Word Document

advertisement

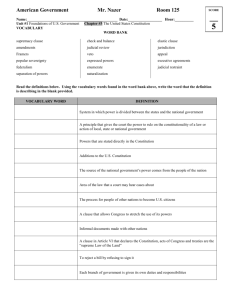

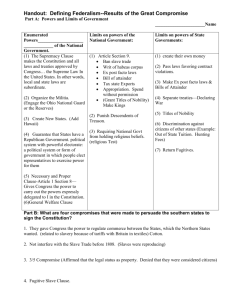

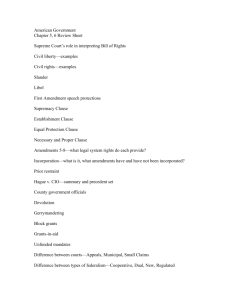

Unit 4-FEDERAL & LOCAL GOVERNMENT PART A CHANGING FEDERALISM 1. DEFINE AND DISCUSS THE SIGNIFICANCE OF THE FOLLOWING: a. b. c. d. e. exclusive powers (L) concurrent powers reserved powers 10th amendment supremacy clause f. g. h. i. j. k. John Marshal urbanization implied powers Necessary and proper clause (p. 54) Full faith and credit clause privileges and immunity clause Federalism and constitutional provisions Article I - Section 8- listed powers of the national government Section 9- listed powers prohibited to the national government Section 10- listed Powers prohibited the state. Article VI Supremacy clause- United States Constitution is the supreme law of the land And federal law is supreme over state law. th 10 Amendment Reserved powers - only place in the constitution where you will find a reserved powers to the state. And it reads: (next page) 10th Amendment THOSE POWERS NOT DELEGATED TO THE UNITED STATES BY THE CONSTITUTION, NOR PROHIBITED BY IT TO THE STATES, ARE RESERVED TO THE STATES RESPECTIVELY, OR TO THE PEOPLE = a very broad, vague definition of state powers . (Important Point: The common interpretation of the tenth amendment is that the majority of governmental responsibility lies with the state. The state governments should have more responsibility and have more to do with what effects your daily life. ) 2. TRACE THE DEVELOPMENT OF FEDERALISM AND THE EIGHT METHODS BY WHICH FEDERAL POWERS EXPANDED. Eight Methods Used to expand nation power 1. JUDICIAL REVIEW Power of the courts to determine the constitutionality of a government action or law. – federal, state, or local - This protects the national governments powers from being infringed upon by the states. - Prevents the passing of law that infringes upon the constitution and the national government. - (Elastic Clause) if a power is listed in the constitution then it is enumerated. 2. NECESSARY AND PROPER CLAUSE #20. CONGRESS HAS THE POWER TO MAKE ALL LAWS NECESSARY AND PROPER FOR CARRYING INTO EXECUTION THE FOREGOING POWERS (HELPFUL IMPLIED POWERS) McCulloch vs. Md. 1819: healthcare 18 Courts ruled that John Marshal said an 1819 supreme court decision gives the national government implied powers. (Not actually mentioned in the constitution) Without this clause, if a power was not listed in the Constitution Congress could not pass a law on that issue or problem. – we would have to constantly amend the Constitution to allow the national government to do things not specifically written in the Constitution. 3. Interstate commerce clause Trade, Between the states, National Government can be regulated by the national government. Interstate Commerce- commercial intercourse, any movement across state lines. 4. Taxation power Sin tax placed on things we don't approve of or is unhealthy. Tariff Tax charged to imports. To influence your behavior. Discourages or encourages. Regulatory tool. Tax deductions. 5. Power to spend for "the general welfare" Most social programs are based on this clause. 6. Fourteenth Amendment- Added after the civil war. Equal protection clause- No state shall deny to any person within its jurisdiction the equal protection of the laws. End discrimination. Due process clause- No State shall deprive any person of life, liberty, or property, without due process of the law. – requires state police and courts to follow national guidelines – Ex: cops must read suspects their Miranda Rights before questioning, poor defendants must be given a courtAppointed attorney. 7. Right to privacy Implied right established in 1960 by the Warren Court. There are certain parts of our lives that are so private and personal that no government has any business making laws or regulating it. Protected Birth control devices cannot ban sale, mailing, etc. Wiretapping Need a search warrant (court order) right to Right to possess pornography in your home. Women's abortions Not Protected Drug laws Deviant sexual behavior not protected -Sodomy laws make this illegal 8. Federal aid Forces us to do something we might not have originally done. Speed limit Drinking age Integration of Schools Full faith and credit clause - every state has to recognize court proceedings and practices in all other forty-nine states. Privileges and Immunities clause - New residents have the same rights as natives. healthcare 19 3. DISCUSS THE THREE TYPES OF FEDERAL AID PROGRAMS & THE FEATURE OF EACH: Three types of Federal Aid Programs 1. Categorical Grants 90% of today’s financial aid comes from this source History – first use or purpose - $ for states to pave highways - 1904 During the Great Depression (1930s) FDR implemented the New Deal. Its purpose was to help states deal with problems of the depression. – Through categorical grants Application: Yes Federal regulations: Extensive (money) Paper Work: Lots Matching Requirements: 10-30% must be contributed by state or local government. The federal government pays 90-70% - No federal $ is received unless state or local government puts up some of its own $ first. How to Use $: For one specific purpose Additional Information: 90% of the $ federal government gives out is categorical grants 2. Block Grants History: began in 1966 LBJ’s Great Society Attack Purpose: To solve social problems of The 1960s & 70s. Application: Yes Federal Regulation: Less Regulation* than categorical grants Paperwork: Less but still exists Matching Requirements: Yes – 10-30% How to Use $: More flexibility more freedom more choice than in categorical grants Additional information: 10% of all federal aid today. 