The Wonderful Wizard of Oz

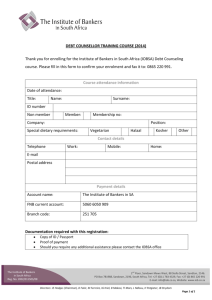

advertisement