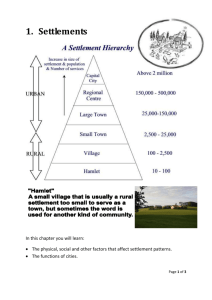

who is part of the settlements - One Group Notice And Distribution

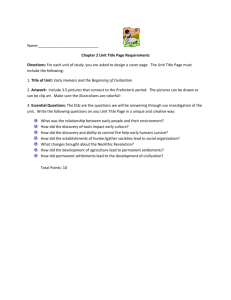

advertisement