Revised_Quality_Review_Checklist_FY_2013-14

advertisement

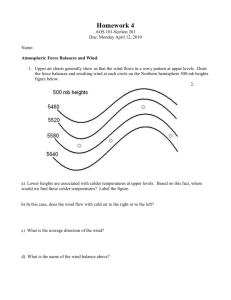

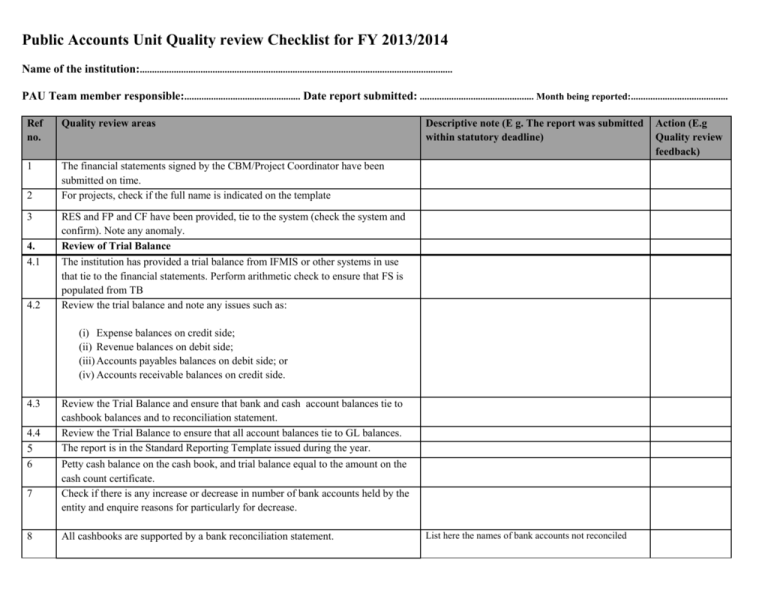

Public Accounts Unit Quality review Checklist for FY 2013/2014 Name of the institution:................................................................................................................................. PAU Team member responsible:................................................ Date report submitted: ............................................... Month being reported:........................................ Ref no. Quality review areas 1 The financial statements signed by the CBM/Project Coordinator have been submitted on time. For projects, check if the full name is indicated on the template 2 3 4. 4.1 4.2 Descriptive note (E g. The report was submitted within statutory deadline) RES and FP and CF have been provided, tie to the system (check the system and confirm). Note any anomaly. Review of Trial Balance The institution has provided a trial balance from IFMIS or other systems in use that tie to the financial statements. Perform arithmetic check to ensure that FS is populated from TB Review the trial balance and note any issues such as: (i) Expense balances on credit side; (ii) Revenue balances on debit side; (iii) Accounts payables balances on debit side; or (iv) Accounts receivable balances on credit side. 4.3 4.4 5 6 7 8 Review the Trial Balance and ensure that bank and cash account balances tie to cashbook balances and to reconciliation statement. Review the Trial Balance to ensure that all account balances tie to GL balances. The report is in the Standard Reporting Template issued during the year. Petty cash balance on the cash book, and trial balance equal to the amount on the cash count certificate. Check if there is any increase or decrease in number of bank accounts held by the entity and enquire reasons for particularly for decrease. All cashbooks are supported by a bank reconciliation statement. List here the names of bank accounts not reconciled Action (E.g Quality review feedback) Ref no. Quality review areas No. of bank accounts for entity (A) No. of bank reconciliation statements (B) No. of banks not reconciled (A) - (B) 9 Review all the bank reconciliation statement along the following: 9.1 Are there long outstanding items (Cheques older than 2 months)? A breakdown of the outstanding deposits and payments should be attached to the report. 9.2 Confirm accuracy of deposits in transit and outstanding payments by analysing the transaction description and Check if the outstanding deposits and payments are not a result of reversals. Obtain the breakdown of the deposits in transit and outstanding payments. 9.3 Are there Un-reconciled differences on the bank reconciliation statement? (Where the cause is bank error, ensure that it is well disclosed on the reconciliation report or there is a separate explanation for the difference. A detailed breakdown or explanation should be provided i.e amount and date when the error was noted, cheque or OP number and why it is deemed as an error) Compare the bank statement closing balance and determine whether the correct bank statement balances are used on bank reconciliations? For foreign currency bank accounts, check if the local currency amounts in Trial Balance tie to the foreign currency in cashbook. Check if the exchange rate used is correct using the spot rate as quoted by central bank. Check if opening balances (Comparatives) reported by entities match with those used in the FY 2012/13 consolidation. Check that the comparatives for all items of RES and FP tie to those consolidated during FY 2012/13. If the entity was allowed to adjust the consolidated financial report for FY 2012/13, ensure that the report clearly provide the movement in opening by showing what was the closing balance, adjustments and adjusted balances for each category of balances (Bank and cash, receivables and payables). Also ensure that these changes result from audit recommendations and inquire if memo authorising adjustments and journals are well kept for future reference. 9.4 9.5 10 11 Descriptive note (E g. The report was submitted within statutory deadline) Name of bank account and account number Month last reconciled Action (E.g Quality review feedback) Ref no. Quality review areas 12 Opening balance adjustment has been supported by authorisation Journals or memo signed by CBM. Ensure that the transfers and direct payments from OTR reconciled for the institution. (Obtain Central Treasury GL for the period). Compare the Inter-entity accounts breakdown and verified with the corresponding focal person if the corresponding recipient/transferring institution has recorded the same. 13 14 Descriptive note (E g. The report was submitted within statutory deadline) List here entities where the inter-entity transfers do no tie Name of Giving entity Amount (Entity) 1 2 3 Name of receiving entity 1 2 3 15 Analysis of funds received from donors is provided on the notes to FS. 16 Donor, date, amount, forex exchange rate and amount in RWF are included. Full names of donors must be indicated Payables and receivables detailed list is provided. 