HVB Bank's profit up by 32.2

advertisement

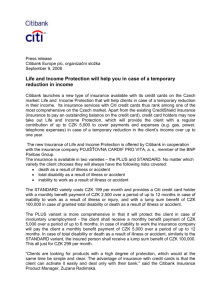

Press Release Prague, 1st February 2007 HVB Bank’s results for 2006 The figures are in accordance with the International Financial Reporting Standards and they are preliminary and non-audited HVB Bank’s profit up by 32.2 % HVB Bank’s net profit after tax grew by 32.2 % to CZK 2,453 million Net income before taxes totals CZK 3,038 million, a 29.3 % increase over the last year Total assets of the bank up by 3.1% Loans to clients grew by 13.5% In 2006, HVB Bank significantly improved its results compared with the same period of the previous year. Net income before taxes increased from CZK 2,349 million (2005) to CZK 3,038 million in 2006 (+ 29.3%). Net profit after tax grew by 32.2% to CZK 2,453 million (2005: CZK 1,856 million). Return on Equity after taxes increased to 14.9 % (2005: 12.8%), while Cost/Income ratio decreased to 42.3% (2005: 50.9%). The results were achieved mainly due to development of interest rates and also due to cost cutting. Items in the income statement In 2006, HVB Bank's net interest income rose to CZK 3,248 million, which represents an increase of 19 % over the same period of the previous year (2005: CZK 2,730 million). Net fee and commission income also made good progress, rising by 1.9 % to CZK 2,099 million (2005: CZK 2,060 million). General administrative expenses were reduced by 6% to CZK 2,416 million (2005: CZK 2,569 million). 1/4 Press Release Prague, 1st February 2007 HVB Bank’s net income before taxes thus totalled CZK 3,038 million, which is up by 29.3% on the previous year’s level (2005: CZK 2,349 million). Net income after taxes was CZK 2,453 million, an increase of 32.2% compared to the previous year (2005: CZK 1,856 million). Balance sheet As at 31 January 2006, HVB Bank's balance-sheet total amounted to CZK 170,594 million, an increase of 3.1% over the year-end 2005 figure (31 December 2005: CZK 165,387 million). On the assets side of the balance sheet, loans and advances to, and placements with, banks were reduced by 40.2% and totalled CZK 21,182 million (year-end 2005: CZK 35,440 million). Trading assets rose by 45.4% to CZK 5,508 million. Loans and advances to customers rose by 13.5 % to CZK 106,561 million (2005: CZK 93,883 million). Investments increased by 18 % to CZK 33,251 million (2005: CZK 28,180 million). On the liabilities side, amounts owed to banks declined by 44.4% to CZK 15,713 million (2005: CZK 28,271 million). Amounts owed to customers rose by 9.1 % to CZK 104,758 million (2005: CZK 96,034 million). Liabilities evidenced by certificates increased by 36.8 % to CZK 25,966 million (2005: CZK 18,987 million). 2/4 Press Release Prague, 1st February 2007 Data from the income statement for 2006 2006 in CZK m 3 248 2005 in CZK m 2 730 change in CZK m 518 change in % 19.0 2 099 2 060 39 1.9 - 2 416 -2 569 153 -6.0 Net income before taxes 3 038 2 349 689 29.3 Net income before taxes 2 453 1 856 597 32.2 Loans to customers 2006 in CZK m 106 561 2005 in CZK m 93 883 change in CZK m 12 678 change in % 13.5 Customer accounts 104 758 96 034 8 724 9.1 Shareholder’s equity 17 664 15 137 2 527 16.7 170 594 165 387 5 207 3.1 Net interest income Net fee and commission income General administrative expenses Main balance sheet data for 2006 Total assets Selected ratios for 2006 2006 v% 2005 v% Return on Equity (ROE) 14.9 12.8 Return on Assets (ROA) 1.5 1.2 Costs/Income Ratio (C/I) 42.3 50.9 end 3/4 Press Release Prague, 1st February 2007 Media Contact: Petra Kopecká, Press Spokesperson HVB Bank Czech Republic a.s. Member of UniCredit Group Tel.: +420 221 112 109, mobile:+420 602 238 443 e-mail: p.kopecka@cz.hvb-cee.com Information about the Company: HVB Bank is the fourth-largest bank in the Czech Republic. HVB Bank is a subsidiary of Bank Austria Creditanstalt (BA-CA), a member of UniCredit Group. UniCredit Group is a strong European banking network which serves more than 35 million customers via 7,000 offices in 20 core countries. For further information on products and services or financial results, go to www.hvb.cz. 4/4