3. Revenue sharing History: began in 1972 under Nixon Purpose: To reduce the role of federal government & encourage state & local governments to do more for themselves & be less dependent on the federal government. Application: No Federal Regulations: Almost no Regulations – fewest of 3 federal aid programs. Paperwork: Very little Matching Requirements: None How to Use $: 1/3 for the state, 2/3 for all local government -$ could be used in eight broad areas. Additional information: 6-7% of all federal aid – but – used it and phased out in 80’s under President Reagan. Proof of our growing reliance in the federal government: In 1995 –66% of all government spending is by federal government. 19% - by state governments 15% - by local governments Compared to: In 1929 – 60% of all government spending run by local government 23% - by state government 17% - by federal government healthcare 20 The six fiscal impact of older programs include: 1. Imposition of national goals A. Raise Drinking Age to 21 B. End Discrimination C. 55mph speed limit D. Integrated, Equal School->Busing 2. Force states to do things otherwise might not do 3. Redistribute effect- Help poor states Cities 4. Paperwork- slower and more expenses. 5. Matching requirements- must come up with some of out own money first. 6. More aid to urban areas – rural areas did not receive their fair share healthcare 21 UNIT 4 – PART B Local Government 3. DISCUSS THE STRUCTURES AND 2 BASIC FUNCTIONS OF COUNTY GOVERNMENT. County government came from England and was set up for two functions: 1. Help the state government carry out state functions – as an administrative sub unit of State government Collect Taxes – automobile license sticker, title transfer Law Enforcement Elections, voter registration, printing ballots, counting votes 2. To provide services, especially, for those people living outside city limits. Road and bridge maintenance Law Enforcement County Hospital Parks and Recreation Library Commissioners court – The governing body of the county composed of 5 officials 1. A county judge – elected county wide – and 4 commissioners elected officials with staggered 4year terms, elected by the county precincts they are living in Set county Tax Decide what federal aid your county will have Hiring and firing of county agricultural extension agent health officer, etc. Decide county budget and decide what services will be offered 2. County Sheriff – Runs jail and enforces the law 3. County clerk – Keeps Public Records Birth Certificates, marriage licenses, death certificates 4. County attorney – Legally advising the County & represents county in court 5. County Treasurer – Signs Checks to pay for Da Bills 6. Tax assessor collector – Transfer titles, tax collection and assessment 7. County Surveyor – Handles property disputes, surveys land 8. County Auditor – Past 35,000 population. Does a check on Treasurer’s checks and needs two . – Appointed by district judge – a check and balance on treasurer 9. Justice of the peace – Pronounce death, conduct marriages, and preside over lowest court. Handles misdemeanors & traffic violations. 10. Constable – Serves papers and warrants, subpoenas Major source of county Revenue and Major expenses: The major source of funding is property tax. Roads and bridges are usually most expensive and then law enforcement, coming in second. Roads and bridges Law enforcement healthcare 22 Problems of County Government 1. No flexibility in structure of county government – all 254 counties in Tx. Basically have the The same structure despite varying populations and needs 2. No chief executive or leader for your county 3. States mandate that county provides certain services and standards and then doesn’t provide money for it. Ex: Texas Jail standards Act. 4. No power to pass ordinances (county laws) 5. DISCUSS THE GENERAL LAW AND HOME RULE CITIES. 1. General Law – under 5,000 in population with no choice-must be a general rule city. Once the population of 5,000 exceeded then it can become a home rule city by popular vote. 2. Home rule cities More freedom from the state government Can set higher taxes & thus offers more services Can annex larger areas of land in to the city limits Can write their own city charter. City charter is a city constitution. City Governments- Creations of your state government. There are rules for how to incorporate one. States regulate how cities are run based on state law and state constitution. 6. COMPARE – CONTRASTS OF THE FOUR MAJOR TYPES OF CITY GOVERNMENT. 1. Strong Mayor-City council Form elect strong full time Mayor and City Council City Council has less power Mayor can hire and Fire all Department Heads. Mayor develops the city budget. Subject to councils approval City planning responsibility of the mayors office. City Mayor Presides over all council meetings and can veto any council Decisions. - Advantage: strong leadership - Disadvantage: mayor too powerful? 2. Weak Mayor-Council People elect part time mayor and council. Most of the power laying in the hands of city council Council hires and fires department heads and creates the budget Council does the city planning The Mayor is a Figurehead with the power to cast a tie breaking vote on the city council. - Advantage: less expensive form of city government - Disadvantages: weak leadership. 3. The Commission Form Voters elect a board of commissioners with no mayor. Each year a different commissioner rotates into the Mayor position. Each Commissioner is a Department Head In its dying day because of the loss of city welfare concern healthcare 23