17 18 Ensure that the breakdown does not include “Others” or “Note a LOT” or “Supplier control” or “Transit Fund” or Returned payment. These should be further broken down. Transit accounts should also have a breakdown. Check if the notes to the financial statements are accurate and tie to the main financial statements. For projects, check if loans and grants are reported separately in the financial statements. Amount (corresponding Giving/Receiving entity) Difference Action (E.g Quality review feedback) Ref no. Quality review areas Check to ensure that the report doesn't contain the following items: 19 Salaries in Kind Grants to foreign government and international organisations Arrears for districts General or sector Budget Supports Proceeds from Loan Borrowing – Except Projects, EWSA and IPRC Kicukiro Repayment of Loan Borrowing – Districts should record loans as payables Subsidies to Public Corporations Transfers from Treasury – for projects Inter government payables should not include RRA 20 Review of Budget Performance 20.1 Confirm if budget performance statement has been included in the report 20.2 Confirm if figures included in the budget performance report are the same as these contained in IFMIS budget execution or performance report Check if the budget performance balances tie to RES category total Check if total initial and revised revenues budget is equivalent to total initial and revised expenditure budget 20.3 20.4 21 Check if the revised budget reported in Financial report matches with district council decision/Finance Law. If there is any discrepancy, explanatory note should be provided 22 Review the OAG report for the previous year and assess whether audit recommendations that require adjusting the financial statements have been captured. 23 Ensure that the Bank and cash balances, omitted payables and receivables for FY 2012/13 are captured as adjustments and have properly been accounted at the time of payment or receipt Ensure that the consular fees and VAT refunds for Embassies have been recorded as Transit funds with RRA and Treasury respectively. Descriptive note (E g. The report was submitted within statutory deadline) Action (E.g Quality review feedback) Ref no. Quality review areas 24 Check if the detailed note of adjustments was provided and ties to the main note and financial statements and judge its accuracy. Also express the need to have adjusting journals and authorising memo as supporting documents of the adjusted transactions. For a given creditor / debtor where the previous balance is still the same as this year, inquire whether this was not paid and if yes ask the reason and document it. Review of cash flow statement Check if cash and cash equivalent at the beginning of the year is the same as that of at the end of last Financial Year Check if balances included in different categories of cash flow statement ties with these contained in the statement of revenues and expenditure Check if cash and cash equivalent during the year ties to total of bank plus cash balances for the period. Confirm the accuracy of changes in payables, receivables and adjustments for the year. Check if the financial statements from Districts include summary of financial information from NBAs and perform arithmetic check to confirm if each category is balancing. For the case of districts, generate the revenue accountability report and check if totals are equivalent to these of Trial Balance. Check if the reconciliation statement between District and RRA is attached to the report Other issues noted but not listed above : document here. 25 26 27.1 27.2 27.3 27.4 28 29 30 31 Descriptive note (E g. The report was submitted within statutory deadline) Action (E.g Quality review feedback) Focal person to rank the quality of the reviewed report: Ranking Criteria Tick as appropriate Satisfactory No issue has been noted as per above criteria Acceptable Few issues noted ( between 1 to 5 issues were noted out of 35 QR areas above) Poor Many issues noted ( between 5 to 15 issues were noted out of 35 QR areas above) Unacceptable Too many issues noted (over 15 issues noted out of 35 QR areas above) Note: Attach a printed copy of the EMAIL feedback to this QR checklist. Quality review done by: Name: .................................................................. Date: ........................................................Signature ………………………. Second review by: Name: ---------------------------------------------------- Date: --------------------------------------------Signature ………………………… Third review done by: Name: ............................................................................. Date: ........................................................Signature ……………………………..