks this happened. Some investors failed to do “sufficient due diligence” while others only came to realize after the fact how complex these assets were. Kroszner suggests that the recovery will be slow and gradual. Speech at the Institute of International Bankers Annual Breakfast Dialogue, Washington, D.C., October 22, 2007. Headline versus Core Inflation in the Conduct of Monetary Policy Chapter 17 describes the differences between core inflation and overall inflation. In this article, Federal Reserve governor Frederic Mishkin talks about the differences and shows why the Fed should analyze both measures. He illustrates that if the Fed were to respond to headline inflation instead of core inflation, then a temporary supply shock would lead the Fed to respond too strongly with monetary policy, causing unemployment to rise more than it would if the Fed responded to core inflation. But he also describes why the Fed should still pay attention to headline inflation. Speech at the Business Cycles, International Transmission and Macroeconomic Policies Conference, HEC Montreal, Canada, October 20, 2007. Monetary Policy Under Uncertainty In Chapter 18, we noted that one of the main difficulties of making monetary policy in practice is dealing with uncertainty. In this speech, Fed chairman Ben Bernanke discusses recent contributions to how monetary policymakers need to deal with uncertainty. He outlines issues related to the breakdown of money demand relationships, the challenge of data revisions, the use of dynamic factor models, dealing with worst-case scenarios, the use of simple rules that work well in many economic models, and dealing with how people form expectations. Speech at the Economic Policy Conference, Federal Reserve Bank of Saint Louis, October 19, 2007. The Role of Money in Monetary Policy: Why Do the Fed and ECB See It So Differently? Central banks in different countries learn from each other and often have the same basic goals, especially the goal of keeping inflation low, as we discuss in Chapter 18. Comparing the Federal Reserve in the United States with the European Central Bank, there is one major difference in how they operate: the ECB puts more emphasis on the money supply. In this article, George Kahn and Scott Benolkin describe the reasons why the ECB focuses more on the money supply than the Fed does. Federal Reserve Bank of Kansas City Economic Review, Third Quarter 2007, pp. 5–36.