Absorption costing Marginal costing

advertisement

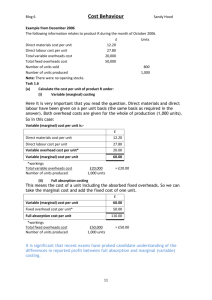

THE INSTITUTE OF CHARTERED ACCOUNTANTS OF SRI LANKA POSTGRADUATE DIPLOMA IN BUSINESS AND FINANCE - 2013/2014 Principles of Financial and Cost Accounting Thilanka Warnakulasooriya B.Com Special (Col), ACA Absorption costing It is costing system which treats all manufacturing costs including both the fixed and variable costs as product costs Marginal costing It is a costing system which treats only the variable manufacturing costs as product costs. The fixed manufacturing overheads are regarded as period cost 2 Absorption costing Cost Non Manufacturing cost Manufacturing cost Direct Material Direct Labor Finish Good Overhead Selling & Distribution Cost of good sold Admin Profit & Loss Account Marginal costing Cost Non Manufacturing cost Manufacturing cost Direct Material Direct Labor Finish Good Variable Overhead Fixed Overhead Cost of good sold Selling & Distribution Admin Profit & Loss Account Comparison of absorption costing & Marginal Costing Situation Stock Level Profit 1 No change No difference 2 Increases AC Profit is greater than MC Profit 3 Decreases MC profit is greater than AC profit Difference between absorption and marginal costing 8 Treatment for fixed manufacturing overheads Absorption costing Marginal costing Fixed manufacturing overheads are treated as product costing. It is believed that products cannot be produced without the resources provided by fixed manufacturing overheads Fixed manufacturing overhead are treated as period costs. It is believed that only the variable costs are relevant to decision-making. Fixed manufacturing overheads will be incurred regardless there is production or not 9 Absorption costing Value of closing stock Marginal costing High value of closing Lower value of closing stock will be obtained as stock that included the some factory overheads variable cost only are included as product costs and carried forward as closing stock 10 Absorption costing Reported profit Marginal costing If the production = Sales, AC profit = MC Profit If Production > Sales, AC profit > MC profit As some factory overhead will be deferred as product costs under the absorption costing If Production < Sales, AC profit < MC profit As the previously deferred factory overhead will be released and charged as cost of goods sold 11